Goodwill Impairment Risk Analysis Report on Bright Dairy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the data and information I have collected, I will prepare a professional analysis report on the goodwill impairment risk of Bright Dairy.

Bright Dairy & Food Co., Ltd. (Stock Code: 600597.SH) is one of the leading enterprises in China’s dairy industry, with its main businesses covering the production, development and sales of dairy products and animal husbandry [0]. The company is headquartered in Shanghai, with product lines covering multiple categories such as room temperature milk, low temperature milk, yogurt, and milk powder [1].

| Indicator | Value |

|---|---|

| Market Capitalization | RMB 11.303 billion |

| Current Stock Price | RMB 8.17 |

| P/E Ratio (TTM) | 16.25x |

| P/B Ratio | 1.19x |

| ROE | 7.18% |

| Net Profit Margin | 2.88% |

| Current Ratio | 0.86 |

| Quick Ratio | 0.58 |

Bright Dairy’s goodwill mainly comes from its acquisition of New Zealand’s Synlait Milk Limited in 2019, and its acquisition of 60% equity in Qinghai Xiaoxiniu Bio-Dairy Co., Ltd. in 2021 [1]. Among them, the Synlait project is an important part of Bright Dairy’s internationalization strategy, while the Xiaoxiniu project is a key layout for the company to expand the western market and enrich its product matrix.

According to Bright Dairy’s 2024 annual report, the company recorded a

It is worth noting that Synlait’s operating situation continued to be under pressure in 2024, mainly affected by the following factors:

- Continuous decline in international dairy product prices

- Decline in gross profit margin due to rising labor costs

- Underperformance of the North Island asset group

Bright Dairy acquired 60% equity of Qinghai Xiaoxiniu in October 2021, with a transaction consideration of RMB 612 million. According to the performance bet agreement signed at that time, the original shareholders of Xiaoxiniu promised to achieve the cumulative performance target from 2022 to 2024.

| Indicator | Value |

|---|---|

| Three-Year Cumulative Completion Rate | 93.32% |

| Reasons for Incompletion | Intensified market competition, fluctuations in raw material prices |

According to the special audit report issued by BDO China Shu Lun Pan Certified Public Accountants LLP, Xiaoxiniu’s three-year cumulative completion rate is 93.32%, which did not meet the 100% performance commitment target [1]. This means that Bright Dairy may need to conduct further impairment tests on the goodwill related to Xiaoxiniu.

From the disclosed data, the goodwill impairment loss recognized by Bright Dairy in 2024 is approximately RMB 78.05 million. Compared with the company’s total asset scale, the impairment amount is within a controllable range. However, the following points need attention:

-

Synlait’s Sustained Pressure: The net profit of New Zealand’s Synlait Milk Limited was -RMB 58.48 million in 2024, with the loss margin expanding compared to the previous year, mainly affected by the decline in commodity prices and rising labor costs [1]

-

Xiaoxiniu’s Unmet Performance Commitment: The completion rate is only 93.32%. Although it will not trigger significant goodwill impairment, it means that the profitability of the acquired asset is under certain pressure

-

Impairment Risk of North Island Asset Group: Synlait has recognized additional impairment losses for the long-term assets of the North Island asset group, and the future profitability of this part of the assets remains uncertain

-

Proactive Impairment Recognition: The company has recognized approximately RMB 78.05 million in goodwill impairment losses on Synlait’s North Island asset group and Xiaoxiniu-related assets, indicating that the management has conducted a pragmatic assessment of asset quality [1]

-

Planned Acquisition of Remaining Xiaoxiniu Equity: In January 2025, Bright Dairy plans to acquire the remaining 40% equity of Xiaoxiniu for RMB 500 million [3]. This transaction indicates that the company still has confidence in Xiaoxiniu’s future development prospects, and the PE multiple corresponding to the acquisition price is approximately 13.98x, which is significantly lower than the average valuation of comparable companies

-

Reasonable Valuation Premium: The acquisition price represents a 15.74% premium over the assessed value, but considering Xiaoxiniu’s channel advantages and brand value in the Qinghai-Tibet market, the premium range is reasonable

-

Synlait’s Ongoing Operational Difficulties: Synlait’s losses expanded in 2024, and the impairment risk of the North Island asset group may continue

-

Xiaoxiniu’s Unfulfilled Performance Commitment: The 93.32% completion rate means that profitability has not reached the expected level at the time of acquisition

-

Intensified Competition in the Dairy Industry: The entire industry is facing pressures such as imbalanced supply and demand of raw milk and high operating costs, which may suppress the company’s overall profitability

| Indicator | Value |

|---|---|

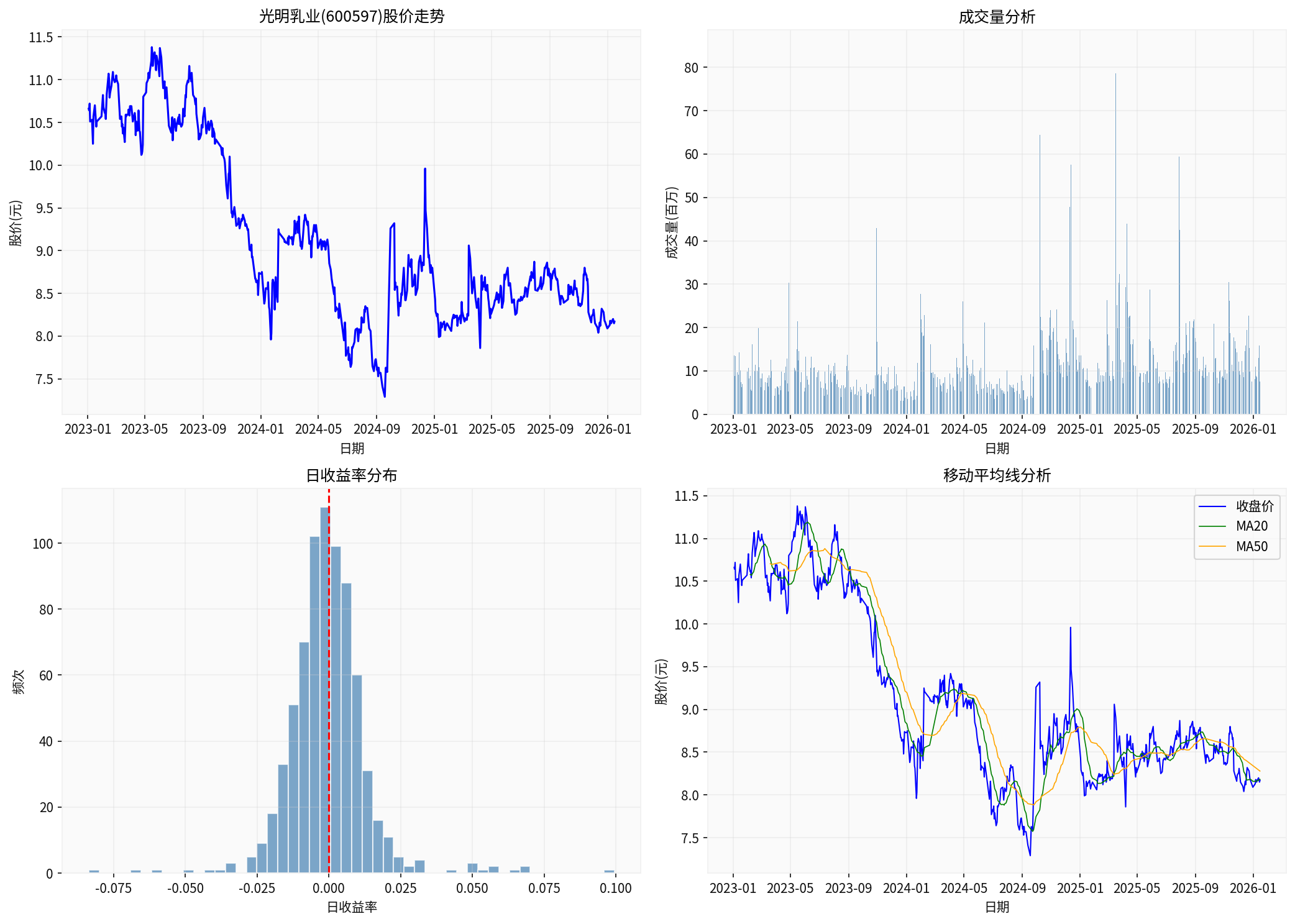

| 2024 Opening Price | RMB 8.73 |

| 2024 Closing Price | RMB 8.54 |

| Highest Price | RMB 10.18 |

| Lowest Price | RMB 7.23 |

| Annual Price Change | -2.18% |

| Annualized Volatility | 27.19% |

| Maximum Drawdown | -22.61% |

| Valuation Indicator | Bright Dairy | Industry Average | Evaluation |

|---|---|---|---|

| P/E (TTM) | 16.25x | 20-25x | Low |

| P/B | 1.19x | 2-3x | Low |

| EV/OCF | 13.66x | 15-20x | Reasonably Low |

From a valuation perspective, Bright Dairy’s current stock price has fully reflected the market’s concerns about the company’s goodwill impairment risk and performance pressure. Both P/E and P/B ratios are at historical low levels.

Based on the comprehensive assessment of the company by financial analysis tools [0]:

-

Liquidity Pressure: The current ratio of 0.86 and quick ratio of 0.58 indicate that the company faces relatively high short-term debt repayment pressure. According to the 2024 annual report, the company’s current liabilities exceed current assets by RMB 1.383 billion [1]

-

Weak Profitability: ROE of 7.18% and net profit margin of 2.88%, which are at the lower-mid level in the industry

-

Cash Flow Status: The latest quarterly data shows that the company can still maintain positive operating cash flow

- Recognized Impairment: ✓ Partially recognized

- Risk Exposure: Mainly Synlait’s North Island asset group and Xiaoxiniu-related assets

- Risk Evolution: Need to continuously monitor Synlait’s operational improvement and Xiaoxiniu’s integration effect

- Valuation is at a historical low, with a relatively high margin of safety

- The acquisition price of Xiaoxiniu’s remaining equity is reasonable

- The supply and demand inflection point of the dairy industry is expected to appear in 2025-2026

- Goodwill impairment risk has not been fully eliminated

- Fierce industry competition and sustained cost pressure

- Uncertainty about the recovery time of overseas business (Synlait)

-

Risk of Synlait’s Continuous Losses: If international dairy product prices remain depressed, Synlait may need to recognize further impairment

-

Xiaoxiniu Integration Risk: After acquiring the remaining 40% equity, how to achieve effective integration and improve profitability is a key challenge

-

Industry Cycle Risk: The dairy industry is greatly affected by the supply and demand of raw milk, and industry cycle fluctuations may affect the company’s performance

-

Liquidity Risk: The company’s current ratio is low, and attention should be paid to its capital management capability

Based on the above analysis, we believe that the goodwill impairment risk of Bright Dairy

- Synlait’s continuous losses and the impairment pressure of the North Island asset group remain the main risk points

- Although Xiaoxiniu has completed 93.32% of the performance commitment, its profitability has not reached the expected level at the time of acquisition

- The transaction price for the acquisition of Xiaoxiniu’s remaining 40% equity is reasonable, indicating the company’s confidence in the acquired assets

From a valuation perspective, the current stock price has fully reflected the market’s concerns about goodwill impairment and performance pressure. For investors with low risk appetite, it is recommended to make investment decisions after paying attention to the progress of Synlait’s business improvement and Xiaoxiniu’s integration effect; for investors with higher risk tolerance, the current valuation level may provide a certain margin of safety.

[0] Jinling API - Bright Dairy Company Overview and Financial Data

[1] 2024 Annual Report of Bright Dairy & Food Co., Ltd. (https://static.cninfo.com.cn/finalpage/2025-04-30/1223413933.PDF)

[3] Announcement of Bright Dairy & Food Co., Ltd. on the Acquisition of 40% Shares of Xiaoxiniu (https://stockmc.xueqiu.com/202511/600597_20251129_CFBM.pdf)

[4] Notes to 2024 Financial Statements of Bright Food (Group) Co., Ltd. (http://static.cninfo.com.cn/finalpage/2025-04-30/1223447581.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.