AI Stock Pullback Drives Interest in International Dividend and Value Opportunities

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on the Barron’s report [1] published on November 12, 2025, which highlighted growing concerns about AI stock valuations and suggested investors consider international stocks and bonds as alternative investment strategies focusing on dividends and value investing principles.

The market data on November 12, 2025, reveals significant divergence between major indices, with the NASDAQ Composite declining 0.67% to 23,406.46, while the Dow Jones Industrial Average gained 0.50% to 48,254.82 [0]. This performance gap indicates tech-heavy stocks experienced more pressure, aligning with the article’s theme of AI stock concerns. The S&P 500 also declined 0.25% to 6,850.92, while the Russell 2000 fell 0.51% to 2,450.80 [0].

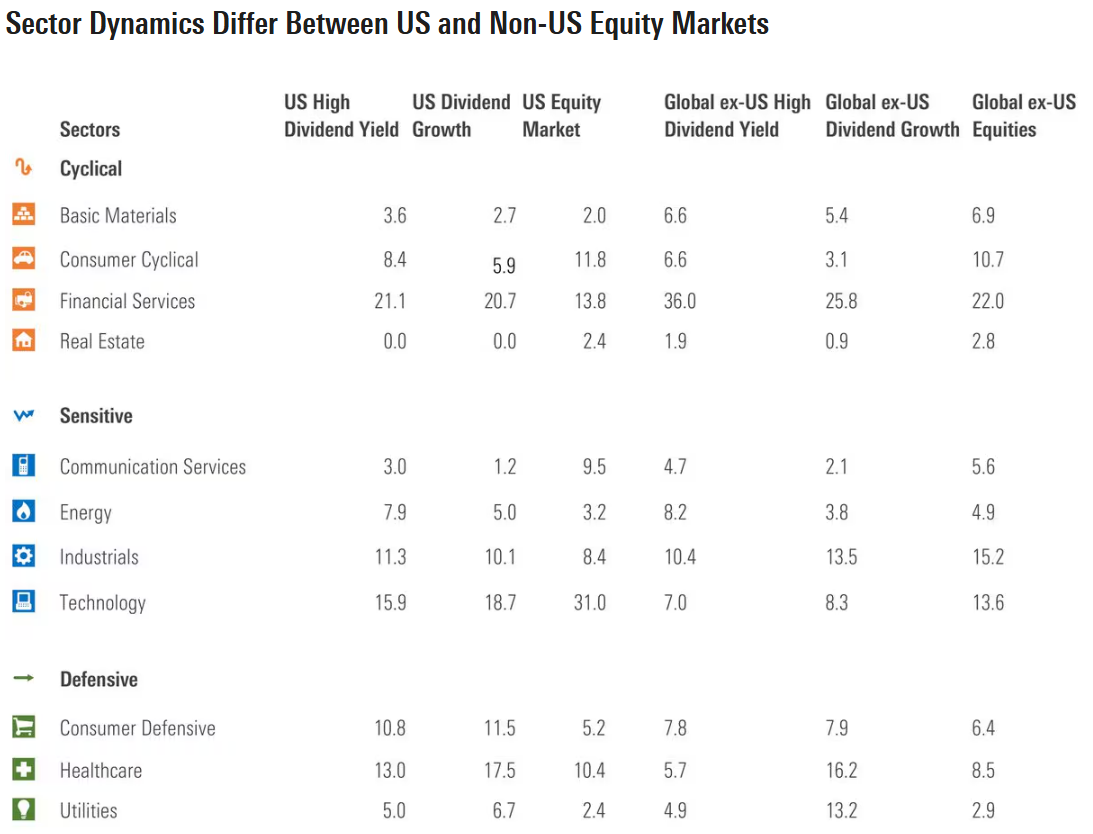

Sector performance analysis shows the Technology sector declining 0.81%, contrasting with gains in Communication Services (+1.38%) and Basic Materials (+0.61%) [0]. This rotation pattern supports the narrative of investors moving from growth to value strategies.

- Concentration Risk: Portfolios heavily weighted in AI stocks face elevated volatility risk as valuation concerns persist

- Currency Exposure: International investments carry additional foreign exchange risk that could impact returns

- Sector Rotation Risk: Potential for overcorrection if value rally becomes overcrowded

- Liquidity Concerns: Some international markets may have lower trading volumes affecting execution

- International Value ETFs: Gaining attention as alternatives to US growth strategies [6]

- High-Dividend Strategies: Becoming more attractive amid volatility [7]

- Diversification Benefits: International exposure may provide portfolio resilience

The market data reveals a notable rotation from growth to value strategies, with the Technology sector declining 0.81% while Communication Services and Basic Materials posted gains [0]. International dividend opportunities are attracting attention with yields of 4-10% available in European markets [5], providing income generation potential amid tech sector volatility.

The NASDAQ’s 0.67% decline versus the Dow Jones’ 0.50% gain on November 12, 2025, underscores the tech-specific pressure [0]. While some AI stocks like NVIDIA showed resilience (+0.33%), the broader tech weakness suggests selective rather than uniform impact [0].

Market sentiment indicators reveal growing skepticism about AI valuations, with multiple recent headlines questioning the sustainability of AI stock premiums [2, 3, 4]. This environment supports the case for portfolio diversification through international dividend and value strategies as highlighted in the Barron’s analysis [1].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.