Detailed Analysis Report on Topstar (300607.SZ) H-Share Listing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and public information, I provide you with a systematic analysis of the valuation impact and investment opportunities of Topstar’s H-share listing.

- January 16, 2026, Topstar officially submitted an application for H-share issuance and listing to the Hong Kong Stock Exchange, planning to list on the main board of the Hong Kong Stock Exchange [1][2]

- The offering is only available to eligible overseas investors and domestic Qualified Domestic Institutional Investors (QDII) [1][2]

- The application materials are draft versions, which may be updated and revised in accordance with regulatory requirements [1]

The H-share listing will bring the following valuation boost opportunities for Topstar:

| Valuation Boost Factor | Specific Impact |

|---|---|

Global Capital Coverage |

The Hong Kong stock market targets international investors, which is conducive to attracting global allocation-oriented institutional capital |

Brand Internationalization |

Enhance the company’s popularity and brand influence in the international market |

R&D Investment Capacity |

Expand financing channels and strengthen the capability of technological R&D investment |

Industrial Chain Discourse Power |

As a “chain leader” enterprise, international financing helps consolidate its industry position |

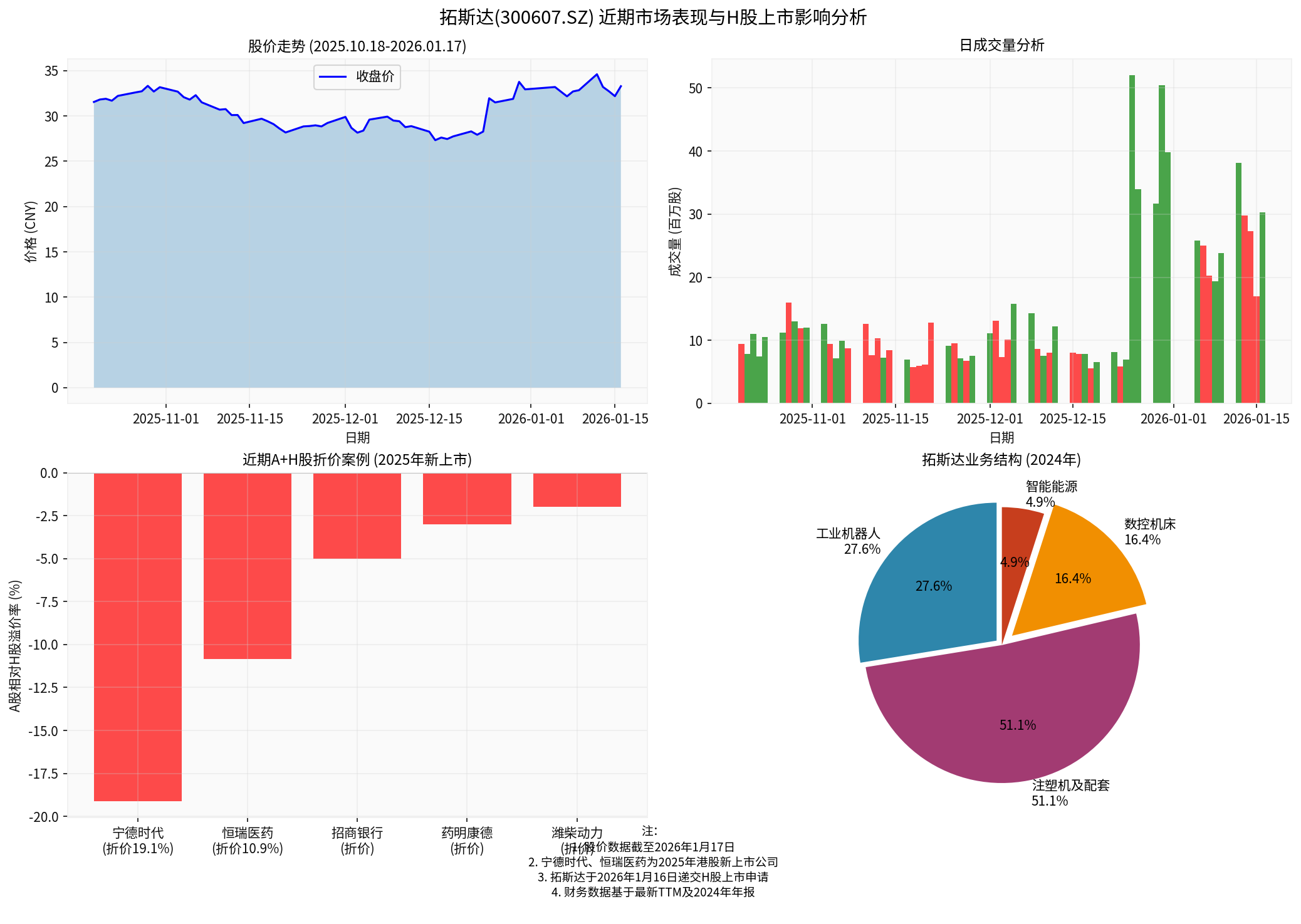

Topstar belongs to the industrial robot track in the high-end manufacturing sector, which has a solid valuation foundation in the Hong Kong stock market. Based on the analysis of recent A+H share listing cases:

- CATL(listed on Hong Kong Stock Exchange in 2025): A-share is discounted by 19.11% compared with H-share [3]

- Hengrui Pharmaceuticals(listed on Hong Kong Stock Exchange in 2025): A-share is discounted by 10.85% compared with H-share [3]

The “inversion” phenomenon of these two leading enterprises reflects that

Based on the 2024 financial data, Topstar is optimizing its business structure [4]:

- Increased Proportion of Product-Based Business: up 15.62 percentage points year-on-year

- Improved Gross Profit Margin: The gross profit margin of product-based business reached 34.25%, up 3.30 percentage points year-on-year

- Growth of Industrial Robot Business: Revenue increased by 12.50% year-on-year, with a gross profit margin of 47.53%

This strategic transformation of

As of January 16, 2026, the number of A+H listed companies has expanded to

| Premium Type | Number | Typical Cases |

|---|---|---|

A-Share Discount (Inversion) |

5 | CATL (-19.11%), Hengrui Pharmaceuticals (-10.85%) |

A-Share Premium < 100% |

Majority | Bank stocks with an average premium of 39.72% |

A-Share Premium > 100% |

37 | Zhejiang Shibao (360.30%), Junda Co., Ltd. (over 200%) [3] |

Based on a comprehensive judgment of the following factors, Topstar’s H-share is

| Influencing Factor | Analysis Conclusion |

|---|---|

Industry Attribute |

Industrial robots belong to high-end manufacturing, and the valuation in Hong Kong stock market is relatively reasonable |

Company Quality |

As a “chain leader” enterprise in Guangdong Province, it has a prominent industry position |

Business Structure |

The gross profit margin is continuously improving, which is in line with the preferences of the Hong Kong stock market |

Comparable Cases |

Leading enterprises such as CATL and Hengrui Pharmaceuticals have all experienced discounts |

Liquidity |

QDII funds can participate, providing liquidity support |

Base Scenario (Neutral Assumption):

├── Most Optimistic: H-share has a 5-10% premium over A-share (global capital scramble)

├── Base Scenario: H-share has a 5-15% discount to A-share (similar to CATL)

└── Conservative Scenario: H-share has a 15-25% discount to A-share (overall market downturn)

| Strategy Type | Operation Suggestions |

|---|---|

Short-Term |

The H-share listing news has been reflected in the stock price (+3.42% on January 18), so caution is needed for short-term chasing of high prices [0] |

Medium-Term |

Pay attention to the profitability recovery brought by business structure optimization, and accumulate positions on dips |

Long-Term |

After the Hong Kong listing, the A+H dual valuation system may bring opportunities for revaluation |

┌────────────────────────────────────────────────────────────────────────┐

│ Risk Factor │ Risk Level │

├────────────────────────────────────────────────────────────────────────┤

│ Overall low valuation of Hong Kong stock market │ Medium-High │

│ Intensified competition in the robot industry │ Medium │

│ Performance fluctuations during business transformation │ Medium │

│ International geopolitical risks │ Low │

│ Uncertainty in listing approval │ Low │

└────────────────────────────────────────────────────────────────────────┘

- Track Advantage: Industrial robots benefit from “Intelligent Manufacturing 2025” and export growth

- Successful Business Transformation: Increased proportion of product-based business and continuous improvement of gross profit margin

- Valuation Recovery in Hong Kong Stock Market: International listing is expected to bring valuation revaluation

- Improved Liquidity: Dual listing increases capital attention

As can be seen from the above chart [0]:

- Stock Price Trend: From October 2025 to January 2026, the stock price rose from about RMB 22 to RMB 33, an increase of more than 50%

- Trading Volume: The recent trading volume has increased significantly, indicating rising market attention

- Business Structure: The injection molding machine business accounts for the highest proportion (51.1%), followed by the industrial robot business (27.6%)

- Valuation Impact: The H-share listing will bring Topstar an opportunity forinternational valuation anchoring. It is expected that the H-share will be discounted by 10-20% compared with the A-share, close to the level of CATL

- Investment Opportunities:

- A-share investors may pay attention to the medium and long-term investment opportunities brought by business structure optimization

- Hong Kong stock investors may pay attention to the scarcity premium(industrial robot track)

- A-share investors may pay attention to the medium and long-term investment opportunities brought by

- Risk Warning: Pay attention to the liquidity of the Hong Kong stock market and changes in the prosperity of the robot industry

| Time Node | Key Points for Attention |

|---|---|

| Listing Approval Stage | Hearing progress, introduction of cornerstone investors |

| Prospectus Stage | Offering pricing, fundraising amount |

| After Listing | H-share liquidity, changes in A-H share price spread |

[1] Securities Times - “Topstar: Submits Application for H-Share Issuance and Listing to the Hong Kong Stock Exchange” (https://finance.eastmoney.com/a/202601183622650492.html)

[2] Sina Finance - “Topstar Applies for H-Share Issuance and Listing on the Hong Kong Stock Exchange” (https://finance.sina.com.cn/stock/zqgd/2026-01-18/doc-inhhthyv8807359.shtml)

[3] Securities Times Network - “Star Companies Cluster to Stage Listing ‘Double City Story’ A-H Premium Index Fluctuates Slightly and Valuation Gap Narrows” (https://www.stcn.com/article/detail/3598260.html)

[4] Securities Times Network - “Behind Topstar’s Strategic Transformation: Positioning in Embodied Intelligence and Remolding Growth Logic” (https://stcn.com/article/detail/1684557.html)

[0] Gilin API Data - Real-time Market and Financial Data of Topstar (300607.SZ)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.