Rani Therapeutics Q2 2025: High-Risk Pipeline Progress Amid Liquidity Crisis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Rani Therapeutics Holdings Inc. (NASDAQ: RANI) delivered a complex Q2 2025 earnings report that simultaneously demonstrates technological promise and financial distress. The clinical-stage biotechnology company showed meaningful progress in cost reduction and pipeline development, particularly with its RT-114 obesity treatment platform, while facing severe liquidity constraints that threaten near-term operational viability. With shares trading at $0.51 (down 3% post-earnings) and a current market cap of just $35 million, Rani represents a classic high-risk, high-reward biotechnology investment scenario where the upcoming Phase 1 trial initiation could serve as a make-or-break catalyst.

Rani demonstrated effective expense control with total operating expenses declining to $10.5 million from $12.5 million in Q2 2024. R&D expenses decreased 10% to $5.5 million while G&A expenses fell 22% to $5.0 million, resulting in a 16% improvement in net loss to $11.2 million. This disciplined spending suggests management is actively extending cash runway despite the absence of contract revenue.

The company’s financial position presents immediate sustainability challenges:

- Cash position declined 63% to $10.2 million from $27.6 million at year-end 2024

- Current liabilities ($20.6 million) exceed current assets ($11.1 million) by $9.5 million

- Stockholders’ deficit of $9.2 million with negative book value of -$0.142 per share

- Quarterly cash burn of $11.2 million suggests runway may not extend beyond Q3 2025 without additional financing

Management has been proactive in addressing funding needs, securing $7.3 million through May-July 2025 equity offerings and filing a $200 million shelf registration for future flexibility. However, these raises have been dilutive and insufficient to resolve the fundamental cash runway issue.

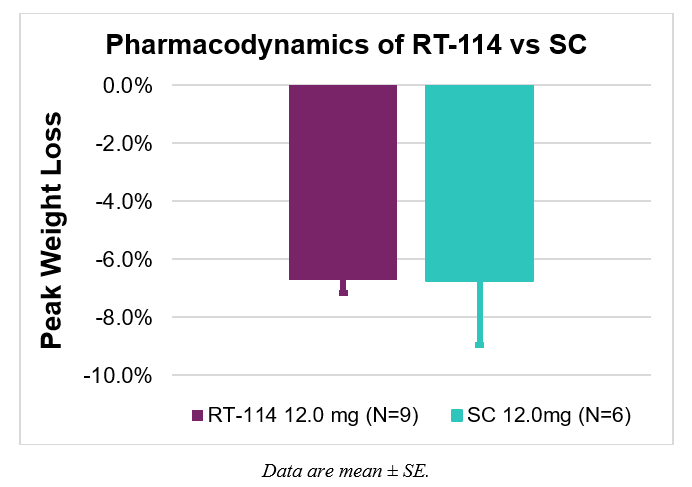

The company’s flagship RT-114 program represents the most significant value driver:

- Phase 1 trial expected to initiate in H2 2025, serving as critical near-term catalyst

- Oral bispecific GLP-1/GLP-2 receptor agonist delivered via proprietary RaniPill® technology

- Preclinical canine studies demonstrated bioequivalence to subcutaneous injection

- Dual-agonist approach differentiates from monovalent GLP-1 therapies in crowded market

Recent collaborations provide external validation of the platform technology:

- May 2025: Research agreement with Chugai Pharmaceutical for two undisclosed molecules

- Ongoing ProGen collaboration for GLP-1/GLP-2 dual agonist (PG-102) development

- Platform versatility demonstrated through RT-116 oral semaglutide preclinical data

The obesity treatment market represents a massive commercial opportunity, with Rani’s oral delivery approach addressing significant patient compliance issues versus current injection therapies. However, the company faces intense competition from established players like Novo Nordisk and Eli Lilly, along with multiple oral GLP-1 therapies in development.

RANI shares have experienced significant deterioration:

- 3% immediate decline following Q2 earnings announcement

- Additional 3.4% decline over subsequent 24 days

- Current price of $0.51 represents 85% decline from 52-week highs of $3.34

- Trading below both 50-day ($0.516) and 200-day ($0.975) moving averages

The company faces immediate delisting threats:

- Minimum bid price requirement of $1.00 (deadline: December 2025)

- Minimum market value requirement (deadline: October 2025)

- Current trading levels significantly below compliance thresholds

Despite positive analyst coverage (3 analysts: 2 Strong Buy, 1 Buy) with an average price target of $7.75, the market appears to be pricing in substantial execution and financing risks. The 1,400% implied upside from current levels reflects the binary nature of the investment thesis.

-

Financing-Pipeline Interdependency: Rani’s ability to advance RT-114 through Phase 1 trials directly depends on securing additional financing, creating a circular dependency where clinical success is needed for favorable financing terms, but financing is needed to achieve clinical milestones.

-

Technology Platform Economics: The RaniPill® platform’s value extends beyond RT-114, with potential applications across multiple therapeutic areas. However, the current market cap appears to assign minimal value to this platform potential, focusing instead on immediate liquidity concerns.

-

Strategic Partnership Timing: The Chugai Pharmaceutical agreement, while validating the technology, may be insufficient to address near-term cash needs. Strategic partnerships typically require longer development timelines before generating meaningful revenue.

Rani exemplifies clinical-stage biotechnology risks: high cash burn rates, binary clinical outcomes, and extended development timelines. The company’s negative equity position exacerbates these systemic risks by limiting financing options and increasing dilution potential.

Current market conditions for early-stage biotechnology companies remain challenging, with investors showing preference for later-stage, de-risked assets. This environment may limit Rani’s ability to secure favorable financing terms, potentially accelerating the need for dilutive capital raises.

- Liquidity Crisis: Current cash position may not sustain operations beyond Q3 2025 without immediate additional financing

- NASDAQ Delisting: Failure to regain compliance with bid price and market value requirements by respective deadlines

- Clinical Trial Execution: No guarantee of successful Phase 1 RT-114 trial initiation or results

- Financing Dilution: Additional capital raises likely to be highly dilutive at current valuation levels

- Catalyst-Driven Upside: Successful Phase 1 trial initiation and initial results could trigger significant valuation re-rating

- Platform Validation: Positive RT-114 data would validate RaniPill® technology for multiple applications

- Strategic Partnership Expansion: Chugai collaboration could evolve into broader strategic partnership or acquisition interest

- Market Opportunity: Obesity treatment market expansion and oral delivery preference create substantial commercial potential

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.