In-Depth Analysis Report on Jianghuai Automobile's Loss Reduction Trend and New Energy Transformation of Traditional Automakers

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest disclosed financial data, Jianghuai Automobile (600418.SS) is in a critical strategic transformation period, with its financial status characterized by ‘confirmed loss reduction trend, but under pressure on profitability’ [0][1].

| Indicator Category | 2024 Actual | 2025 Forecast | YoY Change |

|---|---|---|---|

| Net Profit Attributable to Parent | -RMB 1.784 billion | -RMB 1.68 billion | Loss reduced by RMB 104 million |

| Non-Recurring Net Profit | -RMB 2.74 billion | -RMB 2.47 billion | Loss reduced by RMB 270 million |

| Operating Revenue | RMB 39.2 billion | Approximately RMB 38 billion | YoY decrease of approximately 3% |

| R&D Expenses | Approximately RMB 1.65 billion | RMB 2.216 billion | YoY growth of 34.47% |

An in-depth analysis of Jianghuai Automobile’s loss sources identifies three major dragging factors:

The joint venture project between Jianghuai Automobile and Volkswagen (Volkswagen Anhui) became the biggest drag on performance in 2024. Financial reports show that Volkswagen Anhui incurred severe operating losses in 2024, leading Jianghuai Automobile to recognize an investment loss of approximately

The 7-year contract manufacturing cooperation with NIO officially ended in 2024, having a profound impact on Jianghuai Automobile. Statistics show that since 2018, NIO has paid a total of approximately RMB 2.5 billion in contract manufacturing fees to Jianghuai, with the fee reaching as high as RMB 1.127 billion in 2022 alone [3]. The end of the contract manufacturing model means Jianghuai lost a stable annual revenue source of over RMB 1 billion, exposing the strategic risk of over-reliance on a single customer.

In H1 2025, Jianghuai Automobile’s R&D expenses reached RMB 2.216 billion, a YoY increase of 34.47%, accounting for 11.44% of operating revenue [3]. Administrative expenses also surged to RMB 1.120 billion, a YoY increase of 43.99%, mainly used for the operation of the Zunjie Super Factory, talent recruitment, and digital transformation. While these investments lay the foundation for long-term development, they have severely dragged down performance in the short term.

Jianghuai Automobile’s Zunjie brand’s first model, the S800, developed in partnership with Huawei, has shown better-than-expected market performance, providing important support for the sustainability of the loss reduction trend [3][4]:

- 1,000 units were pre-ordered within 1 hour of launch

- 5,000 firm orders were placed within 19 days

- 10,000 firm orders were placed within 67 days

- 12,000 orders were received within 87 days

- Average transaction price reaches RMB 950,000

- The top-spec “Star Glory Executive Version” priced at RMB 1.018 million accounts for 70% of total orders

The investment in the Zunjie Hefei Super Factory reaches RMB 3.98 billion, with a designed annual production capacity of 200,000 units. The factory is currently in the capacity ramp-up phase:

- August delivery volume: Targeting 1,000 units

- September production target: 3,000 units

- End-of-year target: 4,000 units (30% higher than the original target)

If the Zunjie S800 can maintain monthly sales of 3,000-4,000 units, based on an average transaction price of RMB 950,000, it is expected to bring

Despite the impressive performance of the Zunjie S800, the sustainability of Jianghuai Automobile’s loss reduction trend still faces the following challenges:

In H1 2025, Jianghuai Automobile’s total vehicle exports were approximately 107,000 units, ranking 9th among the top 10 vehicle export enterprises, compared with 120,000 units in the same period of 2024, when it ranked 8th [3]. Complex international situations and intensified competition in overseas markets have led to a significant decline in export business, which is difficult to recover in the short term.

In H1 2025, Jianghuai’s passenger vehicle sales were only 66,000 units, a YoY decrease of 16.12%. Its brands such as Sehol, YIWEI, and Refine have failed to form a synergetic force, facing fierce competition from rivals such as Wuling and Changan. Capacity utilization rate is only 36%, and inefficient operations have pushed up unit fixed costs.

As of H1 2025, Jianghuai Automobile’s current ratio is 0.80 and quick ratio is 0.68, both below the 1.0 warning line. The company is promoting a RMB 4.9 billion private placement plan to support the development of high-end intelligent electric platforms [2], but still faces tight liquidity before the funds are in place.

| Scenario | Key Assumptions | 2026 Net Profit Forecast |

|---|---|---|

| Optimistic | Zunjie S800 monthly sales of 4,000 units + Volkswagen Anhui loss reduction + export recovery | Loss reduced to -RMB 1 billion |

| Neutral | Zunjie S800 monthly sales of 2,500 units + maintaining current operating level | Approximately -RMB 1.4 billion |

| Pessimistic | Zunjie capacity bottlenecks + intensified price wars + continuous increase in R&D investment | Losses expand |

In 2025, China’s new energy vehicle (NEV) market reached a historic turning point, with NEV penetration rate exceeding

- Market Structural Transformation:NEVs have officially become the dominant force in the market, and traditional fuel vehicles have entered a decline channel

- Competition Landscape Restructuring:BYD ranks first with sales of 4.6 million units, while traditional automakers such as Geely, Changan, and SAIC are accelerating their catch-up

- Profit Differentiation Intensifies:Leading companies maintain high profitability, while traditional automakers with slow transformation are generally under pressure

| Rank | Automaker Group | Sales (10,000 units) | YoY Growth Rate | NEV Share |

|---|---|---|---|---|

| 1 | BYD | 460 | +60.8% | 100% |

| 2 | Geely Automobile | 207 | +78.9% | 56% |

| 3 | Changan Automobile | 100 | +36.0% | 30% |

| 4 | SAIC Motor | 155 | +31.0% | 35% |

| 5 | Chery Automobile | 85 | +45.0% | 25% |

| … | Jianghuai Automobile | 8 | -15.0% | <15% |

The above data shows that Jianghuai Automobile has clearly fallen behind in the new energy transformation of traditional automakers, and the gap with leading enterprises continues to widen.

Geely Automobile’s NEV sales reached 2.07 million units in 2025, surging 78.9% YoY, with NEV share jumping from less than 40% in 2024 to over 56%, successfully achieving a qualitative change from “parallel development of fuel and NEVs” to “NEV-led” [5][6].

- Strategic Focus with the “Taizhou Declaration”:At the end of 2024, Geely released a strategy to fully transition to NEVs, privatized Zeekr, and promoted brand integration between Zeekr and Lynk & Co to resolve internal homogeneous competition

- Precise Layout of the Galaxy Series:The Galaxy Series achieved the “million-unit target” with sales of 1.235 million units, covering the mainstream market of RMB 70,000-200,000

- High-End Breakthrough with Zeekr:The Zeekr brand achieved annual sales of 224,000 units, with sales exceeding 30,000 units in November, becoming a new growth engine for the group

- Significant Cost Reduction and Efficiency Improvement:Brand integration brought significant synergies, reducing vehicle manufacturing costs by approximately 15%

Changan Automobile’s operating revenue reached RMB 276.72 billion in 2024, a YoY increase of 7.7%, with NEV sales of 733,000 units, a YoY increase of over 50% [7]. In 2025, it set a target of 1 million NEV sales, demonstrating its determination for transformation.

- Dual Brand Layout of Deepal + Avatr:Deepal S7 and Avatr 12 form a high-end twin star, covering mainstream and luxury markets

- Advantages of Blue Whale Hybrid Technology:Self-developed hybrid technology forms differentiated competitiveness

- Continuous Increase in R&D Investment:The proportion of R&D expenses to revenue has increased, mainly used for battery technology, intelligent connectivity, and lightweighting

- Global Strategic Synergy:Overseas sales targets are set alongside NEV targets to diversify geopolitical risks

Based on industry success cases and Jianghuai Automobile’s actual situation, traditional automakers need to follow the following strategic framework to turn losses into profits:

| Transformation Missteps | Correct Practices |

|---|---|

| Launching multiple new brands simultaneously | Focus on 1-2 core brands, concentrate resources to create hit models |

| Covering the entire price range | Choose 1-2 market segments to deepen and build brand recognition |

| Developing independent and joint venture brands in parallel | Clarify the positioning of the main brand, handle synergy with the joint venture segment properly |

- Three-Electric Technology:Battery, motor, and electronic control account for 65% of the total vehicle cost, and cost control needs to be achieved through full self-development [6]

- Intelligentization Capabilities:Intelligent driving and intelligent cockpits are becoming key to brand differentiation; XPeng Motors achieved a 125.9% YoY growth relying on its intelligent driving technology [6]

- Platform Development:Achieve multi-model sharing through high-end intelligent electric platforms to reduce single-vehicle R&D costs

The cooperation model between Jianghuai and Huawei provides an important reference for traditional automakers:

- Huawei Inside Model:Provides core technologies such as intelligent driving (ADS 4.0) and HarmonyOS cockpit

- Brand Empowerment Effect:Huawei’s brand endorsement enhances product premium capability

- Rapid Mass Production and Launch:Accelerate product iteration with the help of Huawei’s ecosystem

The designed annual production capacity of Jianghuai’s passenger vehicle factory in Hefei is 500,000 units, but actual output is only 180,000 units, with a capacity utilization rate of 36%. In contrast, enterprises such as BYD and Geely generally have a capacity utilization rate of over 70%. Improving capacity utilization is key to spreading fixed costs and improving gross margin.

In 2025, China’s vehicle exports reached 6.316 million units, with NEV passenger vehicle exports reaching 2.208 million units, accounting for over 40% of total exports [8]. Enterprises such as SAIC, BYD, and Geely have achieved export growth through overseas factory construction and channel layout, and Jianghuai Automobile needs to re-examine its overseas strategy.

| Dimension | Rating | Explanation |

|---|---|---|

| Financial Health | ★★☆☆☆ | Sustained losses, tight cash flow |

| Transformation Progress | ★★★☆☆ | Zunjie S800 has achieved market success, but is in capacity ramp-up phase |

| Competitive Advantage | ★★☆☆☆ | Weak brand power, insufficient technology accumulation |

| Valuation Level | ★★★☆☆ | Stock price has already reflected transformation expectations in advance |

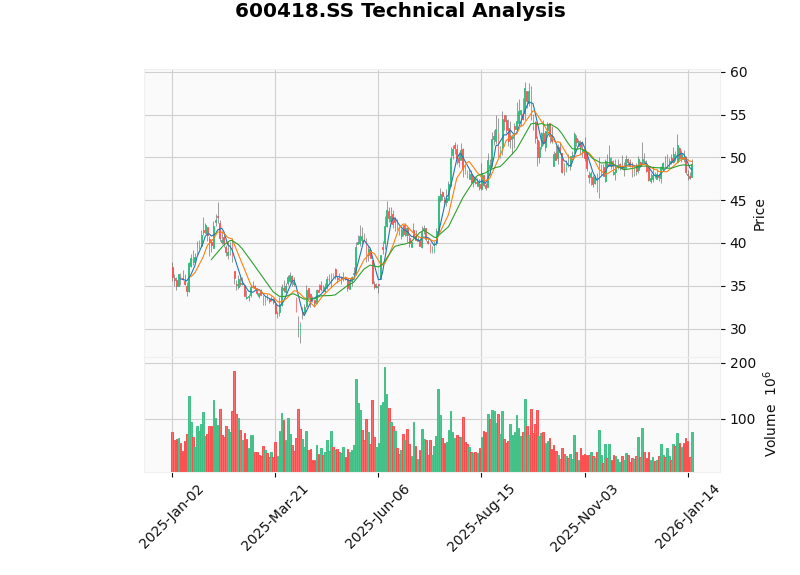

According to technical analysis, Jianghuai Automobile’s stock price is currently in a sideways consolidation phase [0]:

- Current Price:RMB 49.27

- Support Level:RMB 48.49

- Resistance Level:RMB 50.05

- Trend Judgment:Sideways consolidation, no clear direction

- MACD Indicator:No crossover, bearish bias

- KDJ Indicator:K value 24.4, D value 30.5, bearish bias

The stock price has risen by approximately 398% since the low point in February 2025, and the market has fully priced in the Zunjie concept [3]. Without unexpected positive news in the short term, the stock price may face adjustment pressure.

- Zunjie capacity ramp-up falls short of expectations:Supply chain bottlenecks may limit delivery volume

- Intensified price wars:Fierce competition in the NEV market may erode gross margins

- Volkswagen Anhui continues to incur losses:The joint venture business may continue to drag down performance

- Cash flow rupture risk:Sustained losses may lead to a liquidity crisis

- Contract manufacturing revenue returns to zero:After the complete termination of cooperation with NIO, contract manufacturing revenue will be wiped out

Jianghuai Automobile expects a net loss of RMB 1.68 billion in 2025, a loss reduction of approximately RMB 104 million compared with the same period last year, confirming a loss reduction trend, but with a limited magnitude and mainly relying on non-recurring factors. Looking ahead to 2026, the loss reduction trend is expected to continue, but faces the following key variables:

- Zunjie S800 orders continue to be converted into deliveries, expected to contribute annual revenue of RMB 3-4.5 billion

- If the RMB 4.9 billion private placement is successfully completed, it will ease capital pressure

- Huawei’s brand empowerment effect continues to be released

- High uncertainty in Volkswagen Anhui’s joint venture business

- Unclear prospects for export business recovery

- Sustained high R&D investment

For the entire traditional automaker sector, the window period for new energy transformation is rapidly narrowing. Leading enterprises such as BYD, Geely, and Changan have established scale advantages and brand moats, while slow-transforming automakers such as Jianghuai are facing the risk of marginalization. For traditional automakers to turn losses into profits, they must simultaneously implement strategic focus, independent technology, win-win cooperation, and capacity optimization; a single breakthrough will not be enough to survive in the fierce market competition.

[0] Jinling API Data - Company Profile and Technical Analysis of Jianghuai Automobile (600418.SS)

[1] Sina Finance - Jianghuai Automobile Trapped in Joint Venture and Transformation Dilemma, Expected to Lose RMB 1.77 Billion in 2024 (https://finance.sina.com.cn/stock/relnews/cn/2025-02-11/doc-inekasqi6747715.shtml)

[2] Stock Star - Reports on Jianghuai Automobile’s 2024 Expected Loss and Private Placement (https://finance.sina.com.cn/stock/relnews/cn/2025-02-11/doc-inekasqi6747715.shtml)

[3] Autohome Chejiahao - Jianghuai Automobile Loses RMB 770 Million in Half a Year, Breakup with NIO, Zunjie Struggles to Save the Situation (https://chejiahao.autohome.com.cn/info/21777349)

[4] Sina Finance - Jianghuai Automobile: Amid Growing Pains of Transformation, Can Zunjie Become the Key to Breaking the Deadlock? (https://cj.sina.cn/articles/view/3093070657/b85c834100101p41w)

[5] Sohu Auto - 2025 NEV Group Sales Ranking (https://m.sohu.com/a/976695688_100044558)

[6] 21st Century Business Herald - 2025 Auto Market Sales Hit a New High, Top 5 Automakers “Capture” Half the Market (https://www.21jingji.com/article/20260115/herald/83b9a9997b55209f6991f7eb9a11b719.html)

[7] NetEase Auto - 2025 Sales Exceed 1 Million Units: Ambitions and Layout of Changan NEV (https://www.news18a.com/news/storys_218109.html)

[8] LeadLeo Research Institute - 2025 China Whole Vehicle Industry Research Report (https://pdf.dfcfw.com/pdf/H3_AP202507281717257473_1.pdf)

[9] Sina Finance - Analysis of China’s Auto Industry Competition Landscape and Brand Ranking (2025 Latest Insights) (https://finance.sina.com.cn/roll/2025-07-02/doc-infeanhh5741385.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.