Analysis of the Impact of the Anhui Baijiu Market Competition Pattern on Kouzijiao

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and research materials, I now provide you with a systematic and comprehensive analysis report.

Anhui Province is an important major province for baijiu production and sales in China, with a market scale of approximately RMB 35-40 billion. The Anhui baijiu market exhibits a distinct

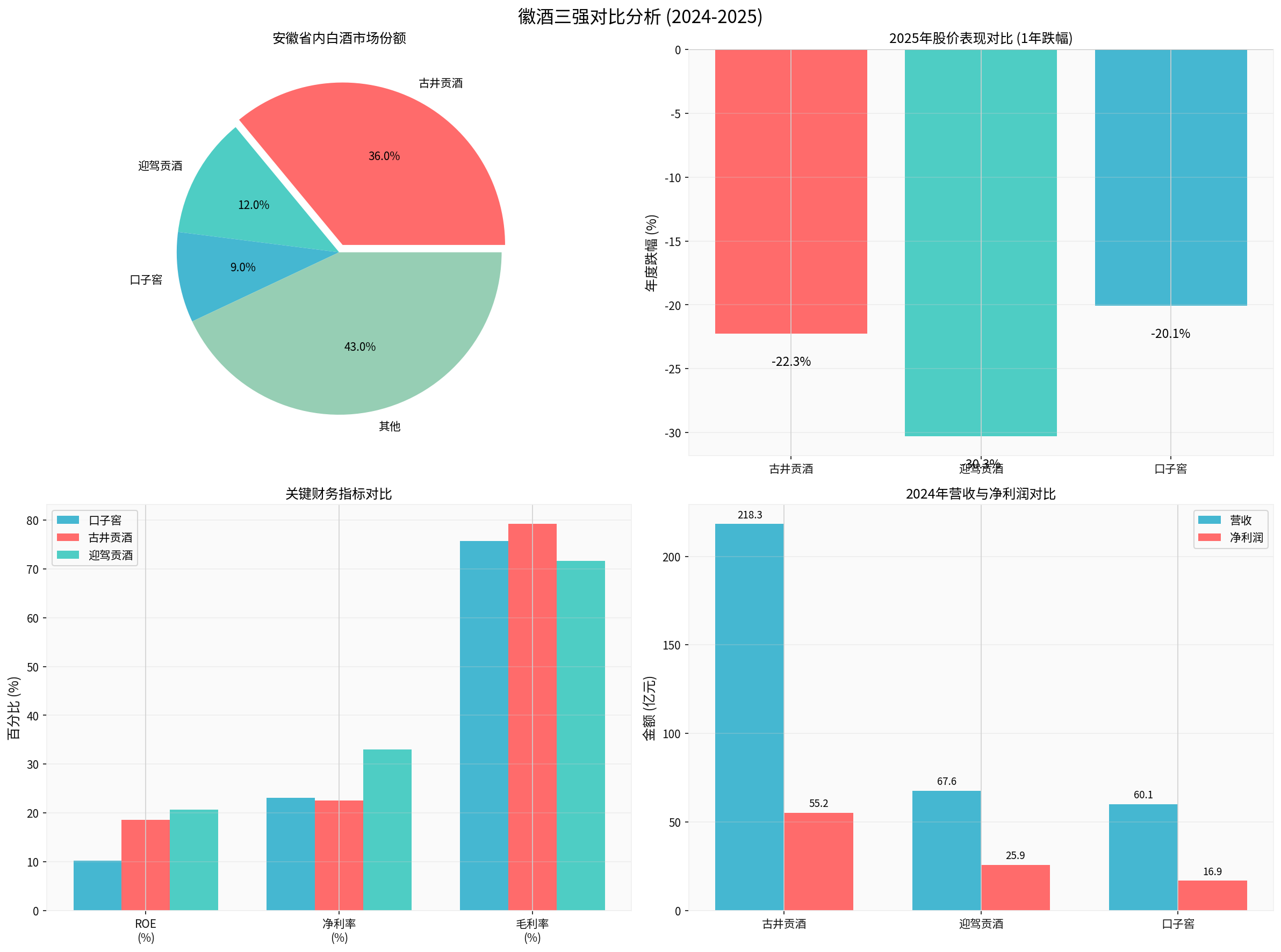

| Enterprise | Provincial Market Share | 2024 Revenue (RMB 100 million) | 2024 Net Profit (RMB 100 million) | Core Products |

|---|---|---|---|---|

Gujing Gongjiu |

36% | 218.3 | 55.17 | Gu 20+, Gu 16 |

Yingjia Gongjiu |

12% | 67.6 | 25.89 | Dongzang Series |

Kouzijiao |

9% | 60.15 | 16.89 | Jian Series |

The combined market share of CR3 in Anhui reaches

From a historical evolution perspective, Kouzijiao’s advantage relative to Gujing Gongjiu has continued to decline:

- 2015: Kouzijiao’s revenue accounted for 49% of Gujing Gongjiu’s

- 2025: This proportion has dropped to approximately 21%[1]

According to Kouzijiao’s 2025 performance forecast [2][3]:

- Net Profit: Expected to be RMB 662-828 million, representing a50%-60% year-over-year decline

- Revenue Decline: Revenue in the first three quarters of 2025 was RMB 3.174 billion, down 27.24% year-over-year

- Q3 Sharp Plunge: Net profit attributable to parent shareholders in the third quarter was only RMB 26.96 million, a92.55% year-over-year plunge, marking the largest single-quarter decline since the company’s listing

Even more worrying is that the fourth quarter may see a

| Indicator | Kouzijiao | Gujing Gongjiu | Yingjia Gongjiu | Industry Interpretation |

|---|---|---|---|---|

| ROE | 10.21% | 18.60% | 20.71% | Kouzijiao has the lowest capital efficiency |

| Net Profit Margin | 23.10% | 22.60% | 33.00% | Yingjia Gongjiu has the strongest profitability |

| Gross Profit Margin | 75.65% | 79.2% | 71.6% | Gujing Gongjiu has the strongest product strength |

| Current Price (RMB) | 29.36 | 133.98 | 38.99 | — |

Kouzijiao’s

Kouzijiao’s stock performance is significantly weaker than that of its competitors [0]:

- Decline in the past year: 20.07%

- Decline in the past three years: 51.70%

- Decline in the past five years: 56.22%

- Technical analysis shows a downtrend, with RSI in the oversold zone and MACD showing a bearish signal

Gujing Gongjiu relies on

- Scale Advantage: Revenue is 3.6 times that of Kouzijiao, with significant scale effects

- Channel Advantage: Deep distribution model + strong marketing team, with high efficiency in expense allocation

- Brand Advantage: Gu 20 has become a benchmark product in Anhui’s mid-to-high-end baijiu segment

- Expansion Outside Anhui: Has established scaled presence in regions such as East China, North China, and Hubei

Yingjia Gongjiu achieved a turnaround by virtue of its

- In 2022, its revenue and net profit comprehensively surpassed Kouzijiao

- Sales expense ratio is only 8%, far lower than Gujing Gongjiu’s (27%) and Kouzijiao’s (14%)

- Mid-to-high-end baijiu accounts for 78% of its sales, with continuous optimization of product structure

- The high-end “Jian Series” has underperformed in terms of off-take, and brand strength is insufficient to support price points above RMB 600 [2][3]

- The actual transaction prices of Jian 10 and Jian 20 have fallen below the guide prices

- Gross profit margins of products across all price tiers have shown a downward trend

- Relies on the “large distributor system” business model, which has gradually become ineffective amid the trend of channel flattening

- Digital transformation is lagging, with insufficient monitoring of terminal off-take data [2]

- As of the end of Q3 2025, inventory reached as high as RMB 6.218 billion

- Inventory turnover days increased from 1,052 days in 2022 to 1,286 days in 2024

- The surge in inventory severely ties up capital, affecting operational efficiency

- The “alcohol ban” has impacted government consumption scenarios, leading to a sharp decline in sales of high-end products [2]

- Macro economic downturn has led to a contraction in business banquet consumption scenarios

The market size of mixed-fragrance baijiu accounts for only

| Price Band | 2020 Share | 2025 Share | Trend |

|---|---|---|---|

| High-End (RMB 800+) | 16% | 16% | Stable |

| Sub-Premium (RMB 300-800) | 10% | 18% | Significantly Increased |

| Mid-Range (RMB 100-300) | 37% | 43% | Continuously Rising |

| Low-End (Below RMB 100) | 38% | 24% | Sharply Declined |

Kouzijiao’s Jian Series is mainly positioned in the RMB 300-1000 sub-premium price band, which is in the most fiercely competitive segment, facing multiple attacks from Gujing Gongjiu, Yingjia Gongjiu, and national famous baijiu brands [1].

- Deteriorating Competition Pattern: Gujing Gongjiu’s “one superpower, multiple strong players” pattern is increasingly consolidated, while Kouzijiao’s market share continues to shrink

- Prominent Internal Shortcomings: Outdated channel model, hindered product upgrading, and severe inventory pressure

- Deteriorating External Environment: Policy impacts + industry adjustments, combined with the ceiling of the mixed-fragrance baijiu category

- The industry’s deep adjustment period will continue, and the squeeze situation will be difficult to alleviate in the short term

- There is significant uncertainty in the recovery of off-take for high-end products

- Inventory digestion will take a long time, which may continue to affect performance

- The RMB 10 billion revenue target faces significant challenges

- Progress of channel reform and digital transformation

- Whether new channel models such as bulk liquor shops can effectively clear inventory

- Changes in market acceptance of the Jian Series products

- M&A opportunities brought by industry integration

Kouzijiao is facing the most severe operational challenges since its listing. Amid the fierce competition in the Anhui baijiu market, the company needs to re-examine its strategic positioning and accelerate channel transformation and product upgrading to reverse its current predicament.

[0] Gilin API - Kouzijiao (603589.SS) Company Profile and Financial Data (https://gilin-data.oss-cn-beijing.aliyuncs.com)

[1] Soochow Securities - In-Depth Research Report on Gujing Gongjiu (https://pdf.dfcfw.com/pdf/H3_AP202601091816872888_1.pdf)

[2] Beijing Business Daily - Why Kouzijiao Suffered a Performance Waterloo with its Worst Annual Report (http://www.bbtnews.com.cn/2026/0113/581584.shtml)

[3] Sina Finance - Kouzijiao’s Performance Plunge: Where Does Mixed-Fragrance Baijiu Go From Here (https://finance.sina.com.cn/stock/stockzmt/2026-01-14/doc-inhhfrsx8485651.shtml)

[4] Hualong Securities - In-Depth Research Report on Yingjia Gongjiu (https://pdf.dfcfw.com/pdf/H3_AP202311191611678621_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.