TSMC Earnings Lift Valuations of Asian Tech Stocks; China's GDP Data to Be Released

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data and analysis, I provide the following comprehensive insights:

TSMC released its Q4 2026 earnings report on January 15, 2026, which delivered stellar results [0]:

| Indicator | Value | YoY Growth |

|---|---|---|

| Revenue | NT$1.046 trillion (approx. $33.7 billion) | +20.5% |

| Net Profit | NT$50.574 billion | +35% |

| Earnings Per Share (EPS) | $3.09 | 9.57% above expectations |

| Gross Margin | 62.3% | Remained at a high level |

| 2026 Capital Expenditure | $520-$560 billion | +27%-37% YoY |

- Achieved YoY profit growth for 8 consecutive quarters, demonstrating strong growth momentum [1]

- High Performance Computing (HPC) segment (including AI/5G) contributed 55% of total revenue, becoming the largest revenue source [1]

- 7nm and more advanced processes accounted for 77% of wafer revenue, solidifying its technological leadership position [1]

- 2026 revenue is expected to grow by nearly 30%, with management issuing strong guidance [2]

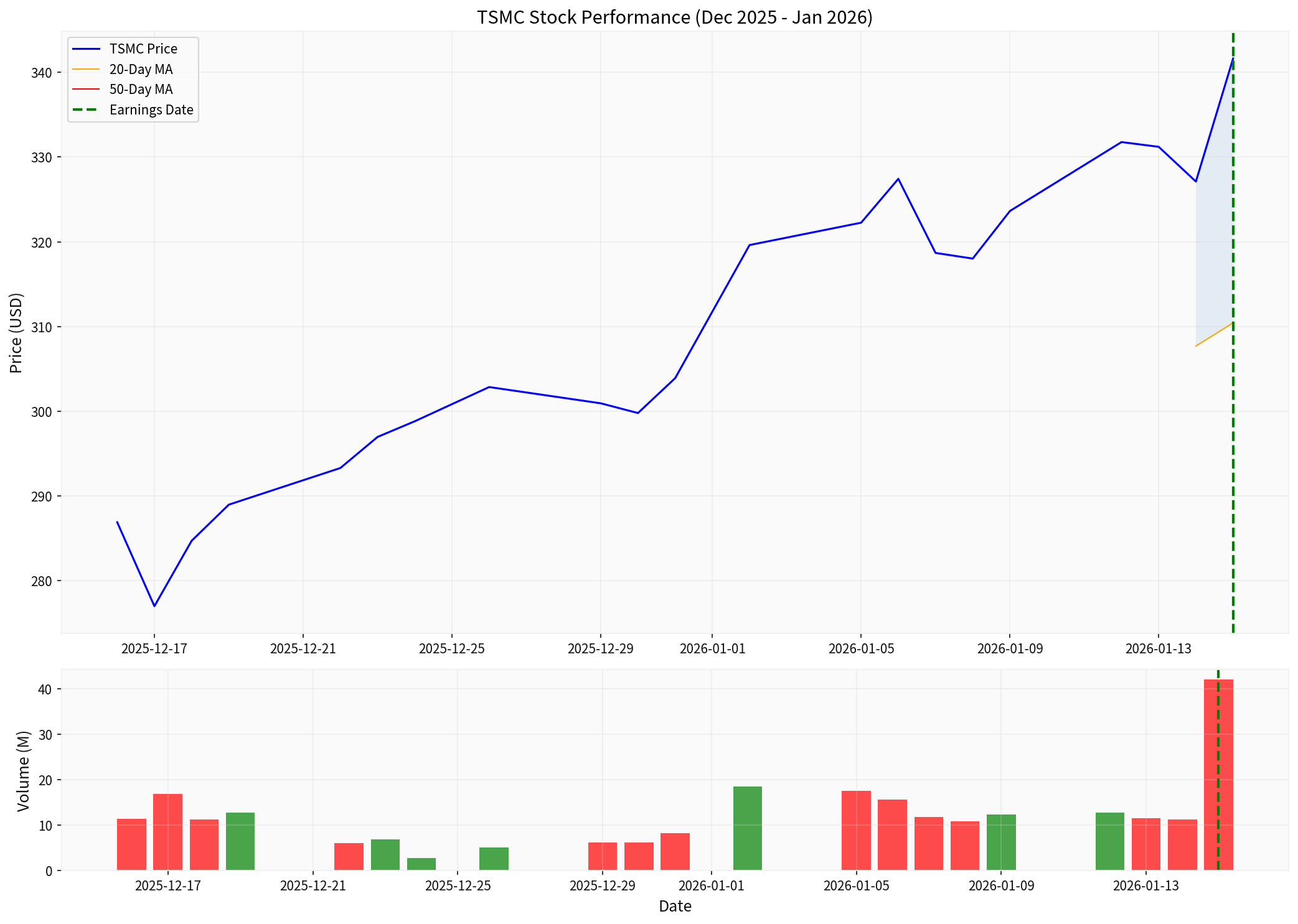

- TSMC’s stock price rose 4.43% in a single day, closing at $341.64, hitting an all-time high [0]

- ASML’s market cap exceeded $500 billion, directly boosted by TSMC’s upward revision of capital expenditure [3]

- U.S. semiconductor sector rallied across the board, with the Philadelphia Semiconductor Index’s rise leading to a follow-up rally in Asian tech stocks

| Support Factors | Analysis |

|---|---|

Increased Certainty in AI Demand |

TSMC’s 2nm process is already in mass production, and its 2026 capacity expansion will meet the strong demand for AI chips [1] |

Solid Leading Edge in Advanced Processes |

77% of revenue comes from processes at 7nm and below, creating insurmountable technological barriers |

Sufficient Confidence Reflected in Capital Expenditure |

The $520-$560 billion capital expenditure guidance indicates optimistic expectations for medium-to-long-term demand |

Raised Dividend Expectations |

2026 cash dividend will be raised from NT$18 per share to at least NT$23 per share [2] |

As a core node in the global semiconductor supply chain, TSMC’s strong performance provides multiple layers of support to Asian tech stocks:

- Japanese semiconductor equipment stocks(Tokyo Electron, SCREEN) are expected to benefit from growing equipment demand

- South Korean tech stocks(Samsung Electronics, SK Hynix) form a complement in the memory chip and AI chip segments

- Taiwanese tech stockssaw an overall lift in valuations, with the MSCI Taiwan Index expected to extend its upward trend

- Mainland China’s semiconductor industry chain, despite being affected by tariffs, can still expect spillover effects from AI demand

| Institution/Forecast | Q4 GDP YoY Growth Rate | Full-Year GDP Growth Rate |

|---|---|---|

| Nomura | 4.3% | - |

| Huatai Securities | approx. 4.5% | approx. 5.0% |

| National Economic Research Center of Peking University | 4.6% | - |

| World Bank (2026 Forecast) | - | 4.4% |

| Consensus of Most Institutions | 4.3%-4.6% | approx. 5.0% |

| Scenario | GDP Growth Rate | Market Impact |

|---|---|---|

Above Expectations (>4.8%) |

Economic recovery is stronger than expected | Risk assets rally across the board, Asian currencies strengthen, and Hong Kong stocks and A-shares stage a sharp rebound |

In Line with Expectations (4.3%-4.6%) |

Economy closes the year on a stable note | Markets react mildly, with focus on follow-up policy measures |

Below Expectations (<4.3%) |

Insufficient recovery momentum | Short-term pressure, with defensive sectors relatively resilient |

- Industrial Production Remains Resilient: The December manufacturing PMI rose to 50.1%, returning to the expansionary range [4]

- High-tech Manufacturing Grows Rapidly: PMIs for the equipment manufacturing and consumer goods industries reached 50.4% and 50.4% respectively

- External Demand Remains Supported: Excavator sales rose 19.2% YoY, indicating infrastructure investment and export momentum [4]

- Real Estate Investment Remains Under Pressure: Real estate development investment continues to decline

- Consumption Recovery is Mild: December total retail sales of consumer goods are expected to rise only 1.5%-1.8% YoY

- Price Indicators Remain Weak: Although the deflator’s decline has narrowed, deflationary pressures persist

| Market | Impact Path |

|---|---|

Hong Kong Stocks |

Directly benefit from expectations of China’s economic recovery, with the Hang Seng Tech Index showing high elasticity |

A-shares |

Consumer and tech sectors are expected to see valuation recovery, while financial and real estate sectors may diverge |

Yen-denominated Assets |

Recovery in Chinese demand supports Japanese exports, and the yen may appreciate moderately |

Korean Won / New Taiwan Dollar |

Asian currencies move in tandem; stabilization of the RMB supports regional currency stability |

Commodities |

Prices of industrial metals such as copper and iron ore may be lifted |

- ✅ Demand for AI chips is expected to continue “surging” in 2026, with Counterpoint Research projecting sustained strength [1]

- ✅ Mass production of 2nm process and advancement of advanced packaging technology ensure technological leadership

- ✅ Substantial upward revision of capital expenditure shows management’s strong confidence in demand outlook

- ⚠️ Uncertainty in global tariff policies (especially the impact of U.S.-Taiwan trade agreements) [5]

- ⚠️ Demand for consumer electronics (smartphones, PCs) is affected by memory shortages and price increases

- ⚠️ Construction of overseas factories may lead to short-term profit margin dilution

- The judgment that the full-year growth target of around 5% was “well achieved”has been fully priced in

- Focus on Structural Highlights: Performance of high-tech manufacturing and consumer trade-in policies

- Policy Signals Are More Important: Watch for further easing of fiscal and monetary policies in 2026

| Sector | Recommendation | Rationale |

|---|---|---|

Semiconductor Industry Chain |

Accumulate on dips | TSMC’s upward revision of capital expenditure benefits equipment/material suppliers |

Asian Tech Stocks |

Cautiously optimistic | Valuations have support, but profit-taking needs to be watched out for |

Hong Kong/A-share Consumer Sectors |

Focus on policies | When GDP data meets expectations, consumer stimulus policies are the key variable |

Defensive Assets |

Standard allocation | Maintain portfolio balance to cope with potential volatility |

[0] Gilin API Market Data (https://www.gilin-ai.com)

[1] CNBC - “TSMC Q4 profit record AI chip demand” (https://www.cnbc.com/2026/01/15/tsmc-q4-profit-record-ai-chip-demand-nt1-trillion.html)

[2] Yahoo Finance - “Taiwan Semiconductor Manufacturing Q4 Earnings Call” (https://finance.yahoo.com/news/taiwan-semiconductor-manufacturing-q4-earnings-080340798.html)

[3] GuruFocus - “ASML Surpasses $500 Billion Market Cap” (https://www.gurufocus.com/news/4114625/asml-surpasses-500-billion-market-cap-boosted-by-tsmcs-increased-capital-spending)

[4] Yicai - “Industrial Production Led Growth in Q4 2025” (https://m.thepaper.cn/newsDetail_forward_32373886)

[5] Benzinga - “Trump Administration Offers Tariff Relief” (https://www.benzinga.com/markets/tech/26/01/49955348/trump-administration-offers-tariff-relief-in-exchange-for-250-billion-taiwan-chip-investment-tsmc-we)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.