In-depth Analysis of Investment Value of Intech Technology's RMB 30 Million Subsidiary Establishment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I will provide you with an in-depth investment analysis report on Intech Technology’s establishment of a subsidiary.

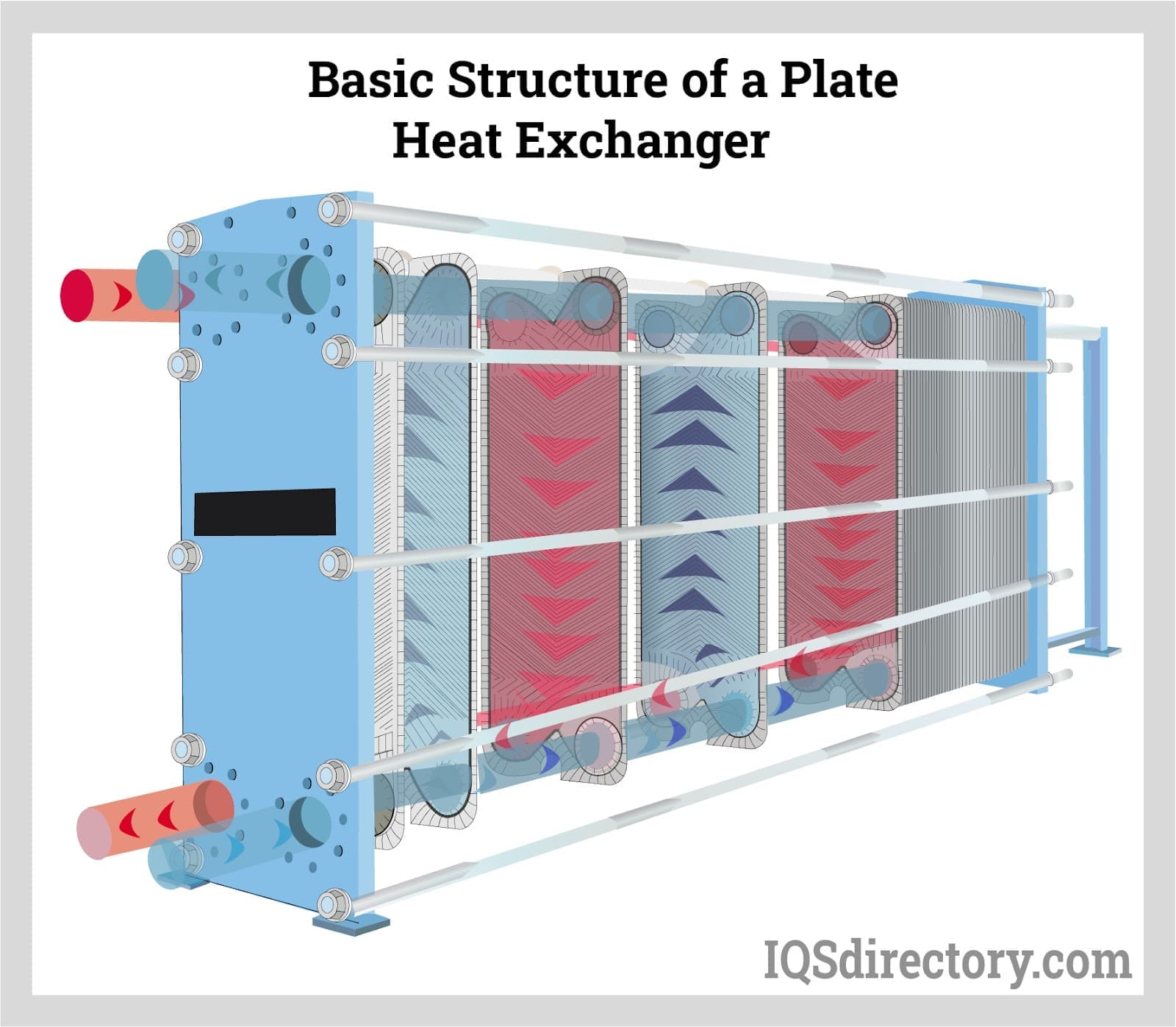

Intech Technology (Stock Code: 301399.SZ) is a national-level specialized and sophisticated “little giant” enterprise engaged in the R&D, production, and sales of high-efficiency heat exchangers[1]. The company’s main products include shell-and-tube heat exchangers, double-pipe heat exchangers, plate heat exchangers, falling film heat exchangers, evaporative condensers, liquid-cooled radiators, and distributors, which are widely used in heating, hot water, refrigeration, data centers, industrial and agricultural production, and other fields[2].

The company has high-quality customer resources and has established long-term stable cooperative relationships with well-known domestic and foreign manufacturers, including domestic leading enterprises such as Haier, Tianjia, Midea, and GREE, as well as American manufacturers like McQuay, York, Trane, and Carrier, and Japanese manufacturers such as Daikin, Hitachi, and Mitsubishi Heavy Industries[2].

According to data from the 2024 China Heat Pump Industry Development Yearbook, the total sales volume of the heat pump industry reached RMB 30.63 billion in 2024, a year-on-year decrease of 7.5%[2]. Although the domestic market is under short-term pressure, the International Energy Agency (IEA) predicts that global heat pump sales will grow from 38 million units in 2025 to 60 million units in 2030[2]. Meanwhile, the market size of data center temperature control is expected to increase from RMB 12.4 billion in 2022 to RMB 25.1 billion in 2025, with a compound annual growth rate of 26.5%[2].

| Indicator | 2024 | 2023 | YoY Change |

|---|---|---|---|

| Operating Revenue | RMB 525 million | RMB 567 million | -7.40% |

| Net Profit Attributable to Parent | RMB 59.43 million | RMB 101 million | -41.25% |

| Gross Profit Margin | 23.20% | - | -5.12ppt |

| Asset-Liability Ratio | 11.52% | - | - |

| Current Ratio | 10.14 | - | - |

The company’s performance declined significantly in 2024, mainly due to the following reasons:

- Industry Cycle Factors: The total sales volume of the heat pump industry decreased by 7.5% year-on-year, leading to market demand contraction[2]

- Cost-side Pressure: Rigid expenditures such as management fees and R&D expenses remain persistent

- Impact of Asset Impairment: Credit impairment losses and asset impairment losses totaled approximately RMB 12.17 million

It is worth noting that the company’s financial structure remains stable, with a current ratio as high as 10.14 and an asset-liability ratio of only 11.52%, demonstrating strong risk resistance and capital reserves[2].

According to the company announcement, Intech Technology plans to invest RMB 30 million of its own funds in Hangzhou to establish a wholly-owned subsidiary, Zhejiang Inruite Enterprise Management Co., Ltd.[1]. The company stated that this investment is based on strategic planning and future business development needs, aiming to seek new growth points, optimize industrial layout, and enhance comprehensive competitiveness[1].

Based on the operation status of the company’s existing subsidiaries and industry characteristics, the evaluation of the investment payback period is as follows:

| Subsidiary | Registered Capital | Establishment Date | Current Status | Contribution |

|---|---|---|---|---|

| Xinchang County Jingxin Precision | RMB 10 million | 2017 | Mature Operation | Net profit of RMB 16.89 million in 2024 |

| Zhejiang Intech Heat Exchange Equipment | RMB 20 million | 2024 | No Revenue Yet | No significant impact during the reporting period |

- Optimistic Scenario: If the subsidiary is positioned as an extension of existing businesses or a digital management platform, it is expected to break even in 18-24 months

- Neutral Scenario: If it involves new business sectors (such as data center liquid cooling, energy storage thermal management, etc.), results are expected to be seen in 36-48 months

- Conservative Scenario: If it only serves as a management service platform, investment returns will be reflected indirectly through cost savings and efficiency improvements

According to the announcement disclosure and the company’s strategic planning, the new subsidiary may involve the following profit models:

- Positioning: A unified management platform integrating the company’s R&D, production, and sales resources

- Profit Sources: Management fee allocation, service fee income

- Expected Contribution: Reduce management costs by 5%-10% and improve operational efficiency by 15%-20%

- Positioning: Expand into emerging sectors such as data center liquid cooling, energy storage thermal management, and new energy vehicle thermal management

- Profit Sources: Product sales revenue, technical service fees

- Expected Contribution: Referring to the company’s liquid-cooled radiator product matrix, the gross profit margin of the new business can reach 25%-30%

- Positioning: The main implementer of the company’s digital factory and intelligent manufacturing

- Profit Sources: Cost savings from internal settlement

- Expected Contribution: Improve production efficiency by 20%-30% and reduce defective product rate by more than 50%

- Policy Dividend Support: Under the carbon neutrality goal, heat pump technology, as a key path for clean energy heating, has clear long-term benefits[2]

- Broad Market Space: The data center temperature control market has a compound annual growth rate of 26.5%, providing incremental space for the company[2]

- High-Quality Customer Resources: Has established stable cooperation with global mainstream HVAC manufacturers, laying a foundation for new business expansion

- Sufficient Financial Support: The asset-liability ratio is only 11.52%, and the current ratio is 10.14; the RMB 30 million investment will not affect the company’s normal operations

- Existing Successful Precedent: The Jingxin Precision subsidiary operates well, contributing a net profit of RMB 16.89 million in 2024 with an ROE of approximately 13.9%

- Industry Cycle Risk: The heat pump industry’s sales volume decreased by 7.5% in 2024, and short-term demand is still waiting to recover[2]

- Performance Fluctuation Risk: Net profit decreased by 41.25% year-on-year in 2024, with significant performance fluctuations[2]

- Uncertainty of New Business: The announcement does not clarify the specific business direction of the subsidiary, and the investment target is still unclear

- Risk of Intensified Competition: The heat exchanger industry is highly competitive, and the effect of digital transformation investment remains to be verified

| Indicator | 2024 (Actual) | 2025 (Forecast) | 2026 (Forecast) |

|---|---|---|---|

| Operating Revenue | RMB 525 million | RMB 550 million | RMB 605 million |

| Net Profit Attributable to Parent | RMB 59 million | RMB 65 million | RMB 78 million |

| Net Profit Margin | 11.3% | 11.8% | 12.9% |

| ROE | 4.5% | 5.0% | 6.0% |

Intech Technology’s establishment of a wholly-owned subsidiary with RMB 30 million is a

| Evaluation Dimension | Score (5-point Scale) | Explanation |

|---|---|---|

| Strategic Rationality | 4.0 | Aligns with the company’s strategic goal of “seeking new growth points” |

| Capital Safety | 4.5 | Investment with own funds, no impact on liquidity |

| Expected Return | 3.0 | Long payback period, limited short-term performance contribution |

| Industry Prospects | 3.5 | Long-term positive, short-term pressure |

| Execution Certainty | 3.5 | Specific business direction not clarified in the announcement |

Investors need to pay attention to the following risks:

- Risk of continued downturn in the heat pump industry’s prosperity

- Risk of slower-than-expected business progress of the new subsidiary

- Risk of raw material price fluctuations

- Risk of high customer concentration

[1] Sina Finance - Intech Technology: Plans to Establish a Wholly-Owned Subsidiary with RMB 30 Million (https://finance.sina.com.cn/jjxw/2026-01-15/doc-inhhkffx3389807.shtml)

[2] Intech Technology 2024 Annual Report (https://static.cninfo.com.cn/finalpage/2025-04-29/1223366424.pdf)

[3] 36Kr - Intech Technology: Plans to Establish a Wholly-Owned Subsidiary with RMB 30 Million (https://www.36kr.com/newsflashes/3640207210384518)

[4] Qianzhan Yan - Financial Statement Analysis of Intech Technology (https://stock.qianzhan.com/hs/caiwufenxi_301399.sz.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.