In-Depth Analysis of Micron's $1.8 Billion Acquisition of Powerchip's Taiwan Wafer Fab

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now obtained complete transaction information and market data, let me provide you with an in-depth analysis report.

According to the official announcement [1], Micron Technology (Nasdaq: MU) on

| Item | Details |

|---|---|

Acquisition Target |

Powerchip’s Tongluo Campus P5 Wafer Fab |

Target Assets |

Approximately 300,000 square feet (about 28,000 square meters) of clean room space in a 300mm (12-inch) wafer fab |

Transaction Price |

$1.8 billion in cash (approximately RMB 12.572 billion) |

Expected Completion Time |

Second Quarter of 2026 |

Capacity Contribution Time |

Significant DRAM wafer capacity contribution starting from the second half of 2027 |

Regulatory Requirements |

Subject to final agreement signing and necessary regulatory approvals |

In addition to the acquisition transaction, the two parties have also established a

- DRAM Advanced Packaging Collaboration: Micron will establish long-term cooperation with Powerchip in post-wafer assembly processing for Micron’s DRAM wafers

- Technical Assistance: Micron will assist Powerchip in refining its existing niche DRAM product lines

- Capacity Migration: Powerchip will orderly migrate personnel, equipment, and product lines from the Tongluo fab back to its Hsinchu campus while ensuring uninterrupted production

Following the announcement, the stock prices of both companies rose significantly [0]:

- Closing Price: $362.75 (+$26.12, +7.76%)

- 52-Week Range: $61.54 - $365.81

- Trading Volume: 47.9 million shares (significantly higher than the daily average of 27.1 million shares)

- Market Capitalization: $408.28 billion

- P/E Ratio: 34.48x

- Closing Price: NT$62.00 (+NT$5.60, +9.93%)

- 52-Week Range: NT$11.95 - NT$62.00 (all-time high)

- Trading Volume: 23.3 million shares

- Market Capitalization: NT$260.42 billion

- P/E Ratio: -29.81x (due to negative net profit)

Powerchip’s stock price rose by nearly 10% in a single day, hitting an all-time high, reflecting the market’s

- Transaction Premium: The $1.8 billion acquisition price represents significant value realization for Powerchip

- Strategic Cooperation Value: Long-term cooperation with Micron ensures future business security

- Business Transformation Opportunity: This transaction allows Powerchip to accelerate its transformation towards high-value-added products related to AI

The current global memory chip market is experiencing an

- DRAM contract prices are expected to rise 58% quarter-over-quarter in Q1 2026 [5]

- Server DDR5 contract prices are expected to rise 60% [5]

- Mobile DRAM contract prices are expected to rise 62% [5]

- Samsung and SK Hynix plan to increase server DRAM prices by 60%-70% in Q1 2026 [5]

This acquisition will further strengthen the competitive landscape of the world’s

| Manufacturer | Market Share | Strategic Layout |

|---|---|---|

Samsung Electronics |

Global No.1 | Comprehensive layout of HBM and DDR5 |

SK Hynix |

Global No.2 | Leading in HBM, deeply integrated with Nvidia |

Micron Technology |

Global No.3 | Capacity expansion through acquisition, strengthening Taiwan layout |

- Capacity Supplement: Obtaining an existing 300mm wafer clean room avoids the long cycle of building a new fab (usually 3-5 years)

- Geographic Synergy: The Tongluo fab is adjacent to Micron’s Taichung fab, which can generate significant operational synergies

- HBM Capacity Expansion: Meeting the explosive demand for HBM (High-Bandwidth Memory) from AI servers

This acquisition took place shortly after the signing of the US-Taiwan economic and trade agreement [3]:

- On January 15, 2026, the United States and Taiwan signed a trade agreement

- Taiwan is required to invest at least $250 billion in the United States

- Semiconductor exports enjoy the terms of ‘zero tariffs within quota, 15% preferential tariff beyond quota’

Micron’s acquisition is an important part of the strategic layout of US technology companies to strengthen supply chain control.

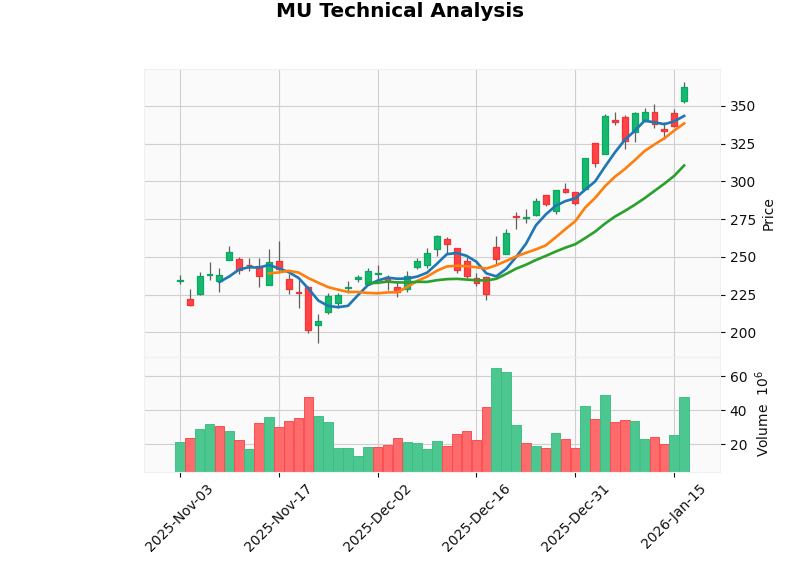

| Indicator | Status | Interpretation |

|---|---|---|

Trend Determination |

Uptrend (to be confirmed) | Breakout pattern, buy signal appeared on 01/09 |

MACD |

Bullish Crossover | Bullish momentum |

RSI (14) |

Overbought Risk | Potential short-term pullback pressure |

KDJ |

Bearish Crossover | Weak short-term technical indicators |

Key Resistance Level |

$365.81 | Next target at $382.15 |

Key Support Level |

$338.40 | Short-term defensive level |

- Financial Stance: Conservative (high depreciation/capital expenditure ratio), with room for profit improvement as investments mature

- Debt Risk: Low risk

- Free Cash Flow: Latest free cash flow of $1.668 billion, positive

- HBM Leader Potential: Micron is actively seizing market share in HBM3e

- Key Partner in Nvidia’s Supply Chain: Core participant in the AI chip ecosystem

- Insider Buying Signal: Mark Liu, former TSMC Chairman and current Micron Director, recently purchased approximately$8 millionworth of MU shares in the public market [4]

- Valuation Advantage: Forward P/E is lower than Nvidia and other AI hardware stocks

- Realization of acquisition transaction premium

- Stock price hits all-time high, market sentiment is bullish

Powerchip Chairman Huang Tsung-jen stated that the company will

- 3D AI DRAM

- WoW (Wafer-on-Wafer)

- Silicon Interposers

- Silicon Capacitors

- PMIC (Power Management IC)

- Power Devices

- The company is still in a loss-making state (negative P/E ratio)

- Uncertainties exist in business transformation

- High dependence on mature process foundry business

| Industry Chain Segment | Benefit Logic | Representative Companies |

|---|---|---|

Memory Chip Design |

Product price hikes directly improve gross profit margin | GigaDevice, Longsys, BIWIN |

Packaging and Testing |

Demand for capacity expansion | TFME, JCET |

Equipment and Materials |

Wafer fab construction boom | NAURA, AMEC |

Power Semiconductors |

Demand from AI data centers | CRRC Times Electric, StarPower Semiconductor |

- Regulatory Approval Risk: The transaction is subject to necessary regulatory approvals, with uncertainties

- Integration Risk: Migration and integration of factories, personnel, and equipment may affect production efficiency

- Timing Risk: Capacity contribution will only start in the second half of 2027, with a long time horizon

- Macroeconomic Risk: If the global economy experiences a hard landing, the collapse of consumer electronics demand will drag down memory prices [4]

- Overcapacity Risk: If all manufacturers expand production on a large scale, overcapacity may occur after 2027

- Technology Iteration Risk: Rapid iteration of technologies such as HBM may affect investment returns

- China-US Tech Competition: The semiconductor industry is a key focus of the competition, potentially facing policy risks

- Taiwan Strait Situation: High concentration of production capacity in Taiwan, geopolitical risks cannot be ignored

- Industry Consolidation Trend Confirmed: Micron’s acquisition of Powerchip’s Taiwan wafer fab is an important milestone in the global semiconductor industry consolidation, reflecting the strategic intention of US technology companies to strengthen supply chain control

- Memory Chip Bull Market Continues: Driven by AI, the supply-demand imbalance of memory chips will persist, and the price hike cycle will continue at least until 2026, and may even last until 2028

- Investment Window Opened: Currently, the memory chip sector is in a historic investment window, with capital shifting from the "price hike logic" to the "technology growth logic"

| Target | Recommendation | Rationale |

|---|---|---|

Micron Technology (MU) |

Buy on Dips |

Industry leader, beneficiary of HBM, strong insider buying signal |

Powerchip (6770.TW) |

Hold/Reduce Position |

Significant short-term price increase, wait for a pullback before positioning for long-term transformation |

A-Share Memory Industry Chain |

Actively Monitor |

Leading companies such as GigaDevice and TFME |

- Progress of Micron’s Acquisition Approval: Expected to be completed in the second quarter of 2026

- HBM Capacity Progress: Monitor the progress of Micron’s HBM3e obtaining Nvidia certification

- Memory Price Trend: Possibility of convergence in price increases in Q2 2026

- Powerchip’s Transformation Progress: Monitor the implementation of its AI product lines

[1] Micron Technology, Inc. - Press Release: “Micron Signs Letter of Intent to Acquire Tongluo Fab, and Enters into Strategic Partnership with Powerchip” (https://investors.micron.com/news-releases/news-release-details/meiguangqianshuyixiangshushougoutongluochangqu)

[2] IT Home - “Micron to Acquire Powerchip’s Tongluo Wafer Fab for $1.8 Billion, with Additional In-Depth Collaboration” (https://www.ithome.com/0/914/114.htm)

[3] Lianhe Zaobao - “Micron to Acquire Powerchip’s Taiwan Wafer Fab for $1.8 Billion” (https://www.zaobao.com.sg/realtime/china/story20260118-8118259)

[4] Vocus - “This Week’s Clasia Investment Strategy and Selected List: Historic Divergence in Policy, Electricity, and Silicon” (https://vocus.cc/article/amp/696c4cc4fd89780001733e58)

[5] Eastmoney - “Domestic Memory Leaders Hit New Highs, Capital Shifts from ‘Price Hike’ to ‘Technology Growth’ Logic” (https://finance.eastmoney.com/a/202601183622657968.html)

[6] China Securities Journal - “Memory Price Hike Trend Continues, Multiple Listed Companies Announce Capacity Expansion Plans” (https://www.cs.com.cn/ssgs/gsxw/202601/t20260114_6533151.html)

[7] ESM China - “2026 Wafer Foundry Market Trend Interpretation: From Advanced Process Competition to Mature Capacity…” (https://www.esmchina.com/news/13773.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.