Analysis of the Impact of U.S. Arms Sales to Taiwan on Defense Contractors

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have now collected sufficient data, so let me conduct a systematic analysis for you.

According to the latest information, the U.S. government approved multiple arms sales agreements to Taiwan between late 2025 and early 2026 [1]:

| Arms Sales Item | Amount | Main Content | Contractor |

|---|---|---|---|

| Infrared Search and Track System Contract | $328.5 million |

55 Legion Enhanced Sensor Pods and supporting facilities | Lockheed Martin |

| Large-Scale Arms Sales Program | Over $11 billion |

420 tactical ballistic missiles, 82 HIMARS rocket launchers, anti-armor missiles | Multiple Contractors |

| Fighter Jet Components | $330 million |

Spare parts supply for F-16 and other fighter jets | Raytheon Technologies, Northrop Grumman, etc. |

- F-35 Program: Delivered 191 aircraft in 2025, a record high (only 110 in 2024) [4]

- Received a $3.63 billionmodification to the Navy’s F-35 logistics support contract in December 2025 [5]

- Third-quarter order backlog exceeded $170 billion, reflecting long-term visibility [6]

- As a core supplier of the HIMARS system and missile defense systems, it has benefited from multiple arms sales agreements

- Stock price has risen by approximately 61%since early 2025, with outstanding performance [7]

| Company | Ticker | Current Stock Price | Daily Gain | 52-Week Gain | P/E | Market Capitalization |

|---|---|---|---|---|---|---|

| Lockheed Martin | LMT | $572.70 |

+2.58% | +18.21% | 31.85x | $134 billion |

| Raytheon Technologies | RTX | $198.84 |

+2.45% | +61.0% | 40.83x | $266.2 billion |

| Northrop Grumman | NOC | $653.14 |

+4.42% | +52.8% | 23.52x | $93.2 billion |

The defense sector continued its strong performance in early 2026 [8]:

- L3HarrisandHuntington Ingalls: Rose11%in the first 5 trading days of the year

- Northrop Grumman,Lockheed Martin: Rose over4%

- AeroVironment(UAVs): Surged over40%

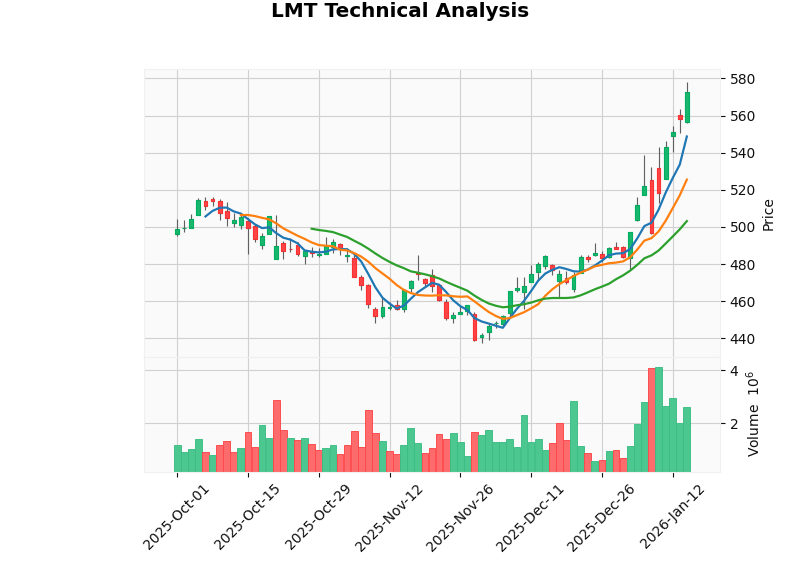

- Trend: In an uptrend (breakout pattern, to be confirmed)

- Key Technical Levels: Resistance at $578.02, next target at $594.28; Support at $525.48

- Beta: 0.24 (low correlation with the market, strong anti-drop capability)

- RSI: In the overbought zone, with risk of short-term correction

- Trend: In an uptrend (breakout signal, buy signal triggered on January 13)

- Key Technical Levels: Resistance at $198.87, next target at $203.27; Support at $189.75

- Beta: 0.44 (moderate correlation with the market)

The Chinese Ministry of Foreign Affairs announced countermeasures against

- Northrop Grumman Systems Corporation

- Boeing St. Louis Branch

- L3Harris Maritime Services Company

- Multiple UAV and technology companies (Red Cat Holdings, Teal Drones, etc.)

- Freeze all movable property, real estate, and other types of assets in China

- Prohibit organizations and individuals in China from conducting transactions or cooperation with them

- Executives have their assets frozen and are prohibited from entering Chinese territory (including Hong Kong and Macau)

- Each F-35 requires 400 kgof rare earth materials

- China has absolute dominance in rare earth deep processing and precision ceramics

- China’s rare earth exports to the U.S. decreased by 11%month-on-month

- Reconstructing a complete rare earth supply chain independent of China will take at least 8 years

- Raytheon Technologies has operated in China for 80 years, with aircraft engine and elevator businesses in 11 cities

- Lockheed Martin once coveted market shares in the nuclear power and aviation sectors

- The U.S. Industry Federation estimates that the sanctions may cause $29 billion to $56.2 billionin losses

According to an MUFG research report, defense stocks have significantly outperformed the broader market amid geopolitical tensions [11]:

| Time Period | Defense ETF Performance | S&P 500 Performance | Excess Return |

|---|---|---|---|

| 2025 to date | +24% to +27% | +4% | +20% to +23% |

- Strong Anti-Drop Capability: LMT’s Beta is only 0.24, RTX’s Beta is only 0.44 [0]

- Counter-Cyclical: Attracts capital inflows during periods of rising geopolitical risks

- Policy-Driven: High certainty in defense budget growth

- European defense stocks have been re-rated, with obvious valuation premiums

- U.S. peers are relatively undervalued: Lockheed Martin P/E 31.85x,RTX P/E 40.83x,General Dynamics Forward P/E 23.0x

- U.S. military-industrial stocks may have catch-up growth opportunities

| Scenario | Intrinsic Value | vs. Current Stock Price |

|---|---|---|

| Conservative Scenario | $732.90 | +28.0% |

| Base Scenario | $1,194.31 | +108.5% |

| Optimistic Scenario | $3,106.14 | +442.4% |

| Probability-Weighted | $1,677.78 | +193.0% |

- WACC: 5.9% (risk-free rate +4.5%, market risk premium +7.0%)

- Terminal growth rate assumption: 2.0%-3.0%

- Cost sensitivity: A 1% increase in costs may reduce valuation by approximately 8-10%

✅

✅

✅

✅

⚠️

⚠️

⚠️

⚠️

| Company | Consensus Rating | Target Price | vs. Current Price |

|---|---|---|---|

| LMT | Buy (54%) | $543.00 | -5.2% |

| RTX | Neutral-Buy | $200.00 | +0.6% |

| NOC | Buy | - | - |

The impact of U.S. arms sales to Taiwan on defense contractors is

- Significant Short-Term Order Growth: The $11 billion arms sales agreement directly increases order backlogs and drives revenue growth

- Strong Stock Performance: The defense sector has significantly outperformed the broader market year-to-date, with LMT, RTX, and NOC hitting all-time highs

- Geopolitical Risk Premium Emerges: The implicit geopolitical risk premium in the valuation system has driven excess returns for defense stocks

- Limited Risk from China’s Countermeasures: Although the sanction measures are severe, the Chinese business shares of major defense contractors are small, so the impact is controllable

- Supply Chain Resilience is Key: Dependence on rare earths is a long-term potential risk, but it is difficult to replace in the short term

[1] Voice of America - “Pentagon Awards Lockheed Martin a Contract Worth Nearly $330 Million for Arms Sales to Taiwan” (https://www.voachinese.com/a/pentagon-awarded-lockheed-martin-a-contract-worth-nearly-330-million-for-arms-sales-to-taiwan-20260101/8098024.html)

[2] European Machine Tool Network - “Lockheed Martin’s Production Line Suddenly Stopped” (https://ouzhoujc.com/news-detail/288/288568.html)

[3] First Logistics Network - “Behind Trump’s Largest Arms Sales to Taiwan: U.S. Military-Industrial Supply Chain” (http://www.cn156.com/cms/qianyanguancha/119723.html)

[4] Breaking Defense - “Lockheed boasts record 191 F-35 deliveries in 2025” (https://breakingdefense.com/2026/01/lockheed-boasts-record-191-f-35-deliveries-in-2025/)

[5] GovCon Wire - “Lockheed Books $3.6B Navy F-35 Logistics Contract” (https://www.govconwire.com/articles/lockheed-navy-f-35-logistics-contract-modification)

[6] Gainify - “Top 7 Defense Stocks to Consider in 2026” (https://www.gainify.io/blog/defense-stocks)

[7] Chronicle Journal - “RTX Deep Dive: Navigating the $1.5 Trillion Defense Frontier” (http://markets.chroniclejournal.com/chroniclejournal/article/predictstreet-2026-1-8-rtx-deep-dive-navigating-the-15-trillion-defense-frontier-and-the-buyback-ultimatum)

[8] Yahoo Finance - “Defense Stock Rally Extends as Geopolitics Stays Tense” (https://finance.yahoo.com/news/defense-stocks-soar-again-trump-122326044.html)

[9] Chinese Ministry of Foreign Affairs - “Decision on Taking Countermeasures Against U.S. Military-Industrial Related Enterprises and Senior Executives” (https://www.mfa.gov.cn/wjbxw_new/202512/t20251226_11787617.shtml)

[10] Chinese Embassy in the U.S. - “Decision on Taking Countermeasures Against U.S. Military-Industrial Related Enterprises and Senior Executives” (https://us.china-embassy.gov.cn/zmgx_1/zxxx/202601/t20250103_11797061.htm)

[11] MUFG Americas - “Geopolitical Risk Premium” (https://www.mufgamericas.com/sites/default/files/document/2025-06/Geopolitical_Risk_Premium_Final.pdf)

[12] AInvest - “China’s Sanctions on U.S. Defense Firms and Implications for Boeing” (https://www.ainvest.com/news/china-sanctions-defense-firms-implications-boeing-ba-geopolitical-risk-assessment-stock-valuation-analysis-2512/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.