Integrated Analysis

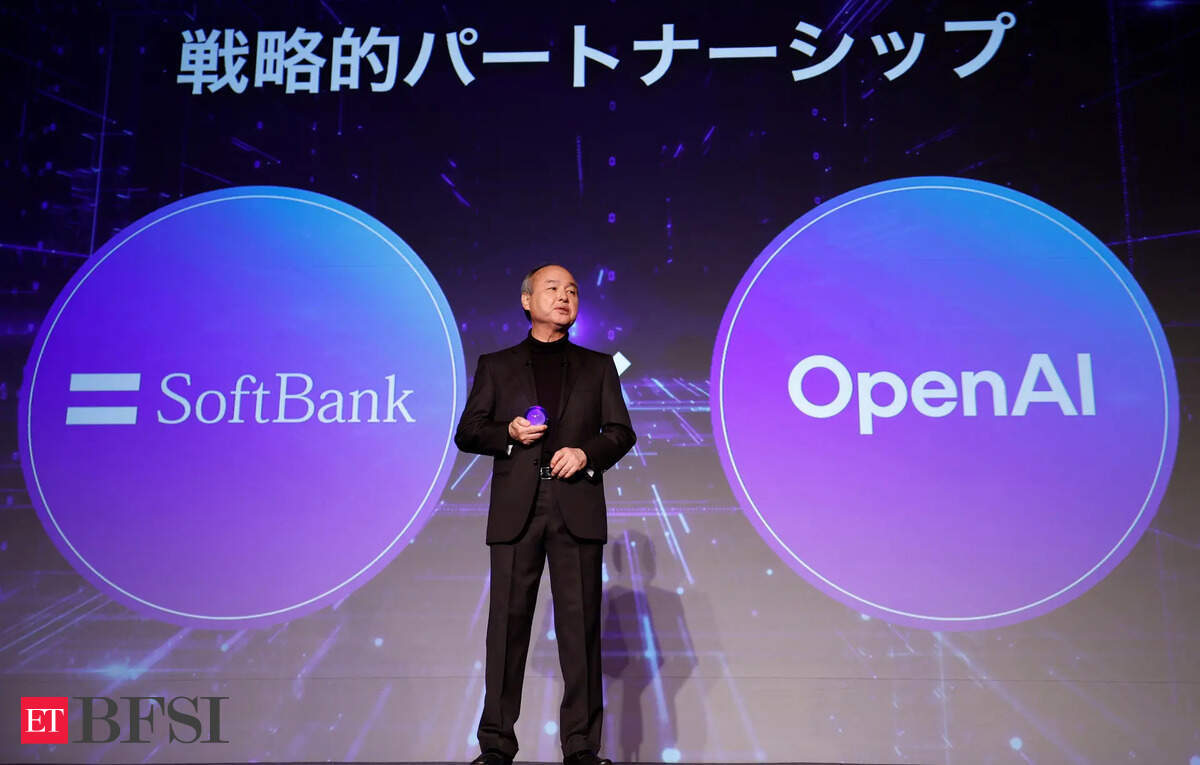

This analysis is based on the Reuters report [1] published on November 12, 2025, which highlighted “tech turbulence and data deluge” as major market themes. The technology sector experienced significant stress driven by two major developments: SoftBank’s strategic reallocation from Nvidia to OpenAI and CoreWeave’s operational challenges [1].

Market Performance Divergence

: The technology sector underperformed significantly, with the Nasdaq Composite declining 0.67% to 23,406.46, while the broader S&P 500 fell only 0.25% to 6,850.92. Notably, the Dow Jones Industrial Average gained 0.50% to reach a new record high of 48,254.82 [0]. This divergence suggests a clear rotation pattern from growth-oriented tech stocks to value-oriented industrial stocks.

Sector Rotation Patterns

: Technology emerged as the second-worst performing sector with a 0.81% decline, while Energy was the worst performer at -1.22%. In contrast, Communication Services led with +1.38%, followed by Basic Materials (+0.41%) and Healthcare (+0.34%) [0]. This pattern indicates investors are seeking defensive positioning amid tech sector uncertainty.

Key Insights

SoftBank’s Strategic Pivot Significance

: SoftBank’s sale of its entire 32.1 million share Nvidia stake, valued at $5.8 billion, represents more than just portfolio rebalancing. The move funds a comprehensive $41 billion investment strategy including $22.5 billion in OpenAI, $6.5 billion for chipmaker Ampere, and $5 billion for ABB’s robotics business [1][2]. This massive capital reallocation from established AI hardware (Nvidia) to AI platforms (OpenAI) suggests SoftBank sees greater long-term value in AI software and services over hardware infrastructure.

AI Infrastructure Execution Risks

: CoreWeave’s 16% stock decline after announcing data center delays reveals critical vulnerabilities in AI infrastructure deployment. Despite strong Q3 2025 revenue growth of 134% year-over-year to $1.36 billion, the company revised its 2025 revenue guidance downward to $5.05-5.15 billion, below analyst estimates of $5.29 billion [4]. More concerning, the company reduced its full-year capex outlook to $12-14 billion from $20-23 billion, indicating significant scaling challenges [4].

Market Psychology Shift

: The combination of SoftBank’s exit from Nvidia and CoreWeave’s operational challenges suggests growing concerns about AI sector sustainability. When major investors like SoftBank sell high-performing AI hardware stocks to fund other AI ventures, it often signals peak valuations and potential sector consolidation [2][3]. This psychological shift could trigger broader revaluation across AI-related stocks.

Risks & Opportunities

Critical Risk Factors

: The analysis reveals several elevated risk factors that warrant careful attention:

-

AI Valuation Concerns

: SoftBank’s exit from Nvidia, despite its strong performance, may signal peak valuations in AI hardware [2][3]. Historical patterns suggest such major investor exits often precede sector consolidation periods.

-

Infrastructure Bottlenecks

: CoreWeave’s delays highlight supply chain constraints in AI infrastructure that could affect the entire sector [4]. The company’s reliance on third-party data center providers creates execution risks that may be systemic across the AI infrastructure industry.

-

Liquidity Pressure

: SoftBank’s need to sell assets to fund OpenAI investments suggests potential capital constraints in the AI investment landscape [1][2]. This could limit funding availability for other AI ventures and increase sector volatility.

Opportunity Windows

: Despite the risks, several opportunities emerge from this market turbulence:

-

Sector Rotation Benefits

: The flow of capital from technology to communication services and defensive sectors [0] may create value opportunities in traditionally overlooked areas.

-

Infrastructure Solutions

: Companies that can address AI infrastructure bottlenecks and provide reliable data center services may see increased demand as providers like CoreWeave seek more reliable partners.

-

Selective AI Opportunities

: The market correction may create entry points for quality AI companies with strong fundamentals and proven execution capabilities.

Key Information Summary

Market Data Highlights

: On November 12, 2025, NVIDIA dropped 2.96% to $193.80 on high volume of 153.22M shares, while SoftBank Group plunged 10% in Tokyo trading to ¥21,910 [0][1]. CoreWeave declined 16% after announcing data center delays that impacted full-year guidance [1][4].

Critical Information Gaps

: Several key details remain unclear that could affect market dynamics: CoreWeave has not disclosed which specific customers were affected by data center delays or the revenue impact magnitude [4]; SoftBank’s $22.5 billion OpenAI investment structure and expected returns lack detailed disclosure [1][2]; and the full scope of delayed government economic data releases remains uncertain [1].

Monitoring Priorities

: Market participants should focus on CoreWeave’s Q4 2025 results to assess whether data center delays can be resolved [4]; SoftBank’s OpenAI investment deployment timeline and structure [1][2]; Federal Reserve policy implications with multiple officials speaking and futures showing two-thirds chance of December rate cut [1]; and technical levels including yen approaching 160 per dollar that could trigger Japanese intervention [1].

The market’s reaction to these developments suggests a maturing AI sector where investors are becoming more selective about execution capabilities and sustainable business models, moving beyond the initial enthusiasm that characterized earlier AI investment cycles.