The Declining Prevalence of 2 and 20 Fee Structures in 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Reddit discussions provide valuable on-the-ground perspectives on fee structures across different investor segments:

-

Retail vs. Institutional Divide: Users correctly distinguish between wealth managers (0.5-1.5% plus fund fees) and hedge funds/private equity that charge 2/20. Edward Jones reportedly charges ~1.4-1.5% on top of mutual fund expense ratios, confirming retail fees remain much lower than traditional hedge fund structures[6].

-

Geographic Variations: European investors report paying around 2% total fees (TER + transaction + management) with entry fees up to 5% being normal, suggesting regional differences in fee structures[6].

-

Performance Fee Complexity: Users note that 2/20 persists for uncorrelated returns but includes important investor protections like high watermarks, 8-12% hurdle rates, and clawbacks. Performance fees are often negotiable and client-specific[6].

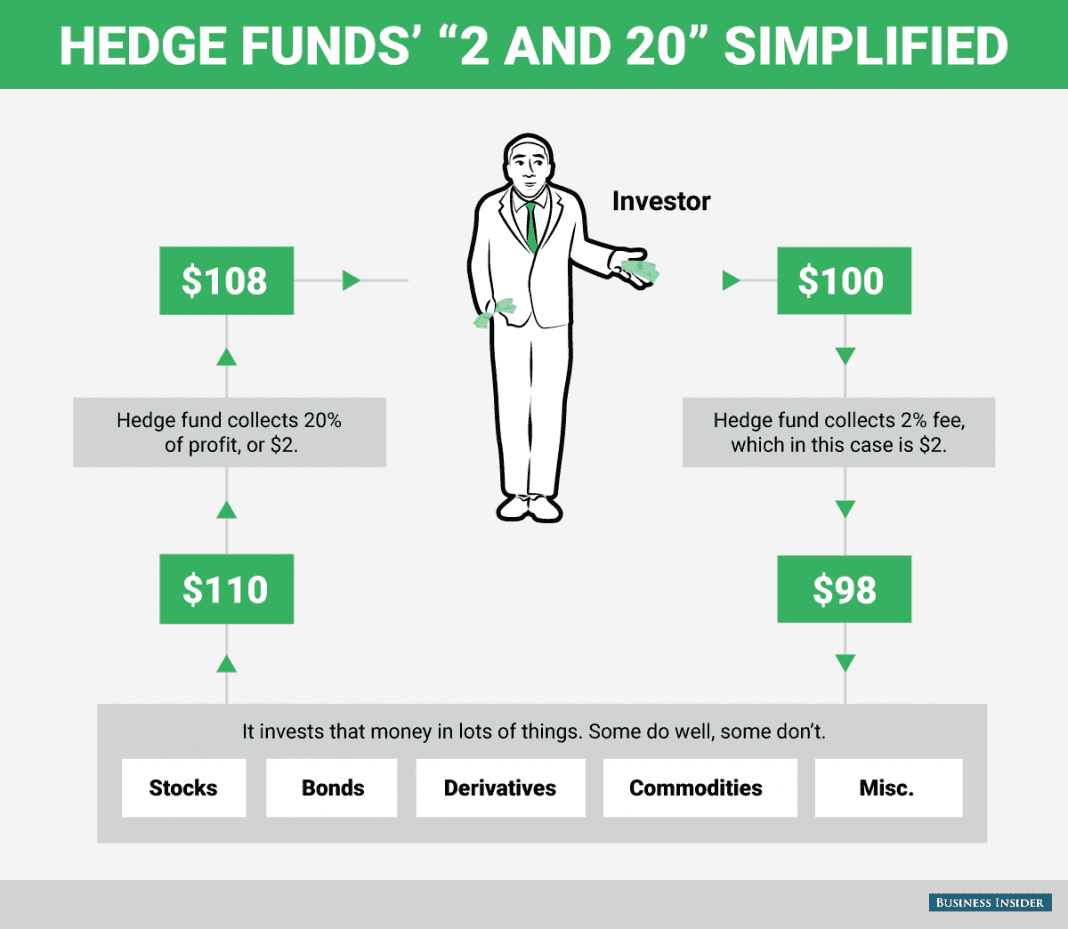

The traditional 2 and 20 model is experiencing significant decline across the industry:

-

Fee Compression Accelerating: Newer hedge funds now average approximately 1.37% management fees and 16.3% performance fees, substantially below the traditional benchmark. This trend has intensified since 2020 due to competitive pressures and investor demands[1][2].

-

ETF Competition Impact: Some hedge funds are converting to ETFs with dramatically lower fees (e.g., 0.69% vs traditional 2 & 20), creating direct competition for traditional hedge fund fee structures[1].

-

Institutional Investor Influence: Large investors are demanding more sophisticated fee arrangements including hurdle rates, fee scaling based on AUM, and longer lockup periods. This has led to increased adoption of alternative compensation models like partnership tracks and deferred compensation[3][4].

-

Emerging Manager Strategy: Newer fund managers are using lower fees as a competitive advantage to attract capital and differentiate from established players, accelerating fee compression across the industry[2][3].

Reddit observations align closely with industry research, revealing a complex fee landscape:

-

Market Segmentation Confirmed: Reddit users correctly identify that 2/20 remains prevalent in hedge funds and private equity but not in retail wealth management. Research confirms this segmentation, with fee pressure varying significantly by fund size and strategy type[1][6].

-

Fee Evolution Reality: The perception that 2/20 is declining is accurate, but the transition is uneven. While newer funds average 1.37%/16.3%, established funds with strong performance may still command premium fees[2][4].

-

Investor Protection Mechanisms: Reddit’s emphasis on performance fee protections (hurdle rates, high watermarks, clawbacks) reflects industry best practices that have become standard in response to investor demands[6].

- Fee Complexity: Investors may struggle to compare funds with varying fee structures and performance calculations

- Hidden Costs: Lower headline fees may be offset by other expenses or less favorable terms

- Fee Arbitrage: Investors can access sophisticated strategies at historically low fees through newer managers

- Negotiation Power: Institutional investors have increased leverage to customize fee structures

- ETF Alternatives: Hedge fund ETF conversions provide access to strategies at dramatically reduced costs

- The fee compression trend is likely to continue as ETF competition intensifies

- Traditional 2/20 may become a premium pricing model reserved for top-tier managers

- Emerging managers with lower fees could accelerate industry consolidation[1][2][3]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.