In-Depth Analysis of the Rationality of Cambricon's 630 Billion RMB Valuation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now I will conduct a comprehensive analysis based on the acquired data to provide you with a detailed valuation assessment and investment value analysis.

Based on the latest trading data, Cambricon (688256.SS) currently has a market capitalization of

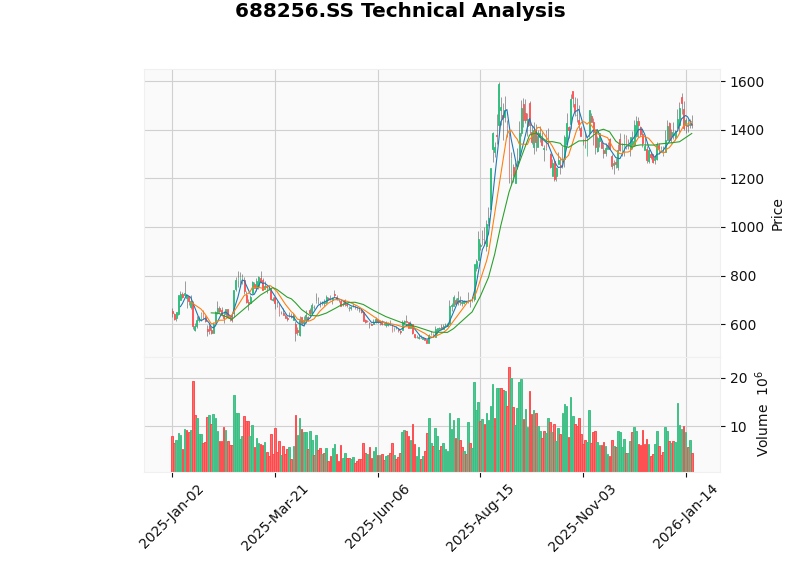

In terms of stock performance, Cambricon has risen 129.77% in the past year, with an even more impressive 143.81% gain in the last six months, and a cumulative increase of over 2328% in three years, demonstrating strong market momentum [1]. However, this staggering valuation level has also sparked widespread market debate about its rationality.

Cambricon’s revenue growth is nothing short of astonishing: in 2024, the company achieved revenue of 1.174 billion RMB, a year-on-year increase of 66%; in the first three quarters of 2025, it achieved revenue of 4.607 billion RMB, a year-on-year surge of 2386.38% [2][3]. Looking at quarterly performance, the company’s revenue grew quarter by quarter from 989 million RMB in Q4 2024 to 1.769 billion RMB in Q2 2025, demonstrating strong growth momentum [3].

More importantly, the company has successfully turned a profit: in the first three quarters of 2025, net profit attributable to parent company shareholders reached 1.605 billion RMB, with single-quarter net profit reaching 683 million RMB in Q2 2025, and net profit margin rising to 32.8% [2][3]. This marks Cambricon’s first sustained profitability since its listing, signifying that the company is transitioning from the “strategic investment phase” to the “commercialization harvest phase” [4].

In Q2 2025, the company’s net cash flow from operating activities was 2.311 billion RMB, a significant improvement compared to -1.399 billion RMB in Q1 [4]. As of Q3 2025, the company’s inventory reached 3.7 billion RMB, and monetary funds reached 5.2 billion RMB, with the balance sheet health continuously improving [3].

Analysis using the DCF valuation model shows that Cambricon’s intrinsic value is negative in three scenarios: -23.93 RMB in the conservative scenario, -36.94 RMB in the base scenario, and -94.59 RMB in the optimistic scenario, all of which deviate significantly from the current stock price of 1420 RMB [0].

The underlying reason for this result is that Cambricon is still in a high-growth phase, with a historically negative EBITDA margin (average -125.8%) and negative free cash flow (latest FCF is -1.984 billion RMB). Traditional DCF models struggle to effectively value high-growth technology companies that have not yet achieved stable profitability [0]. This also explains why the market mostly uses P/S (price-to-sales ratio) or growth-oriented valuation methods.

According to industry data, China’s AI chip market showed a clear oligopolistic pattern in 2024: NVIDIA held

| Company | Valuation/Market Cap | Technical Route | Market Share | Development Stage |

|---|---|---|---|---|

| HiSilicon (Huawei) | Unlisted | ASIC/DSA | 21.4% | Large-scale Mass Production |

| Cambricon | 630 billion RMB | ASIC/DSA | ~1-2% | Commercial Breakthrough |

| Moore Threads | 310 billion RMB | Full-Function GPU | <1% | Early Stage of Scale-up |

| Muxi | 250 billion RMB | GPGPU | ~1% | Early Stage of Scale-up |

| Biren Tech | ~100 billion HKD | GPGPU | 0.2% | Initial Listing Stage |

| Kunlun Chip | ~20 billion RMB in Revenue | ASIC/DSA | ~2% | Independent Operation |

China’s AI chip companies are mainly divided into two technical camps: one follows the full-function GPU route (e.g., Moore Threads), competing directly with NVIDIA; the other follows the ASIC/DSA dedicated chip route (e.g., Cambricon, HiSilicon), emphasizing energy efficiency ratio and scenario-specific optimization [6]. The latter has advantages in faster commercialization under the background of domestic substitution.

- Sector Scarcity: Cambricon is a rare listed domestic AI chip company, with a strong capital scarcity premium [3]

- Performance Turnaround: The substantial growth in revenue and profit in 2025 validates its commercialization capabilities

- Policy Support: Policy dividends from domestic substitution continue to be released, and AI chips are a strategic industry

- Market Sentiment: The AI boom has pushed up the valuation center of the entire sector

- High Customer Concentration: The top five customers contribute 94.6% of revenue, with the largest customer accounting for 79% [3]

- Valuation Bubble Risk: 318x PE and 106x PS deviate significantly from traditional valuation ranges

- International Competitive Pressure: NVIDIA recently obtained US export approval for H200 chips to China, which will impact domestic players [7]

- Technology Gap: Domestic GPUs generally target NVIDIA’s previous-generation H100 product, with an obvious technological generation gap [7]

According to analyst forecasts, Cambricon’s revenue is expected to reach 6.771 billion RMB, 13.535 billion RMB, and 23.004 billion RMB in 2025-2027, with net profit attributable to parent company shareholders reaching 2.106 billion RMB, 4.869 billion RMB, and 8.733 billion RMB respectively [3]. If these targets are achieved, the current valuation will be gradually digested by performance.

- Risk of AI demand falling short of expectations

- Risk of high customer concentration

- Risk of supply chain instability

- Risk of divergence between valuation and performance

- Risk of changes in international chip control policies [3]

[0] Jinling API Market Data and DCF Valuation Analysis

[1] Jinling API Company Profile and Financial Indicators

[2] Soochow Securities “Cambricon-U (688256) 2025 Q3 Earnings Review” (https://pdf.dfcfw.com/pdf/H3_AP202510201765235309_1.pdf)

[3] Soochow Securities “Cambricon-U (688256) 2024 Annual Report & 2025 Q1 Earnings Review” (https://pdf.dfcfw.com/pdf/H3_AP202504251662074955_1.pdf)

[4] China Fund News “The First Half of 2025 Marks a Historic Moment for the Three Giants of Domestic Chip Design” (https://www.chnfund.com/article/AR62903dd9-f6bc-25e5-d479-3a1c126d778d)

[5] Securities Times “Domestic GPU Manufacturers Race to Go Public, None Have Exceeded 1% Market Share” (https://www.stcn.com/article/detail/3546594.html)

[6] The Paper “After Four Years of Preparation, Robin Li Unveils a Big Move” (https://m.thepaper.cn/newsDetail_forward_32363446)

[7] Huxiu “History is on the Side of China’s GPUs” (https://www.huxiu.com/article/4826460.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.