Analysis of the Impact of EU-US Trade Frictions on European Market Investment Sentiment and Cross-Border Capital Flows

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Based on collected data and analysis, we now present a comprehensive investment research report:

On January 17, 2026, US President Trump announced a

Affected European countries include Denmark and its allies. The Trump administration has clearly stated that the tariff measures will remain in place until “fully acquire Greenland”[3]. This move has triggered strong reactions across Europe:

- European Commission President Ursula von der LeyenandEuropean Council President António Costaissued a joint statement, stating that the tariff hike will “undermine transatlantic relations and could lead to a dangerous vicious cycle”[4]

- French President Emmanuel Macron,German Chancellor Friedrich Merz, and other key EU leaders have stated that they will “act in unity and coordination” to safeguard European sovereignty[4]

- Manfred Weber, Chairman of the European People’s Party (EPP), the largest group in the European Parliament, clearly stated that the existing EU-US trade agreement “cannot be ratified at this stage”[5]

Bernd Lange, Chairman of the European Parliament’s Committee on International Trade, has urged the European Commission to

| Measure Type | Specific Content | Scope of Impact |

|---|---|---|

Suspension of Trade Agreement |

Suspend the ratification of the EU-US Trade Agreement | Affects tariff reductions for industrial and agricultural products |

Anti-Coercion Instrument |

Activate the EU’s retaliatory legal tool | Targets the US trade surplus in services |

Retaliatory Tariffs |

Impose a 25% tariff on $28 billion worth of US goods | Covers aircraft, auto parts, alcoholic beverages, etc. |

Services Trade Retaliation |

Impose tariffs on US digital services | Targets service revenues of tech giants |

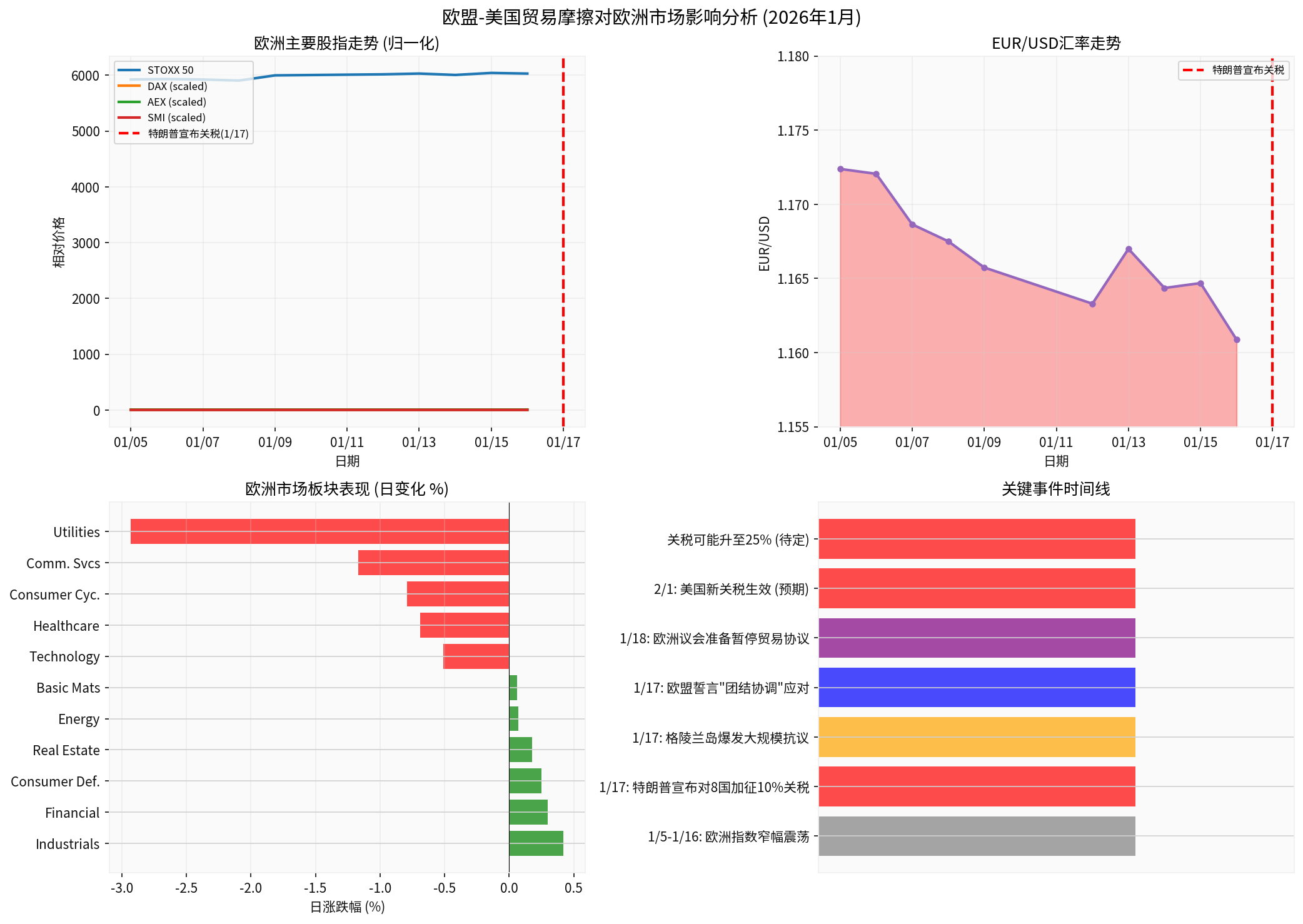

As of January 16, 2026 (the last trading day before the news was announced), major European stock indices exhibited a

| Index | Closing on Jan 5 | Closing on Jan 16 | Price Change During Period | Remarks |

|---|---|---|---|---|

STOXX 50 |

5,923.69 | 6,029.45 | +1.78% | Narrow fluctuations |

Germany DAX |

24,868.69 | 25,297.13 | +1.72% | Relatively resilient |

Netherlands AEX |

1,759.75 | 1,787.25 | +1.56% | Stable performance |

Switzerland SMI |

13,247.32 | 13,413.59 | +1.26% | Slight upward movement |

Notably, on January 16 (Thursday), the market already reacted to the impending tariff news, with major indices closing lower across the board:

- STOXX 50: -0.17%

- Germany DAX: -0.15%

- Netherlands AEX: -0.15%

- Switzerland SMI: -0.25%

The EUR/USD exchange rate has declined steadily from the

- Market concerns over the escalation of EU-US trade frictions

- Safe-haven sentiment driving short-term US dollar strength

- Capital outflow pressure weighing on the euro

Sector performance in the US market shows[0] that

| Best Performing | Daily Gain | Worst Performing | Daily Loss |

|---|---|---|---|

| Industrial Stocks | +0.42% | Utilities | -2.93% |

| Financial Services | +0.30% | Communication Services | -1.17% |

| Consumer Staples | +0.25% | Consumer Discretionary | -0.79% |

This differentiation indicates that investors are shifting from defensive assets to cyclical sectors, suggesting relative confidence in the economic outlook, but overall risk appetite has declined.

- Increased Uncertainty: The deterioration of transatlantic relations has increased uncertainty about the export prospects of European enterprises

- Stalled Trade Agreement: The EU-US trade agreement, which was partially implemented, faces the risk of full rejection[5]

- Corporate Profit Pressures: European enterprises dependent on the US market (especially the automotive, machinery, and luxury goods sectors) are facing cost increases

- Expectations of Policy Coordination: The EU leaders’ commitment to “unity and coordination” helps stabilize market sentiment

- Retaliatory Tool Options: The EU has a diverse set of retaliatory tools to effectively hedge risks

- Internal Demand Potential: The European economy may shift to the internal market, reducing dependence on the US market

According to market analysts’ forecasts[7], sentiment in the European market may evolve through three phases:

| Phase | Time Frame | Expected Characteristics |

|---|---|---|

Phase 1 (1-2 Weeks) |

News Digestion Period | Increased volatility, rising safe-haven sentiment |

Phase 2 (1-3 Months) |

Negotiation and Game Period | Sector differentiation, tech stocks relatively resilient |

Phase 3 (3-6 Months) |

New Equilibrium Period | Market repricing, focus on fundamentals |

The escalation of EU-US trade frictions may lead to the following changes in capital flows:

- Short-Term Speculative Capital: Hedge funds and quantitative funds may reduce their European risk exposure

- USD-Denominated Assets: European investors may increase holdings of US dollar assets to hedge risks

- Capital in Sensitive Sectors: Sectors dependent on US exports, such as automotive and machinery, may face capital withdrawals

- Emerging Asian Markets: Markets in Japan, China, and Southeast Asia may attract safe-haven capital

- European Internal Market: Intra-EU trade may receive more attention

- Defensive Assets: Demand for traditional safe-haven assets such as gold and government bonds is rising

According to analysis from RBC Capital Markets[7], the following capital flow characteristics are present in the European market in 2026:

- Continuous Capital Inflows into European Tech Stocks: Despite trade frictions, the European technology supply chain (especially chip-related sectors) continues to attract capital[8]

- Relative Strength of Scandinavian Currencies: Nordic currencies may outperform the EUR, as trade frictions have a smaller direct impact on Scandinavian countries

- Policy Arbitrage Opportunities: The ECB’s stable interest rate policy, combined with uncertainty in Federal Reserve policy, may trigger cross-border arbitrage transactions

In response to the current situation, it is recommended that investors consider the following strategies:

| Strategy Type | Specific Recommendations | Risk Level |

|---|---|---|

Defensive Strategy |

Increase holdings in European utilities and healthcare staples sectors | Low |

Hedging Strategy |

Short EUR/USD or buy US dollar call options | Medium |

Diversification Strategy |

Increase allocations to Asian markets, reduce dependence on single EU or US markets | Medium |

Opportunistic Strategy |

Focus on high-quality European export enterprises that have been unduly sold off | High |

| Risk Type | Description | Impact Level |

|---|---|---|

Trade War Escalation |

Mutual tariff hikes expand in scope | High |

Deterioration of NATO Relations |

Security cooperation is affected | High |

Supply Chain Disruptions |

Industrial chains such as automotive and aerospace are impacted | Medium-High |

Inflation Rebound |

Imported commodity costs rise | Medium |

Decline in Corporate Confidence |

Investment decisions are delayed | Medium |

| Scenario | Probability | Expected STOXX 50 Level | Expected EUR/USD Range |

|---|---|---|---|

Optimistic Scenario : Both parties reach a compromise |

25% | 6,300-6,500 | 1.18-1.22 |

Baseline Scenario : Low-intensity frictions persist |

50% | 5,800-6,200 | 1.14-1.18 |

Pessimistic Scenario : Full-scale trade war |

25% | 5,200-5,700 | 1.08-1.14 |

-

Limited but Sustained Short-Term Impact: The direct impact of EU-US trade frictions on the European market is limited (major index declines <1%), but uncertainty will continue to roil the market

-

EUR Under Pressure but Has a Floor: The EUR/USD exchange rate may find support in the 1.14-1.16 range, with the ECB’s stable policy providing a floor

-

Differentiated Capital Flows: Short-term capital may flow out, but structural capital (especially in the tech sector) continues to flow in

-

Limited Impact of Retaliatory Measures: The EU’s retaliatory measures are more political signals, with relatively controllable actual economic impacts

- Prefer Defensive Allocations: In the short term, it is recommended to increase allocations to defensive European sectors such as healthcare and utilities

- Focus on Technology Supply Chains: Strong capital expenditure guidance from chip enterprises such as TSMC supports European technology suppliers

- Maintain Flexible Positions: Adjust risk exposure in a timely manner based on negotiation progress

- Monitor the German Election: The March German election may become a turning point for European policy[7]

[1] Sina Finance - EU Prepares to Suspend EU-US Trade Agreement After Trump’s Latest Tariff Threat (https://finance.sina.com.cn/world/2026-01-18/doc-inhhsmvf9125523.shtml)

[2] Storm Media - “Tariffs on 8 European Countries if Greenland is Not Sold!” (https://www.storm.mg/article/11096069)

[3] Yahoo Finance Hong Kong - EU Prepares to Suspend EU-US Trade Agreement After Trump’s Latest Tariff Threat (https://hk.finance.yahoo.com/news/川普發出最新關程华和議-211746593.html)

[4] Euronews - EU vows coordinated response to Trump’s tariffs threat over Greenland sale (https://www.euronews.com/my-europe/2026/01/17/eu-vows-coordinated-response-to-trumps-tariffs-threat-over-greenland-sale)

[5] Bloomberg - EU Set to Halt US Trade Deal Over Trump’s New Tariff Threat (https://www.bloomberg.com)

[6] NetEase News - European Parliament Member: EU Should Use Anti-Coercion Instrument to Respond to US Tariff Hike (https://www.163.com/dy/article/KJHB9R8405198CJN.html)

[7] RBC Capital Markets - Currency Report Card & 2026 Trades (https://www.rbccm.com/assets/rbccm/docs/fx/currency-report-card.pdf)

[8] XTB - Capital flows into European technology stocks (https://www.xtb.com/int/market-analysis/news-and-research/midday-wrap-capital-flows-into-european-technology-stocks)

[0] Gilin AI Financial Database - Market Index, Exchange Rate, and Sector Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.