Investment Value Analysis of the Duty-Free Policy for Value-Added Processing in Hainan Free Trade Port

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained policy materials and market data, I will systematically evaluate the investment value of the Duty-Free Policy for Value-Added Processing in Hainan Free Trade Port.

On December 18, 2025, Hainan Free Trade Port officially launched full-island customs clearance, marking the comprehensive implementation of the policy system featuring “zero tariff, low tax rate, simplified tax system”[1]. As one of the core policies of Hainan Free Trade Port, the Duty-Free Policy for Value-Added Processing has the following key points:

- Expanded Scope of Application:The number of zero-tariff commodity tariff lines increased from 1,900 before customs clearance to approximately 6,600, accounting for 74% of all commodity tariff lines, up from 21%[2]

- Value-Added Processing Threshold:Hainan-produced goods with value-added processing reaching 30% are exempt from import tariffs when entering the Chinese mainland via the “second line”

- Expanded Beneficiary Entities:Extended from independent legal persons to various enterprises and public institutions, significantly lowering policy thresholds[3]

As of December 2024, there were 106 registered enterprises for value-added processing in Hainan Province, with a cumulative domestic sales value of 6.7 billion yuan and 540 million yuan in tariff exemptions[5].

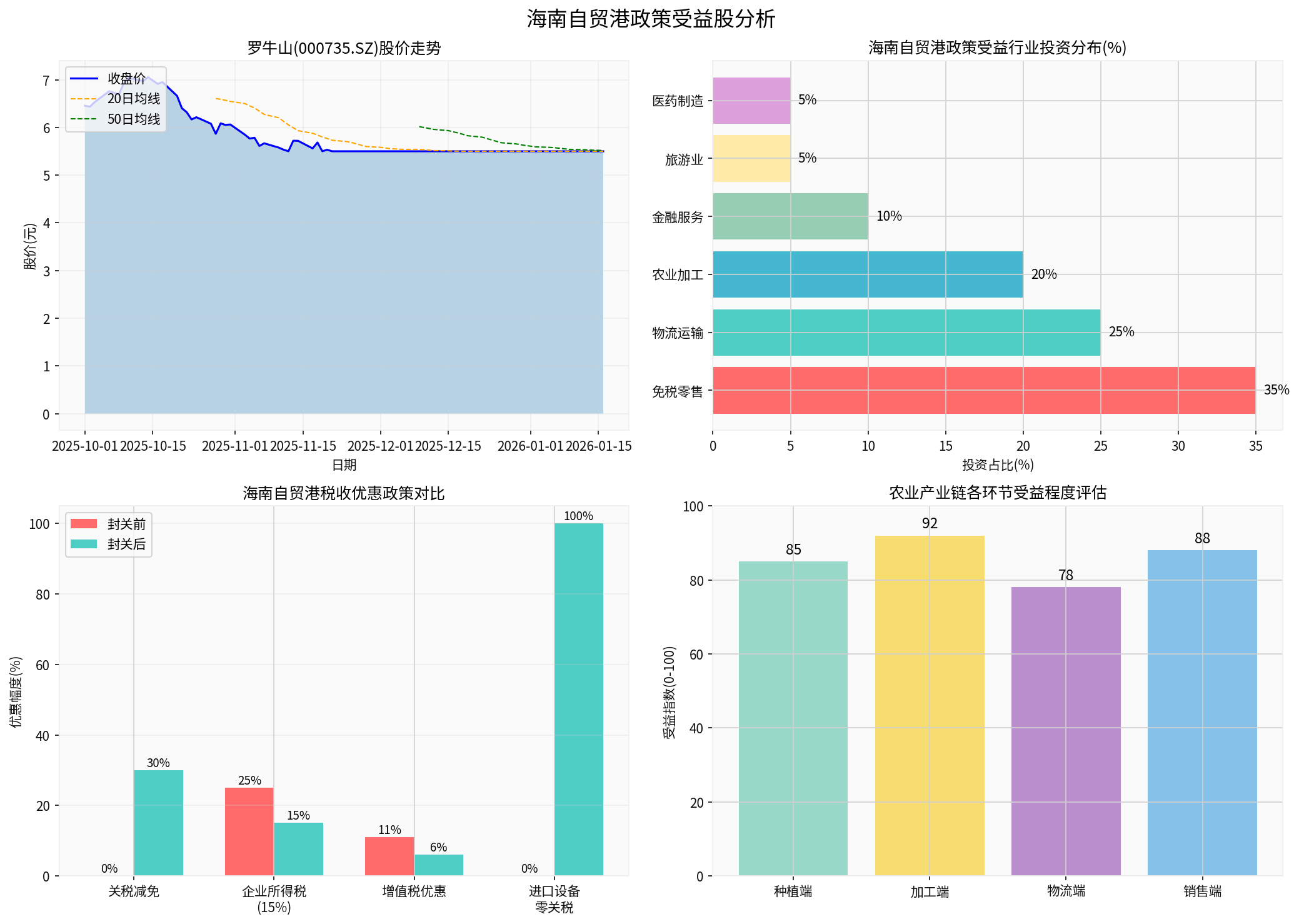

The Hainan Free Trade Port policy has varying degrees of benefits for each link of the agricultural industry chain:

| Industry Chain Link | Benefit Level | Core Benefits |

|---|---|---|

Processing Segment |

92% | The 30% value-added processing duty-free policy directly reduces production costs |

Sales Segment |

88% | Products enjoy tariff reductions when entering the mainland market |

Planting Segment |

85% | Inclusion of Hainan-produced goods in value-added calculation boosts procurement demand |

Logistics Segment |

78% | The “two ends outside” model drives growth in import and export logistics |

- Tropical Agricultural Product Processing:Deep processing of characteristic agricultural products such as coffee, mango, betel nut, and jackfruit

- Southern Breeding Seed Industry:More than 2,800 enterprises have gathered in Yazhou Bay Science and Technology City, and the output value of the southern breeding seed industry exceeded 18 billion yuan in 2024[6]

- Natural Rubber Processing:Hainan Xiangyuan Industry has successfully completed multiple batches of value-added processing business, with nearly 600,000 yuan in tariff reductions[7]

- Jewelry Processing:The import tariff on seawater pearls is as high as 21%. After the first batch of policies was implemented, enterprises have imported over 8 million yuan worth of goods, saving 1.7 million yuan in tariffs[8]

- Core Business: Hainan’s largest “vegetable basket project” guarantee base, covering animal husbandry and cold chain logistics

- Market Capitalization: Approximately 9.09 billion yuan, current stock price: 7.89 yuan[9]

- ROE: -2.31% (net profit margin: -4.67%), operating at a loss

- Financial Approach: Conservative, with prudent accounting policies

- Debt Risk: Low risk, current ratio: 1.01[9]

- Cold chain logistics business benefits from the growth of Hainan’s agricultural product import and export

- Deep processing of livestock products can enjoy the duty-free policy for value-added processing

- As a local agricultural leader in Hainan, it will directly benefit from the policy dividends of the Free Trade Port

- Core Business: Hainan food processing enterprise, with layout in grain, oil, and cross-border trade

- Market Capitalization: Approximately 4.89 billion yuan, current stock price: 7.39 yuan[9]

- ROE: -1.70% (net profit margin: -0.65%)

- Financial Approach: Aggressive, with a low depreciation/capital expenditure ratio

- Debt Risk: Low risk, current ratio: 1.69[9]

- Reduced import costs for raw materials used in edible oil processing

- Cross-border trade business directly benefits from the facilitation measures of the Free Trade Port

- Inclusion of Hainan-produced agricultural products in value-added calculation can reduce tax burdens

- Core Business: Natural rubber planting, processing, and sales

- Market Capitalization: 25.63 billion yuan, stock price: approximately 5.99 yuan[10]

- 2024 revenue: 33.96 billion yuan, with a year-on-year growth of 3.23%

- Net Profit: -275 million yuan (year-on-year reduction in loss of 40.24%)

- Gross Profit Margin: 2.69%, Net Profit Margin: -1.27%[10]

- One of the first enterprises to enjoy the duty-free policy for value-added processing

- Value-added processing of rubber products for domestic sales can be exempt from tariffs, reducing raw material import costs

- Inclusion of Hainan-produced natural rubber in value-added calculation enjoys superimposed policy effects

| Cost Item | Before Customs Clearance | After Customs Clearance | Cost Savings Rate |

|---|---|---|---|

| Tariffs (high-tax categories) | 15-25% | 0 | 100% |

| Imported Equipment | Includes tariff and VAT | Zero tariff | Savings of over 20% |

| High-End Pesticides/Fertilizers | Includes tariff | Zero tariff | Savings of 30-50% |

| Corporate Income Tax | 25% | 15% | Savings of 40% |

- Import raw materials from abroad → Process locally in Hainan → Export overseas

- Typical Case: The coffee category has completed the first batch of import and export trade[11]

- After customs clearance, upstream and downstream enterprises are allowed to combine value-added processing statistics

- Enterprises shift from calculating “their own accounts” to jointly calculating “industry chain accounts”

- Easier to meet the 30% value-added threshold and enjoy tax incentives[12]

- Policy expectations have been partially reflected in stock prices

- Focus on the first batch of targets actually enjoying policy dividends

- Policy details are improved, and corporate performance actually improves

- Focus on leading enterprises in the processing and manufacturing industry

- Industrial clusters are formed, and industry chain collaboration effects emerge

- Hainan Free Trade Port becomes a strategic hub connecting the domestic and international dual circulations

- Policy Implementation Risk:Need to pay attention to the exclusion scope of the “four types of measures” (tariff quotas, anti-dumping and countervailing duties, trade remedies, safeguard measures)

- Weak Industrial Foundation:Hainan’s industrial foundation is relatively weak, and industry chain supporting facilities are not yet complete

- Increased Competition Risk:International agchemical giants may enter the Hainan market relying on technological and price advantages[13]

- Exchange Rate Fluctuation Risk:Import and export businesses are affected by exchange rate fluctuations

The Duty-Free Policy for Value-Added Processing in Hainan Free Trade Port brings historic development opportunities for local listed companies and agricultural processing enterprises in Hainan. For different types of investors, it is recommended to adopt differentiated strategies:

| Investor Type | Recommended Targets | Investment Logic |

|---|---|---|

Value Investment |

Hainan Rubber (601118.SH) | Industry leader, direct policy beneficiary, rated “Overweight” by analysts |

Thematic Investment |

Luoniushan (000735.SZ), Jingliang Holdings (000505.SZ) | Local agricultural leaders in Hainan, with strong policy support |

Long-Term Layout |

Enterprises related to the Southern Breeding Seed Industry | Strategic overlay of the “Southern Breeding Silicon Valley” and Free Trade Port policies, with strong long-term growth certainty |

[1] King & Wood Mallesons - Business Opportunities in Hainan FTP Policies After Customs Clearance

[4] King & Wood Mallesons - Detailed Explanation of the Duty-Free Policy for Value-Added Processing

[7] Securities Times - Hainan Customs Clearance Starts a New Chapter, “Zero Tariff” Dividends Released

[9] Gilin API - Financial Data of Hainan Listed Companies

[10] Eastmoney - Stock Data of Hainan Rubber (601118)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.