Reddit Scalping Strategy Analysis: Heiken Ashi Hammer Approach

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The strategy author shares a

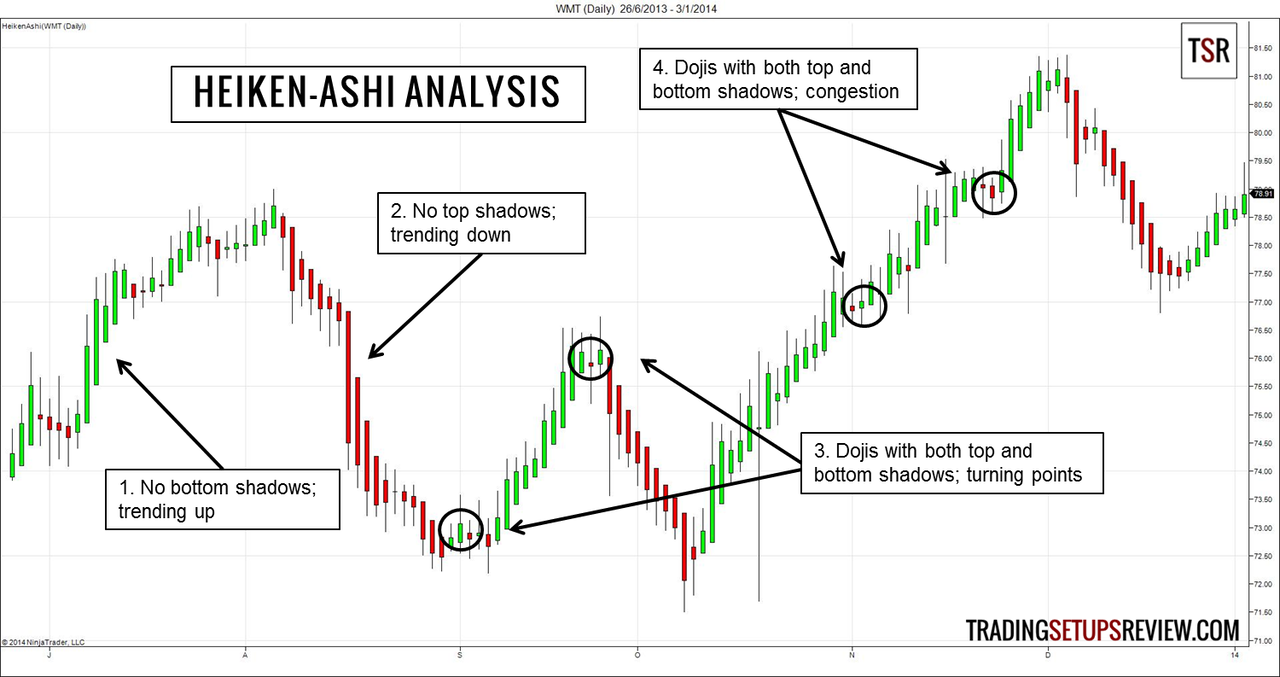

- Entry signals: Heiken Ashi hammers at support/resistance zones during market open

- Filters: H1/M15 trend alignment, RSI bands (30-50 sell, 50-70 buy), and MA crossovers

- Risk management: Fixed 1.4RR stop loss

- Life_Nail_946stresses that6 months of backtestingis essential to verify any edge

- Ok-Proposal6598questionscontradictory RSI rulesand conflicts between trend-following and mean-reversion signals

- JustHereForWSBguysclarifies they ignore buy signals when RSI is 30-50, only proceeding with sell signals in that range

- RSI generates frequent false signals during volatile market opens

- Moving average crossovers suffer from lag and whipsaw effects

- Multi-timeframe analysis creates conflicting signals between H1 and M15 charts

- All indicators are based on historical data with no future accuracy guarantees

- High failure probability: 71-99% retail trader loss rates suggest systemic challenges

- Indicator conflicts: Multiple filters may create contradictory signals during volatile conditions

- Suboptimal risk-reward: 1.4RR may be insufficient for scalping profitability

- Psychological pressure: Rapid decision-making during market opens increases execution errors

- Spread and slippage: Significantly impact small profit targets in scalping

- Strategy refinement: The community feedback on RSI rules and backtesting requirements offers improvement paths

- Risk adjustment: Increasing RR to 1:2-1:3 could improve long-term viability

- Filter optimization: Reducing conflicting indicators might clarify signal generation

- Extended backtesting: The 6-month testing period suggested by Reddit users could provide better validation

While the Reddit strategy demonstrates thoughtful technical analysis combining multiple filters, the lack of empirical validation and misaligned risk parameters present significant concerns. Investors should approach this strategy with extreme caution, requiring extensive backtesting and parameter optimization before any live implementation.

The community’s critical feedback and research findings on high retail failure rates suggest this strategy, in its current form, carries substantial risk of capital loss.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.