In-Depth Analysis of TSMC (TSM)'s Advanced Process Gross Margin and Profitability

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest financial data and market information, I will provide you with an in-depth analysis of the profitability and sustainability of TSMC’s 62.3% gross margin from advanced processes.

TSMC’s Q4 2025 earnings report, released on January 15, 2026, shows that the company achieved

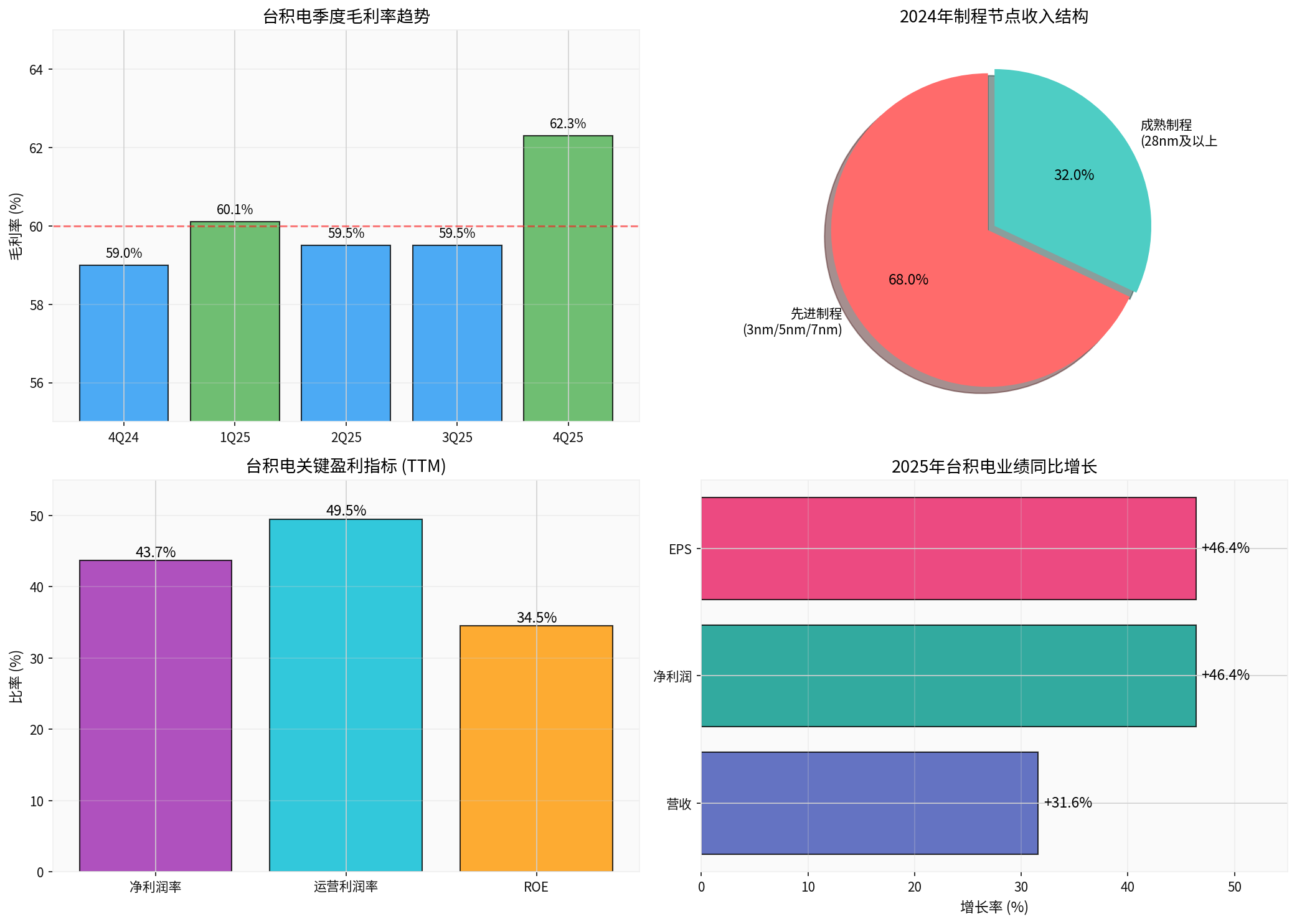

On a full-year basis, TSMC achieved a gross margin of 59.9% in 2025, an increase of 380 basis points from 2024’s 56.1%[1]. The company’s net profit reached NT$171.788 billion, growing 46.4% year-over-year; earnings per share (EPS) jumped from NT$45.25 in 2024 to NT$66.25, also recording a 46.4% increase[1]. The net profit margin rose from 40.5% in 2024 to 45.1% in 2025, demonstrating a strong trend of profitability expansion[1].

TSMC’s CFO clearly stated on the earnings call that the 280 basis point increase in Q4 gross margin was mainly driven by three factors:

TSMC’s technological leadership in advanced processes provides solid support for its high gross margin. According to the company’s disclosure,

Against the backdrop of explosive growth in AI chip demand, TSMC’s advanced packaging and advanced process capacities have maintained high utilization rates. The company confirmed in its earnings report that overall capacity utilization improved significantly in the fourth quarter, with demand for AI-related products in particular keeping 8-inch and 12-inch fabs running at full capacity. The improvement in capacity utilization directly dilutes fixed costs and enhances the profitability of each unit of product.

TSMC’s technological lead in semiconductor manufacturing is expanding. The company is the world’s only pure-play foundry to achieve mass production of the 3nm process, and R&D on the 2nm process is progressing smoothly, with risk production expected to start by the end of 2025. This

Leveraging its technological advantages and production scale, TSMC holds a dominant position in pricing negotiations with customers. The company has successfully achieved

Semiconductor manufacturing is a typical capital-intensive industry, and TSMC’s

- Achieve economies of scale in equipment procurement

- Dilute R&D costs

- Improve capacity utilization

- Accelerate the yield ramp-up curve

For 2026, TSMC’s management has provided

The Q1 2026 guidance is equally positive: revenue is expected to be between $34.6 billion and $35.8 billion, with gross margin projected to reach a new high of 63%-65%[2]. This guidance exceeds general market expectations, demonstrating the company’s full confidence in its own profitability.

CEO C.C. Wei emphasized on the earnings call:

TSMC plans to invest $52-56 billion in capital expenditure in 2026, with

TSMC’s production bases in Taiwan expose it to significant geopolitical risks. Intensified Sino-US tech competition may affect the company’s ability to access certain customers or technologies. The company is diversifying risks by building advanced process fabs in Arizona, US, but the new fabs require time for capacity ramp-up and have high initial costs, which may exert certain pressure on short-term profitability.

TSMC’s revenue is denominated in NT dollars while a high proportion of its costs are denominated in US dollars, so foreign exchange volatility has a direct impact on the company’s gross margin. The relatively favorable foreign exchange environment in Q4 2025 drove the gross margin increase[1]. However, the 2026 exchange rate trend is uncertain, which may affect the company’s profit expectations.

Samsung and Intel are increasing their investment in advanced processes to narrow the technological gap with TSMC. If competitors make breakthrough progress, it may challenge TSMC’s pricing power and market share. However, based on current technological progress, TSMC’s leading position will remain solid in the foreseeable future.

From a technical analysis perspective, TSMC’s stock price shows a

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Latest Closing Price | $346.23 | - |

| 20-Day Moving Average | $310.65 | Short-term moving average above long-term moving average |

| 50-Day Moving Average | $298.32 | Clear upward trend |

| 200-Day Moving Average | $245.90 | Long-term upward trend |

| RSI (14) | 79.02 | Entered overbought territory |

| MACD | 11.07 | Momentum indicator is positive |

| Beta Coefficient | 1.27 | Higher than market volatility |

TSMC’s current market capitalization is approximately $1.79 trillion, with core valuation metrics based on TTM data as follows[0]:

| Indicator | Value | Industry Comparison |

|---|---|---|

| Price-to-Earnings (P/E) | 27.62x | Semiconductor industry average is approximately 20-25x |

| Price-to-Book (P/B) | 8.77x | High among tech stocks |

| ROE | 34.52% | Significantly higher than industry average |

| Net Profit Margin | 43.70% | Leading level among global manufacturing industries |

According to the latest data, analysts have assigned a

- Solid Technological Leadership: 3nm process leads competitors by 1-2 generations, 2nm R&D progressing smoothly

- Structural Growth in AI Demand: Global AI infrastructure construction drives sustained strong demand for advanced chips

- Continuous Release of Scale Effects: Large-scale capital expenditure brings cost dilution effects

- Positive Management Guidance: 2026 gross margin target of 63%-65%, revenue growth of 30%

- Optimized Customer Structure: Stable orders from top tech firms, solid pricing power

- Persistent geopolitical uncertainties

- Foreign exchange volatility may affect short-term profit margins

- Risk of technical correction amid overbought conditions

[0] Jinling AI - TSMC Company Profile, Technical Analysis and Market Data

[1] TSMC Investor Relations, “4Q25 Management Report” (https://investor.tsmc.com/english/encrypt/files/encrypt_file/reports/2026-01/4Q25 Management Report.pdf)

[2] Yahoo Finance, “TSMC Q4 FY2025 Earnings Call Transcript” (https://finance.yahoo.com/quote/TSMC.BA/earnings/TSMC.BA-Q4-2025-earnings_call-399056.html)

[3] Investing.com, “TSMC Q4 2025 Slides: Revenue Exceeds Guidance as Advanced Nodes Drive Growth” (https://za.investing.com/news/company-news/tsmc-q4-2025-slides-revenue-exceeds-guidance-as-advanced-nodes-drive-growth-93CH-4063636)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.