Analysis of the Impact of Share Reduction by the Controlling Shareholder of Changying Precision (300115)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the company data, market performance and financial information I obtained, below is an analysis of the potential impact of the share reduction by Changying Precision’s controlling shareholder:

| Item | Details |

|---|---|

Share Reduction Subject |

Ningbo Changying Yuefu Investment Co., Ltd. (Controlling Shareholder) |

Current Shareholding Ratio |

32.7% |

Planned Reduction Ratio |

No more than 1% |

Number of Shares to Be Reduced |

Approximately 13,583,600 shares |

Share Reduction Time Window |

February 10 to May 9, 2026 (approximately 3 months) |

Share Reduction Method |

Concentrated Auction Trading |

Reason for Share Reduction |

Own Capital Arrangement |

Based on the current stock price of $44.11, the estimated amount of this share reduction is

- Timing Sensitivity: The share reduction announcement was released on January 19, 2026, and the share reduction window starts on February 10, leaving a “news vacuum period” of about 3 weeks, during which the market may pre-react to selling expectations[1]

- High-Level Share Reduction Signal: The current stock price is near the52-week high(only about 8% away from the high of $47.99). The controlling shareholder’s choice to reduce holdings at this time is usually interpreted by the market as a signal that “the stock price is considered overvalued”[0]

- Concentrated Auction Trading Method: Compared to block trading, concentrated auction trading has a greater direct impact on the secondary market stock price because it is sold directly on the secondary market

- High Valuation Pressure: The current price-to-earnings ratio (P/E) of 93.03 times and price-to-book ratio (P/B) of 7.25 times are both at historical highs, and there is inherent pressure for valuation correction[0]

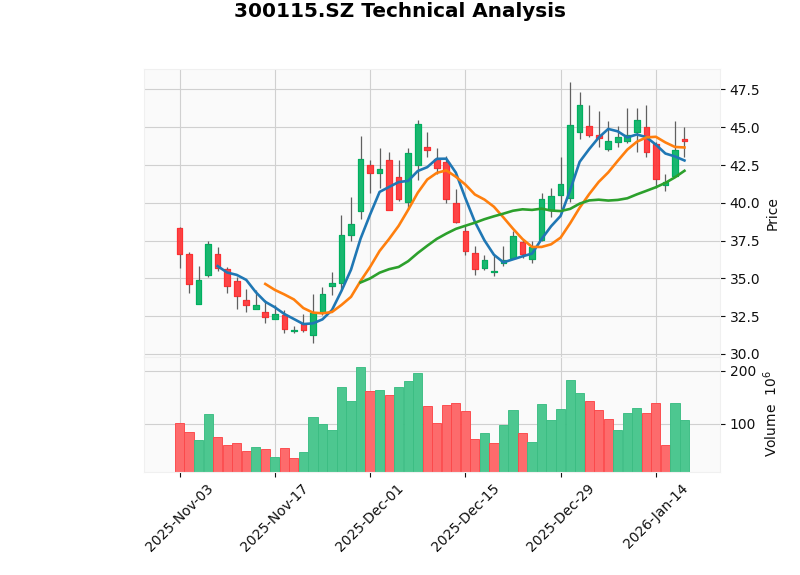

- The stock price is currently in a sideways consolidation pattern, with no clear trend direction[0]

- Support level: $42.12; Resistance level: $45.42[0]

- The MACD indicator is in a bearish state, and KDJ is in a bearish zone[0]

- A beta coefficient of 1.22 indicates that the stock’s volatility is higher than the market average, and the impact of news may be amplified[0]

| Scenario | Estimated Adjustment Range | Trigger Condition |

|---|---|---|

Mild Adjustment |

-5% to -10% | The market has fully digested the share reduction expectation, with moderate trading volume |

Moderate Adjustment |

-10% to -15% | The broader market weakens during the share reduction period, coupled with valuation regression |

Significant Adjustment |

-15% to -25% | Macroeconomic shock + underwhelming performance + resonance from share reduction |

Based on historical data, when the controlling shareholder’s share reduction ratio exceeds 0.5% of the total share capital, the

| Impact Dimension | Specific Performance |

|---|---|

Signal Effect |

“Insider share reduction” is regarded as a signal of insufficient confidence in the company’s future development |

Information Asymmetry |

The controlling shareholder has access to more company information, and its actions are closely interpreted by the market |

Selling Pressure Expectation |

Investors are worried about continuous selling pressure during the share reduction period and may choose to exit in advance |

Valuation Logic Reconstruction |

High-level share reduction may trigger the market to re-evaluate the company’s true value |

- Limited Share Reduction Ratio: The 1% reduction is small relative to the controlling shareholder’s 32.7% shareholding, and control is not threatened

- Clear Time Window: The 3-month share reduction period provides clear predictability for the market

- Fundamental Improvement: The substantial 2024 performance growth indicates that the company’s business is improving[1]

- Sufficient Liquidity: The average daily trading volume is approximately 120 million shares, which can absorb the selling pressure from the share reduction[0]

| Investor Type | Possible Reaction |

|---|---|

Institutional Investors |

Focus on the reason for the share reduction and subsequent use of funds, and assess whether it indicates a strategic adjustment |

Mid-to-Long-Term Value Investors |

Focus on changes in fundamentals; if performance continues to improve, they may increase holdings on dips |

Short-Term Traders |

May use news for band trading, creating short-term volatility |

Retail Investors |

Susceptible to sentiment, may panic sell |

| Dimension | Evaluation | Confidence Level |

|---|---|---|

Short-Term Stock Price Impact |

Bearish , the stock price is expected to come under pressure within 1-2 weeks after the share reduction announcement |

High |

Mid-Term Trend Impact |

Neutral-Bearish , depends on performance realization and the overall market environment |

Medium |

Impact on Investor Confidence |

Short-Term Pressure, Mid-Term Expected Recovery |

Medium-High |

- Actual Trading Volume During Share Reduction Period: If trading volume increases significantly while the stock price stabilizes, it indicates strong absorbing power

- Subsequent Supplementary Announcements: Pay attention to whether the controlling shareholder discloses the specific use of funds

- 2025 Q1 Report Performance: Whether performance can continue the high growth trend of 2024

- Peer Performance and Sector Sentiment: The overall performance of the consumer electronics and precision manufacturing sectors

- The current valuation level (93x P/E) has fully reflected market optimistic expectations, and any underwhelming information may be amplified

- A current ratio of 1.00 and quick ratio of 0.65 indicate that the company’s short-term liquidity is tight[0]

- The controlling shareholder’s statement of “own capital arrangement” is vague, and other possibilities cannot be ruled out

The chart above shows Changying Precision’s recent stock price trend, which is currently in a sideways consolidation phase, and technical indicators indicate a bearish consolidation pattern[0].

[0] Jinling AI Financial Database - Changying Precision (300115.SZ) Market Data, Valuation Indicators and Technical Analysis

[1] Hexun.com - “Changying Precision: Controlling Shareholder Plans to Reduce Holdings of No More Than 1% of the Company’s Shares” (https://stock.hexun.com/2026-01-19/223208658.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.