Market Rotation Intensifies: Tech Weakness vs Value Strength Amid Fed Uncertainty

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

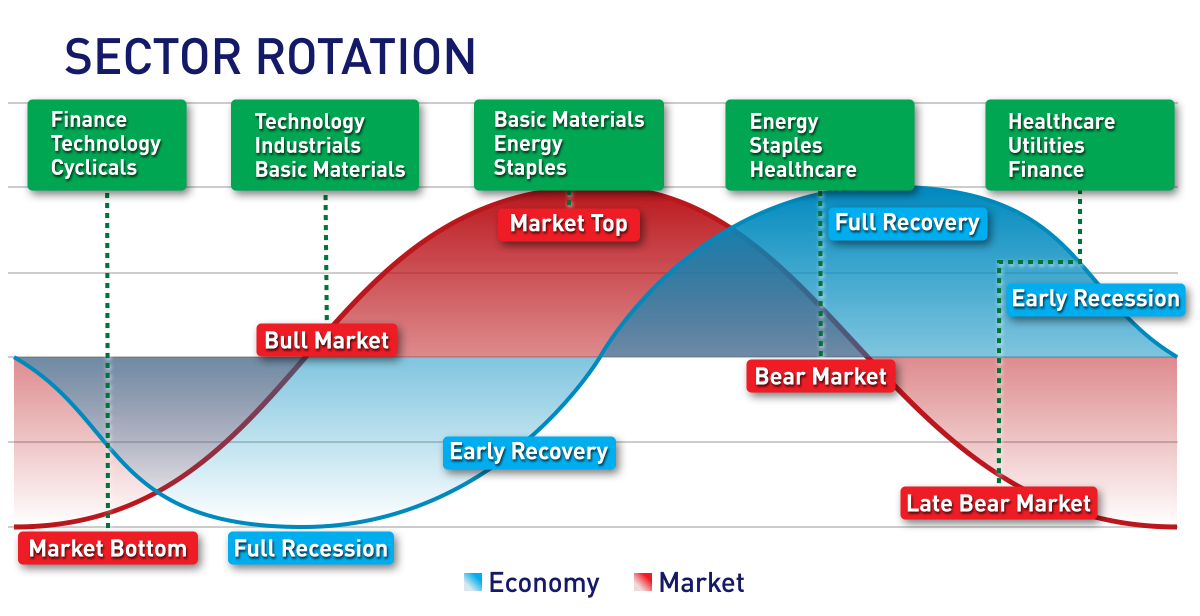

Reddit users reported significant market rotation on November 12, 2025, with

- Pfizer (PFE) acquired Metsera (MTSR)after Novo Nordisk (NVO) withdrew from bidding due to FTC antitrust concerns, with PFE potentially overpaying according to some analysts

- Waymo launched the first U.S. freeway robotaxi serviceacross San Francisco, Los Angeles, and Phoenix

- Nextracker (NXT) rebranded to Nextpower, expanding beyond solar tracking into integrated power technology solutions

- Gilat Satellite Networks (GILT) reported Q3 2025 revenue up 58% YoYand raised full-year guidance

The Reddit discussion and research findings align on the key theme of

The MTSR acquisition saga highlights increasing

- Continued tech weakness could spread to broader market if Fed maintains hawkish stance

- Data-center power shortage may constrain AI infrastructure growth

- Regulatory antitrust scrutiny could disrupt healthcare M&A pipeline

- Value rotation may continue if Fed cuts rates in December

- Energy infrastructure solutions could benefit from data-center power constraints

- Autonomous vehicle commercialization reaching new inflection point

- Integrated energy technology platforms (like Nextpower) positioned for growth

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.