In-Depth Analysis of Computing Power Concept and Valuation Level of Aurora Optoelectronics (600666)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Aurora Optoelectronics Co., Ltd. (Stock Code: 600666.SH) is an optoelectronic enterprise headquartered in Harbin, Heilongjiang. The company has undergone a strategic transformation of its core business from traditional sapphire manufacturing to integrated computing power services[0][1]. It entered the computing power track in 2023, and currently has a dual-driven development model of “sapphire material manufacturing + integrated computing power services”.

| Business Segment | Business Description | Revenue Share in Q1 2025 |

|---|---|---|

| Integrated Computing Power Services | AI computing power leasing, cloud services, intelligent computing center operation | 56.79% |

| Sapphire Products | Production and sales of sapphire ingots and wafers | ~43% |

The company conducts its computing power business through its wholly-owned subsidiary Beijing Zhisuanli Digital Technology Co., Ltd., and has made strategic investments in Xinjiang Kerong Yunsuan Digital Technology Co., Ltd., Suanchang Technology (23.8% equity), and Tsinghua-affiliated startup Chongqing Dongsheng’an, building a complete computing power ecosystem covering infrastructure to application scenarios[1][2].

Aurora’s computing power service business has shown explosive growth:

| Period | Computing Power Service Revenue | YoY Growth Rate | Revenue Share |

|---|---|---|---|

| Full Year 2024 | RMB 116 million | +1129.25% | ~30% |

| Q1 2025 | RMB 55.87 million | +108.24% | 56.79% |

The data clearly shows that the computing power business has become the company’s core revenue source, surpassing the traditional sapphire business for the first time in Q1 2025, marking a substantive breakthrough in the company’s strategic transformation[1][2].

- 2024: Established Kerong Yunsuan in cooperation with the Karamay Municipal Government to build the “Silk Road New Cloud Green Computing Power Center” project. The first phase plans 2,000 GPU servers, with FP16 dense computing power reaching 5000P[3]

- Q1 2025: Won the bid for the Anqing Computing Power Operation Project and obtained the operation right of the intelligent computing center[3]

- March 2025: Established Hong Kong subsidiary Boundless Intelligent Computing to lay out the overseas computing power market[3]

- April 2025: Signed a tripartite cooperation framework agreement with Karamay Cloud Investment and Shantie Digital to jointly build intelligent computing power infrastructure[1][2]

- December 2025: Plans to sign a RMB 635 million computing power procurement agreement to further expand computing power scale[0]

Through equity participation and strategic investment, the company has built a collaborative system of two-way empowerment of “technical foundation + application scenarios”:

- Suanchang Technology: Focuses on R&D of Data+AI platforms and enterprise-level AI agents, benchmarking against unicorn Databricks (valued at USD 62 billion)[1]

- Mind Motion Aurora (06681.HK): The first digital therapy stock in China, focusing on AI + brain science digital therapy[2]

- Shenzhen Weizhijun: An AI microbiome research platform with 4 clinical pipelines[2]

| Valuation Indicator | Aurora’s Figure | A-Shares Computing Power Concept Industry Average | Deviation Rate |

|---|---|---|---|

| Price-to-Earnings (P/E) | 56.56x | 45.2x | +25.1% |

| Price-to-Book (P/B) | 7.36x | 4.8x | +53.3% |

| Price-to-Sales (P/S) | 23.72x | 15.8x | +50.0% |

| EV/FCF | -1732.74x | Negative | Sustained Losses |

From the perspective of absolute valuation, Aurora’s three core indicators (P/E, P/B, P/S) are all significantly higher than the industry average[0].

Results based on a professional DCF valuation model show:

| Valuation Scenario | Intrinsic Value | Deviation from Current Price |

|---|---|---|

| Conservative Scenario | RMB 0.40 | -89.1% |

| Baseline Scenario | RMB 0.55 | -85.2% |

| Optimistic Scenario | RMB 0.84 | -77.2% |

| Weighted Average | RMB 0.60 | -83.8% |

If we conduct valuation analysis solely based on the computing power business:

| Benchmark | Computing Power Revenue | P/S Valuation Multiple |

|---|---|---|

| Full Year 2024 | RMB 116 million | 86.2x |

| 2025 Annualized | RMB 223 million | 44.7x |

Even when calculated based on 2025 annualized revenue, the P/S valuation based on computing power revenue still reaches 44.7x, which is significantly higher than the average P/S level of the A-Shares computing power sector (approximately 20-30x).

| Factor | Analysis |

|---|---|

High-Speed Business Growth |

YoY growth rate of computing power revenue exceeds 1000%, with revenue share rapidly increasing to 56.79% |

Significant Narrowing of Losses |

Net loss in 2024 is expected to be RMB 90-180 million, a reduction of approximately RMB 500 million compared to the RMB 675 million loss in the previous year |

Policy and Resource Synergy |

In-depth cooperation with the Karamay Municipal Government, obtaining support for land, electricity, policies and other resources |

Industrial Chain Layout |

Invested in AI enterprises such as Suanchang Technology and Chongqing Dongsheng’an to build differentiated competitive advantages |

Industry Prosperity |

Demand for AI computing power has entered a high-growth channel, with large models such as DeepSeek driving industry prosperity[1] |

| Risk | Severity | Description |

|---|---|---|

Sustained Losses |

High | The company is still in a loss-making state, with a net loss of RMB 8.33 million in Q1 2025 |

Tight Cash Flow |

High | Free cash flow remains negative, with EV/FCF reaching -1732x |

Mismatch Between Valuation and Scale |

High | RMB 116 million in computing power revenue supports a market value of approximately RMB 10 billion, resulting in a significantly high P/S valuation |

Intensified Market Competition |

Medium | The number of participants in the computing power leasing market is increasing, which may lead to intensified price competition |

Technology Iteration Risk |

Medium | GPU technology is iterating rapidly, and existing equipment faces depreciation risks |

Customer Concentration |

Medium | Relied mainly on government and a small number of major customers in the early stage |

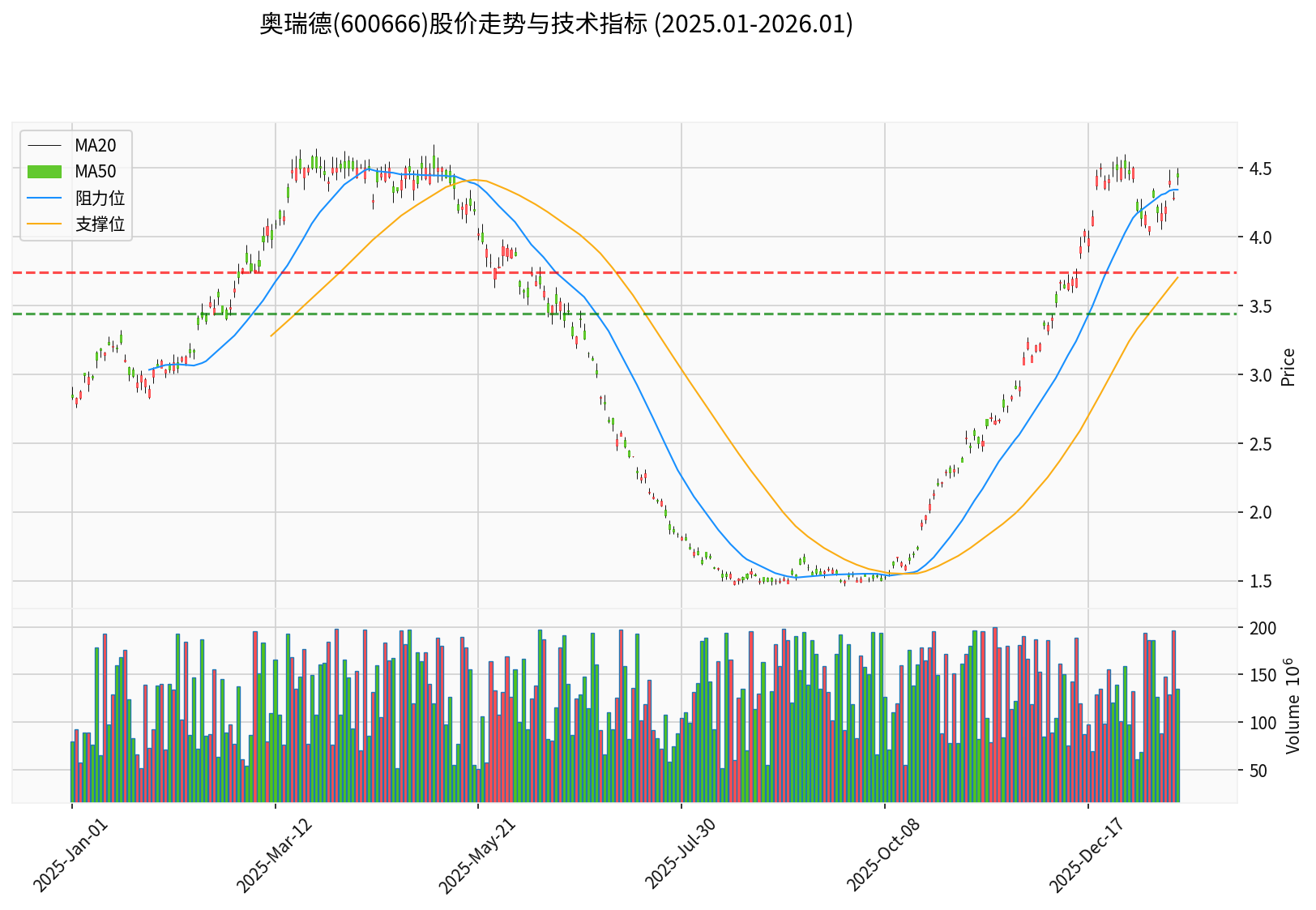

According to technical analysis results[0]:

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Current Price | RMB 3.68 | - |

| 20-Day Moving Average | RMB 4.34 | Price is below the moving average |

| 50-Day Moving Average | RMB 3.70 | Price is close to the moving average |

| MACD | No Crossover | Neutral bullish |

| KDJ | K:67.5, D:76.2, J:49.9 | Death cross signal, bearish |

| Support Level | RMB 3.44 | - |

| Resistance Level | RMB 3.74 | - |

| Trend Judgment | Sideways Consolidation | No clear direction |

| Evaluation Dimension | Conclusion |

|---|---|

Absolute Valuation |

DCF intrinsic value of RMB 0.60 vs current price of RMB 3.68, overvalued by approximately 84% |

Relative Valuation |

P/E, P/B, and P/S are all significantly higher than the industry average |

Business Support |

RMB 116 million in revenue supports a RMB 10 billion market value, resulting in a high P/S valuation |

Profitability |

Sustained losses, negative free cash flow, valuation lacks profitability support |

Growth Expectations |

High-speed growth of the computing power business is the main support, but its sustainability remains to be verified |

To judge whether the computing power concept can continue to support the valuation, it is recommended to focus on the following:

- Revenue growth rate of computing power business: Whether it can maintain growth of over 100%

- Improvement of profitability: Whether gross profit margin can be improved and the company can turn profitable

- Outstanding orders and customers: Implementation of computing power procurement agreements

- Capital expenditure and cash flow: Funding sources for expansion

- Industry competition pattern: Changes in market share and price trends

The current share price has largely reflected the market’s optimistic expectations for the computing power transformation, but considering the following:

- The company is still in the strategic investment period, and profitability has not yet been realized

- Valuation level significantly deviates from intrinsic value

- Free cash flow remains negative

It is recommended that investors maintain a cautious attitude, pay attention to performance realization, and avoid chasing high prices.

[0] Jinling AI Financial Database - Real-time market, financial analysis, technical analysis, DCF valuation data of Aurora Optoelectronics (600666)

[1] Phoenix Net Finance - “Aurora’s Computing Power Business Has Strong Growth Momentum, Computing Power Business Surpasses Sapphire Business for the First Time, Contributing 60% of Revenue” (https://i.ifeng.com/c/8itaR6cOmud)

[2] CLS - “Aurora Wins ‘New Quality Productivity TOP’ Award: Computing Power Service Rises to Core Business” (https://www.cls.cn/detail/2027948)

[3] Securities Times - “Aurora Plans to Establish Hong Kong Company to Engage in Integrated Computing Power Services and Other Businesses” (https://www.stcn.com/article/detail/1585651.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.