In-Depth Analysis Report on Performance and Capital Trends of Oradtech (600666)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data, I provide you with an in-depth analysis report on Oradtech (600666.SS).

According to the company’s 2025 H1 Profit Forecast Announcement[1]:

| Indicator | H1 2025 | H1 2024 | Change |

|---|---|---|---|

| Net Profit Attributable to Parent Shareholders | RMB 50 million - RMB 75 million | -RMB 5.2779 million | Turned from loss to profit |

| Net Profit Excluding Non-Recurring Gains and Losses | -RMB 20 million to -RMB 10 million | -RMB 20.1551 million | Sustained loss |

| Earnings Per Share | Approximately RMB 0.02 - RMB 0.03 | -RMB 0.0019 | Significant improvement |

-

Investment Income from Equity Transfers: The company transferred equity in Harbin Qiuguan Optoelectronics Technology Co., Ltd. and Oradtech Optoelectronics (Zhengzhou) Investment Management Co., Ltd., recognizing investment income of approximately RMB 76.76 million[1]

-

Core Business Remains in Loss:

- Although the computing power business has grown, the overall gross profit is still insufficient to cover various period expenses

- The net profit excluding non-recurring gains and losses remains negative, indicating that the profitability of the core business has not yet recovered

According to the company’s Litigation Progress Announcement[2], there are major legal risks:

- Huge Amount Involved: Involves a performance compensation dispute with former shareholders Zuo Hongbo and Chu Shuxia, involving 400.89 million shares or cash of RMB 461 million

- Significant Uncertainty in Recovery: The shares of the performance compensators have been pledged and are subject to sequential freezing, and their personal asset rights are restricted

- Second Instance Judgment Issued: The company needs to bear litigation costs of approximately RMB 18.659 million

| Indicator | Data |

|---|---|

| Total Pledge Ratio | 6.06% |

| Total Number of Pledged Shares | 167 million shares |

| Number of Pledge Transactions | 6 |

- Qitaihe Oradtech Optoelectronics Technology Co., Ltd.had its bankruptcy liquidation application accepted by the court in June 2025 and is no longer included in the consolidated financial statements[1]

- Qiuguan Optoelectronics has been included in the list of dishonest persons subject to execution for failing to fulfill obligations under effective legal documents

The company was publicly condemned by the Shanghai Stock Exchange in 2022 for multiple violations including financial fraud, failure to disclose major contracts and guarantees in a timely manner[3].

The 2024 financial statements of subsidiaries Qiuguan Optoelectronics and Oradtech (Dongguan) were issued with an “Unqualified Audit Report with Emphasis of Matter Paragraphs on Going Concern Uncertainty and Provisions”[3].

According to data from financial analysis tools[0]:

| Financial Indicator | Value | Risk Assessment |

|---|---|---|

| Accounting Attitude | Conservative | Prudent |

| Debt Risk | Medium Risk | Monitor |

| Free Cash Flow | -RMB 241 million | Net Outflow |

| Current Ratio | 1.76 | Relatively Healthy |

| Quick Ratio | 1.55 | Relatively Healthy |

| Asset-Liability Ratio | 29.10% | Moderate |

According to Northbound Capital’s position data at the end of 2025[4][5]:

- Market Value of Holdings Hits a New High: As of the end of 2025, the market value of Northbound Capital’s holdings reached RMB 2.59 trillion, hitting a new high since 2022

- Shift in Industry Preference: From large finance and large consumption tohard technologyandnon-ferrous metalsindustries

- Electronics and power equipment industriessaw an increase in the market value of holdings of over RMB 160 billion each

Although public data does not directly show the specific changes in Northbound Capital’s holdings of Oradtech, an analysis from the perspective of industry and concepts is as follows:

| Driving Factor | Analysis |

|---|---|

Computing Power Concept |

The company is classified under the “Computing Power Concept” and “East Data West Computing” sectors, which aligns with Northbound Capital’s preference for hard technology |

Optical Optoelectronics |

The optical optoelectronics industry it belongs to is a technology track |

Stock Price Performance |

It has recorded a 58.62% increase in the past year and a 61.40% increase in the past three years, with significant excess returns[0] |

Chip Concentration |

The number of shareholders decreased from 133,800 at the end of June 2025 to 107,100 at the end of September, indicating a trend of chip concentration |

- Thematic Investment-Driven: The computing power industry chain is supported by policies, and Northbound Capital may buy based on thematic allocation

- Technical Signal: The stock price broke through key resistance levels, attracting trend-following funds

- Chip Game: Concentrated chips facilitate capital operations, attracting transaction-oriented funds to participate

- Valuation Repair: After experiencing historical violations, the stock price is at a relatively low level, leaving room for valuation repair

| Risk Type | Specific Content | Risk Level |

|---|---|---|

Performance Sustainability |

Dependent on non-recurring gains and losses, core business still in loss | 🔴 High |

Legal Litigation |

Significant uncertainty in the recovery of performance compensation | 🔴 High |

Historical Stain |

Has received regulatory punishment, compliance risks | 🟠 Medium-High |

Liquidity |

Small-cap stock with large fluctuations in trading volume | 🟠 Medium |

Pledge Risk |

Equity pledge ratio of 6.06% | 🟡 Medium |

| Opportunity Type | Specific Content | Assessment |

|---|---|---|

Computing Power Business |

A new infrastructure direction; if profitability is achieved, it is expected to reshape valuation | 🟢 Long-Term Focus |

Asset Disposal |

Stripping invalid assets can improve the financial structure | 🟡 Observe |

Chip Concentration |

Decrease in the number of shareholders, increase in control degree | 🟡 Observe |

- Performance growth depends on non-recurring gains and losses, with sustainability in doubt

- Litigation risks have not been fully resolved

- The stock price has risen significantly recently, creating a need for adjustment

- Track the disclosure of the 2025 annual report

- Focus on the actual profitability of the computing power business

- Pay attention to litigation progress

- Need to wait for the core business to achieve stable profitability

- Resolve historical legacy issues

- Verify the effectiveness of transformation

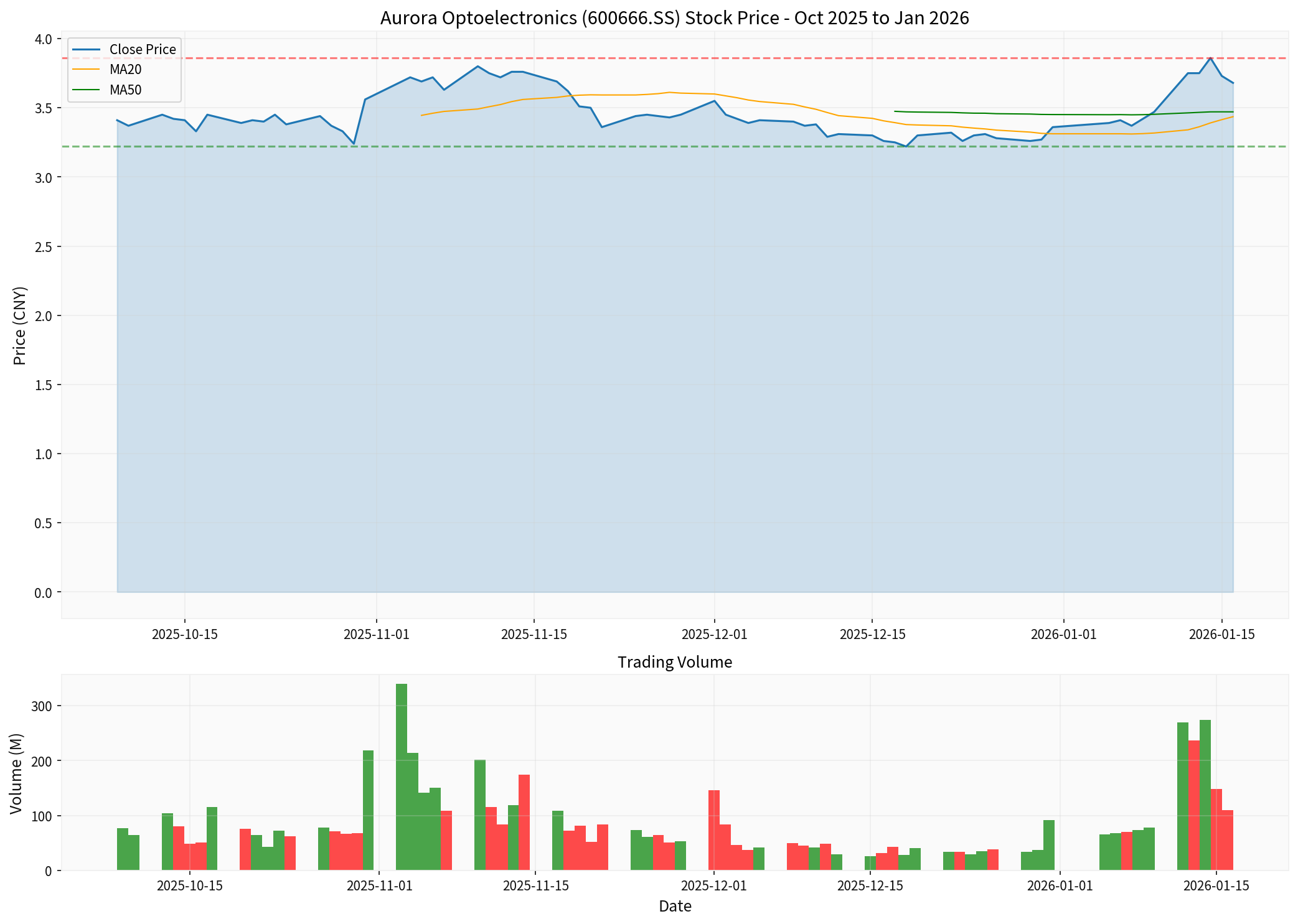

- Highest Price During the Period: RMB 4.00

- Lowest Price During the Period: RMB 3.18

- Latest Price: RMB 3.68

- Price Change During the Period: +7.92%

- Average Daily Trading Volume: Approximately 88.33 million shares

Oradtech’s performance surge in 2025 is mainly due to non-recurring gains and losses from equity transfers, and the profitability of its core business has not yet recovered. The company still faces multiple challenges such as litigation risks, historical compliance issues, and subsidiary bankruptcy liquidation. Northbound Capital’s position increase may be mainly driven by thematic investment in the computing power concept and the attraction of excess stock returns, but investors should be highly vigilant about the sustainability of its performance and legal risks, and make decisions prudently.

[1] Oradtech Optoelectronics Co., Ltd. 2025 H1 Profit Forecast Announcement (https://stockmc.xueqiu.com/202507/600666_20250715_ADD6.pdf)

[2] Oradtech Optoelectronics Co., Ltd. Announcement on Litigation Progress (https://money.finance.sina.com.cn/corp/view/vCB_AllBulletinDetail.php?stockid=600666&id=10686091)

[3] Oradtech Optoelectronics Co., Ltd. 2024 Annual Report (https://stockn.xueqiu.com/SH600666/20250418970761.pdf)

[4] Securities Times Network - Northbound Capital’s Holding Path Exposed! Lithium Battery Giants Favored, Commercial Aerospace Swept Up on a Large Scale (https://www.9fzt.com/common/ef19d9f426ed3fa52d0d3edbaa2022c0.html)

[5] iFind - Northbound Capital’s Holding Path Exposed! Global Lithium Battery Giants Added to for 7 Consecutive Quarters (https://t.10jqka.com.cn/m/post/postShareDetail/?pid=582318011)

[6] Gilin AI Database - Market Data and Financial Analysis[0]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.