White House Explores Limits on Proxy Advisers and Major Asset Managers' Corporate Voting Power

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

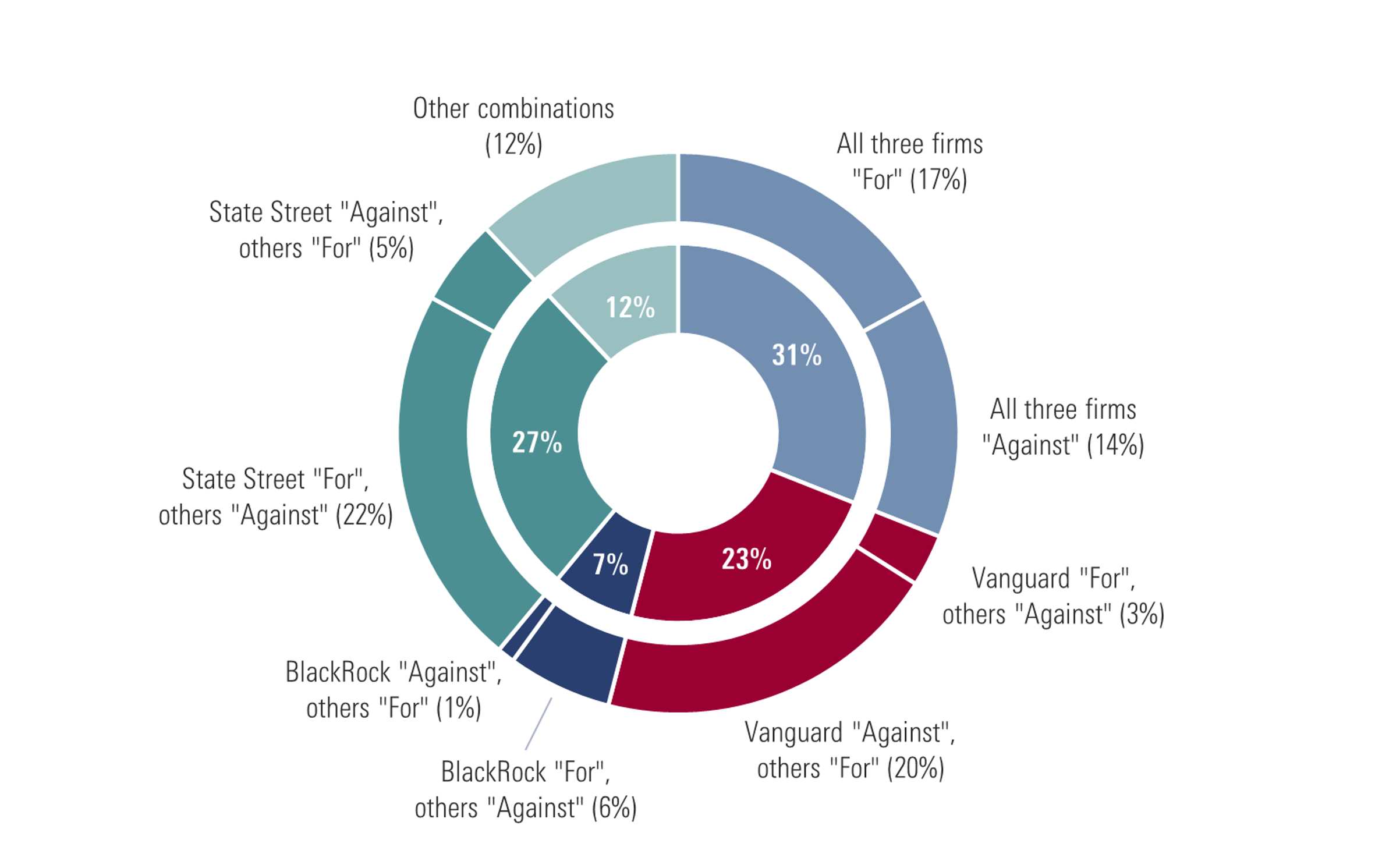

This analysis is based on Reuters reporting [1] published on November 12, 2025, indicating that the White House is exploring executive action to fundamentally reshape shareholder voting dynamics in U.S. corporate governance. The administration’s discussions target two key areas: proxy advisory firms (ISS and Glass Lewis) and the three largest index-fund managers (BlackRock, Vanguard, and State Street) that collectively control approximately 30% or more of shares in many large U.S. companies on behalf of clients [1][3].

The proposed measures represent a significant policy shift aimed at addressing CEO complaints about the outsized influence these entities wield in corporate governance decisions. According to the reports, at least one executive order is being considered that would restrict proxy-advisory firms and require index-fund managers to align their voting practices with client preferences rather than making independent decisions [1][2]. This could fundamentally alter how corporate voting power is exercised across thousands of publicly traded companies.

Market reaction to the news has been relatively muted so far, with major indices showing mixed performance (S&P 500: -0.25%, Dow: +0.50%) [0]. However, some affected stocks showed positive movement, with BlackRock (+0.75%) and State Street (+1.41%) trading higher, possibly reflecting market expectations that reduced governance responsibilities could benefit these firms [0].

- Regulatory Uncertainty:Multiple executive order drafts are reportedly circulating, creating significant uncertainty about the final policy direction and implementation timeline [1][3]

- Legal Challenges:Any executive action would likely face substantial litigation questioning the administration’s regulatory authority over corporate voting practices [2]

- Operational Disruption:The proposed changes would require substantial operational restructuring for affected firms, potentially creating short-term market volatility [1][3]

- Implementation Complexity:Requiring index-fund managers to vote according to millions of individual client preferences presents significant technical and logistical challenges

- Corporate Governance Innovation:The changes could spur development of new voting technologies and client engagement platforms

- Increased Shareholder Participation:Client-directed voting could lead to higher engagement levels among retail investors

- Competitive Advantages:Firms that successfully adapt to new requirements could gain market share in proxy voting services

- Market Efficiency:Reduced concentration of voting power could lead to more diverse corporate governance outcomes

Investors should be aware that while the discussions are ongoing, the final form of any executive action remains uncertain [1][3]. The proposals could significantly alter corporate governance dynamics affecting thousands of companies, potentially creating both risks and opportunities across the financial services sector [1][2].

The White House is exploring executive action to limit the influence of proxy advisers and major asset managers in corporate governance, targeting ISS, Glass Lewis, BlackRock, Vanguard, and State Street [1][3]. The proposed measures could require index-fund managers to align voting with client preferences and potentially restrict proxy-advisory operations, affecting roughly 30% of shares in many large U.S. companies [1]. Multiple executive order drafts are reportedly circulating, indicating ongoing policy development [1][3]. The proposals could significantly impact ESG initiatives and shareholder activism while facing potential legal challenges [1][2]. Market reaction has been mixed so far, with some affected stocks showing positive movement [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.