In-Depth Analysis of How Shengyi Technology's High-End Copper Clad Laminate Technological Advantages Convert to Market Competitiveness

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the above in-depth research and analysis, the following is a systematic report on

Shengyi Technology (600183.SH), founded in 1985, is the leading enterprise in China’s CCL industry. According to Prismark statistics, the company has ranked second globally in total rigid CCL sales for ten consecutive years from 2013 to 2023, with a global market share of approximately 14% [0][1]. The company’s main business covers the design, production and sales of CCLs, prepregs, and printed circuit boards (PCBs), with products widely used in high computing power, AI servers, 5G base stations, chip packaging, new energy vehicles and other fields [0].

- 2024 revenue is expected to reach RMB 20.388 billion, a year-on-year increase of 23%

- 2024 net profit attributable to shareholders is expected to reach RMB 1.744 billion, a year-on-year increase of 50%

- Achieved operating revenue of RMB 20.614 billion in the first three quarters of 2025, a year-on-year increase of 39.8%

- Net profit attributable to shareholders excluding non-recurring gains and losses reached RMB 2.379 billion, a year-on-year increase of 81.25% [2]

- 2016: Established Jiangsu Shengyi and began to engage in the high-frequency and high-speed CCL field

- 2017: Cooperated with Japan’s Chukoh Chemical Industries, Ltd. to introduce a complete set of PTFE high-frequency CCL production technologies, and took the lead in realizing the industrialization of high-frequency CCLs in China [1]

Core Technical Indicators: The polytetrafluoroethylene (PTFE)-based high-frequency CCL has a dielectric constant (Dk) <3.0 and a dielectric loss factor (Df) <0.002, reaching international advanced levels

Previously, the high-frequency CCL market was long-term monopolized by the US-based Rogers and Japanese manufacturers, with a market share of over 90%. Shengyi Technology’s breakthrough has broken this monopoly pattern and realized domestic substitution [1][3].

- Has formed a full product matrix of high-speed CCLs covering M6, M7, M8 and M9 series

- Full coverage of dielectric loss grades to meet different speed requirements

- Meets the strict insertion loss requirements of 800G and 1.6T switches

With the increasing requirements for computing power and bandwidth from AI chips such as NVIDIA’s GB300, the M6/M7 materials used in 400G switches can no longer meet the demand, requiring M8 or even M9 grade materials. Shengyi Technology’s technical reserves perfectly align with this upgrading trend [2].

- Ultra-low coefficient of thermal expansion (CTE) control technology

- High-reliability packaging materials

- Meets the demand for large-size chip packaging substrates

Entering the chip packaging field is a key step for the company to upgrade to high-end electronic materials, which can significantly increase product added value [1].

| Indicator | Shengyi Technology | Total of Other Major Domestic Peers |

|---|---|---|

| R&D Expenses | RMB 1.157 billion | < RMB 1.157 billion |

| R&D Expense Ratio | 5.7% | Industry average of about 4-5% |

The company’s R&D expenses have been higher than the total R&D expenses of domestic comparable companies for years, forming a significant technological barrier [1].

- Increased localization rate of high-frequency and high-speed CCLs

- Terminal customers (such as Huawei, ZTE) accelerating domestic certification

- Supply chain security needs driving accelerated domestic substitution

Shengyi Technology has become one of the world’s first-tier manufacturers in the high-frequency CCL field, with the core parameters of some products fully matching those of the US-based Rogers [1].

- The global AI server and data storage market size is expected to reach USD 396 billion in 2025

- The server and storage PCB market size is expected to reach USD 14.007 billion in 2025

- The compound annual growth rate (CAGR) of demand for high-frequency and high-speed CCLs exceeds 10% [2]

- Volume Growth: Growth in AI server shipments drives increased CCL usage

- Price Growth: The unit price of high-speed materials is higher than that of ordinary materials, and the increase in the proportion of high-end products drives the overall average price up

- Sold 76.2753 million square meters of CCLs, a year-on-year increase of 8.82%

- Achieved operating revenue of RMB 12.68 billion, a year-on-year increase of 31.68%

- The revenue growth rate is significantly higher than the sales volume growth rate, reflecting product structure optimization [2]

- PCB value of ordinary fuel vehicles: approximately RMB 500-800 per vehicle

- PCB value of new energy vehicles: RMB 3,000-4,000 per vehicle (Tesla Model 3)

- CCL usage: 1 ㎡ per ordinary vehicle → 5-8 ㎡ per new energy vehicle [1]

The company has deeply engaged in the automotive field for more than 20 years, with products covering Japanese, European and American brands as well as domestic new power carmakers. Automotive products account for approximately 25% of total sales volume, including a full range of products such as high-speed materials, millimeter wave materials, HDI, high Tg FR-4, and high thermal conductivity materials [1].

- 2024 CCL output reached 140 million square meters, a year-on-year increase of 19.40%

- Ranks second globally in rigid CCL production capacity

- High-speed boards can share production lines with ordinary boards, enabling flexible capacity conversion

Due to the high concentration of the CCL industry and the relatively scattered PCB industry, the company has strong cost pass-through capability. When the prices of raw materials (copper foil, resin, glass fiber cloth) rise, the company can pass on cost pressure through price increases, and even achieve gross margin improvement [3].

Shengyi Technology (Parent Company)

├── CCL and Prepreg Business (Global Second)

└── Shengyi Electronics (62.93% owned, PCB Business)

├── Top 100 Global PCB Enterprise

└── Has Entered AI Server Supply Chains such as Amazon's

- Realizes vertical integration of the industrial chain by laying out the PCB business through its subsidiary Shengyi Electronics

- Shengyi Electronics’ products have entered the supply chains of international brands such as Amazon, Microsoft, Cisco, Google, Intel, and NVIDIA

- Motherboard and accelerator card projects supporting AI have entered mass production stage [1][2]

| Project | Production Capacity Plan | Application Fields | Progress |

|---|---|---|---|

| Jiangxi Shengyi Phase II | 18 million ㎡ CCLs | Packaging, Automotive, Smart Terminals | Capped in December 2024 |

| Thailand Production Base | 12 million ㎡ CCLs | Automotive Electronics, AI Servers, Packaging Substrates | Groundbroken in December 2024 |

| Jiangsu Shengyi Phase II Flexible Materials | Flexible Board Capacity Expansion | Flexible Materials | Started construction in January 2025 |

- Closer to overseas customer needs, improving supply chain response speed

- Avoids trade barriers and reduces geopolitical risks

- Seizes opportunities in global AI computing power infrastructure construction [1]

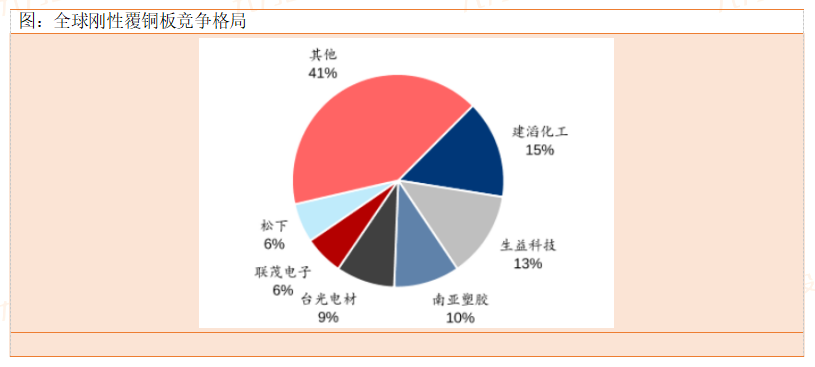

According to market data, in the 2024 global rigid CCL competitive landscape:

- Shengyi Technology’s market share is approximately 13-14%, firmly ranking second globally

- Compared with 2020 (12%), the market share has increased by approximately 2 percentage points

- Far ahead among domestic-funded enterprises [0][3]

According to the company’s official website statistics (data as of March 2025), radio frequency and microwave materials, high-speed products and IC packaging products, as high-end CCL materials, account for a total of 29.29% of the part numbers [1]. This proportion continues to increase, indicating continuous optimization of the company’s product structure.

- Product structure optimization, increase in the proportion of high-margin products

- Scale effects dilute fixed costs

- Smooth cost pass-through during price increase cycles

- R&D investment is converted into product premium capability

| Indicator | Shengyi Technology | US Rogers | Taiwanese Manufacturers |

|---|---|---|---|

| Dielectric Constant (Dk) | 2.8 | 2.7 | 3.0 |

| Dielectric Loss (Df) | 0.0015 | 0.0012 | 0.0020 |

| Thermal Stability | Excellent | Excellent | Good |

| Customer Certification Coverage | Wide | Wide | Medium |

| Patent Layout | Comprehensive | Leading | Developing |

- In 2025, the capital expenditure of the world’s eight major cloud service providers is expected to exceed USD 420 billion, a year-on-year increase of 61%

- It is expected to reach USD 520 billion in 2026, a year-on-year increase of 24%

- Directly drives demand for AI servers and upstream CCLs [2]

- The upgrading path of 400G → 800G → 1.6T switches is clear

- The requirements for CCL material grades continue to increase

- Demand for M8/M9 materials is expected to surge in 2025-2026

- The penetration rate of new energy vehicles in China is expected to reach 25-30% in 2025

- The PCB value per new energy vehicle continues to increase

- Millimeter wave radars, ADAS and other applications drive demand for high-frequency materials

- 2.5D/3D packaging technologies drive demand for packaging substrates

- Increased demand for ultra-low CTE materials

- Shengyi Technology’s layout in the IC packaging material field is expected to benefit

- Raw Material Price Fluctuation Risk: Fluctuations in the prices of raw materials such as copper and resin affect gross margin

- Technological Iteration Risk: If the technical route of new-generation materials changes, it may affect existing technological advantages

- Increased Competition Risk: Capacity expansion by peers may lead to oversupply in the industry

- Geopolitical Risk: Overseas business expansion may face trade barriers

Through three core strategies:

- Breaking Foreign Monopoly: Realized domestic substitution of high-frequency and high-speed CCLs, with technical indicators approaching world-leading levels

- Positioning in the AI Track: Fully laid out the M6-M9 series of high-speed materials, aligning with the surge in AI computing power demand

- Enjoying Volume and Price Growth: Product structure optimization drives gross margin improvement, and scale effects reduce costs

- Global Layout: Production capacity layouts in Thailand, Jiangxi and other regions seize opportunities from global demand growth

Looking ahead, with the acceleration of AI computing power infrastructure construction, the increase in intelligent penetration of new energy vehicles, and the company’s high-end breakthroughs in the IC packaging material field, Shengyi Technology is expected to continue to benefit from the growth in demand for high-end CCLs, and achieve a comprehensive transformation from “technological leadership” to “market leadership”.

[0] Jinling API Market Data (600183.SS)

[1] Guohai Securities - In-Depth Research Report: “Global CCL Leader, Upward Cycle & Growth Driven by AI Demand” (March 2025)

[2] Securities Market Weekly - “Booming Demand for High-End CCLs: Shengyi Technology, Nan Ya Plastics Material See Soaring Performance and Stock Prices” (December 2025)

[3] Xiangcai Securities - In-Depth Research Report on the CCL Industry (May 2022)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.