Analysis Report on Valuation Bottoming Signals of A-Share Real Estate Sector

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and market information, I provide you with a systematic and comprehensive valuation analysis report on the A-share real estate sector.

| Indicator | Vanke A (000002) | China Merchants Shekou (001979) | Industry Characteristics |

|---|---|---|---|

Current Share Price |

$4.73 | $9.24 | Vanke is close to its 52-week low |

P/E (TTM) |

-0.95x | 23.10x | Most real estate enterprises are in loss |

P/B (TTM) |

0.32x | - | 68% below net asset value |

P/S (TTM) |

0.20x | - | Extremely low price-to-sales ratio |

52-Week Range |

$4.62-$8.22 | $8.43-$10.55 | Vanke is only 2.4% away from its 52-week low |

Annual Decline |

-30.95% | -10.47% | China Merchants is relatively resilient |

| Time Period | Decline | Notes |

|---|---|---|

| Past 1 Year | -30.95% | Continuous adjustment |

| Past 3 Years | -74.40% | Deep correction |

| Past 5 Years | -84.87% | Historical low |

| Indicator | Value | YoY Change |

|---|---|---|

| New Commercial Housing Sales Area | 881.01 million sqm | -8.7% |

| Commercial Housing Sales Volume | RMB 8.3937 trillion | -12.6% |

| Real Estate Development Investment | - | -17.2% |

| New Construction Area | - | -20.4% |

| New Housing Prices in First-Tier Cities | - | -1.7% |

| Second-Hand Housing Prices in First-Tier Cities | - | -7.0% |

- Vanke A P/B = 0.32x: The share price is only 32% of net asset value, meaning the market has discounted the company’s asset value by 68%, hitting a historical extreme range [0]

- Vanke A P/S = 0.20x: The price-to-sales ratio is less than 0.2x, indicating extremely pessimistic market pricing [0]

- Negative P/E for Most Enterprises: Due to overall industry losses, the traditional P/E valuation method has become invalid, reflecting that the sector is in a deep adjustment period

- The current price of $4.73 is only 2.4%away from the 52-week low of $4.62 [0]

- It has corrected 42.5%from the 52-week high of $8.22, with sufficient decline [0]

- The 20-day moving average ($4.79) and 50-day moving average ($5.26) are in a bearish arrangement, but the deviation rate is narrowing [0]

- KDJ Indicator: K=28.1, D=38.9, J=6.6, indicating an oversold state [0]

- Annual decline is only 10.47%, significantly outperforming Vanke [0]

- PE=23.10x, which is a reasonable valuation level in the sector [0]

- Indicating that market funds are beginning to differentiate towards high-quality real estate enterprises

- The decline rate of sales area (-8.7%) has narrowed compared to the previous year [Provided by User]

- In the fourth quarter, the transaction area of new housing in 100 cities increased by 4% month-on-month, with an 18% month-on-month growth in December [1]

- Shanghai has become the only first-tier city to achieve both year-on-year and month-on-month growth in new housing transactions[Provided by User]

- Real estate development investment decreased by 17.2%year-on-year, with continuous sector contraction [Provided by User]

- New construction area decreased by 20.4%, with clear expectations of future supply-side contraction [Provided by User]

- Vanke A’s ROE is -31.07%, and net profit margin is-20.92%, with deteriorating profitability [0]

- Vanke A’s Q3 financial report shows EPS of -$1.35, significantly lower than expectations [0]

| Policy Type | Specific Measures | Impact Assessment |

|---|---|---|

Purchase Restriction Relaxations |

Purchase restrictions lifted in areas outside Beijing’s 5th Ring Road, outside Shanghai’s Outer Ring Road, and non-core areas of Shenzhen | Releases purchasing power |

Credit Optimization |

Mortgage interest rates no longer distinguish between first and second homes, unified at 3.05% | Reduces home purchase costs |

Provident Fund Support |

Families with multiple children can borrow up to RMB 2.16 million, with ‘withdraw and borrow’ allowed | Stimulates rigid demand |

Tax Incentives |

Value-added tax on housing held for less than 2 years reduced from 5% to 3% | Promotes second-hand housing circulation |

Destocking |

Local governments plan to use special bonds to repurchase over RMB 650 billion of idle stock land | Improves supply-demand relationship |

- After Shanghai relaxed purchase restrictions on August 25, the average destocking rate in July was 41%; the policy effect requires continuous observation [2]

- The new housing market shows a differentiated pattern, with high-quality projects in core areas remaining popular [3]

- The turnover of the Shanghai and Shenzhen stock markets has exceeded RMB 2 trillion for 11 consecutive trading days, with increased market activity [4]

- The weekly transaction volume of second-hand housing in Shenzhen increased by 1% month-on-month, showing four consecutive weeks of growth [2]

- The transaction proportion of high-end improved housing has increased to 60%, with improved demand actively entering the market [3]

- The ‘price for volume’ pattern continues in the second-hand housing market, with high listed volume [3]

- Expectations of housing price adjustments have not been fully resolved [3]

┌─────────────────────────────────────────────────────────────┐

│ Comprehensive Assessment of Bottoming Signals of A-Share Real Estate Sector │

├─────────────────────────────────────────────────────────────┤

│ │

│ Valuation Bottom: ████████████░░░░ 85% Emerged │

│ ───────────────────────────────────────────────────── │

│ Policy Bottom: ████████████████░ 95% Confirmed │

│ ───────────────────────────────────────────────────── │

│ Price Bottom: ███████████░░░░░░ 75% Initially Emerging │

│ ───────────────────────────────────────────────────── │

│ Fundamental Bottom: ████████░░░░░░░░░ 45% Still Forming │

│ ───────────────────────────────────────────────────── │

│ Sentiment Bottom: ██████████░░░░░░░ 65% Marginal Improvement │

│ │

│ Comprehensive Score: ███████████░░░░░░ 73% │

│ │

└─────────────────────────────────────────────────────────────┘

Specifically:

- Valuation Bottom Has Formed: Indicators such as P/B and P/S are at historical extremes, with severe asset discounts

- Policy Bottom Has Been Confirmed: The intensity of combined policy measures including purchase restriction relaxations, credit optimization, tax incentives, and destocking is unprecedented

- Price Bottom Is Being Confirmed: Share prices of high-quality real estate enterprises are close to historical lows, with limited downside space

- Fundamentals Still Await Recovery: Indicators such as sales, investment, and construction are still declining, but the decline rate has narrowed

| Type | Characteristics | Investment Recommendations |

|---|---|---|

High-Quality Leading Enterprises |

China Merchants Shekou, China Resources Land, etc. | Relatively reasonable PE, stable cash flow, can accumulate on dips |

Oversold Targets |

Vanke A, etc. | Extremely low P/B, high rebound elasticity, but need to pay attention to fundamental risks |

Regional Leading Enterprises |

Binjiang Group, Yuexiu Property, etc. | Deeply rooted in core cities, benefiting from regional recovery |

High-Leverage Real Estate Enterprises |

China Fortune Land Development, etc. | High risk, recommended to avoid |

- Shanghai’s housing prices continue to lead growth, forming a demonstration effect

- Marginal improvement in commercial housing sales data

- More destocking policies are implemented

- Further interest rate cuts

- Sales data fall short of expectations, with the decline rate expanding again

- Credit risk exposure of some real estate enterprises

- Macroeconomic recovery falls short of expectations

- Spillover of overseas market volatility

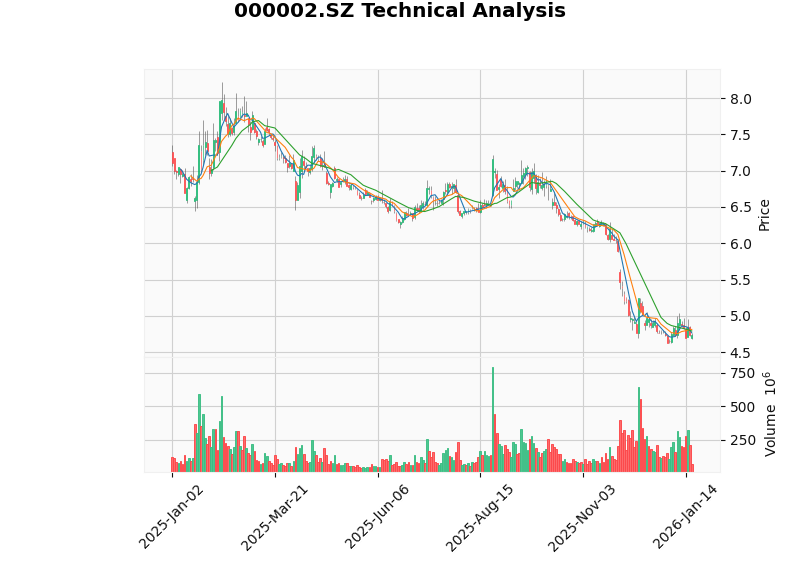

The chart above shows the K-line trend and technical indicators of Vanke A (000002.SZ), from which we can observe:

- The share price continued to decline in 2025 and is currently in a bottom consolidation range

- Trading volume has increased recently, indicating increased capital attention

- Technical indicators show short-term oversold conditions, with potential rebound opportunities

[0] Jinling AI Financial Database - Real-time quotes, technical analysis, financial analysis data

[1] Xinhua News Agency - “Multiple Policies Promote the Stabilization of the Real Estate Market” (2025-11-02)

http://www.news.cn/fortune/20251102/512457f871774164928a3ce8e436cae6/c.html

[2] China Real Estate Association - “Shanghai Relaxes Purchase Restrictions, the Property Market Enters a New Round of ‘Defense Battle’” (2025-08-26)

http://www.fangchan.com/news/6/2025-08-26/7365925282563560015.html

[3] China Business Network - “2025 Property Market: High in Early Stage, Low in Late Stage! Insiders Expect Gradual Stabilization After Four Years of Adjustment” (2026-01-01)

https://www.9fzt.com/common/e3b240f2de2aa39c16dfbbebb23c1af6.html

[4] Eastmoney - “Turnover of Shanghai and Shenzhen Stock Markets Exceeds RMB 2 Trillion for 11 Consecutive Trading Days” (2026-01-19)

https://quote.eastmoney.com/zz/2.931775.html

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.