In-Depth Analysis of Mass Layoffs at the Six Major U.S. Banks: Investment Strategy Report for Bank Stocks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data, and I will provide you with a systematic and comprehensive analysis report.

According to the latest data, the six major U.S. banks (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, Morgan Stanley) cut a total of

| Bank | Layoff Situation | Year-End Headcount | Strategy Features |

|---|---|---|---|

| Wells Fargo | Cut over 12,000 jobs | Approximately 200,000 | Layoffs for 22 consecutive quarters, to continue in the future |

| Citigroup | Cut approximately 3,000 jobs | Continuing to shrink | Direct layoffs during transformation |

| JPMorgan Chase | Slight headcount growth, slowest growth rate | Lowest since the pandemic | Expansion paused |

| Bank of America | Reduction via natural attrition | Planned decline | Halt hiring instead of layoffs |

| Goldman Sachs | Expanded headcount by 2% against the trend | 47,400 | Expand investment banking business |

| Morgan Stanley | Cut jobs first then added 2,500 | Increased at year-end | Expand wealth management |

The core drivers of the layoff wave come from two major factors:

- Cyclical business contraction: M&A activity on Wall Street has plummeted since 2022, leading to a sharp decline in investment banking revenue

- Over-hiring during the pandemic: Banks hired heavily during the pandemic and now need to “pay the price” [2]

Bank executives are targeting

- Wells Fargo: Continuing to promote corporate restructuring, compressing costs through long-term layoffs, and has cut staff for 22 consecutive quarters [2]

- Citigroup: Announced in 2024 that it would cut 20,000 jobs (accounting for approximately 8% of total staff) by the end of 2026; it has cut over 10,000 jobs and is expected to cut approximately 1,000 more positions in January 2026 [2]

- Bank of America: Rely on natural attrition to reduce scale, allowing headcount to fall naturally by halting hiring [2]

- JPMorgan Chase: Expands headcount but growth rate drops to the lowest since the pandemic

- The industry is discussing replacing some labor with artificial intelligenceto further optimize the cost structure through technological means [2]

Taking Citigroup as an example, its cost-cutting plan is expected to generate

The layoff wave boosts bank profitability mainly in the following aspects:

| Impact Path | Specific Performance | Expected Outcome |

|---|---|---|

| Labor Cost Savings | Annual savings of $2-2.5 billion (taking Citigroup as an example) | Directly increase net profit |

| Efficiency Improvement | Streamline structure, reduce hierarchical levels | Improve operational efficiency |

| Capital Release | Saved human capital can be used for investment | Improve return on capital |

Based on the latest financial data [0]:

- ROE (Return on Equity): 15.95%

- Net Profit Margin: 22.24%

- Operating Profit Margin: 28.30%

- Free Cash Flow: -$42.1 billion (strategic investment period)

- ROE: 10.19%

- Net Profit Margin: 16.23%

- Operating Profit Margin: 18.48%

- Aggressive financial stance, relatively high debt risk

The Q4 2025 results of the six major banks show that the banking sector is generally performing well:

- Morgan Stanley’s Q4 revenue reached $17.89 billion, YoY +10.3%, EPS of $2.68 [4]

- Goldman Sachs’ Q4 equity trading revenue hit a record $4.31 billion, Non-GAAP EPS of $14.01 [4]

- Bank of America’s Q4 EPS was $0.98, exceeding market expectations [0]

According to the industry research firm Crisil Coalition Greenwich, the banking industry’s

The current valuation levels of the six major banks are as follows [0]:

| Bank | P/E | P/B | 1-Year Increase | Analyst Target Price |

|---|---|---|---|---|

| JPMorgan Chase | 15.72x | 2.43x | +23.72% | $331.00 (+5.2%) |

| Bank of America | 13.94x | 1.29x | +13.87% | $60.00 (+13.0%) |

| Citigroup | 16.97x | ~1.10x | +77.0% | Best Performer |

| Wells Fargo | 14.22x | 1.28x | +20.5% | In Recovery |

| Goldman Sachs | 19.66x | 1.85x | +62.0% | All-Time High |

| Morgan Stanley | 19.62x | 1.85x | +45.0% | Earnings Beat Expectations |

According to S&P Global data, the total market capitalization of the six major U.S. banks increased from

- Improved regulatory environment: The Trump administration promoted the relaxation of financial regulation, and bank capital requirements are expected to be reduced

- The final version of Basel III has requirements far lower than the initial plan, and banks hold a large amount of idle capital

- Recovery of investment banking business: Global investment banking revenue increased by 15% YoY in 2025, and M&A transaction volume increased by 42% YoY [5]

Gerard Cassidy, a banking analyst at RBC, said: “The importance of changes in the regulatory environment to stock prices cannot be overemphasized. After the financial crisis, the profitability of the entire industry was severely compressed because banks had to significantly increase their capital levels.” [1]

Despite the strong performance of bank stocks, the market has concerns that

- Bank stocks are expected to outperform the S&P 500 for the second consecutive year

- The KBW Bank Index rose 34.17%in the past year [5]

- Saul Martinez, head of U.S. financial stock research at HSBC, warned: “The current situation is so good that it almost seems unrealistic. The fundamentals are indeed good, but the question is how much of this has been priced into the market.” [1]

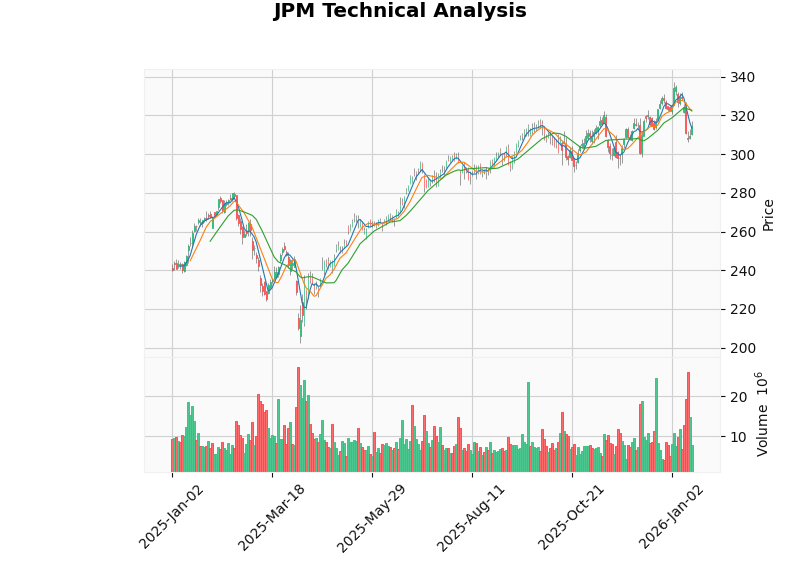

Based on the latest technical analysis data [0]:

- Current Price: $314.59

- Trend Judgment: Sideways Consolidation(no clear direction)

- Key Technical Levels:

- Support Level: $311.36

- Resistance Level: $322.66

- Support Level:

- Technical Indicators: MACD no crossover (bearish bias), KDJ bearish bias, RSI in normal range

- Beta Coefficient: 1.07(basically consistent with market fluctuations)

- Current Price: $53.11

- Trend Judgment: Sideways Consolidation

- Key Technical Levels:

- Support Level: $52.56

- Resistance Level: $55.25

- Support Level:

- Beta Coefficient: 1.29(slightly higher than market fluctuations)

Both banks are currently in the

- Cost Structure Optimization: Layoffs directly reduce operating costs and improve profit margins

- Capital Efficiency Improvement: Saved resources can be redirected to high-return businesses

- Adapt to Market Cycles: Proactive adjustments before the recovery of investment banking business demonstrate management prudence

- Shareholder Return Potential: Saved costs can be returned to shareholders through dividends and share repurchases

- Negative Effects of Excessive Layoffs: May affect service quality and innovation capabilities

- Economic Downturn Risk: If the macroeconomy enters a recession, the risk resistance of banks that have laid off staff may decline

- Technology Replacement Risk: AI-driven layoffs may lead to brain drain and insufficient innovation momentum

| Assessment Dimension | Effectiveness Judgment | Basis |

|---|---|---|

Short-Term Profit Increase |

★★★★☆ | Direct annual labor cost savings of $2-2.5 billion |

Valuation Increase |

★★★★★ | Market capitalization increased by $600 billion in a year, driven by deregulation and business recovery |

Long-Term Competitiveness |

★★★☆☆ | Need to balance cost control and innovation capabilities |

Shareholder Returns |

★★★★★ | Capital release supports dividends and share repurchases |

- JPMorgan Chase (JPM): Industry leader, financially sound, ROE as high as 15.95%, analyst consensus is “Buy”, target price $331.00 [0]

- Citigroup ©: Remarkable transformation results, 77% increase within the year, cost-cutting expected to generate annual savings of $2-2.5 billion [1][2]

- Bank of America (BAC): Most attractive valuation (P/E only 13.94x, P/B only 1.29x), analyst target price shows 13% upside potential [0]

- Valuations have partially reflected optimistic expectations, caution is needed when chasing high prices

- Need to follow up on subsequent financial reports to verify profitability improvements

- Macroeconomic uncertainty may affect bank asset quality

- Conservative Investors: Wait for a breakout of the consolidation range before entering

- Aggressive Investors: Build positions in batches near support levels

- Risk-Seeking Investors: Focus on banks with smaller increases but attractive valuations (such as Bank of America)

| Risk Type | Specific Risk | Impact Level |

|---|---|---|

Macroeconomic Risk |

Economic recession leads to increased credit losses | High |

Valuation Risk |

Good news has been fully priced in | Medium-High |

Regulatory Risk |

Deregulation policies fall short of expectations | Medium |

Operational Risk |

Excessive layoffs affect service quality | Medium |

Technological Risk |

AI employee replacement progress falls short of expectations | Low |

The large-scale layoff wave at the six major U.S. banks is a proactive measure by the banking industry to respond to market cycle changes and optimize cost structures. In the short term, layoffs directly reduce labor costs and improve profitability; in the long term, the key will be whether banks can maintain innovation and service capabilities while reducing costs and improving efficiency.

From an investment perspective, cost-cutting strategies

[0] Jinling API Real-Time Data - Real-Time Quotes, Company Profiles, Financial Analysis, Technical Analysis of the Six Major Banks

[1] CLS Network - “Deregulation Dividends Erupt, Total Market Capitalization of Six Major U.S. Banks Surges by $600 Billion in a Year” (https://www.cls.cn/detail/2240431)

[2] Lianhe Zaobao - “Six Major U.S. Banks Cut Over 10,000 Jobs Last Year, Hitting a 10-Year High” (https://www.zaobao.com.sg/realtime/world/story20260116-8109060)

[3] Yahoo Finance - “Bank Stocks Shine in 2025: 3 S&P 500 Plays to Watch for 2026” (https://finance.yahoo.com/news/bank-stocks-shine-2025-3-130800651.html)

[4] Securities Times Network - “Positive Earnings, Bank Stocks Surge!” (https://www.stcn.com/article/detail/3596048.html)

[5] TradingKey - “Bank Stocks Lead US Equities in 2026” (https://www.tradingkey.com/analysis/stocks/us-stocks/261469067-c-wfc-jpm-bac-ms-gs-bank-stock-tradingkey)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.