ORB Strategy Analysis: Asia Session Trading on Day 80 Implementation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

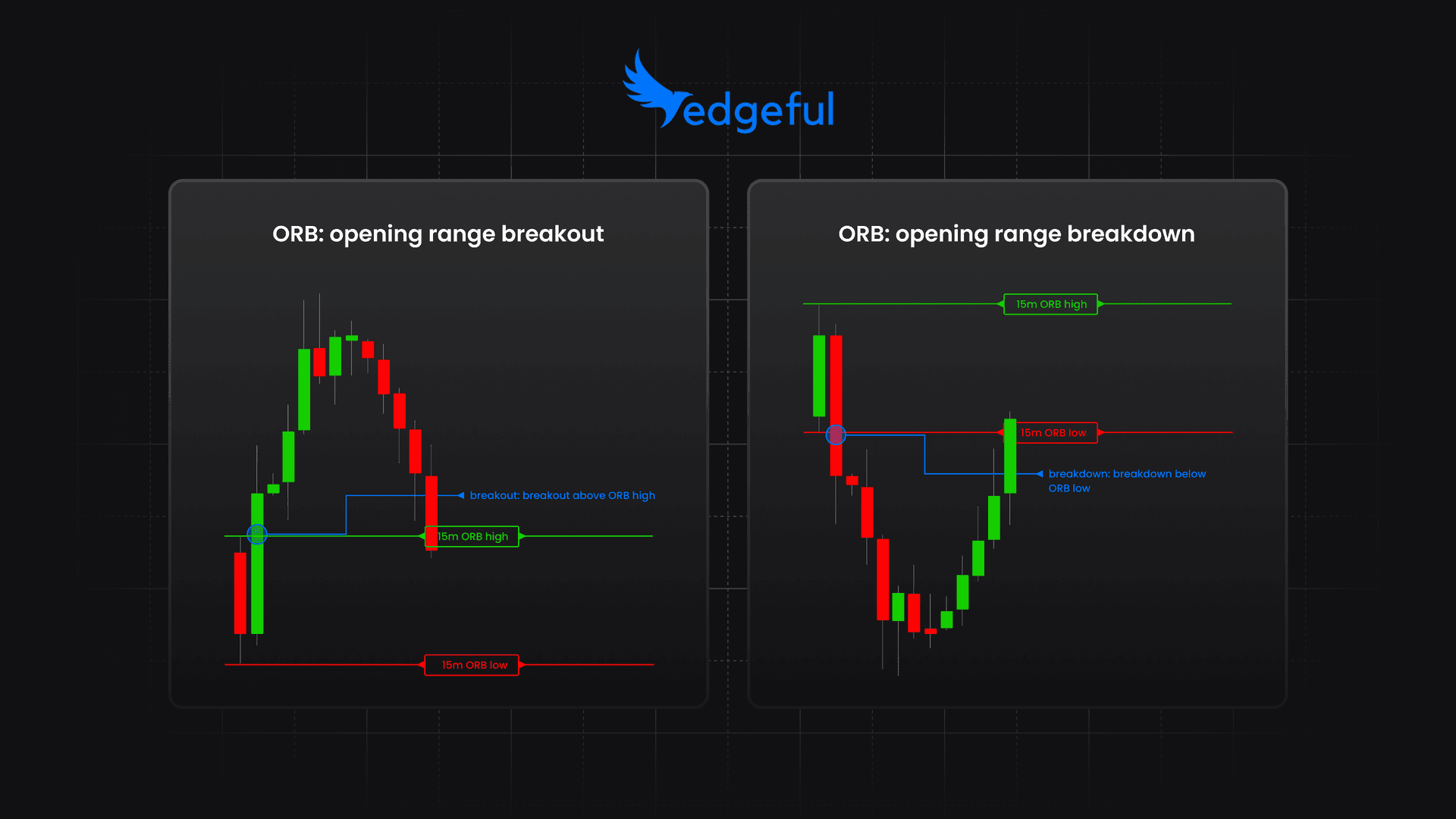

This analysis examines a trader’s 80th day of ORB strategy implementation during the Asia trading session on November 12, 2025, at 13:35:42 UTC [0]. The trader executed a sophisticated approach using a 5-minute opening range breakout, entering long positions after identifying Fibonacci 0.382–0.5 pullback levels with EMA/VWAP alignment confirmation [0]. The risk management approach involved taking partial profits while maintaining exposure with one micro contract.

The market environment presented significant challenges for ORB strategies. Asian markets showed divergent performance with the Nikkei 225 slipping 0.1%, Hang Seng gaining 0.2% to 26,696 points, and CSI 300 falling 0.9% [1]. Chinese A-share markets were particularly weak, with Shanghai Composite down 0.46% and Shenzhen Component declining 1.39% [0]. Market volatility remained subdued with VIX trading in mid-17s as traders awaited US CPI data [1], creating challenging conditions for momentum-based strategies.

The execution timing corresponded to approximately 21:35 Hong Kong time, placing it late in the Asia trading session. This timing factor significantly impacts ORB effectiveness, as late-session breakouts exhibit different characteristics than early-session moves and carry increased gap risk during session transitions [0].

- False Breakout Risk: Low volatility environments increase the probability of false breakouts, potentially leading to premature entries and losses [1]

- Session Transition Risk: Trading near Asia session close increases exposure to gap risk when European markets open

- Liquidity Deterioration: While micro contracts suggest appropriate position sizing, liquidity can rapidly decline during session transitions

- Macro Event Sensitivity: Upcoming US CPI data release represents a significant catalyst that could trigger volatility spikes affecting ORB effectiveness [1]

- Session Overlap Trading: Enhanced liquidity during Asia-Europe and Asia-US session overlaps may provide better breakout confirmation

- Sector Rotation Plays: Continued weakness in technology/AI sectors may create opportunities in alternative instruments

- Volatility Expansion: Potential VIX increases following CPI data could improve ORB strategy conditions

- VIX movements for volatility regime changes

- Session overlap performance patterns

- AI sector rotation continuation

- USDJPY strength impact on export-oriented equities (currently above 154.50) [1]

The ORB strategy implementation on day 80 occurred during a complex market environment characterized by mixed Asian market performance and subdued volatility. The trader employed sophisticated technical analysis combining Fibonacci levels with EMA/VWAP alignment, demonstrating adaptation to challenging conditions [0]. The partial profit-taking approach with one micro contract retention shows sound risk management principles.

However, several critical information gaps limit comprehensive assessment: specific instrument traded, exact entry/exit levels, volume analysis data, and cumulative performance history over the 80-day period [0]. The late-session timing (21:35 Hong Kong time) introduces additional considerations regarding breakout reliability and session transition risks.

Market context suggests continued challenges for ORB strategies in the current low-volatility environment, though potential volatility expansion following upcoming macro events could improve conditions. The strategy’s long-term effectiveness would benefit from performance tracking across different volatility regimes and session overlaps.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.