Analysis of Inventory Turnover Trend of Kweichow Moutai (600519)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the obtained financial data, I will systematically analyze the evolution rules and influencing factors of Moutai’s inventory turnover for you.

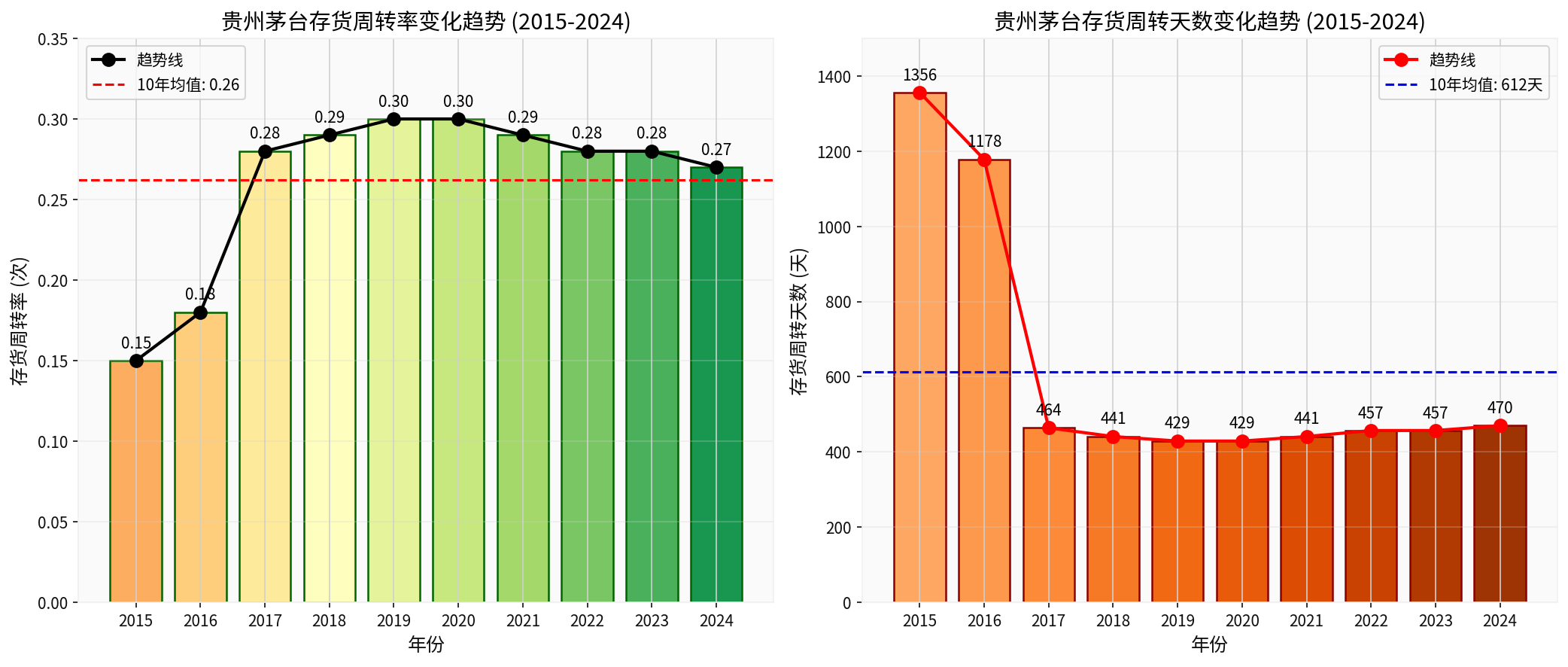

| Year | Inventory Turnover (Times) | Inventory Turnover Days (Days) | Annual Change |

|---|---|---|---|

| 2015 | 0.15 | 1,356 | — |

| 2016 | 0.18 | 1,178 | +20.0% |

| 2017 | 0.28 | 464 | +55.6% |

| 2018 | 0.29 | 441 | +3.6% |

| 2019 | 0.30 | 429 | +3.4% |

| 2020 | 0.30 | 429 | 0.0% |

| 2021 | 0.29 | 441 | -3.3% |

| 2022 | 0.28 | 457 | -3.4% |

| 2023 | 0.28 | 457 | 0.0% |

| 2024 | 0.27 | 470 | -3.6% |

- Average inventory turnover in the past 10 years: 0.26 times

- Average inventory turnover in the past 5 years: 0.28 times

- Cumulative growth from 2015 to 2024: 80.0%

- Fluctuation range: 0.15 ~ 0.30 times [1][2]

Inventory turnover slightly increased from 0.15 times to 0.18 times, representing a 20% growth. During this phase, Moutai began to strengthen channel management and inventory optimization, laying the foundation for subsequent significant improvements.

This is the period with the most significant improvement in Moutai’s inventory turnover:

- 2016-2017: Jumped 56%(0.18→0.28 times)

- 2017-2020: Continued optimization to the peak of 0.30 times

- Consumption Upgrade Dividend: The demand for high-end liquor exploded, resulting in a shortage of Moutai supply

- Channel Reform: Deepened the construction of the “Cloud Merchant” platform to improve delivery efficiency

- Capacity Release: The output of Moutai liquor grew steadily, alleviating the supply-demand contradiction

Inventory turnover fluctuated slightly within the range of 0.27-0.30 times:

- After reaching the peak of 0.30 times in 2020, it showed a slow downward trend

- In 2024, it dropped to 0.27 times, a 10% decrease from the peak

- Capacity Expansion: Moutai promoted the “14th Five-Year Plan” capacity expansion plan, leading to an increase in base liquor inventory

- Market Delivery Rhythm: Controlled the delivery rhythm to maintain terminal prices

- Macro Economy: High-end consumption was slightly under pressure [1][3]

| Comparison Dimension | Kweichow Moutai | Strong-Flavor Liquor (e.g., Wuliangye) |

|---|---|---|

| Inventory Turnover | 0.15-0.30 times | 0.77-0.94 times |

| Brewing Cycle | 5 years (Maotai-flavor) | 1-3 years (strong-flavor) |

| Turnover Characteristics | Naturally low inventory turnover | Relatively high |

The evolution of inventory turnover days more intuitively reflects the improvement in inventory efficiency:

- 2015: Approximately 1,356 days (3.7 years)

- 2017: Approximately 464 days (1.3 years) —Significant improvement of 785 days

- 2024: Approximately 470 days (1.3 years)

- Low inventory turnover ≠ low operating efficiency: The unique brewing process of Maotai-flavor liquor requires Moutai to hold a large amount of base liquor inventory, which is an important guarantee for its product strength

- Pay attention to trend inflection points: Since 2021, inventory turnover has slightly declined; it is necessary to continuously track the pace of capacity deployment and market digestion capability

- Combine with other indicators: Inventory turnover should be comprehensively analyzed with indicators such as advance receipts (contract liabilities) and gross profit margin to evaluate channel health

[1] Eastmoney - Kweichow Moutai Financial Indicator Data (https://emweb.securities.eastmoney.com/PC_HSF10/NewFinanceAnalysis/Index?type=web&code=sh600519)

[2] PDF Research Report - Kweichow Moutai Financial Analysis Notes (http://xqdoc.imedao.com/169e360e4f56e82b3fb5fc08.pdf)

[3] Eastmoney - Kweichow Moutai 2024 Financial Forecast (https://pdf.dfcfw.com/pdf/H3_AP202505261679487019_1.pdf)

[4] Qianzhanyan - Kweichow Moutai Financial Statement Analysis (https://stock.qianzhan.com/hs/caiwufenxi_600519.sh.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.