Paper Trading Stop-Loss Discrepancy: Why $1,500 Risk Exceeds Expected Losses

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The Reddit discussion from r/Daytrading reveals mixed explanations for stop-loss discrepancies in paper trading:

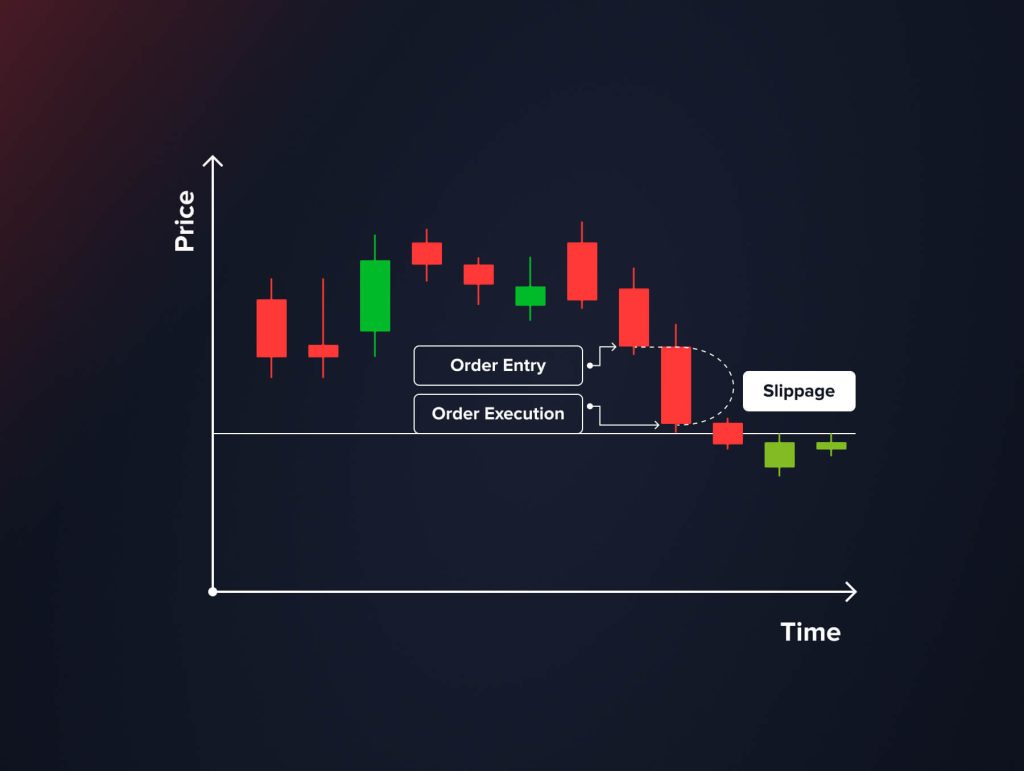

- Slippage Attribution: User Funny_Neck1027 attributes the issue to slippage, while Melodic-Excitement-9 notes that stop orders execute at market without guaranteed prices

- Skepticism About Paper Trading: User jemook questions whether slippage actually occurs in paper trading, citing instant execution characteristics

- Alternative Explanations: ConsciousPlantain977 suggests poor entry prices or emotional selling as potential causes

- Market Focus: Which_Camera_1887 advises focusing on market direction rather than stop-loss mechanics

The community appears divided on whether paper trading can realistically simulate stop-loss execution problems.

- Stop-loss orders convert to market orders when triggered, executing at the next available price rather than the predetermined stop price

- Three primary failure mechanisms: slippage during high volatility, gap risk when prices jump beyond stop levels, and insufficient liquidity during rapid market movements

- Market volatility and major economic announcements increase the likelihood of stop-loss orders exceeding intended risk amounts

- Paper trading platforms execute rules in real-time but don’t account for true slippage, execution delays, or changing market conditions

- Stop-loss execution may not fully replicate order fills or market depth, leading to inaccurate execution prices

- Platform-specific issues include approximated slippage calculations and simplified order execution models

- These limitations can cause paper trading results to show losses exceeding set stop-loss amounts, creating unrealistic expectations

The apparent contradiction between Reddit skepticism about paper trading slippage and the research findings reveals a nuanced reality. While traditional slippage (as experienced in live trading) shouldn’t occur in ideal paper trading environments, platform simulation flaws can create similar-looking discrepancies through different mechanisms:

- Execution Model Simplification: Paper trading platforms use simplified order execution models that may not accurately represent real market depth

- Approximated Calculations: Some platforms attempt to simulate slippage through approximations that can overshoot intended amounts

- Order Book Limitations: Incomplete replication of real-time order books can lead to execution at unexpected prices

- Paper trading results showing stop-loss breaches may indicate platform simulation issues rather than trading skill problems

- The $1,500 stop-loss discrepancy suggests the trader’s platform has execution modeling flaws

- This creates a false sense of security or, conversely, unnecessary concern about risk management

- False Confidence: Traders may develop unrealistic expectations about risk management based on flawed paper trading results

- Platform Dependency: Different paper trading platforms may produce varying results for identical strategies

- Skill Assessment Difficulty: Inaccurate simulations make it challenging to evaluate true trading performance

- Platform Selection: Traders can test multiple paper trading platforms to identify those with more realistic execution modeling

- Risk Management Education: Understanding these limitations encourages development of more robust risk management strategies

- Gradual Transition: Awareness of paper trading limitations supports smoother transitions to live trading with smaller position sizes

Traders experiencing stop-loss discrepancies in paper trading should verify their platform’s execution methodology and consider using multiple platforms for strategy validation before transitioning to live trading.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.