Jabil Circuit (JBL) Form 424B5 Analysis Report on Changes in Securities Issuance Terms

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data, so let me provide you with a comprehensive analysis report.

According to public SEC filings, Jabil Inc. submitted a Form 424B5 prospectus supplement in January 2026, proposing to issue new senior unsecured notes (Senior Notes). This is another important debt financing activity for Jabil following its issuance of 5.450% notes maturing in 2029 in May 2023[1].

| Issuance Element | Details |

|---|---|

| Issuer | Jabil Inc. |

| Security Type | Senior Unsecured Notes |

| Issuance Size | [Amount to be Determined] USD |

| Tenor | Two different tenors |

| Interest Calculation Method | Calculated on a 360-day year (12 30-day months) |

| Interest Payment Frequency | Semi-annual payments |

| Expected Settlement Date | Late January 2026 |

| Expected Net Proceeds After Underwriting Discounts and Fees | [Amount to be Determined] million USD |

Jabil’s choice to repay maturing debt by issuing new notes instead of using cash on hand or bank credit facilities reflects the company’s capital structure optimization strategy:

- Interest Rate Environment Consideration: The current market interest rate environment may support securing long-term funding on more favorable terms

- Debt Maturity Management: Optimize the overall debt maturity profile by issuing notes with different tenors

- Liquidity Reserve Maintenance: Retain bank credit facilities as a liquidity buffer (as of November 30, 2025, the available amount under the revolving credit facility is approximately $3.2 billion)[2]

Based on the latest financial data, Jabil’s debt risk rating is

| Metric | August 31, 2025 | Trend |

|---|---|---|

| Total Assets | $18.543 billion | ↑ |

| Total Liabilities | $17.026 billion | → |

| Shareholders’ Equity | $1.517 billion | ↓ |

| Current Ratio | 0.99 | Near balanced state of 1 |

In terms of debt structure, Jabil’s current debt mainly includes:

- Notes maturing in 2026: $500 million (to be repaid)[1]

- Notes maturing in 2029: $300 million (issued in 2023, coupon rate 5.450%)[4]

- Other long-term debt: approximately $2.387 billion

If this refinancing replaces maturing debt with new notes of a similar scale,

If the coupon rate of the new notes is higher than the 1.700% rate of the notes being replaced, Jabil’s annual interest expense will increase. According to Q1 FY2026 financial results, the company’s net interest and other expenses for the quarter were $63 million[2]. Considering the current direction of Federal Reserve interest rate policy and market environment, the coupon rate of the new notes is expected to be in the range of 4.5%-5.5%.

- If the coupon rate of the new notes is 5.0%, annual interest expense will increase by approximately $165 million ($500 million × 3.3% spread)

- Based on the expected core diluted EPS of $11.55 for FY2026[2], the dilutive impact of increased interest expense on EPS will be approximately $0.15-$0.20

However, this impact may be partially offset by the following factors:

- Scale effect from revenue growth (FY2026 revenue is expected to be $32.4 billion, representing a year-over-year increase of approximately 18%)[2]

- Strong growth momentum in the intelligent infrastructure business

- Profit margin improvement from enhanced operational efficiency

Jabil’s current valuation levels:

| Valuation Metric | Current Value | Industry Comparison | Assessment |

|---|---|---|---|

| Price-to-Earnings (P/E) Ratio | 38.25x | Tech hardware industry average ~20x | Elevated |

| Price-to-Book (P/B) Ratio | 20.01x | Manufacturing industry average ~3-5x | Highly elevated |

| Price-to-Sales (P/S) Ratio | 0.86x | Reasonable range | Moderate |

| Enterprise Value to Operating Cash Flow (EV/OCF) | 17.35x | Manufacturing industry average ~10-15x | Slightly elevated |

- Neutral to Positive: Sound debt management demonstrates financial discipline, which may support the current valuation premium

- Risk Mitigation: Extending debt tenors reduces liquidity risk and eliminates a near-term uncertainty

- Key Focus: The market will focus on the specific terms of the new debt (coupon rate, tenor, covenants) to assess management’s judgment on the interest rate cycle

Unlike equity financing (such as secondary share offerings, convertible bond conversions, etc.), the issuance of senior notes:

- Does not increase total share capital

- Does not change the denominator in the EPS calculation formula

- Does not affect the voting power ratio of existing shareholders

Although there is no direct dilution effect, the value of investor shareholdings may still be affected through the following channels:

As mentioned earlier, if the coupon rate of the new debt is higher than that of the replaced debt, interest expense will increase. While Q1 FY2026 results show strong profitability (core operating income of $454 million, a year-over-year increase of 30.8%)[2], investors still need to pay attention to:

- The company’s ability to control debt costs in a rising interest rate cycle

- The changing trend of interest coverage ratio

Jabil’s current credit profile is robust:

- Cash and cash equivalents: $1.572 billion (as of November 30, 2025)[2]

- Adjusted free cash flow (Non-GAAP): Expected to exceed $1.3 billion in FY2026[2]

A strong track record of debt management helps maintain or improve credit ratings, thereby:

- Reducing future financing costs

- Enhancing M&A and expansion capabilities (such as the recently completed acquisition of Hanley Energy Group for a consideration of $751 million)[1]

Increased debt may affect the company’s capital allocation decisions:

- Share Repurchases: The company spent $300 million on share repurchases during Q1[2], demonstrating a focus on shareholder returns

- Dividend Policy: Quarterly dividend of $0.08 per share, representing a low annualized yield (approximately 0.13%)

- M&A Activities: The ongoing external expansion strategy requires capital support

Notably, Jabil has recently experienced significant board changes:

- Executive Chairman Mark T. Mondello will step down after the January 2026 annual shareholder meeting[5]

- Independent Directors Kathleen A. Walters and Jamie Siminoff will also not seek re-election[5]

- Current Lead Independent Director Steve Raymund is expected to succeed as Chairman[5]

Mondello has served Jabil for 33 years, including 10 years as CEO, and was a core driver of the company’s transformation and development. The leadership transition may raise investor concerns about

- CEO Mike Dastoor has taken over smoothly and delivered strong results

- The new leadership has inherited the established diversification strategy

- Financial results show a strong start to FY2026, with upwardly revised guidance[2]

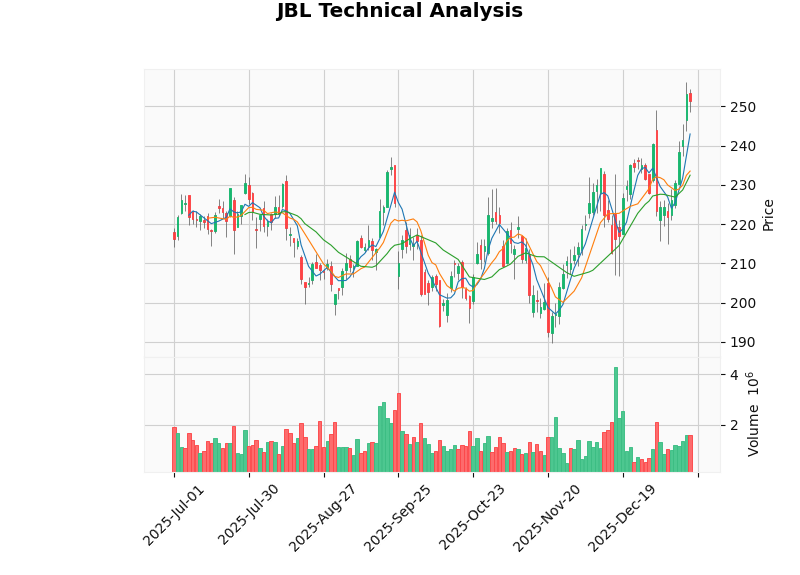

Based on technical analysis tool data[3]:

| Technical Indicator | Value | Signal Interpretation |

|---|---|---|

| Current Price | $251.29 | Near 52-week high ($256.17) |

| 20-Day Moving Average | $232.45 | Short-term support level |

| 50-Day Moving Average | $220.33 | Medium-term trend reference |

| 200-Day Moving Average | $200.39 | Long-term trend reference |

| Support Level | $232.45 | Approximately 7.5% below current price |

| Resistance Level | $255.98 | Approximately 1.9% above current price |

| Beta Coefficient | 1.25 | Higher than market volatility |

| 14-Day RSI | Overbought territory | Short-term pullback risk |

Technical Analysis Conclusion:

The current stock price is in a key price range:

- Upward Breakout: If the $255.98 resistance level is broken, the stock may test the $260-$270 range (near the analyst consensus target price of $271)

- Downward Support: If the $232.45 support level is broken, the stock may pull back to the $220-$225 range

| Investor Type | Recommended Strategy | Rationale |

|---|---|---|

| Existing Holders | Hold/Moderate Reduction | Strong performance, but short-term valuation is elevated |

| Potential Investors | Wait for Pullback | Suggest entering positions in the $230-$240 range |

| Risk-Averse Investors | Set Stop-Loss | Consider stopping loss if the price falls below $220 |

| Impact Dimension | Assessment | Details |

|---|---|---|

Impact on Valuation |

Neutral |

Debt refinancing does not change valuation methodology, but sound debt management can maintain the valuation premium |

Dilution Risk to Shareholdings |

None |

Debt financing does not involve equity issuance |

Impact on EPS |

Slightly Negative |

If the new debt has a higher coupon rate, increased interest expense may slightly dilute EPS |

Impact on Financial Risk |

Positive-Tilted |

Extends debt tenors and reduces refinancing risk |

Short-Term Impact on Stock Price |

Neutral to Negative |

The market may focus on factors of rising debt costs |

Based on market consensus data[6]:

| Rating Agency | Rating | Target Price |

|---|---|---|

| Consensus Rating | Hold |

- |

| Consensus Target Price | $271.00 | 7.8% premium over current price |

| Target Price Range | $244.00 - $283.00 | - |

| Rating Distribution | Buy/Hold/Sell = 11:11:1 | - |

- Interest Rate Risk: If the coupon rate of the new notes is significantly higher than market expectations, it may trigger concerns about debt cost control

- Macroeconomic Risk: Manufacturing sector sentiment is highly correlated with end-market demand

- Leadership Transition Risk: Significant board changes may affect short-term market sentiment

- Increased Competition Risk: Changes in the competitive landscape of the EMS industry may impact profit margins

- FY2026 Q2 financial results (expected on March 19, 2026)

- Announcement of specific terms for the new debt issuance

- Integration progress of Hanley Energy Group

[1] SEC.gov - Jabil Inc. Form 424B5 Prospectus Supplement (January 2026)

https://www.sec.gov/Archives/edgar/data/898293/000119312526012311/d938204d424b5.htm

[2] SEC.gov - Jabil Inc. Form 8-K First Quarter FY2026 Results (December 17, 2025)

https://www.sec.gov/Archives/edgar/data/898293/000162828025057488/jbl-20251217.htm

[3] Jinling AI Technical Analysis Tool - JBL Technical Analysis Data

https://financial.data/api/technical/JBL

[4] SEC.gov - Jabil Inc. Form 424B5 (May 2023)

https://www.sec.gov/Archives/edgar/data/898293/000119312523099246/d367260d424b5.htm

[5] SEC.gov - Jabil Inc. Form 8-K Board Transitions (October 21, 2025)

https://www.sec.gov/Archives/edgar/data/898293/000119312525244288/d73972d8k.htm

[6] Jinling AI Company Overview Data - JBL Company Overview

https://financial.data/api/overview/JBL

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.