Analysis Report on the Adequacy of Asset Impairment Provisions for Zhifei Biological (300122)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the detailed information collected, I now provide you with a professional analysis report on the adequacy of asset impairment provisions for Zhifei Biological.

It needs to be clarified first that the asset impairment pressure currently faced by Zhifei Biological

According to the performance forecast disclosed by the company on January 12, 2025 [1][2][3]:

| Indicator | 2025 Data | Year-over-Year Change |

|---|---|---|

| Net Profit | Loss of RMB 10.698-13.726 billion | Down 630%-780% |

| Net Profit Excluding Non-recurring Gains and Losses | Loss of RMB 10.554-13.541 billion | Down 630%-780% |

- Inventory Impairment: Provisions for inventories near or at expiration (net realizable value is lower than book value)

- Credit Impairment: Assessment of expected credit losses on accounts receivable based on age of receivables

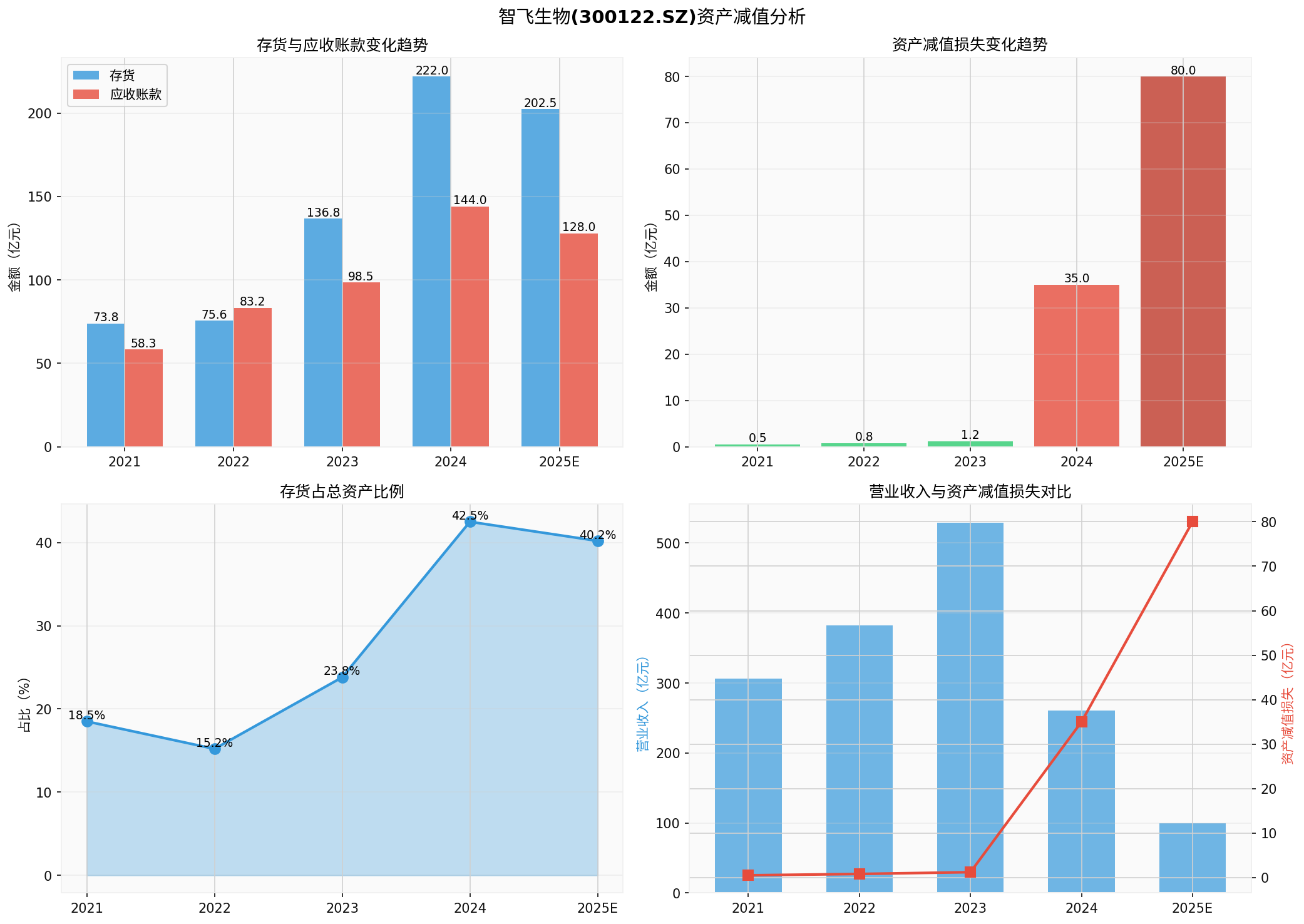

| Financial Indicator | 2021 | 2022 | 2023 | 2024 | Q3 2025 |

|---|---|---|---|---|---|

| Inventory Balance (in RMB 100 million) | 73.85 | 75.63 | 136.75 | 222.0 |

202.46 |

| Accounts Receivable (in RMB 100 million) | 58.32 | 83.23 | 98.52 | 144.0 | 128.14 |

| Inventory as a Percentage of Total Assets | 18.5% | 15.2% | 23.8% | 42.5% |

40.2% |

| Year-over-Year Growth of Inventory | - | 2.4% | 80.8% | 147.25% |

-9.85% |

| Year-over-Year Growth of Revenue | - | 24.8% | 38.3% | -50.74% |

- |

The expected loss of RMB 10.698-13.726 billion in 2025 represents a decline of over 6 times compared to the net profit of RMB 2.018 billion in 2024 [1][2]. Such a large-scale loss indicates that the company is carrying out a relatively thorough risk clearance.

The company clearly stated in its performance forecast that it would “base on the principle of prudence” to accrue inventory impairment and credit impairment provisions [1][2][3], reflecting a prudent attitude in accounting treatment.

The Q3 2025 report shows [2]:

- Net cash flow from operating activities reached RMB 2.985 billion, with a year-over-year growth of 201.18%

- Maintained positive for three consecutive reporting periods

- Accounts receivable and inventory decreased by 5.21% and 9.85% year-over-year, respectively

As of the end of Q3 2025, the inventory balance still reached as high as RMB 20.246 billion, accounting for over 40% of total assets [4][5]. Taking into account:

- HPV vaccines have a shelf life of only 3 years

- A large number of products purchased in 2023-2024 will face expiration risks in 2026

- A large amount of inventory products may require further impairment provisions

According to the H1 2025 report data [4][5]:

- The proportion of accounts receivable with an age of over 1 year increased from approximately 24% at the beginning of the period to nearly 45%

- The company’s bad debt provision policy: 50% provision for accounts receivable aged 2-3 years, 100% provision for those aged over 3 years

- Facing the risk of rapid accumulation of bad debts in 2026

| Indicator | 2024 Data | Risk Assessment |

|---|---|---|

| Inventory Growth Rate | +147.25% | Seriously deviated from normal levels |

| Revenue Growth Rate | -50.74% | Seriously inconsistent with inventory growth |

| Inventory-to-Revenue Ratio | 85% | Severe inventory overstock |

| Company | Q1-Q3 2025 Revenue Change | Net Profit Status |

|---|---|---|

| Zhifei Biological | Over 60% decrease | Loss of RMB 1.206 billion |

| Wantai Biological | -23.09% | Loss of RMB 0.173 billion |

| Watson Biological | -20% | Net profit down 36% |

Among 17 listed vaccine companies, only 6 achieved profitability in H1 2025 [1][2]. Against the backdrop of in-depth industry adjustments, Zhifei Biological’s inventory and accounts receivable impairments may take longer to fully digest.

- Core Issue: Merck’s HPV vaccines have a shelf life of 3 years [4][5]

- Time Window: Vaccines purchased in 2023-2024 will expire collectively in 2026

- Potential Loss: Unsold inventory will be directly recorded as current period costs

According to data from the National Institutes for Food and Drug Control (NIFDC) [1][2]:

- The batch release volume of 9-valent HPV vaccines in 2024 decreased by 30% year-over-year

- The total batch release volume in the first 11 months of 2025 was only 24 batches (domestic + imported)

- The price of Wantai Biological’s domestic 9-valent HPV vaccine is RMB 499 per dose, only 40% of the price of imported products

| Indicator | Q3 2025 Data | Risk Warning |

|---|---|---|

| Short-term Borrowings | RMB 10.318 billion | High short-term debt repayment pressure |

| Monetary Funds | RMB 2.498 billion | Tight capital chain |

| Current Liabilities | RMB 12.885 billion | Liquidity pressure |

| Asset-Liability Ratio | Approximately 36% (rises to 48% after loan) | Increased debt burden |

| Assessment Dimension | Assessment Result | Explanation |

|---|---|---|

Overall Assessment |

Basically adequate, but with doubts |

The billion-yuan level loss reflects significant impairment efforts |

Inventory Impairment |

Potentially inadequate |

The RMB 20.2 billion inventory scale remains high, and expiration risks have not been fully released |

Accounts Receivable Impairment |

Basically adequate |

The age-of-receivables method is relatively prudent, but bad debt losses may persist |

Future Risk Exposure |

High uncertainty |

Expiring vaccines in 2026 may lead to further impairment |

- From the perspective of accounting standards: The company accrues impairment provisions based on the “principle of prudence”, which complies with the requirements of enterprise accounting standards. The large-scale loss in 2025 reflects management’s recognition of risks.

- From the perspective of substantive risks: Considering that the RMB 20.2 billion inventory contains a large number of products near or at expiration, and the continuous deterioration of accounts receivable age,there may still be room for further impairment in the future.

- From the perspective of industry cycles: This impairment is a concentrated risk clearance during the in-depth industry adjustment period, which will have a significant short-term impact on performance, but it is conducive to the company lightening its operational burden for future development.

- From the perspective of going concern: The company has applied for a RMB 10.2 billion syndicated loan, adjusted its procurement plan with Merck, and actively reduced inventory. If it can effectively resolve inventory pressure, its performance is expected to stabilize in 2026.

| Risk Level | Assessment | Recommendation |

|---|---|---|

Short-term Risk |

High | Monitor inventory digestion progress and actual bad debt losses in 2026 |

Medium-term Risk |

Medium | Monitor the launch progress of self-developed products and the recovery of agency business |

Long-term Risk |

Medium-Low | Monitor the strategic layout of “Prevention + Treatment” and internationalization progress |

[0] Jinling API Financial Analysis Data

[1] Securities Times Network - “Accruing Impairment Provisions to Lighten Burden, Zhifei Biological Adjusts in Multiple Dimensions to Build Momentum for 2026” (https://www.stcn.com/article/detail/3589406.html)

[2] Securities Daily Network - “Continuously Increasing R&D and Internationalization Layout to Build Momentum for Future Growth, Zhifei Biological Actively Responds to Industry Adjustments” (https://finance.eastmoney.com/a/202601143619079156.html)

[3] Tonghua Shun - “Accruing Impairment Provisions to Lighten Burden, Zhifei Biological Adjusts in Multiple Dimensions to Build Momentum for 2026” (https://m.10jqka.com.cn/20260113/c673967480.shtml)

[4] Eastmoney - “Inventory, Huge Loss, Emergency Loan, Zhifei Biological Faces a Moment of Survival via Pledging” (https://wap.eastmoney.com/a/202601133617604296.html)

[5] Caiwen News - “Zhifei Biological with a Market Value of RMB 48 Billion Forecasts a Billion-Yuan Loss, Once Agreed on a Hundred-Billion-Yuan Procurement with Merck During the Peak Period” (https://www.caiwennews.com/article/1412951.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.