Economic Analysis: 40-Day Government Shutdown Creates Data Void for Economists

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

This analysis is based on the Wall Street Journal report [1] published on November 12, 2025, examining how professional economists navigated a 40-day period without government economic data during the longest federal shutdown in U.S. history.

The government shutdown represented a fundamental disruption to economic analysis infrastructure, creating what analysts termed a “data vacuum” [4]. With the Bureau of Labor Statistics and other federal agencies unable to collect and release data, economists lost access to the most reliable and comprehensive economic indicators including jobs reports, inflation data, and other crucial statistics [1, 4]. This forced professional forecasters to fundamentally alter their daily workflows, breaking habits like waking at 5 a.m. to analyze morning economic releases [1].

The timing was particularly critical as the economy was already showing signs of weakness, with a sharp hiring slowdown and rising inflation creating stagflation concerns [4]. Economic growth had slowed to an average annualized rate of only 1.6% in the first half of 2025, and a pre-shutdown jobs report showed a sharp decrease in hiring in August [4]. The shutdown occurred during this period of economic vulnerability, amplifying its impact on market functioning and policy decisions.

Economists were forced to adopt creative approaches to economic analysis, turning to unconventional sources for insights. The reference to consulting plumbers about consumer spending illustrates how analysts sought grassroots economic indicators when official data was unavailable [1]. This shift toward anecdotal and private sector data sources, while innovative, inherently reduced the precision and reliability of economic forecasts. The experience highlighted the profession’s dependence on government statistics and the challenges of maintaining analytical rigor without them.

The shutdown disrupted deeply ingrained professional rhythms. The mention of economists learning to “sleep past 5 a.m.” reflects how fundamentally the routine of monitoring morning economic releases had become embedded in the profession [1]. This went beyond mere inconvenience - it represented a fundamental challenge to the methodology and timing of economic analysis, forcing economists to restructure their entire approach to market monitoring and forecasting.

The shutdown exposed the economy’s vulnerability to political dysfunction. With approximately 650,000 federal workers furloughed [3] and the shutdown expected to boost the unemployment rate by about 0.4 percentage points in October [3], the data void compounded existing economic weakness. The absence of reliable economic indicators may have contributed to market inefficiencies and increased risk premiums, as investors and businesses had to make decisions with incomplete information [4].

- Data Quality Degradation: The forced reliance on alternative data sources likely reduced the accuracy and reliability of economic forecasts, as private sector data and anecdotal evidence lack the comprehensiveness of official government statistics [4]

- Policy Uncertainty: The data void created significant challenges for monetary policy at a critical economic juncture, though Federal Reserve Chair Jerome Powell stated that alternative data suggested the overall economic outlook hadn’t changed significantly since the September meeting [5]

- Market Volatility: Financial markets faced increased uncertainty without government economic data, potentially leading to suboptimal capital allocation and increased risk premiums [4]

- Methodological Innovation: The shutdown forced economists to develop new analytical approaches and alternative data sources that could complement traditional government statistics in future analysis

- Contingency Planning: The experience provides valuable lessons for economic institutions in developing more robust analytical frameworks that can withstand future data disruptions

- Data Recovery Analysis: Once government data releases resumed, economists had the opportunity to compare alternative data methodologies against official statistics, potentially improving forecasting models

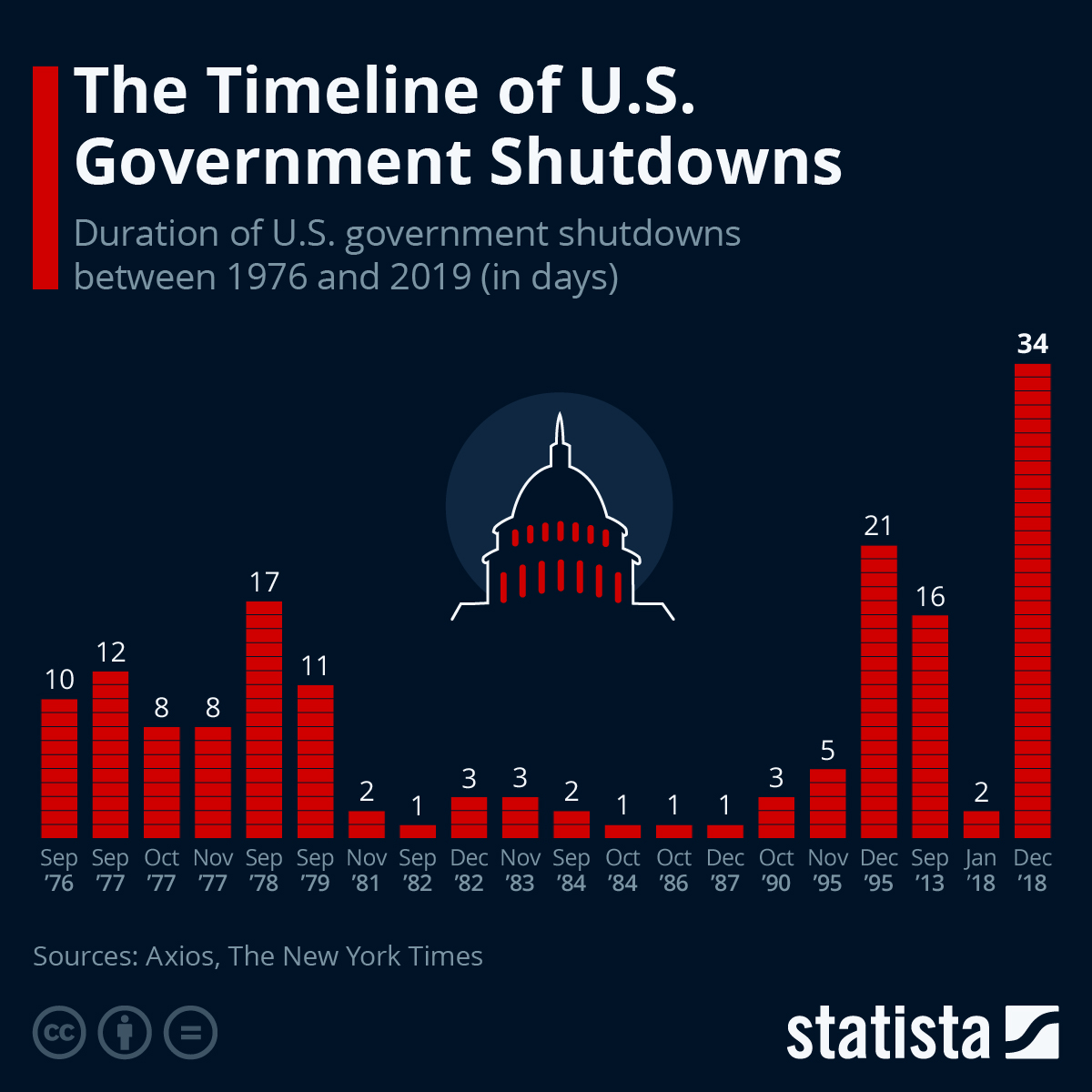

- The government shutdown lasted 40 days, making it the longest in U.S. history [3]

- Approximately 650,000 federal workers were furloughed during the shutdown [3]

- The shutdown was expected to boost the unemployment rate by about 0.4 percentage points in October [3]

- The economy was growing at an average annualized rate of only 1.6% in the first half of 2025 [4]

- A jobs report before the shutdown showed a sharp decrease in hiring in August [4]

- The economy was showing signs of stagflation with rising inflation alongside slowing growth [4]

- Goldman Sachs economists expected the October jobs report to be released shortly after the government reopened, possibly the following Tuesday or Wednesday [5]

- Other major data releases were expected to be delayed by “at least a week” [5]

- The Bureau of Labor Statistics needed time to work through the backlog of releases once the shutdown ended [5]

The shutdown experience highlighted the critical importance of government economic statistics in modern financial analysis and exposed vulnerabilities in the economic analysis infrastructure that may warrant attention from policymakers and financial institutions alike.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.