In-Depth Analysis of Novo Nordisk (NVO)'s M&A Capacity and Strategic Contraction Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data and information, and will provide you with a systematic and comprehensive analysis report.

January 13, 2026, Maziar Mike Doustdar, Novo Nordisk’s new CEO, made his first public appearance at the 44th J.P. Morgan Healthcare Conference, announcing the company’s major strategic restructuring [1]. This new leader’s first public speech conveyed several key signals:

Doustdar openly acknowledged at the conference that 2025 was a difficult year for Novo Nordisk. Sales of GLP-1 drugs failed to meet market expectations, and the company faced multiple pressures [3]:

- Patent Expiration Risk: Semaglutide faces patent expiration in multiple markets

- Intensified Competition: Eli Lilly’s (Zepbound/Mounjaro) market share continues to rise

- Valuation Pressure: The stock price has fallen sharply from its peak, and investor confidence has been hit

Based on the latest financial data, Novo Nordisk has the financial strength to implement large-scale M&A [0]:

| Financial Indicator | Value | Industry Position |

|---|---|---|

| Market Capitalization | $277.06 billion | One of the world’s largest diabetes/obesity drug developers |

| Free Cash Flow | $69.659 billion | TTM |

| ROE | 66.95% | Excellent return on capital |

| Net Profit Margin | 32.88% | Extremely strong profitability |

| Cash on Hand | Sufficient | Supports large-scale M&A |

The company’s strong cash flow generation capacity and robust balance sheet provide solid support for its M&A strategy.

The “value for money” principle emphasized by Doustdar reflects the management’s clear understanding of the current biopharmaceutical M&A market:

- Obesity Pipeline Assets: Late-stage obesity R&D projects, especially candidate drugs with differentiated advantages

- Innovative Diabetes Therapies: Next-generation insulin, GLP-1 combination therapies, oral formulations

- Complementary Technologies for Metabolic Diseases: Such as AI-driven drug discovery platforms and drug delivery technologies

- Refuse to pay excessive premiums for “narratives”

- Focus on assets with clear clinical value and commercialization paths

- Emphasize synergies and integration feasibility

At the 2026 J.P. Morgan Healthcare Conference, M&A became a core topic [1]:

- Merck: Plans to invest approximately $40 billion in ADCs, bispecific antibodies, and other areas, and is in talks to acquire Revolution Medicines for up to $32 billion

- Eli Lilly: Acquired Venyx, a company focused on inflammation, for $1.2 billion

- Amgen: Fired the first shot in biotech M&A for 2026

Against this backdrop, Novo Nordisk’s $40 billion M&A capacity puts it in a favorable position in the competition for potential targets.

Novo Nordisk’s strategic contraction represents a partial reversal of its 2019 diversification strategy [2]. At that time, Chairman Helge Lund stated that “long-term success can only be achieved through product portfolio diversification”.

- Exit therapeutic areas not directly related to diabetes and obesity

- Suspend or terminate R&D projects for non-core indications

- Focus on the needs of the 2 billion diabetes and obesity patient population

- Full range of diabetes treatment options

- Obesity (with Wegovy/Ozempic as the core)

- Rare disease business (hemophilia, growth hormone, etc.)

- Liver diseases (metabolism-related indications such as NASH)

- Optimized Resource Allocation: Concentrate R&D and commercial resources on core advantage areas

- Improved Operational Efficiency: Streamline organizational structure and accelerate decision-making speed

- Enhanced Professional Depth: Establish higher competitive barriers in the metabolic disease field

- Improved Capital Efficiency: Exit inefficient businesses and improve overall investment returns

- Limited Growth Space: Abandoning diversification may miss opportunities in other therapeutic areas

- Concentrated Competition Risk: All resources are bet on direct competition with Eli Lilly

- Patent Cliff Pressure: Core products face concentrated impact from patent expirations

- Difficulty in Valuation Repair: A single business model may limit valuation imagination

The current global GLP-1 market presents a duopoly competitive pattern between Novo Nordisk and Eli Lilly [5][6]:

| Company | 2024 Market Share | 2025 Trend | Competitive Advantage |

|---|---|---|---|

| Novo Nordisk | Approximately 60-70% | Declining | First-mover brand advantage, complete product portfolio |

| Eli Lilly | Approximately 30-40% | Rising rapidly | More potent efficacy, pricing flexibility |

- Oral Formulation Competition: Novo Nordisk has been the first to obtain approval for oral Wegovy, and Eli Lilly’s orforglipron is expected to be approved in 2026 [4][6]

- Efficacy Differentiation: CagriSema (a combination of semaglutide + amylin) shows approximately 23% weight loss effect [3]

- Capacity Expansion: Both companies are investing heavily in production facilities

2026 has been positioned as the “Year of Oral Drugs” [4]. Novo Nordisk has gained a first-mover advantage in this field:

- Approved by the FDA in December 2025, becoming the first oral GLP-1 obesity drug

- No cold chain storage required, significantly reducing logistics costs

- Improves patient compliance and convenience

- Launched ahead of Eli Lilly’s orforglipron

- Oral formulations may account for approximately 24% (about $22 billion) of the global weight-loss drug market by 2030 [6]

- Oral formulations are expected to attract new patient groups and expand the total market capacity

Novo Nordisk submitted a New Drug Application (NDA) for CagriSema to the FDA in December 2025 [7]. This drug has the following characteristics:

- The first combined injection therapy of GLP-1 and amylin analog

- Administered once a week

- Approximately 23% weight loss effect (better than monotherapy)

- The FDA is expected to make an approval decision in 2026

- Expected to establish a differentiated position beyond Zepbound and Wegovy

- Provides a new option for patients who are resistant to or unresponsive to existing treatments

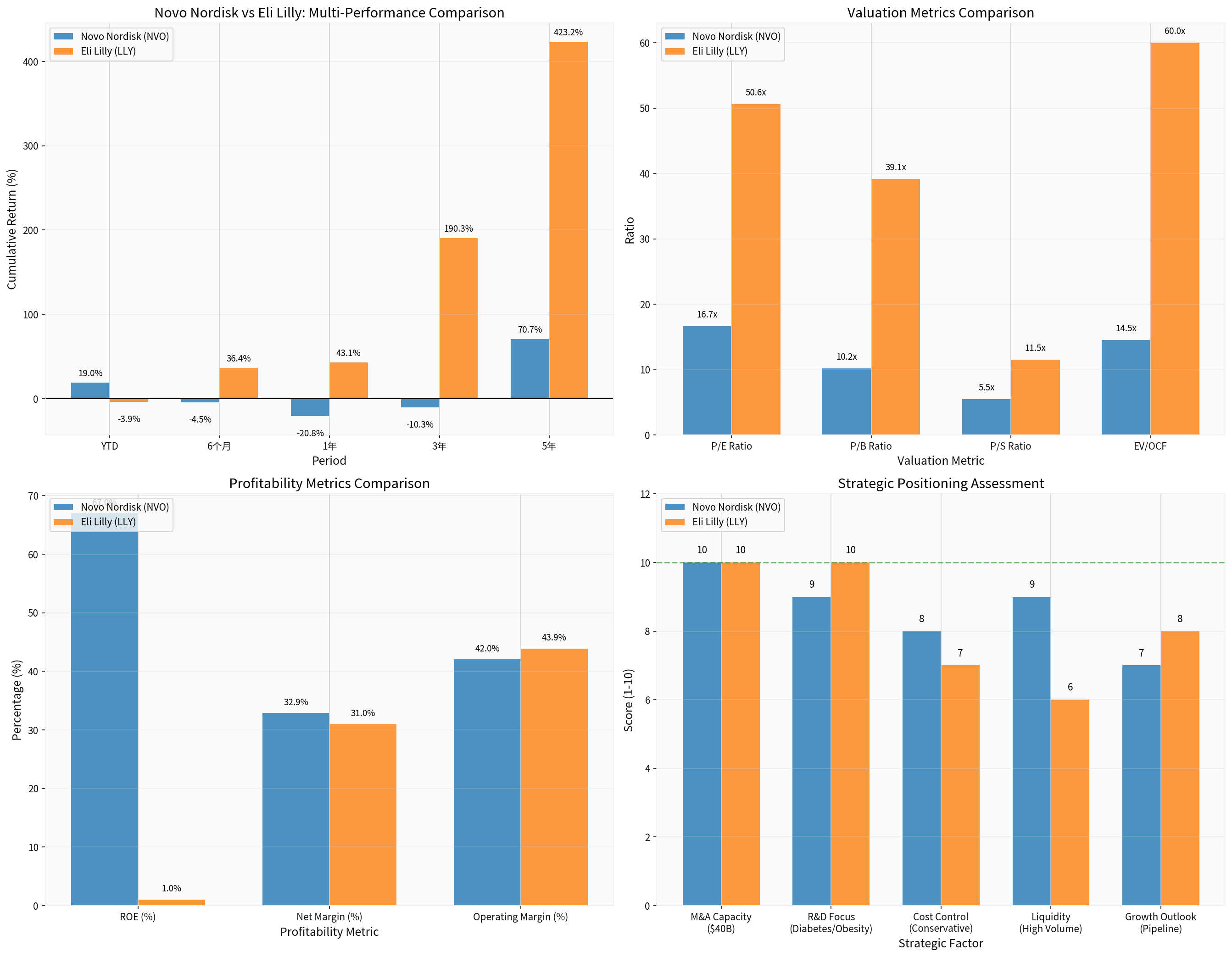

Novo Nordisk’s stock price has experienced significant fluctuations [0]:

| Period | Return Rate | Notes |

|---|---|---|

| 1-Day | +9.12% | Sharp rebound |

| 5-Day | +3.64% | Uptrend continues |

| 1-Month | +30.48% | Strong recovery |

| 6-Month | -4.53% | Pullback under pressure |

| YTD | +18.97% | Significant recovery |

| 1-Year | -20.79% | Pullback from highs |

| 3-Year | -10.30% | Overall weakness |

| 5-Year | +70.72% | Long-term positive |

- Current Price: $62.33

- 52-Week Range: $43.08 - $93.80

- Support Level: $58.20

- Resistance Level: $62.40

- Next Target: $64.44

There are significant differences in valuation indicators between Novo Nordisk and Eli Lilly [0]:

| Valuation Indicator | Novo Nordisk (NVO) | Eli Lilly (LLY) | Interpretation of Differences |

|---|---|---|---|

| Market Capitalization | $277.06 billion | $930.88 billion | LLY is larger |

| P/E | 16.66x | 50.58x | NVO is more valuation-attractive |

| P/B | 10.18x | 39.14x | NVO’s valuation is more reasonable |

| P/S | 5.48x | 11.50x | NVO is cheaper |

| EV/OCF | 14.52x | 59.99x | NVO has better cash flow returns |

Novo Nordisk’s current P/E ratio (16.66x) is in a historically low range, with a discount of approximately 67% relative to Eli Lilly (50.58x). This discount partially reflects:

- 2025 performance fell short of expectations

- Market share being eroded by Eli Lilly

- Concerns about patent expiration

- Expectations of slowing growth

| Profitability Indicator | Novo Nordisk | Eli Lilly | Analysis |

|---|---|---|---|

| ROE | 66.95% | 1.02% | NVO has excellent capital efficiency |

| Net Profit Margin | 32.88% | 30.99% | Comparable |

| Operating Profit Margin | 42.03% | 43.86% | Slightly lower but strong |

| Current Ratio | 0.78 | 1.55 | NVO has weaker liquidity |

Novo Nordisk’s ROE is as high as 66.95%, demonstrating extremely strong shareholder return capacity, far exceeding Eli Lilly’s 1.02%.

Based on technical analysis results [0]:

| Indicator | Value | Signal Interpretation |

|---|---|---|

| MACD | Bullish crossover (no bearish crossover) | Upward momentum continues |

| KDJ | K:82.2, D:80.8 | Overbought zone, be alert to pullback |

| RSI | Overbought risk | Short-term adjustment possible |

| Beta | 0.36 (vs. SPY) | Low volatility characteristic |

- Trend Type: Uptrend (to be confirmed)

- Status: Breakout day (to be confirmed)

- Trend Score: 4.0/5.0

- Resistance Levels: $62.40 (short-term), $64.44 (next target)

- Support Levels: $58.20 (short-term), 50-day moving average at approximately $50.62

- If it breaks through $62.40 and stabilizes, consider following up

- If it falls below $58.20, be alert to a deeper pullback

- Currently in an overbought zone, it is recommended to wait for a pullback before positioning

-

First-Mover Advantage and Brand Recognition

- Has over 100 years of diabetes treatment history

- Brand trust established by Ozempic/Wegovy

- Prescribing habits of doctors and patients

-

Complete Product Portfolio

- Injectable formulations (Wegovy, Ozempic)

- Oral formulations (Rybelsus, oral Wegovy)

- Combination therapies (CagriSema)

- Insulin product line

-

R&D Depth

- Late-stage pipeline: CagriSema, 7.2mg high-dose semaglutide

- Early-stage pipeline: Multiple obesity and diabetes projects in R&D

- Amylin biology as a core research area

-

Manufacturing Capabilities

- Approximately 78,500 employees

- Operations in approximately 80 countries

- Strong global commercialization capabilities

-

Market Share Loss

- Eli Lilly’s Mounjaro/Zepbound is rapidly seizing market share

- 2025 GLP-1 sales fell short of expectations

-

Patent Expiration Pressure

- Core patents for semaglutide are about to expire

- Facing competition from generics and biosimilars

-

Valuation Discount

- Market concerns about slowing growth

- Analyst target price is a 24.6% discount to the current price

Based on comprehensive assessment:

| Strategic Factor | Novo Nordisk Score (1-10) | Eli Lilly Score (1-10) |

|---|---|---|

| M&A Capacity | 10 | 10 |

| R&D Focus | 9 | 10 |

| Cost Control | 8 | 7 |

| Liquidity | 9 | 6 |

| Growth Prospects | 7 | 8 |

Total Score |

43 |

41 |

Novo Nordisk has advantages in cost control and liquidity, while Eli Lilly has a slight edge in R&D focus and growth prospects.

-

Valuation Attractiveness

- P/E is only 16.66x, a historically low level

- Approximately 67% discount compared to Eli Lilly

- High ROE (66.95%) demonstrates excellent capital efficiency

-

Product Portfolio Upgrade

- Oral Wegovy approved, providing new growth drivers

- CagriSema NDA submitted to FDA, releasing pipeline value

- 7.2mg high-dose semaglutide is about to be commercialized

-

Market Expansion Potential

- 2 billion diabetes and obesity patients worldwide

- Oral formulations expand patient access

- Growth opportunities in emerging markets

-

M&A Capacity

- $40 billion M&A firepower

- Can quickly strengthen the pipeline or acquire key technologies

- Maintain flexibility in a highly competitive market

-

Intensified Competition Risk

- Sustained challenges from Eli Lilly

- Threats from new entrants (Viking, Pfizer, etc.)

- Price competition may compress profit margins

-

Patent Expiration Risk

- Significant revenue decline after semaglutide patent expiration

- Continuous innovation is required to maintain market position

-

Execution Risk

- The new CEO’s strategic adjustments need time to be verified

- Uncertainty in M&A target selection and integration

- Challenges in the promotion of oral Wegovy

-

Macroeconomic Risks

- Healthcare payment pressure

- Political scrutiny (disputes over price increases)

Based on the latest data [0]:

- Strong Buy: 2.6%

- Buy: 61.5%

- Hold: 28.2%

- Sell: 7.7%

- Consensus Target: $47.00 (24.6% discount to current price)

- Target Range: $42.00 - $54.00

- Analyst Consensus Score: 47.5 (Buy)

- December 8, 2025: Argus Research downgraded to Hold

- November 28, 2025: Goldman Sachs maintained Buy

- November 24, 2025: HSBC downgraded to Hold

| Investment Type | Recommendation | Rationale |

|---|---|---|

| Long-Term Investment | Consider Holding |

Valuation is attractive, core business is solid |

| Short-Term Trading | Cautious |

High volatility, wait for better entry points |

| Value Investment | Worth Paying Attention To |

P/E is at a historically low level, fundamentals are robust |

| Growth Investment | Less Attractive |

Slowing growth, valuation discount |

The M&A capacity and strategic contraction strategy announced by Novo Nordisk’s new CEO Doustdar at the 44th J.P. Morgan Healthcare Conference have the following impacts on the company’s market competitiveness and long-term investment value:

- Resource Focus: Concentrate R&D and commercial resources on the core areas of diabetes and obesity, which is expected to improve operational efficiency

- Strengthened Competitive Barriers: Establish a deeper moat in the metabolic disease field

- Clear Investor Communication: A clear strategic direction helps the market understand the company’s value

- Maintain Flexibility: Maintain strategic initiative in a rapidly changing market

- Pipeline Supplement: Can quickly acquire late-stage assets or complementary technologies

- Competitive Advantage: Occupy a favorable position in the wave of industry M&A and integration

- Strategic contraction may limit growth space

- Uncertainty in M&A execution

- Competition with Eli Lilly will continue to intensify

- FDA approval decision for CagriSema

- Commercialization progress of oral Wegovy

- Launch of 7.2mg high-dose semaglutide

- Quarterly performance exceeding expectations

- Eli Lilly’s orforglipron may be approved

- Impact of patent expiration becomes apparent

- Market competition continues to intensify

- Successful M&A to obtain blockbuster assets

- CagriSema becomes a new growth engine

- Oral formulations expand market leadership

- Valuation recovers to historical average

- Continued market share loss

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.