AI Bubble Risk Analysis: Depreciation Mismatch Threatens Tech Sector Valuations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

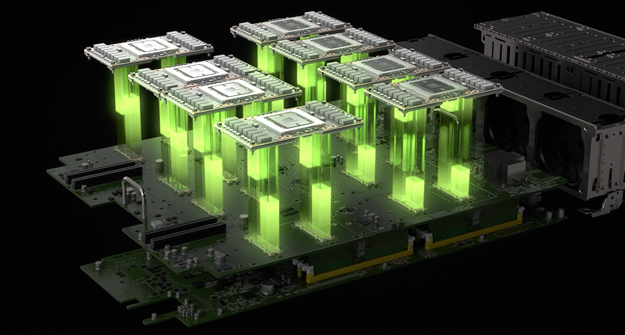

This analysis is based on the Seeking Alpha report [1] published on November 12, 2025, which highlights a fundamental accounting discrepancy in AI infrastructure investments. The core issue centers on a mismatch between Nvidia’s 1-year chip production cycle and hyperscalers’ 5-6 year depreciation schedules for AI chips [1]. This creates what Michael Burry describes as “one of the more common frauds of the modern era” [2].

The depreciation-useful life mismatch creates significant artificial earnings inflation across major technology companies. Burry estimates approximately $176 billion in depreciation understatement from 2026-2028 [2][3]. Specific company impacts include:

- Oracle: Potential earnings overstatement of 26.9% by 2028 [3]

- Meta: Potential earnings overstatement of 20.8% by 2028 [3]

- Other Hyperscalers: Similar proportional impacts based on their AI capital expenditures

Current depreciation policies among major tech companies show a concerning trend of extending useful life assumptions [6]:

- Google: 6 years (increased from previous schedules)

- Meta: 5.5 years (increased this year)

- Microsoft: 6 years (increased from 4 years in 2022)

- Amazon: 5 years (actually shortened from 6 years)

The accounting practices create artificial competitive advantages that distort market dynamics [6]:

- Earnings Inflation: Lower depreciation expenses artificially boost reported profitability

- Service Subsidization: Hyperscalers can offer artificially cheap AI services due to accounting advantages

- Barrier Creation: New entrants face steeper economics and capital-raising challenges

Despite these concerns, immediate market reaction has been muted. Nvidia currently trades at $193.80 (+0.33% in after-hours trading) with a 30-day performance of +2.22% [0]. Major indices show strength: S&P 500 (+1.78%), NASDAQ (+2.27%), Dow Jones (+3.91%) over the past 30 days [0].

The fundamental flaw in current accounting practices lies in ignoring the rapid pace of AI technological advancement. While hyperscalers book depreciation over 5-6 years, the realistic useful life of AI chips is likely 1-3 years due to rapid technological obsolescence [6]. This creates a systematic overstatement of asset values and corresponding understatement of expenses.

The combination of massive AI capital expenditures and aggressive accounting practices creates conditions for potential systemic risk [1]. If AI capex write-offs occur, particularly for debt-financed investments, the resulting defaults could trigger broader market disruptions. This risk is amplified by the interconnected nature of major technology companies and their role in market infrastructure.

There appears to be a significant disconnect between identified accounting risks and market pricing. While some institutional investors like Jackson Square Partners have been reducing semiconductor positions [4], the broader market has not fully priced in the depreciation mismatch risk. This suggests potential for sharp corrections when the accounting reality becomes apparent.

- Michael Burry’s promised detailed analysis on November 25, 2025 could trigger market reassessment [2]

- Q4 2025 earnings reports may reveal increased scrutiny of depreciation policies

- Potential SEC intervention on AI accounting practices

- AI infrastructure utilization rates may reveal shorter replacement cycles than assumed

- Debt covenant compliance issues for companies with high AI capex commitments

- Competitive dynamics shift as new AI chip generations accelerate obsolescence

- The analysis warns that debt-financed AI capex write-offs could result in defaults and cause systemic events [1]

- Artificially inflated earnings across multiple large-cap tech companies could lead to correlated corrections

- Monitor earnings quality metrics and depreciation policy changes

- Assess debt levels relative to AI capex commitments

- Consider timing risks in AI-related investments

- Companies with more conservative depreciation practices may gain competitive advantages

- Alternative AI chip providers like AMD, forecasting 60% AI growth ahead [5], may benefit from market reevaluation

- New entrants with transparent accounting practices could attract investor capital

The depreciation-useful life mismatch in AI infrastructure represents a significant accounting concern that could impact earnings quality across major technology companies. The core issue involves hyperscalers depreciating AI chips over 5-6 years while rapid technological advancement suggests realistic useful lives of 1-3 years [1][6].

This discrepancy creates approximately $176 billion in potential depreciation understatement through 2028 [2], with material impacts on companies like Oracle (26.9% potential earnings overstatement) and Meta (20.8% potential earnings overstatement) by 2028 [3].

Market participants should monitor several key indicators: Michael Burry’s detailed analysis expected November 25, 2025 [2]; Q4 2025 earnings reports for depreciation policy discussions; SEC positions on AI accounting practices; and actual AI infrastructure utilization rates and replacement cycles.

The combination of massive capital expenditures, aggressive accounting practices, and rapid technological change creates conditions where corrections could be severe and widespread. Historical patterns suggest that accounting irregularities involving large-cap technology companies typically lead to material market adjustments when discovered [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.