Valuation Rebound Potential and Investment Risk Assessment of the Russian Stock Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and sanctions situation analysis, below is a comprehensive assessment of the valuation rebound potential and investment risks of the Russian stock market:

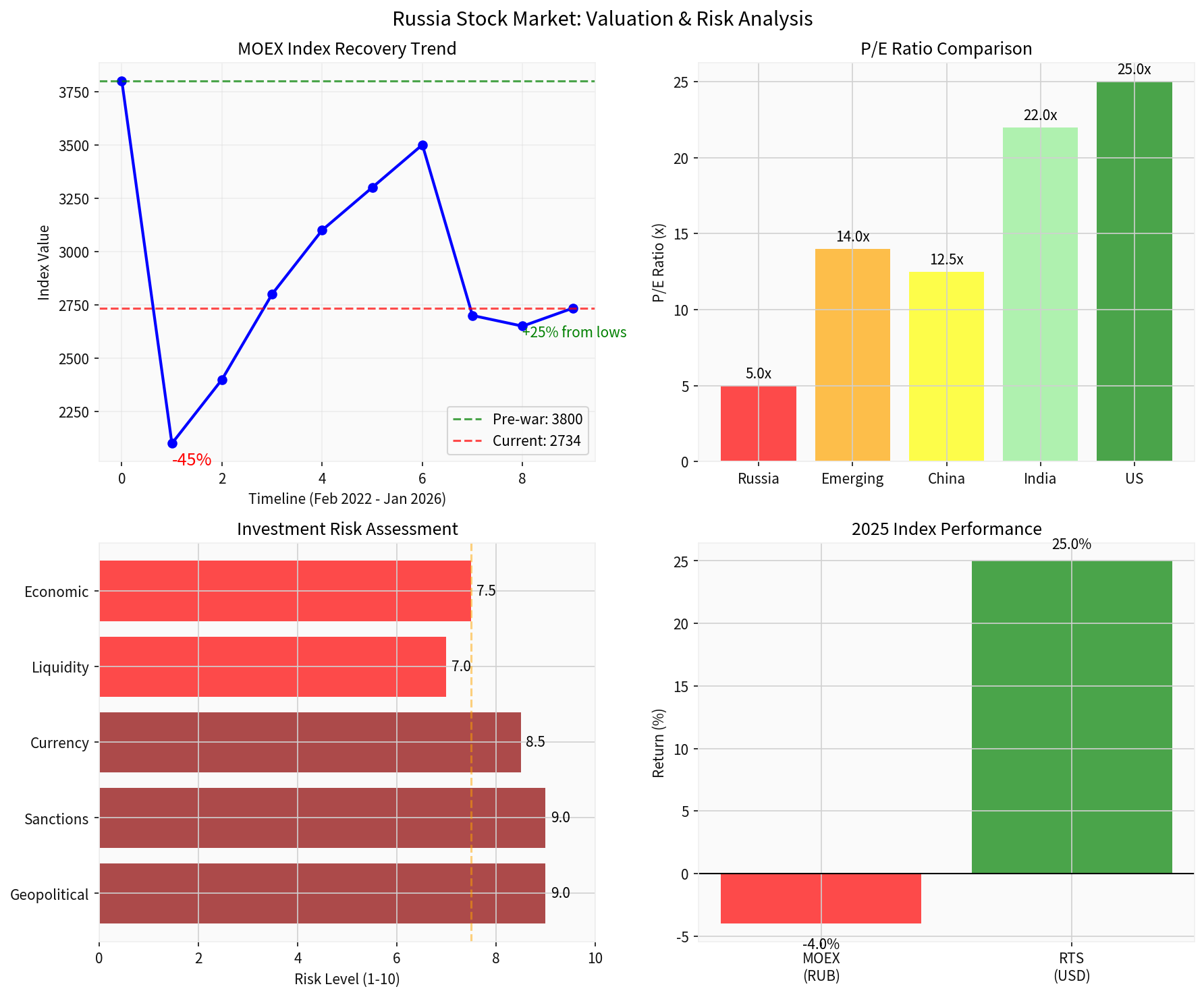

As of January 16, 2026, the performance of Russia’s two major indices shows a divergent pattern [0][1]:

| Index | Current Level | 2025 Performance | Denomination Currency |

|---|---|---|---|

MOEX Russia Index |

2,733.75 points | -4.0% | Russian Ruble |

RTS Index |

1,106.46 points | +24.9% | US Dollar |

| Time Period | MOEX Index Level | Decline from Pre-Sanctions Level |

|---|---|---|

| February 2022 (Pre-War) | ~3,800-4,000 points | — |

| March 2022 (Lowest Point) | ~2,100-2,200 points | -45% to -50% |

Current Level |

2,733.75 points |

~28%-32% [0] |

The current P/E ratio of the Russian stock market is only

| Market/Index | P/E Multiple |

|---|---|

MOEX Russia |

5.0x |

| Emerging Market Average | 14.0x |

| China CSI 300 | 12.5x |

| India NIFTY | 22.0x |

| US S&P 500 | 25.0x |

This extremely low valuation reflects the dual effects of sanctions risk premium and liquidity discount.

- Potential Rebound Space:Rebound to 80%-90% of pre-sanctions levels

- Corresponding Level:MOEX Index around 3,000-3,500 points

- Trigger:Easing of geopolitical conflicts, lifting or significant mitigation of sanctions

- Potential Rebound Space:Fluctuate around current levels

- Corresponding Level:Range of 2,600-2,900 points

- Trigger:No major policy changes, stable domestic economy

- Downside Risk:The index may retest the previous low of 2,100-2,200 points

- Trigger:Further restrictions on energy exports, escalation of financial sanctions

| Risk Type | Risk Rating (1-10) | Risk Status |

|---|---|---|

Geopolitical Risk |

9.0 | 🔴 Extremely High |

Financial Sanctions Risk |

9.0 | 🔴 Extremely High |

Exchange Rate Risk |

8.5 | 🔴 Extremely High |

Macroeconomic Risk |

7.5 | 🟠 High |

Liquidity Risk |

7.0 | 🟠 High |

Corporate Governance Risk |

7.5 | 🟠 High |

- The Russia-Ukraine conflict enters its fourth year, with unclear prospects for peace talks [4]

- Sanctions are expected to remain in place or even escalate in 2026 [5]

- Persistent risk of restrictions on energy exports

- SWIFT sanctions continue to affect cross-border payment and settlement [4]

- EU freezing of Russian assets may extend into 2026 [4][5]

- Western audit firms are gradually exiting the Russian market

- Foreign investors face severe legal and compliance risks

- The Central Bank of Russia expects the ruble to depreciate to 90-94 against 1 USDby 2026 [2]

- The central bank may reduce foreign exchange market interventions starting in 2026 [3]

- US dollar-denominated investment returns will be significantly eroded

- GDP growth has slowed sharply: only 0.6% in Q3 2025 [2]

- Potential technical recession (early 2026)

- Oil and gas revenues have declined due to falling oil prices and export restrictions [2]

- Trading volume on the Moscow Exchange continues to decline [3]

- Large-scale withdrawal of foreign institutional investors

- Market size has contracted by approximately 30%-40% compared to pre-sanctions levels

- Decline in the quality and transparency of information disclosure

- Major Western audit firms have exited the Russian market

- Management incentives may be more oriented towards political goals rather than shareholder value

Despite high risks, there are still some structural opportunities in the Russian stock market:

- Utilities:Stable electricity prices, rigid demand

- Consumer Staples:Related to people’s livelihood, less affected by economic cycles

- Pharmaceuticals and Healthcare:Supported by policies, growing demand for import substitution

- Oil and Gas Companies:Despite sanctions, still generate export revenues through alternative channels

- Mining Companies:Coexistence of domestic and external demand

- Gold Producers:Benefit from safe-haven demand and ruble depreciation

- State-Owned Enterprises:Receive implicit government backing

- Import Substitution Industries:Increased policy support

- Infrastructure Investment-Related:Key direction of government fiscal stimulus

- Domestic Substitution Demand:Market gaps left by the exit of Western technology companies

- Digital Transformation:Nebius (NASDAQ: NBIS), a spin-off of Yandex, has performed strongly, with a gain of over 225% in 2025 [6]

| Investor Type | Strategy Recommendation |

|---|---|

Risk-Taking Investors |

Consider bargain-hunting high-quality blue-chip stocks, focus on state-owned enterprises with stable cash flow, and set strict stop-loss levels |

Risk-Averse Investors |

It is recommended to avoid or maintain extremely low positions, invest indirectly through ETFs or funds, and monitor changes in sanctions policies |

All Investors |

Build positions in batches to reduce timing risk, diversify across different sectors, and closely track sanctions developments |

- Progress of Russia-Ukraine conflict negotiations

- Evolution of Western sanctions measures

- Ruble exchange rate trend (key psychological level: 90 against 1 USD)

- Changes in international oil prices

- Monetary policy direction of the Central Bank of Russia

The Russian stock market is currently in a unique

[0] Gilin AI Market Data (Retrieved on January 17, 2026)

[1] TASS - “Russian stock market indices in the green this Friday” (https://tass.com/economy/2072593)

[2] Meduza - “Stalling growth, falling oil prices, and the civilian sector sacrificed” (https://meduza.io/en/feature/2025/12/30/stalling-growth-falling-oil-prices-and-the-civilian-sector-sacrificed)

[3] Marketscreener - “Moscow Exchange MICEX RTS : Trading Volumes in December 2025” (https://www.marketscreener.com/news/moscow-exchange-micex-rts-trading-volumes-in-december-2025-ce7e58dade89fe20)

[4] Mishcon - “A pivotal year for international sanctions and economic statecraft” (https://www.mishcon.com/news/a-pivotal-year-for-international-sanctions-and-economic-statecraft)

[5] HK Law - “OFAC Sanctions: Top 5 Trends for 2026” (https://www.hklaw.com/en/insights/publications/2026/01/ofac-sanctions-top-5-trends-for-2026)

[6] CM News - “Will Nebius Stock Double in 2026?” (https://cmnews.com.tw/article/newsyoudeservetoknow-32d0e725-e332-11f0-9992-eec88df23fdc)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.