Impact Analysis of Tighter Regulation on the Securities Investment Consulting Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on the collected information, I will conduct a systematic analysis from three dimensions: regulatory status quo, impact on investor service quality, and impact on the A-Shares market ecology.

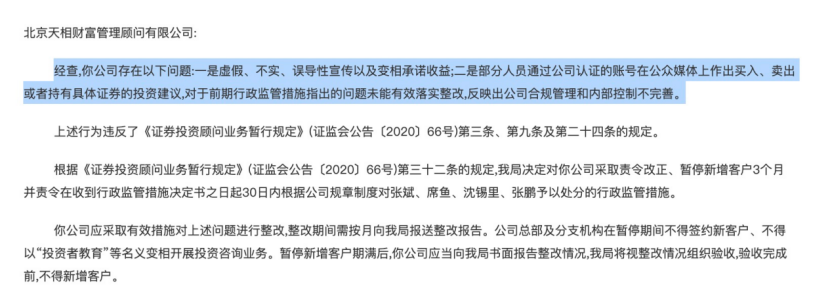

According to the latest data, as of the end of 2025, there are 76 domestic securities investment consulting institutions in total, among which 17 have been subject to regulatory measures suspending new customer acquisition, accounting for as high as 22.4% [1]. In 2025, a total of 46 securities investment consulting institutions were penalized 56 times, a year-on-year increase of 36.59% [1]. Just 19 days into 2026, three institutions—Beijing Tianxiang Fortune, Huiyan Zhitou Technology, and Shenzhen Luojia Investment—were successively penalized [2].

Regulatory penalties show a graded characteristic:

- Light-level: Issuance of warning letters, order to make corrections, increase in the number of compliance inspections

- Medium-level: Suspension of new customer acquisition (3-6 months)

- Heavy-level: Revocation of securities investment consulting business license

Notably, from November to December 2025, Zhongfang Xinfu and Qingdao Damo had their securities investment consulting business licenses revoked by the CSRC, and relevant responsible persons were imposed with heavy fines and market entry bans [3].

Judging from penalty cases, the main types of illegal activities include [1][4]:

| Type of Illegal Activity | Specific Manifestations |

|---|---|

| False and Misleading Advertising | Promise of returns, use of exaggerated expressions, display of individual stock historical performance |

| Irregular Business Operations on New Media | Stock recommendations via live streaming by unlicensed personnel, use of scripts that skirt compliance boundaries |

| Chaotic Qualification Management | Investment advice provided by personnel not registered with the Securities Association |

| Lack of Internal Control and Compliance | Outsourcing of business and compliance work to third parties |

| False Submission of Materials | Omission of key information in filing materials, lack of service agreements |

- Some illegal institutions suspend business operations, reducing the supply of optional services for investors

- Existing customers may face service downgrades or institutional integration

- "Low-rate traps" may increase in the market, and vigilance is needed against compliance risk transfer

- Significantly Enhanced Investor Protection: Regulation has curbed behaviors such as false advertising and insufficient risk warnings, directly reducing investor rights and interests damage caused by information asymmetry [1]

- Improved Service Transparency: Compliant institutions will pay more attention to information disclosure and risk revelation

- Higher Professional Thresholds: Investors can access more professional investment consulting services

Tighter regulation is forcing the industry to transform from "marketing-driven" to "service-driven" [5]:

- Institutions need to increase compliance investment and treat compliance costs as long-term investments

- Business models need to be adjusted to serve the interests of core customers

- Personnel qualification management will be stricter, improving the overall professional level

With regulators’ targeted crackdown on illegal activities, investors need to:

- Pay attention to risk warnings issued by regulators

- Improve their understanding of professional knowledge related to the securities market

- Maintain a rational investment mindset and be vigilant against the temptation of "capital-preservation with high returns" [4]

Changes in the Number of Securities Investment Consulting Institutions:

- End of 2021: 83 institutions

- End of 2025: 76 institutions (a decrease of 7)

The "cut-off" effect of the "suspension of new customers" penalty is emerging:

- Institutions cannot acquire new customers during the penalty period, and their business essentially enters a "suspended" state

- Sales teams are significantly reduced, and customer resources are concentrated in compliant leading institutions

- Accelerates industry reshuffling and promotes optimal resource allocation [3]

- False stock recommendation information and exaggerated return promotions will be significantly reduced

- The authenticity and seriousness of market information dissemination are maintained

- Curbing market manipulation behaviors through models such as "pig butchering scams"

- Reduce short-term irrational market fluctuations caused by misleading information

- Improve the quality of investor decision-making and enhance market pricing efficiency

- Discourage speculative behaviors that deviate from fundamentals, such as "shell stock speculation" and "ST stock speculation" [6]

Regulation in 2025 showed three major characteristics [6]:

| Characteristic | Specific Manifestations |

|---|---|

| New Delisting Rules Take Effect | 15 companies hit the red line of mandatory delisting due to major violations, a record high |

| Accountability to Individuals | Heavy penalties for the main culprit controlling shareholders, and investigation of the "ecosystem" that cooperates with fraud |

| Technology Empowerment | "Penetrating" monitoring enables full-chain regulation |

This new regulatory normal is reshaping the A-Shares market ecology:

- "Shell companies" and "zombie companies" have nowhere to hide

- The illusion of "shell value" is accelerating its demise

- Listed companies refocus their operations on actual performance and corporate governance

Under compliance pressure, the standardized development of securities investment consulting institutions will:

- Improve the overall research service quality of institutional investors

- Promote the dissemination of rational investment concepts

- Provide higher-quality sell-side research services to the market

Associate Professor Zheng Dengjin from Central University of Finance and Economics pointed out that regulation shows two major trends [1]:

- Targeted Governance: Addressing high-frequency violations such as new media business operations, qualification management, and false advertising, and increasing the cost of violations through "cut-off" penalties

- Adaptive Development: As the onlineization of investment advisory services accelerates, regulators are building a closed-loop system of "prevention - investigation - rectification - clearing"

The following is expected in the future:

- Leading Institution Concentration: Resources are concentrated in compliant leading institutions

- Service Differentiation: Institutions need to build differentiated competitive advantages

- Technology Empowerment: Technological means will become an important support for compliance management

Against the backdrop of normalized strict regulation, investors should:

- Choose formal licensed institutions

- View investment return expectations rationally

- Establish long-term investment and value investment concepts

- Protect their legitimate rights and interests through formal channels

Tighter regulation of the securities investment consulting industry is an inevitable requirement for the comprehensive deepening of capital market reform. In the short term, regulatory rectification brings growing pains to the industry, and some institutions have their businesses restricted; but in the long run, this process will:

- Purify the Market Ecology: Crack down on false information dissemination and maintain market fairness and order

- Protect Investors: Reduce investor rights and interests damage caused by misleading information

- Improve Service Quality: Drive institutions to transform from "marketing-driven" to "service-driven"

- Optimize Resource Allocation: Accelerate industry reshuffling and improve the overall quality of intermediary services

The establishment of the new regulatory normal marks the transformation of the A-Shares market from "financing-focused" to "investment-focused", with investor protection becoming the core goal of regulation. For compliant institutions, this is an opportunity to enhance competitiveness and achieve sustainable development; for the entire capital market, this is a necessary path toward high-quality development.

[1] Sina Finance - "3 Securities Investment Consulting Institutions Suspended from Acquiring New Customers" (https://finance.sina.com.cn/jjxw/2026-01-19/doc-inhhuuzz2908748.shtml)

[2] Securities Times - "6 Penalties in the Opening Days Unveil the New Normal of A-Shares Regulation" (https://www.stcn.com/article/detail/3591468.html)

[3] NetEase - "2025 Strict Regulatory Storm on Investment Advisory Institutions" (https://www.163.com/dy/article/KIPLHBIM05198R91.html)

[4] Wuhan Municipal Bureau of Local Financial Work - "11 Securities Investment Consulting Institutions Penalized for False and Misleading Advertising" (https://jrj.wuhan.gov.cn/ztzl_57/xyrd/dcczbsc/202305/t20230506_2196071.shtml)

[5] Securities Times - "Suspended from Acquiring New Customers for 3 Months! Established Investment Advisor Penalized" (https://www.stcn.com/article/list/finance.html)

[6] Securities Times - "Regulators Tightly Track Multiple *ST Companies’ Various Shell Preservation Attempts to Prevent Violations" (https://www.stcn.com/article/detail/3574979.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.