Analysis Report on the Impact of Differentiated Trade-In Policies on the Auto Market (2025-2026)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and analysis, I provide you with a

According to the analysis of Cui Dongshu, Secretary-General of the Passenger Car Market Information Joint Conference, there are significant differences in the subsidy intensity of the 2025 trade-in policies for passenger vehicles and commercial vehicles

| Vehicle Type | Scrap-and-Replace Subsidy | Trade-In Subsidy | Market Performance |

|---|---|---|---|

| Commercial Vehicle | Approximately RMB 105,000 | Approximately RMB 80,000-90,000 | Strong retail growth in December |

| Passenger Vehicle | Approximately RMB 68,000 | Approximately RMB 50,000-60,000 | 14% plunge in retail sales in December |

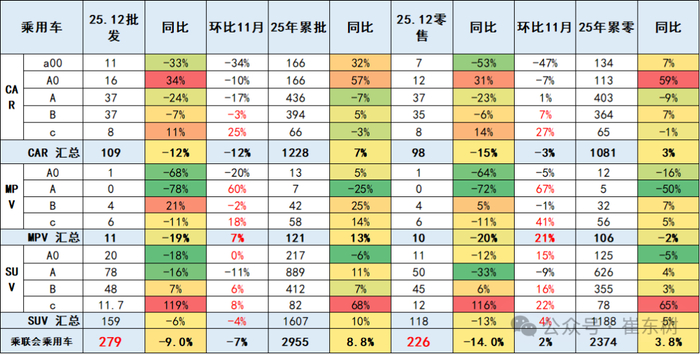

- Passenger vehicle retail sales: 2.261 million units, YoY -14.0%, MoM +1.6%

- Passenger vehicle wholesale sales: 2.789 million units, YoY -9.0%, MoM -7.0%

- A00-class sedan retail sales: YoY -53%(most severely impacted)

- Budget MPV retail sales: Significant YoY decline

Despite the plunge in December, the market still achieved growth in full-year 2025

- National passenger vehicle wholesale growth rate: 9%

- New energy passenger vehicle wholesale growth rate: 25%

- New energy retail penetration rate: 59.1%, up 9.6 percentage points YoY

On December 30, 2025, the National Development and Reform Commission (NDRC) and the Ministry of Finance issued the Notice on Implementing Large-Scale Equipment Upgrade and Consumer Goods Trade-In Policies in 2026

| Subsidy Type | 2025 (Fixed Amount) | 2026 (Percentage) | Change Range |

|---|---|---|---|

| New Energy Scrap-and-Replace | RMB 20,000 | 12% of vehicle price (capped at RMB 20,000) | -20% to -40% |

| New Energy Trade-In | RMB 15,000 | 8% of vehicle price (capped at RMB 15,000) | -25% to -45% |

| Fuel Vehicle Scrap-and-Replace | RMB 15,000 | 10% of vehicle price (capped at RMB 15,000) | -20% to -35% |

| Fuel Vehicle Trade-In | RMB 13,000 | 6% of vehicle price (capped at RMB 13,000) | -30% to -50% |

According to forecasts from the China Association of Automobile Manufacturers (CAAM)

- 2026 passenger vehicle scrap-and-replace subsidy: Expected to decline by 20%-30%

- 2026 passenger vehicle trade-in subsidy: Expected to decline by up to 30%

- 2026 commercial vehicle growth effect: Expected to be significantly better than passenger vehicles

- Full-year retail sales: Flat or slight growth(approximately 29.9 million units)

- Wholesale growth rate: Approximately 1%

- Trend pattern: “U-shaped: High in early stage, low in mid-stage, high in late stage”

Based on financial data analysis of major automakers

| Automaker | Net Profit Margin | Return on Equity (ROE) | Profitability Rating | Policy Sensitivity |

|---|---|---|---|---|

| BYD (002594.SZ) | 4.56% | 17.62% | Strong | High (sales-driven) |

| Geely Automobile (0175.HK) | 5.41% | 17.38% | Strong | Medium-High |

| Changan Automobile (000625.SZ) | 4.15% | 8.83% | Medium | High (reliant on low-end market) |

- Sales Decline Pressure: Subsidy cuts → Consumer wait-and-see attitude → Sales drop → Lower capacity utilization

- Intensified Price Competition: To maintain sales, automakers may restart price wars → Gross margin under pressure

- Cash Flow Pressure: Extended accounts receivable cycle (some automakers have reached 60-90 days)

The Passenger Car Market Information Joint Conference proposes the following policy recommendations to offset subsidy cuts:

| Policy Recommendation | Expected Effect | Implementation Difficulty |

|---|---|---|

1. Personal Income Tax Deduction for Vehicle Purchasers |

Expected to increase sales by 8.5% |

Medium (requires cooperation from tax authorities) |

2. Promote New Energy Vehicle Rural Market Expansion |

Expected to increase sales by 5.2% |

Medium-Low (existing foundation) |

3. Optimize C7 Driver’s License Application for Budget Electric Vehicles |

Expected to increase sales by 3.5% |

Low |

4. Exempt Qualified Pure Electric Vehicles with Range <200km from Purchase Tax |

Expected to increase sales by 4.2% |

Medium |

5. Encourage Vehicle Purchases for Newlyweds and Families with Children |

Expected to increase sales by 2.8% |

Low |

- Theoretical Effect: Directly boosts consumer purchasing power, equivalent to subsidy transfer

- Limitation: Higher-income groups benefit more, with limited stimulation for the low-end market

- Comprehensive Evaluation:Effective, but with uneven coverage

- Theoretical Effect: Third-tier and lower-tier cities are the core incremental market in the future[6]

- Supporting Requirements: Need to continue expanding charging infrastructure

- Comprehensive Evaluation:Highly effective, a key measure to fill the gap from subsidy cuts

- Theoretical Effect: Reduces vehicle purchase barriers for the elderly and low-income groups

- Implementation Foundation: The C7 driver’s license policy has been introduced; application procedures need optimization

- Comprehensive Evaluation:Partially effective, targeting specific groups

- Theoretical Effect: Reduces price barriers for entry-level electric vehicles (market below RMB 100,000)

- Market Background: Pure electric models account for over 80% of this segment, which is price-sensitive[7]

- Comprehensive Evaluation:Medium to highly effective, targeting price-sensitive markets

- Theoretical Effect: Stimulates demand from specific groups

- Limitation: Limited policy stimulation intensity

- Comprehensive Evaluation:Auxiliary policy with limited effect

Based on the expected effects of the above policy package:

| Scenario | Domestic Retail Sales | YoY Growth Rate | Average Profit Margin |

|---|---|---|---|

No Policy Enhancement |

29.9 million units | 0% | 4.5% |

+ Personal Income Tax Deduction for Vehicle Purchases |

32.4 million units | +8.4% | 5.8% |

+ New Energy Vehicle Rural Market Expansion |

31.45 million units | +5.2% | 5.4% |

+ Comprehensive Policy Package |

33.8 million units | +13.0% | 6.5% |

- The “Two New” policies over the past two years have partially overdrawn demand [6]

- Consumers have formed a “dependency” on subsidy expectations

- In 2026, the new energy vehicle purchase tax exemption will be reduced from full exemption to 50% exemption (maximum deduction reduced from RMB 30,000 to RMB 15,000)

- First- and second-tier city markets are becoming saturated

- First-time vehicle buyers are decreasing, shifting to trade-ins and additional purchases

- Fierce competition in sinking markets but insufficient infrastructure

- The total 2026 sales targets set by most automakers are close to market capacity

- Export growth faces geopolitical risks (EU tariffs, declining Russian market)

- Price war pressure persists

-

Significant Impact of Policy Differentiation: In 2025, passenger vehicle subsidies were 20%-30% lower than commercial vehicle subsidies, directly leading to a 14% plunge in retail sales in December

-

Certain Pressure from Subsidy Cuts in 2026:

- Passenger vehicle scrap-and-replace subsidy is expected to decline by 20%-30%

- The shift in subsidy method (fixed amount → percentage) weakens incentives for the low-end market

- Relatively beneficial to the RMB 150,000-200,000 price segment

-

Policy Recommendations Can Partially Offset but Not Fully Compensate:

- Personal income tax deduction for vehicle purchases: Most effective(expected +8.5% sales)

- New energy vehicle rural market expansion: Key measure(expected +5.2% sales)

- Comprehensive policy package: Expected to offset approximately 50%-60% of the impact from subsidy cuts

- Personal income tax deduction for vehicle purchases:

-

Widening Gap Among Automakers:

- Leading enterprises (BYD, Geely) have strong resilience

- Automakers highly reliant on the low-end market face greater pressure

- Accelerate transformation to overseas markets and new product cycles

| Direction | Target | Rationale |

|---|---|---|

Leading Automakers |

BYD (002594.SZ), Geely Automobile (0175.HK) | Comprehensive product portfolio, accelerated overseas layout |

Intelligentization Industry Chain |

Desay SV, ThunderSoft | Definite trend of intelligent upgrade |

Beneficiaries of New Energy Vehicle Rural Market Expansion |

Changan Automobile (000625.SZ), Wuling Motors | Channel advantages in sinking markets |

Avoid |

New forces with sales scale below the “survival threshold” | Concurrent cash flow and profitability pressures |

[1] Sina Finance - “Cui Dongshu of Passenger Car Market Information Joint Conference: Passenger Vehicle Consumption Faces Great Pressure in 2026” (https://finance.sina.com.cn/7x24/2026-01-19/doc-inhhvsft1241037.shtml)

[2] Zhitong Finance - “China Galaxy Securities: 2026 Trade-In Policy Launched” (https://hk.investing.com/news/stock-market-news/article-1268128)

[3] Investing.com - “Cui Dongshu: National Passenger Vehicle Wholesale Grew 9% in 2025” (https://cn.investing.com/news/stock-market-news/article-3163150)

[4] Sina Finance - “China Galaxy Securities: 2026 Trade-In Policy Launched, Passenger Vehicle Sales in January Expected to Transition Smoothly” (https://finance.sina.com.cn/stock/hkstock/ggscyd/2026-01-14/doc-inhhfrsx8497121.shtml)

[5] China Association of Automobile Manufacturers - “Analysis of National Passenger Vehicle Market in December 2025” (https://www.cada.cn/Trends/info_91_10424.html)

[6] Autohome - “2026: China’s Automobile Industry Enters a Watershed of Logic Transformation” (https://chejiahao.autohome.com.cn/info/24740264)

[7] Gasgoo - “Automakers’ 2026 Sales Targets ‘Sky-High’” (https://i.gasgoo.com/news/70442481.html)

[8] 36Kr - “Cui Dongshu of Passenger Car Market Information Joint Conference: Passenger Vehicle Consumption Faces Great Pressure in 2026” (https://www.36kr.com/newsflashes/3646135797256073)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.