Viking Therapeutics (VKTX) Analysis: Strong Comeback Driven by Phase 2 Obesity Drug Success

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on recent market developments and clinical trial results for Viking Therapeutics (VKTX), highlighting the company’s strong comeback following positive Phase 2 data for its obesity drug VK2735 [1]. The key catalysts include exceptional efficacy data showing 78% of prediabetic patients achieving normal glycemic status versus 29% for placebo [1], maintained Buy ratings from major analysts including William Blair [1], and significant stock momentum with shares rising approximately 45% in October 2025 driven by takeover speculation [2]. The company’s Phase 3 trials are enrolling ahead of schedule with results anticipated by 2027, positioning Viking as a potential acquisition target in the rapidly consolidating obesity drug market [2].

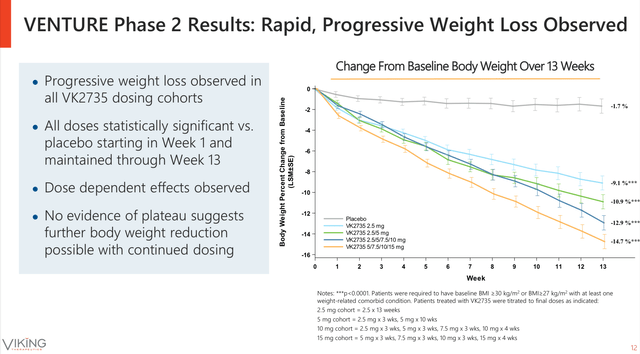

Viking Therapeutics’ VK2735 program has demonstrated remarkable clinical efficacy in Phase 2 trials presented at ObesityWeek 2025 [3]. The VENTURE trial results revealed exceptional outcomes across multiple metabolic parameters:

- Prediabetes Reversal:78% of VK2735-treated patients with prediabetes achieved normal glycemic status compared to 29% for placebo (p=0.0008) [1]

- Metabolic Syndrome Improvement:68% of patients no longer met metabolic syndrome criteria versus 38% for placebo (p=0.02) [1]

- Weight Loss Efficacy:Up to 14.7% mean body-weight reduction with 88% of patients achieving ≥10% weight loss [1]

- Safety Profile:92% of treatment-emergent adverse events were classified as mild or moderate, indicating improved tolerability [1]

The clinical development pipeline includes both subcutaneous (injectable) and oral formulations of VK2735, with two Phase 3 trials (VANQUISH-1 and VANQUISH-2) currently enrolling ahead of schedule [2]. Enrollment is expected to complete by end of 2025/Q1 2026, with results anticipated mid-2027 [2].

Viking Therapeutics currently trades at $40.78 with a market capitalization of $4.61 billion [0]. The stock has shown significant momentum, gaining 13.72% over the past 5 days and 21.51% over the past month [0], though it remains down 32.71% over the past year, reflecting previous volatility [0].

The investment community maintains strong bullish sentiment with 90.9% of analysts rating VKTX as Buy [0]. The consensus price target of $105.00 represents 157.5% upside potential [0], with major firms including JP Morgan, Morgan Stanley, and BTIG maintaining Buy/Overweight ratings [0].

The obesity drug market is experiencing intense consolidation activity, with Pfizer’s $7.3 billion bid for Metsera being countered by Novo Nordisk’s $9 billion offer [2]. This context makes Viking’s $4.6 billion market cap appear potentially undervalued compared to recent transactions [2]. The broader GLP-1 drug market is valued at over $100 billion and projected to exceed $150 billion by 2030 [2], providing substantial commercial opportunity.

Viking maintains strong financial positioning with a current ratio of 28.34 indicating excellent short-term liquidity [0]. Management has confirmed sufficient resources to fund Phase 3 trials through completion [2].

The convergence of clinical success, market consolidation, and analyst support creates a compelling investment narrative. The exceptional Phase 2 data [1] directly correlates with the maintained Buy ratings [1] and increased M&A speculation [2], suggesting market participants recognize the strategic value of Viking’s clinical assets.

The 78% prediabetes reversal rate represents a potentially paradigm-shifting therapeutic advance [1]. This efficacy level, combined with the manageable safety profile, positions VK2735 as a potential best-in-class candidate in the competitive GLP-1 landscape. The dual formulation strategy (injectable and oral) provides additional commercial flexibility and market penetration potential.

The ongoing consolidation in the obesity drug space [2] creates a favorable environment for clinical-stage companies with compelling data. Viking’s strong Phase 2 results and accelerated Phase 3 timeline [2] position it as an attractive acquisition target for major pharmaceutical companies seeking to enter or expand in the obesity market.

Viking Therapeutics presents a high-risk, high-reward investment opportunity centered on VK2735’s Phase 3 development timeline. The company’s strong Phase 2 data [1], accelerated enrollment schedule [2], and favorable M&A environment [2] support the bullish analyst consensus with a $105 price target [0]. However, investors should be aware of the extended timeline to potential commercialization and the binary nature of clinical development outcomes. The current valuation appears reasonable given the clinical data and market opportunity, but success ultimately depends on Phase 3 trial results and the company’s ability to differentiate in an increasingly competitive obesity drug market.

[0] Ginlix Analytical Database - Market data, financial metrics, and analyst consensus

[1] Yahoo Finance/Insider Monkey - “William Blair Reiterates ‘Buy’ Rating on Viking Therapeutics (VKTX) Following New VK2735 Data” - November 11, 2025

[2] The Motley Fool - “Here’s Why Shares in Viking Therapeutics Shot Higher in October” - November 5, 2025

[3] PR Newswire - “Viking Therapeutics Highlights Clinical Data from VK2735 Obesity Program in Presentation at ObesityWeek® 2025” - November 6, 2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.