Analysis Report on the Impact of VF Corporation (VFC)'s China Market Expansion

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above data collection and analysis, I will provide you with an in-depth analysis report on the impact of the expansion of VF Corporation (V.F. Corporation)'s brands in the Chinese market on its stock price and overall business growth.

VF Corporation (V.F. Corporation, NYSE: VFC) is one of the world’s largest apparel companies, founded in 1899 and headquartered in Greensboro, North Carolina, USA. The company owns a number of globally renowned outdoor, sports, and workwear brands, including The North Face®, Vans®, Timberland®, Dickies®, etc.[0][1].

- Current Price:$19.18

- Market Capitalization:$7.494 billion

- 52-Week Price Range:$9.41 - $29.02

- Daily Trading Volume:6.23 million shares (near average)

| Time Period | Price Change | Assessment |

|---|---|---|

| 1 Day | -0.47% | Minor Pullback |

| 5 Days | -5.56% | Short-term Pressure |

| 1 Month | -0.47% | Relatively Stable |

| 3 Months | +33.94%** | Strong Rebound |

| 6 Months | +63.51%** | Significant Recovery |

| 1 Year | -16.61% | Weak Long-term |

| 3 Years | -37.34% | Mid-term Adjustment |

| 5 Years | -77.14% | Long-term Decline |

Notably, VFC’s stock price has rebounded significantly after hitting a low in 2024, with a gain of over 63% in the past six months, reflecting the market’s recognition of the company’s transformation results.

In November 2025, Smartwool, a brand under VF Corporation, opened its first China store in Beijing Raffles City, marking an important layout for the brand in the Chinese market[1]. Founded in 1994 in Colorado, USA, Smartwool is the first outdoor company to create high-performance merino wool ski socks. It was acquired by Timberland in 2005, and was incorporated into VF Corporation along with Timberland in 2011.

- Core Products:Merino wool outdoor socks, base layers, jackets, etc.

- Brand Philosophy:“go far. feel good.”

- Target Audience:Outdoor sports enthusiasts, long-distance travelers, daily commuters

VF Corporation’s China market strategy dates back to 2007:

| Time | Event | Strategic Significance |

|---|---|---|

| April 2007 | Acquired The North Face’s China business | Direct control over China market operations |

| 2011 | Acquired Timberland (including Smartwool) | Improved outdoor brand portfolio |

| 2024 | Asia-Pacific Business Transformation Plan | Enhanced digitalization and supply chain development |

| 2025 | Opening of Smartwool’s first Beijing store | Deepened layout in segmented markets |

- At the time of the 2007 acquisition, it was expected to achieve $40 million in revenue within 5 years

- Has now established a comprehensive wholesale and retail network in China

- Has sales offices in Shanghai, Beijing, and Guangzhou

- Has become VF Corporation’s core growth engine in the Asia-Pacific region

China’s outdoor sports market is in a period of rapid development, providing a favorable market environment for VF Corporation:

| Year | Market Size (Billions of USD) | YoY Growth Rate |

|---|---|---|

| 2022 | 220 | 12.0% |

| 2023 | 250 | 13.6% |

| 2024 | 290 | 16.0% |

| 2025E | 340 | 17.2% |

| 2026E | 400 | 17.6% |

According to data from iResearch, the compound annual growth rate (CAGR) of China’s outdoor products market is expected to reach 7% from 2020 to 2025[2]. International outdoor brands continue to increase their investment in the Chinese market, reflecting the strong growth trend of domestic outdoor sports consumption demand.

- Earnings Per Share (EPS):$0.52 (exceeded expectations by 22.50%)

- Revenue:$2.80 billion (exceeded expectations by 2.57%)

- Gross Margin:Increased 270 basis points year-over-year

- Adjusted Operating Margin:-3.2%, improved 270 basis points compared to the same period last year

| Segment | Revenue (Millions of USD) | Proportion |

|---|---|---|

| Outdoor | $1,660 | 68.6% |

| Active | $760.75 | 31.4% |

| Region | Revenue (Millions of USD) | Proportion |

|---|---|---|

| US | $1,340 | 47.9% |

| Europe | $1,070 | 38.3% |

| Asia-Pacific | $386.56 | 13.8% |

Although the Asia-Pacific business accounts for a relatively small proportion, its growth potential is significant. The North Face and Timberland maintain strong growth momentum in the Asia-Pacific region.

According to VF Corporation’s FY2025 10-K Report[3]:

| Indicator | FY2025 | FY2024 | YoY Change |

|---|---|---|---|

| Total Revenue | $9.505 billion | $9.916 billion | -4.1% |

| Operating Profit | $304 million | -$144 million | Return to Profit from Loss |

| Net Income | -$190 million | -$969 million | Significant Improvement |

| Current Ratio | 1.40 | 1.22 | Improved |

- Outdoor Segment:$5.576 billion (1.4% growth), stable performance

- Active Segment:$3.095 billion (12.1% decline), Vans brand under pressure

- Workwear Segment:$833 million (6.6% decline)

- Successfully sold the Supreme brand, recovering approximately $1.5 billion in cash

- Debt level decreased significantly, long-term debt fell from $4.7 billion to $3.4 billion

- Improved inventory management, enhanced inventory turnover efficiency

- Gross margin has improved for consecutive quarters

- Asia-Pacific business accounts for only 13.8%, with significant room for growth

- Vans brand continues to face pressure (14% YoY decline)

- Net profit margin is only 0.95%, profitability needs improvement

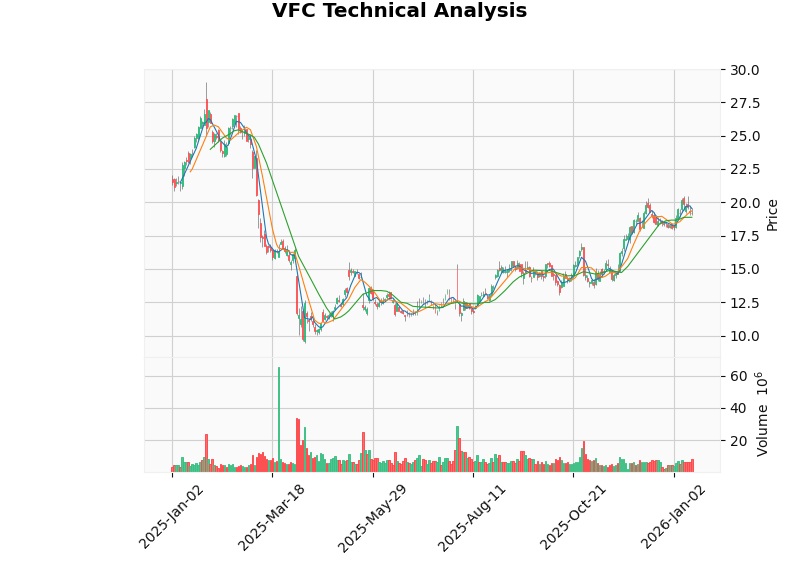

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $19.18 | - |

| 20-Day Moving Average | $18.87 | Slightly Above Moving Average |

| 50-Day Moving Average | $17.56 | Above Moving Average |

| 200-Day Moving Average | $14.29 | Significantly Above Moving Average |

| MACD | No Crossover | Bearish Signal |

| KDJ | K:58.3, D:63.7, J:47.6 | Weak |

| RSI | Normal Range | - |

| Beta (vs. SPY) | 1.69 | High Volatility |

- Support Level:$18.82

- Resistance Level:$19.54

- Trading Range Reference:[$18.82, $19.54]

The stock price is currently trading above the 50-day and 200-day moving averages, indicating a relatively strong medium-to-long-term trend. However, the MACD indicator shows no crossover signal, and the KDJ indicator is weak, lacking a clear direction in the short term.

- Opening Price During Period: $18.25

- Closing Price During Period: $19.18

- Highest Price During Period: $29.02

- Lowest Price During Period: $9.41

- Daily Average Volatility: 4.29%

- Price Range Amplitude: 176.49%

- China’s outdoor sports market is expected to reach $40 billion in size by 2026

- The opening of first stores for segmented brands such as Smartwool helps tap into high-margin segmented markets

- Direct control over The North Face’s China business enables higher profit margins

- Has a complete product line layout from high-end (The North Face) to professional segmented (Smartwool)

- Meets the increasingly segmented outdoor sports needs of Chinese consumers

- Leverages emerging outdoor fashion trends such as “trail running” and “Gorpcore”

- The Asia-Pacific business transformation plan includes establishing a digital supply chain hub in Singapore

- Added senior management in Shanghai, close to the consumer market

- Enhances responsiveness to rapidly changing domestic consumption trends

- Slower economic growth in China, decline in consumer spending

- RMB exchange rate fluctuations affect profit repatriation

- Geopolitical factors may bring uncertainty

- Domestic brands (such as Arc’teryx under Anta, Kolon) are rising rapidly

- International brands are accelerating their entry into the Chinese market (Nike ACG, CRISPI, Norrøna, etc.)

- Continuous investment in marketing and channel development is required

- Significant differences in consumer preferences across different cities

- Balancing e-commerce channels and physical stores

- Increased complexity in dealer management

- Expansion news such as the opening of Smartwool’s first store may bring a minor positive catalyst

- However, the current stock price has rebounded significantly (+63% in the past 6 months), and may face profit-taking pressure in the short term

- Successful expansion in the Chinese market will increase the proportion of Asia-Pacific revenue (current 13.8%)

- Direct operation model can improve profit margins compared to the licensing model

- Aligns with the management’s strategic focus shift from “transformation to growth”

| Indicator | Value |

|---|---|

| Consensus Rating | Hold (HOLD) |

| Median Target Price | $18.00 |

| Target Price Range | $10.00 - $25.00 |

| Current Price Premium/Discount | -6.2% |

- Buy: 40.4% (23 analysts)

- Hold: 54.4% (31 analysts)

- Sell: 5.3% (3 analysts)

| Indicator | Value | Industry Comparison |

|---|---|---|

| P/E (TTM) | 82.93x | Relatively High |

| P/B | 5.07x | Medium |

| P/S | 0.79x | Relatively Low |

| ROE | 6.09% | Medium |

The current high P/E is mainly due to the company’s recovery from losses, with expected earnings not yet fully reflected. The P/S ratio is only 0.79x, indicating that the market remains cautious about revenue growth.

- Business Transformation Results Evident:VF Corporation has completed cost reduction, profit margin improvement, and debt reduction, and is shifting from the “transformation phase” to the “growth phase”[0]

- China Market Expansion is a Growth Driver:The opening of Smartwool’s first Beijing store marks another milestone for VF Corporation’s deepened layout in China’s outdoor market, aligning with the company’s Asia-Pacific business transformation strategy[1]

- Short-term Risks and Opportunities Coexist:The stock price faces profit-taking pressure after the recent rebound, but still has upside potential supported by China market expansion in the medium-to-long term

- Pay Attention to the Upcoming Earnings Report:The company will release its Q3 FY2026 earnings report on January 28, 2026 (expected EPS: $0.43), which will be an important window to verify the growth trend

| Risk Type | Details |

|---|---|

| Macroeconomic | Slower economic growth in China, decline in consumer spending |

| Brand Risk | Vans brand continues to face pressure, intensified competition |

| Exchange Rate Risk | USD/CNY exchange rate fluctuations |

| Execution Risk | Execution effect of China market expansion falls short of expectations |

| Valuation Risk | Current P/E (82.93x) is relatively high |

- Asia-Pacific business revenue growth rate

- Number of store expansions in the Chinese market

- Gross margin improvement trend

- FY2026 earnings guidance

The chart above shows the technical analysis candlestick chart of VFC’s stock price, including moving averages and key support and resistance levels.

The chart above includes four analysis dimensions:

- Top Left:2025 stock price trend and moving averages

- Top Right:Comparison of stock price changes across periods

- Bottom Left:Revenue proportion by business segment

- Bottom Right:Revenue distribution by region

The chart above shows the growth trend of China’s outdoor sports market size and the timeline of the opening of Smartwool’s first Beijing store.

Brands under VF Corporation continue to increase their investment in the Chinese market, and the opening of Smartwool’s first Beijing store in particular is an important measure for the company to deepen its layout in the Chinese market. In the short term, this helps enhance brand awareness and market share among Chinese consumers; however, in terms of impact on the stock price, VFC’s stock price has rebounded significantly (over 63% gain in the past six months), and may face certain profit-taking pressure in the short term.

In the medium-to-long term, the continuous growth of China’s outdoor sports market provides favorable development opportunities for VF Corporation. The company has transitioned from the “transformation phase” to the “growth phase”, and the expansion of its Asia-Pacific business will become an important engine driving revenue growth. Investors should pay attention to the upcoming Q3 FY2026 earnings report to be released on January 28, 2026, to verify the sustainability of the company’s growth trend.

[0] Jinling API - VFC Real-Time Quotes, Company Overview, Financial Analysis Data

[1] Luxe.co - “Five International Outdoor Brands Open Their First China Stores in Beijing and Shanghai: ACG, Rapha, CRISPI, Smartwool, Norrøna” (https://luxe.co/post/438717)

[2] Guohai Securities - “Anta Sports (02020) In-Depth Report: Value Remodeling in the Post-Beta Era” (https://file.iyanbao.com/pdf/9b030-bb9fbeda-e9bc-4096-a6a5-7b658a22a33e.pdf)

[3] VF Corporation 10-K Annual Report (SEC Filing Date: 2025-05-22) (https://www.sec.gov/Archives/edgar/data/103379/000010337925000023/vfc-20250329.htm)

[4] VF Corporation Official Website - Investor Relations and Press Releases (https://www.vfc.com/investors/news-events-presentations/press-releases/detail/894/vf-acquires-the-north-facer-branded-business-in-china)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.