Analysis of the 'Investment Copper Bar' Phenomenon and Implications for Metal Market Investing

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the market data and technical analysis I have obtained, below is an in-depth analysis report on the ‘investment copper bar’ phenomenon:

The recently launched “investment copper bar” products in Shenzhen Shuibei Market are priced at

| Feature | Details |

|---|---|

| Pre-sale Price | RMB 190 per 1000 grams |

| Sales Model | Pre-order, advance reservation required |

| Buyback Policy | Sale-only, no buyback |

| Processing Fee Issue | Merchants believe processing fees may be higher than the value of copper itself |

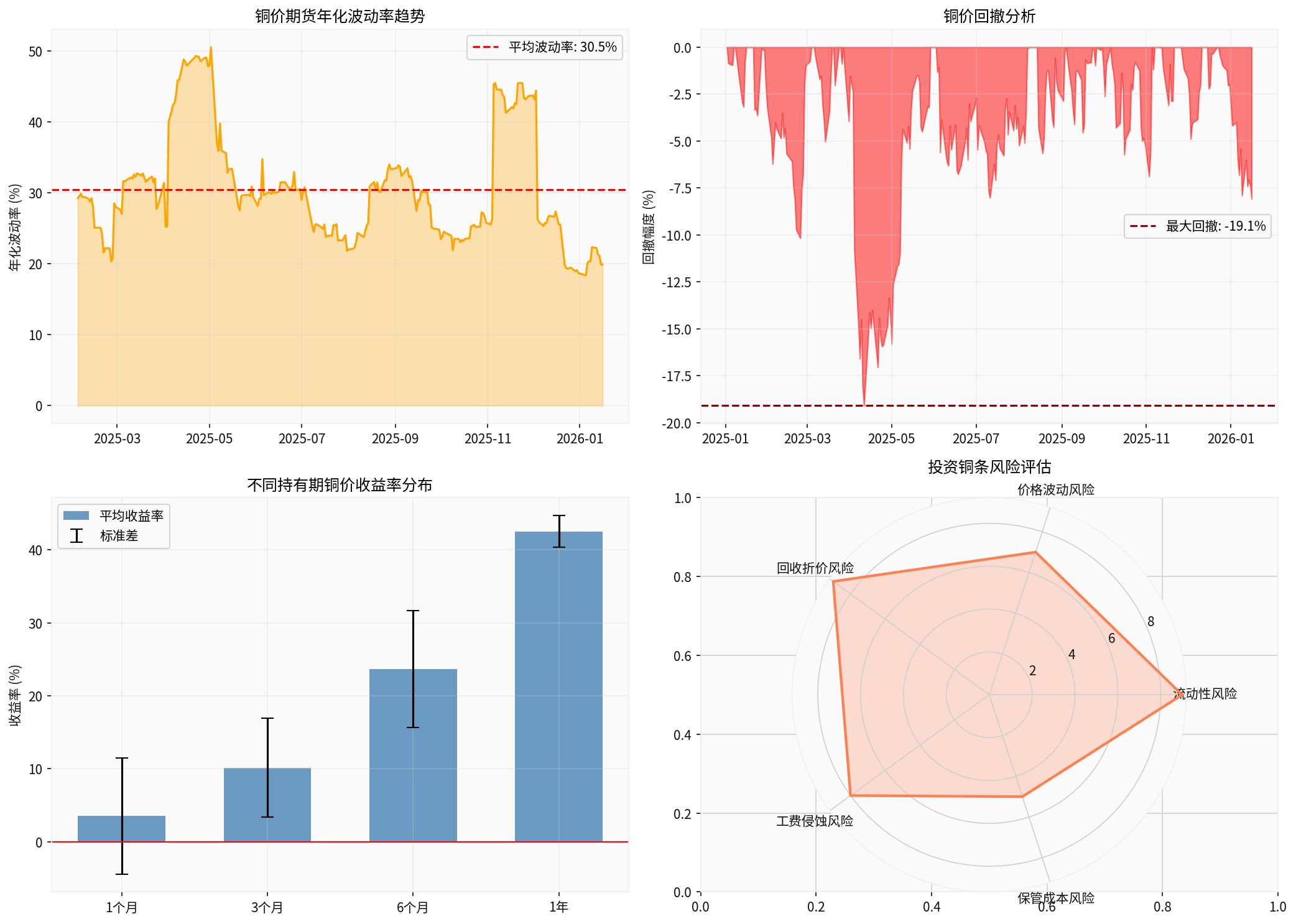

Based on the latest technical analysis data of COMEX Copper Futures (HG)[0]:

- Current Price: $26.16 per pound(approx. RMB 415 per kilogram)

- Full-year 2025 Increase: +39.97%

- Decline from Historical High ($28.72): -8.91%

- Increase from Historical Low ($16.80): +55.71%

| Indicator | Value | Signal Interpretation |

|---|---|---|

| 20-Day Moving Average | $27.34 | Short-term Pressure |

| 50-Day Moving Average | $26.99 | Medium-term Downtrend |

| 200-Day Moving Average | $23.21 | ✅ Long-term Uptrend |

| RSI(14) | 26.18 | ⚠️ Oversold Zone |

| Annualized Volatility | 19.89% | High Volatility |

- ✅ Long-term Trend: Uptrend(Price above 200-day moving average)

- 🔻 Medium-term Trend: Downtrend(Price below 50-day moving average)

- ⚠️ RSI indicates potential short-term oversold condition, with rebound opportunities

| Risk Dimension | Risk Level | Detailed Analysis |

|---|---|---|

Liquidity Risk |

⭐⭐⭐⭐⭐ (Extremely High) | No official buyback channels, can only be liquidated as raw materials |

Price Fluctuation Risk |

⭐⭐⭐⭐ (High) | Annualized volatility of nearly 20%, with amplitude up to 50%+ |

Buyback Discount Risk |

⭐⭐⭐⭐⭐ (Extremely High) | Merchants clearly state that buyback may be based on raw material prices |

Processing Fee Erosion Risk |

⭐⭐⭐⭐ (High) | Processing fees may exceed the value of the copper itself |

Storage Cost Risk |

⭐⭐⭐ (Medium) | Bear storage costs similar to gold |

| Comparison Dimension | Gold | Silver | Physical Copper Bars |

|---|---|---|---|

Financial Attribute |

Strong (Global reserve asset) | Relatively Strong (Dual attributes) | Weak (Pure industrial raw material) |

Liquidity |

High (Buyback available at banks/jewelry stores) | Medium | ❌ Extremely Low (No buyback channels) |

Processing Fee Ratio |

Low (1-3%) | Medium (3-5%) | ⚠️ May be higher than the value of copper itself |

Liquidation Channels |

Mature and well-established | Partial channels | ❌ Only raw material recycling |

Buyback Discount |

Low (2-5%) | Medium (5-10%) | ⚠️ May involve significant discounts |

Price Volatility |

Low | Medium-High | High |

-

Lack of a Mature Recycling System

- Unlike investment gold bars, copper bars lack unified recycling standards and channels

- Merchants clearly state “sale-only, no buyback”, leaving investors in a dilemma of “easy to buy, hard to sell”

-

Severe Processing Fee Erosion

- The pre-sale price of RMB 190 per 1000 grams includes processing fees

- Merchants point out that processing fees may be higher than the value of copper itself, compressing value-added space

-

Opaque Buyback Pricing

- Even if buyback is available, it will most likely be calculated based on raw material prices

- Lack of a standardized pricing mechanism similar to that of gold bars

-

Lack of Price Discovery Mechanism

- The correlation between copper bar prices and international copper prices is questionable

- It is difficult to determine whether there is a premium or discount

-

Law of Enthusiasm Spread: After gold and silver bars became “hit products”, investment enthusiasm spread to industrial metals such as copper bars, reflecting investors’ widespread pursuit of physical assets, but risks of “hotspot speculation” should be heeded[1][2]

-

Asset Allocation Logic: Precious metals have monetary attributes and hedging functions, while industrial metals (such as copper) mainly reflect industrial demand, with fundamental differences in investment logic

-

Differences in Risk Perception: Gold is supported by a mature buyback system, while copper bars lack such guarantees. Although the investment threshold seems lower, the actual risk is higher

| Investment Demand | Recommended Method | Risk Warning |

|---|---|---|

| Asset Preservation/Hedging | Physical gold bars, bank gold accumulation plans, gold ETFs | Pay attention to storage costs and buyback channels |

| Industrial Metal Exposure | Copper futures, copper ETFs, copper mining stocks | Monitor high volatility |

| Copper Price Speculation | Futures/CFD contracts | Requires professional knowledge and risk control capabilities |

Avoid |

❌ Physical copper bars (lack of liquidity guarantees) | High processing fees, no buyback channels |

- Copper ETFs (e.g., CPER): Track copper prices with strong liquidity

- Copper Mining Stocks (e.g., FCX, SCCO): Benefit from copper price increases and production expansion

- Copper Futures: Enable precise exposure management for professional investors

There are significant divergences in the market regarding copper price prospects[1][2]:

- Bulls: Goldman Sachs raised its copper price forecast for the first half of 2026 to $12,750 per ton

- Bears: Citigroup believes “January may be the annual high”, and investors should be wary of a pullback after tariff expectations are realized

- Incidents of gold raw material suppliers and jewelry stores “defaulting and fleeing” have occurred in Shuibei Market before[1]

- As an emerging investment product, copper bars have an immature market and lack standardized regulation

- Investors should be wary of merchant marketing rhetoric and rationally evaluate investment value

| Assessment Dimension | Risk Conclusion |

|---|---|

| Liquidity | ❌ Extremely Low - No official buyback channels, difficult to liquidate |

| Buyback Value | ❌ Highly Uncertain - May involve significant discounts based on raw material prices |

| Investment Value | ⚠️ Limited - Severe processing fee erosion, lack of financial attribute support |

[1] Securities Times - “Investment Copper Bars” Emerge in Shenzhen Shuibei? Reporters Verify→ (https://www.stcn.com/article/detail/3598474.html)

[2] Sina Finance - Copper Bar Investment Draws Attention: A New Hotspot in Shuibei or a Speculation Trap? (https://finance.sina.com.cn/roll/2026-01-18/doc-inhhsscc9064063.shtml)

[0] Gilin AI Financial Database - Real-time Quotes and Technical Analysis Data of COMEX Copper Futures (HG)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.