US Health Insurer Shares Decline on Q3 Cost Pressures and Regulatory Uncertainty

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Seeking Alpha report [1] published on November 1, 2025, which documented sector-wide challenges following third-quarter earnings announcements from major US health insurers.

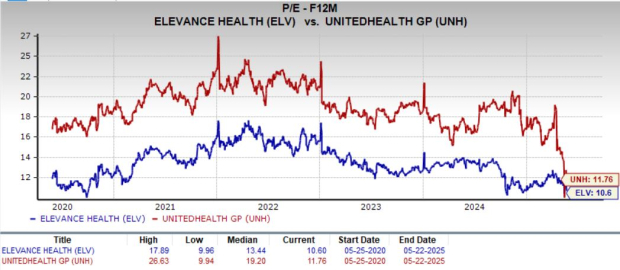

The immediate market reaction demonstrated concentrated weakness in managed-care stocks, with UnitedHealth Group (UNH) declining 0.93%, Humana (HUM) falling 2.60%, Elevance Health (ELV) dropping 1.48%, and Cigna (CI) decreasing 1.09% on November 1, 2025 [0]. Notably, Molina Healthcare (MOH) bucked the trend with a 1.30% gain, though this appeared idiosyncratic rather than representative of sector strength [0]. The broader Healthcare sector showed only modest intraday changes, indicating that the pressure was specifically concentrated in large managed-care insurers rather than across all healthcare subsectors [0].

The sector faces significant regulatory headwinds, including Department of Justice investigations into Medicare Advantage risk-adjustment coding practices and ongoing CMS audits [4]. These regulatory challenges create tail risk for insurers with substantial government-program exposure. Additionally, uncertainty surrounding ACA subsidies and Marketplace stabilization measures adds another layer of complexity to earnings visibility [1][3].

The elevated MCRs across multiple insurers suggest structural medical-cost inflation rather than temporary cyclical pressures. Molina’s Marketplace MCR of 95.6% indicates severe underpricing or utilization acceleration in the individual market [2]. This trend, combined with similar pressures in Medicare Advantage and Medicaid segments, suggests that margin compression may persist beyond the current quarter.

While all major insurers face similar cost pressures, their strategic responses and exposure levels differ significantly. UnitedHealth’s scale and diversified business model provide some insulation, though regulatory scrutiny remains a concern [3][4]. Molina’s heavy concentration in government programs makes it more vulnerable to policy changes and funding adjustments [2]. This divergence will likely lead to idiosyncratic performance outcomes across the sector.

Investor sentiment has shifted from focusing on topline growth to prioritizing margin durability and regulatory execution [1]. This re-rating creates compression risk for sector multiples, particularly for companies with significant Medicare Advantage and Marketplace exposure. The market’s differentiated response (with Molina showing relative strength) suggests that investors are increasingly discriminating based on business mix and regulatory risk profiles.

The US health insurance sector is experiencing significant margin pressure driven by elevated medical costs in government-subsidized programs, with Medicare Advantage, Medicaid, and ACA Marketplace segments showing particularly challenging trends. Major insurers have reported elevated Medical Care Ratios, with Molina Healthcare’s Marketplace MCR reaching 95.6% in Q3 2025 [2]. UnitedHealth Group, despite its scale and revenue growth, faces similar cost pressures and regulatory scrutiny [3]. The immediate market reaction resulted in share price declines of 0.9-2.6% for major managed-care companies [0].

Key factors influencing future performance include: resolution of regulatory investigations, CMS payment policy decisions, state Medicaid rate actions, and companies’ ability to implement effective pricing and network strategies. The sector’s near-term outlook remains challenged by structural cost inflation and regulatory uncertainty, though differentiated company strategies and business mix variations may lead to varying outcomes across individual insurers.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.