Analysis of the Impact of European Luxury Automakers' Sales Decline in the Chinese Market on Global Valuation and Profitability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected data and analysis, I will present to you a comprehensive analytical report on

According to Porsche’s official 2025 delivery data, Porsche delivered

| Region | 2025 Deliveries | Year-over-Year Change | Contribution to Global Decline |

|---|---|---|---|

Chinese Market |

41,938 units | -26% |

Approximately 60% |

| North American Market | 86,229 units | 0% | Stable contribution |

| Europe (excluding Germany) | 66,340 units | -13% | Approximately 20% |

| German Domestic Market | 29,968 units | -16% | Approximately 10% |

| Emerging Markets | 54,974 units | -1% | Marginal impact |

The

- Structural Fluctuations in the Luxury Car Market: China’s high-end consumer market has undergone in-depth adjustments, with consumer confidence and purchasing willingness contracting significantly

- Intensified Competition from Local Electric Vehicles: Chinese new energy vehicle brands (BYD, NIO, Li Auto, etc.) have formed strong competition in terms of intelligent experience and cost performance

- Product Cycle Gap: The 718 Boxster/Cayman and fuel-powered Macan were suspended due to EU cybersecurity regulations, creating a short-term product vacuum

- Price War Pressure: Dealers were forced to cut prices to maintain market share, eroding brand premium capability

2025 data shows that all three German luxury giants (BBA) were not spared from sales declines in the Chinese market[3][4]:

| Brand | 2025 Sales in China | Year-over-Year Change | Global Performance |

|---|---|---|---|

BMW |

626,000 units | -12.5% | +0.5% (slight growth) |

Mercedes-Benz |

552,000 units | -19% |

-9% |

Audi |

617,000 units | -5.6% | -0.5% |

Porsche |

42,000 units | -26% |

-10% |

In contrast to the sharp decline in China, the North American market performed relatively steadily[1]:

- Porsche’s sales in North America remained at 86,229 units, basically flat compared to 2024

- The European market was generally under pressure due to economic slowdown and regulatory constraints

- Q4 data shows that Mercedes-Benz’s sales in China have shown signs of a 7% sequential recovery

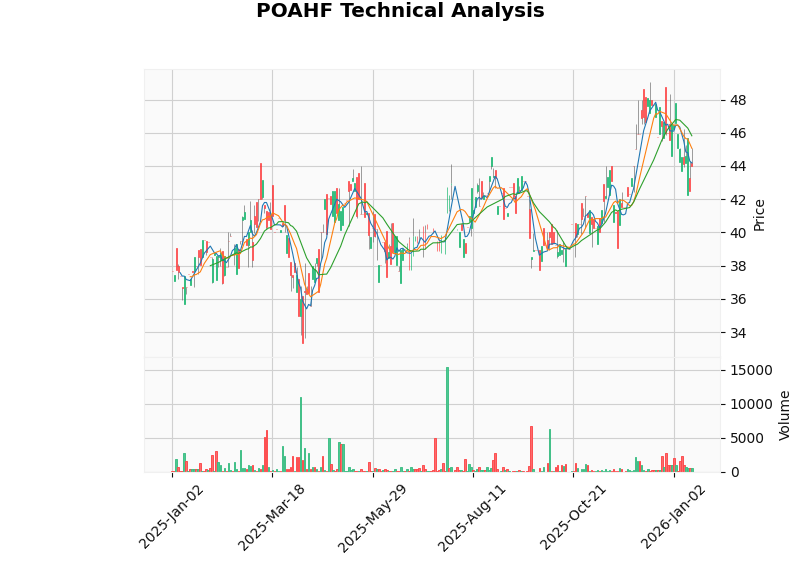

As of January 15, 2026, Porsche (POAHF) closed at

| Time Horizon | Performance |

|---|---|

| 5-Day | -1.21% |

| 1-Month | -7.70% |

| 3-Month | +12.85% |

| 1-Year | +18.31% |

| 3-Year | -26.22% |

| 5-Year | -36.15% |

Porsche’s current valuation indicators reflect market concerns about its profit prospects[0]:

| Indicator | Value | Industry Comparison |

|---|---|---|

P/E Ratio |

-0.54x |

Significantly below normal levels |

P/B Ratio |

0.32x |

Significant asset discount |

ROE |

-60.89% |

Severe erosion of shareholder equity |

P/S Ratio |

-0.54x | Difficulty monetizing revenue |

| Scenario | Valuation | Deviation from Current Price |

|---|---|---|

| Conservative Scenario | -$676.72 | -1637.7% |

| Base Case Scenario | -$903.81 | -2153.6% |

| Optimistic Scenario | -$1,363.80 | -3198.8% |

From a longer-term perspective, Porsche has experienced significant market capitalization contraction[0]:

- 2022: Approximately $22.5 billion

- 2024: Approximately $14.8 billion

- 2025 to date: Approximately $13.5 billion

The market capitalization has evaporated approximately

The sales decline in the Chinese market has impacted profitability on multiple levels:

- Reduced capacity utilization, leading to higher unit fixed cost amortization

- Deteriorating profitability of the dealer network, increasing subsidy pressure

- Sustained investment in electrification transformation, with unabated capital expenditure pressure

- Operating Margin: Only1.00%, far below the industry average of 8.5%

- Free Cash Flow: Positive but volatile, with FCF at $1.431 billion

- Liability Risk: Classified as low risk, with a relatively sound financial structure

In response to the sales decline, Porsche has launched a number of strategic adjustments[2]:

- Extend Fuel Vehicle Lifecycle: Postpone the discontinuation of the 718 and Macan electric versions to maintain product portfolio integrity

- Accelerate Hybrid Product Launch: The Cayenne hybrid version was launched at the end of 2025 to fill the product gap

- “Value Over Volume” Strategy: Prioritize maintaining per-vehicle profit margins over pursuing sales growth

- Short-Term Cost Burden: Transformation costs of approximately€1.8 billionare expected

Mercedes-Benz and BMW are also facing profit pressure[4][5]:

- Mercedes-Benz’s 2025 automotive sales fell 9% year-over-year, putting pressure on the margins of its core automotive division

- Although BMW’s global sales grew slightly by 0.5%, its Q4 sales fell by 4.1%, and the share of electric vehicles increased to 26%

- Volkswagen Group’s sales in China fell 8% in 2025, with China still contributing 30% of its global sales

The core challenges faced by European luxury automakers in the Chinese market are

- Rise of Local Brands: Brands such as BYD, NIO, and Li Auto have established a strong presence in the RMB 300,000-500,000 price range

- Intelligence Gap: Chinese consumers’ expectations for smart cockpits and assisted driving are significantly higher than the existing products of European brands

- Accelerated Electrification: The penetration rate of electric vehicles in China continues to rise, and the market share of fuel vehicles is being rapidly eroded

In the face of challenges, both BBA and Porsche are accelerating localization transformation[3][4]:

- BMW plans to launch 20 new modelsin China in 2026

- Mercedes-Benz will introduce more than 15all-new and facelifted models

- Volkswagen Group will launch over 20 new energy modelsin 2026

- Mercedes-Benz has partnered with Momenta to develop intelligent driving systems

- Audi has in-depth cooperation with Huawei ADS (Advanced Driving System)

- Volkswagen is increasing cooperation with local suppliers

- Resilience of the North American Market: Stable sales in the U.S. market provide revenue buffer

- Recovery of Product Cycle: The intensive launch of multiple new models in 2026 is expected to boost sales

- Hybrid Transition Solution: Extending the lifecycle of fuel vehicles can alleviate the pain of electrification transformation

- Brand Moat: Porsche’s brand power in the sports luxury vehicle segment still has premium capability

- Sustained Weakness in the Chinese Market: If luxury vehicle demand continues to contract, profit recovery will be delayed

- Tariff Uncertainties: Changes in Sino-US-EU trade policies may increase cost pressure

- Return on Electrification Investment: Whether large-scale transformation investment can be converted into market share is uncertain

- Intensified Competition: The rapid iteration of Chinese local high-end electric vehicle brands brings continuous challenges

Porsche’s current stock price ($44.01) has pulled back approximately

- Whether the Chinese market can stabilize and recover

- Market feedback on new model launches

- Cost control capabilities in electrification transformation

- Global macroeconomic and consumer confidence trends

[1] Porsche Newsroom - “Porsche delivers 279,449 sports cars to customers in 2025” (https://newsroom.porsche.com/en/2026/company/porsche-deliveries-2025-41516.html)

[2] AInvest - “Porsche’s 2025 Delivery Decline: Navigating Model Gaps, China Headwinds, and a Strategic Pivot” (https://www.ainvest.com/news/porsche-2025-delivery-decline-navigating-model-gaps-china-headwinds-strategic-pivot-2601/)

[3] Sina Finance - “German Luxury Big Three See Sales Decline in China for Two Consecutive Years; BMW, Audi, Mercedes-Benz All Affected” (https://cj.sina.cn/articles/view/1765373140/693974d404001dhxy)

[4] Cailianshe - “Mercedes-Benz, BMW, Volkswagen Release 2025 Results: Global Sales Mixed; Over 55 New Models to Be Launched in Chinese Market in 2026” (https://finance.eastmoney.com/a/202601133617397652.html)

[5] Morningstar - “Porsche Deliveries Fall on China Woes and Model Gaps” (https://www.morningstar.com/news/dow-jones/202601161075/porsche-deliveries-fall-on-china-woes-and-model-gaps)

[0] Jinling AI Financial Database (Real-time market data, technical analysis, financial analysis)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.