In-Depth Fundamental Analysis Report on Phinia Inc. (PHIN)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now that I have collected comprehensive data, let me prepare a detailed fundamental analysis report on Phinia for you.

Phinia Inc. (NYSE: PHIN) is an independent auto parts and solutions provider headquartered in Auburn Hills, Michigan, USA. The company was spun off from BorgWarner and listed independently in 2023, inheriting over 100 years of industry experience and technological accumulation [1]. Currently, Phinia operates 49 facilities across 21 countries worldwide, with a total workforce of over 12,500 employees [2].

Phinia’s operations are divided into two reportable segments:

This is the company’s core segment, offering advanced fuel injection systems, fuel delivery modules, carbon canisters, sensors, electronic control modules, and related software. Specific products include:

- High-pressure fuel pumps and injectors

- Fuel rail assemblies

- Engine control modules

- Complete fuel system solutions (including software and calibration services)

- Gasoline Direct Injection (GDi) systems

- Diesel injection and aftertreatment systems

The company is one of the world’s leading suppliers of GDi fuel injection systems, and its 500bar high-pressure fuel system technology is at the forefront of the industry [3].

This segment offers a broad portfolio of products and services for the independent aftermarket, with well-known brands including Delphi, Delco Remy, and Hartridge. Key products include:

- Fuel injection system components

- Brake and suspension components

- Electrical system components

- Professional diagnostic tools and equipment

- Training and technical support services (Delphi Academy)

The Aftermarket segment provides the company with stable cash flow and high profit margins, and holds a significant position in the North American and European markets.

| Region | Revenue Share | Key Characteristics |

|---|---|---|

| Americas | 42.1% | Core market; key customers include major North American OEMs |

| Europe | 40.4% | Strong Delphi brand foundation; leading regulatory standards |

| Asia | 17.5% | Fastest-growing market; focused on expanding in China |

Based on the latest financial data, Phinia has demonstrated robust growth momentum:

- Q3 2025: Total revenue of $908 million (8.2% YoY growth), with $549 million from Fuel Systems and $359 million from Aftermarket

- Q2 2025: Total revenue of $890 million (2.5% YoY growth), with $537 million from Fuel Systems and $353 million from Aftermarket

- Q1 2025: Total revenue of $796 million (7.8% YoY decline), with $473 million from Fuel Systems and $323 million from Aftermarket

Q3 results significantly exceeded expectations, with revenue beating consensus by 7.64% and EPS of $1.59 surpassing estimates by 35.9% [4].

| Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Gross Margin | 22.0% | 22.1% | 21.6% | 22.3% |

| Operating Margin | 7.3% | 7.0% | 7.8% | 5.5% |

| Net Profit Margin | ~3.5% | - | - | - |

The company’s gross margin stabilizes in the 21-22% range, reflecting strong cost control capabilities. The improvement in operating margin is mainly driven by enhanced operational efficiency and economies of scale.

| Metric | Value | Industry Comparison |

|---|---|---|

| Market Capitalization | $2.7 billion | Mid-sized auto parts supplier |

| P/E Ratio | 30.15x | Slightly above industry average |

| P/B Ratio | 1.71x | Reasonable level |

| EV/EBITDA | 8.12x | Attractive |

| Debt-to-Equity Ratio | 65.95% | Robust capital structure |

| Free Cash Flow (TTM) | $202 million | Healthy cash flow generation capability |

| Dividend Yield | 1.55% | Moderate shareholder return |

According to assessments from financial analysis tools, Phinia’s financial status exhibits the following characteristics [5]:

- The company maintains balanced accounting practices, with no extreme aggressive or conservative operations

- Debt ratio is within a controllable range, with a healthy interest coverage ratio

- Operating cash flow is sufficient to cover debt principal and interest

- Free cash flow reached $203 million over the past 12 months

- Operating cash flow is stable, capable of supporting capital expenditures and dividends

The global fuel delivery system market is highly concentrated, with key players including:

| Rank | Company | Market Position | Core Strengths |

|---|---|---|---|

| 1 | Robert Bosch | Global Leader | Technological leadership, global footprint, economies of scale |

| 2 | DENSO | Global Leader | Japanese automotive ecosystem, hybrid technology |

| 3 | Continental | Global Leader | German precision engineering, digital solutions |

| 4 | Delphi/Phinia | Niche Market Leader | North American market advantage, GDi technology, aftermarket network |

| 5 | Hitachi Astemo | Key Player | Traditional Japanese strengths, electrification layout |

Phinia has significant technological advantages in the following areas:

- GDi Fuel Injection Systems:The company is one of the few global suppliers capable of providing 500bar high-pressure GDi systems, which can significantly improve fuel efficiency and reduce emissions [6]

- Aftertreatment Systems:Has deep technological accumulation in diesel engine emission control, capable of meeting strict emission standards such as Euro 7 and China VI

- Alternative Fuel Technologies:Supports various low-carbon fuel types including ethanol, compressed natural gas (CNG), and hydrotreated vegetable oil (HVO)

- Delphi Brand:Boasts high brand awareness and customer loyalty in the aftermarket

- Delco Remy and Hartridge:Hold strong brand positions in specific niche markets

- Global Service Network:49 facilities across 21 countries, providing localized service support

The company has disclosed several key business developments:

- Secured new project orders for GDi fuel rails and pumps from a leading Chinese domestic OEM, for use in a new hybrid engine platform

- Signed its first GDi pump business contract with one of the Big Three North American OEMs

- Expanded partnerships with major North American distributors

- The Aftermarket segment won a new diesel injection service contract with a major off-road equipment supplier

- Emission Regulation Upgrades:Implementation of new standards such as Euro 7 and China VI will drive demand growth

- Hybrid Transition:The company’s technologies are suitable for hybrid platforms, giving it a favorable position in the electrification transition

- Aftermarket Growth:Expansion of e-commerce channels and brand promotion will drive incremental growth

- Off-Road Equipment Market:Steady demand in off-road sectors such as agriculture, construction, and shipping

According to market reports, Freedom Capital Markets has assigned a Buy rating to Phinia’s stock [7]. Combining the company’s fundamentals and market analysis, the core investment rationale for this rating may include the following aspects:

- The current P/E ratio of 30.15x is lower than that of some large auto parts suppliers

- EV/EBITDA of 8.12x is within a reasonable industry range

- The market has not yet fully reflected the value of the company’s Aftermarket segment

- Q3 revenue beat expectations by 7.64%, and EPS exceeded estimates by 35.9%

- Operating margin increased from 5.5% in 2024 to over 7% in 2025

- Order volume in the Fuel Systems segment continues to grow, particularly in the GDi space

- The Aftermarket segment accounts for 40% of revenue, providing stable cash flow and high profit margins

- Significant synergies between the two segments, sharing technology platforms and customer resources

- Diversified geographic footprint, reducing risks from regional economic fluctuations

- Emission regulation upgrades drive demand for product upgrades

- New customer expansion (particularly domestic OEMs in the Chinese market)

- Technology adaptation for hybrid platforms

- Expansion of e-commerce channels in the Aftermarket segment

- Dividend yield of 1.55%, with considerable potential for annualized total returns

- Stable dividend policy (quarterly dividend of $0.27 per share)

- Share repurchase program provides additional support

The current consensus target price for Phinia is $75, representing approximately 7% upside from the current stock price [4]:

- Highest Target Price: $79

- Lowest Target Price: $71

Analyst rating distribution: 50% Buy, 50% Hold, indicating positive market sentiment towards the company’s medium-to-long-term prospects.

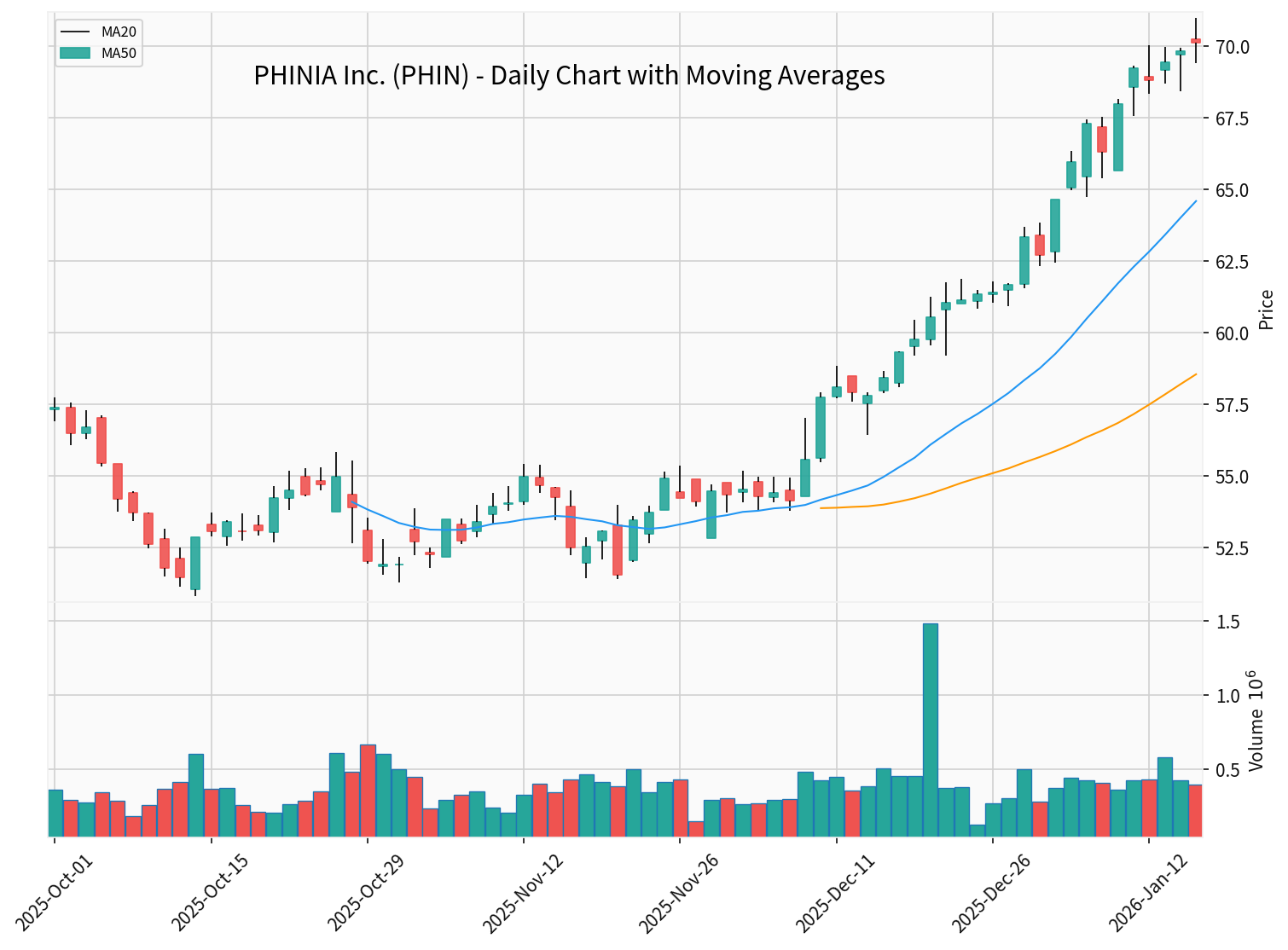

- Latest Closing Price: $70.12

- 52-Week Range: $36.46 - $70.88

- YTD Gain: +8.46%

- 1-Year Gain: +36.87%

- 3-Year Gain: +89.51%

| Indicator | Value | Signal Interpretation |

|---|---|---|

| 20-Day Moving Average | $64.58 | Stock price is above the moving average |

| 50-Day Moving Average | $58.54 | Clear uptrend |

| RSI (14-Day) | 84.21 | Overbought zone |

| MACD | Bullish Crossover | Upward momentum continues |

| Beta | 1.28 | Higher volatility than the broader market |

- Support Level: $67.95

- Resistance Level: $70.97

- Next Target Level: $72.59

- Electric Vehicle Transition:Long-term demand for internal combustion engine-related products may decline

- Macroeconomic Fluctuations:Demand for commercial vehicles and construction machinery is highly correlated with the economic cycle

- Supply Chain Risks:Fluctuations in raw material prices and semiconductor shortages may impact production

- Customer Concentration:High revenue share from top customers

- Technological Obsolescence:Electrification trend may render some technologies obsolete

- Regional Risks:High revenue share from European operations, which may be affected by European economic slowdown

With a current P/E ratio of 30.15x, the stock may face valuation pullback pressure if performance growth falls short of expectations.

- Balanced Business Structure:Dual-driver model of Fuel Systems + Aftermarket provides stability

- Technological Leadership:GDi and low-carbon fuel technologies are at the industry forefront

- Clear Growth Prospects:Emission regulation upgrades and new customer expansion provide growth momentum

- Healthy Financial Status:Low debt risk, stable cash flow generation capability

- Attractive Shareholder Returns:Dividends + potential capital appreciation

Based on its current market capitalization of $2.7 billion, annual net profit of approximately $340 million, and growth prospects, Phinia’s valuation is in a reasonable range. The market has not yet fully reflected the value of the company’s business transformation, and Freedom Capital Markets’ Buy rating may be based on this valuation gap.

- Short-term stock price is in the overbought zone, may face technical pullback

- Monitor Q4 2025 earnings report to be released on February 12, 2026

- Continuously track the long-term impact of the electric vehicle transition on the company’s business

[1] Phinia Investor Relations - Quarterly Results (https://investors.phinia.com/financials/quarterly-results/default.aspx)

[2] Phinia Sustainability Report 2024 (https://www.phinia.com/docs/phinialibraries/sustainability-page-documents/phinia-sustainability-report-2024.pdf)

[3] Phinia Technologies - Gasoline Direct Injection Systems (https://www.phinia.com/technologies)

[4] Yahoo Finance - PHINIA Inc. (PHIN) Stock Analysis (https://finance.yahoo.com/quote/PHIN/)

[5] Jinling AI Financial Analysis API - Phinia Financial Analysis Data

[6] Phinia Newsroom - Agritechnica 2025 Off-Highway Portfolio (https://www.phinia.com/newsroom/news/2025/11/06/phinia-debuts-expanded-technology-portfolio-for-off-highway-customers-at-agritechnica)

[7] YouTube/Jay Woods - Market Update with Phinia Buy Rating from Freedom Capital Markets (https://www.youtube.com/watch?v=YIwfa-28fhg)

[8] Jinling AI Technical Analysis API - Phinia Technical Indicator Data

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.