Analysis of the Impact of Upstream Capital Expenditure Cycles on Orders and Performance Growth of A-share Oil Service Enterprises

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected data and analysis, I now present a systematic and comprehensive analysis report for you.

2025 saw an overall volatile downward trend in international oil prices. According to market data, Brent crude fell from nearly $80/barrel at the beginning of the year to about $60/barrel by the end of the year, with the annual fluctuation range mainly between $60-$80/barrel [0]. A number of authoritative institutions have made forecasts on the 2026 oil price trend:

| Institution | 2026 Brent Crude Average Price Forecast (USD/barrel) | Core Logic |

|---|---|---|

| Goldman Sachs | 56 | Surging production leads to 2 million barrels per day supply surplus |

| JPMorgan Chase | 58 | Supply growth rate is 3 times the demand growth rate |

| Citigroup | 62 | Fluctuates within the range of $55-$65 |

| Sinopec Economic Research Institute | 60-65 | Demand increment of 900,000 barrels per day vs supply increment of 1.4 million barrels per day |

| Beijing Institute of Technology Research | 53-63 | Supply and demand fundamentals remain loose |

Overall, the 2026 international oil price center is expected to operate in the range of $53-$63/barrel. Although it will decline compared with 2025, it will still remain above the break-even line of the oil service industry, providing certain support for upstream capital expenditure [1].

According to industry research reports, global upstream capital expenditure for 2025-2026 presents the following characteristics:

- Overall Scale: The global oil and gas exploration market is approximately $1.02 trillion, accounting for 48.6% of the total scale of the oilfield industry

- Increment Sources: North American shale oil, Brazil’s pre-salt oilfields, and Guyana’s waters have become core increment sources, contributing a total increment of approximately 1.5 million barrels per day

- Investment Structure: Deepwater and ultra-deepwater projects have become the core of investment, with newly proven global offshore oil and gas reserves accounting for 79% in 2025

- Chinese Market: Oil and gas exploration in China’s marine facies formations has become a regional highlight, with an expected average annual investment of RMB 80-100 billion from 2026 to 2030 [2]

The capital expenditure of China’s three major oil companies maintains a steady growth trend, especially with continuous efforts in offshore oil and gas development, providing stable demand support for domestic oil service enterprises.

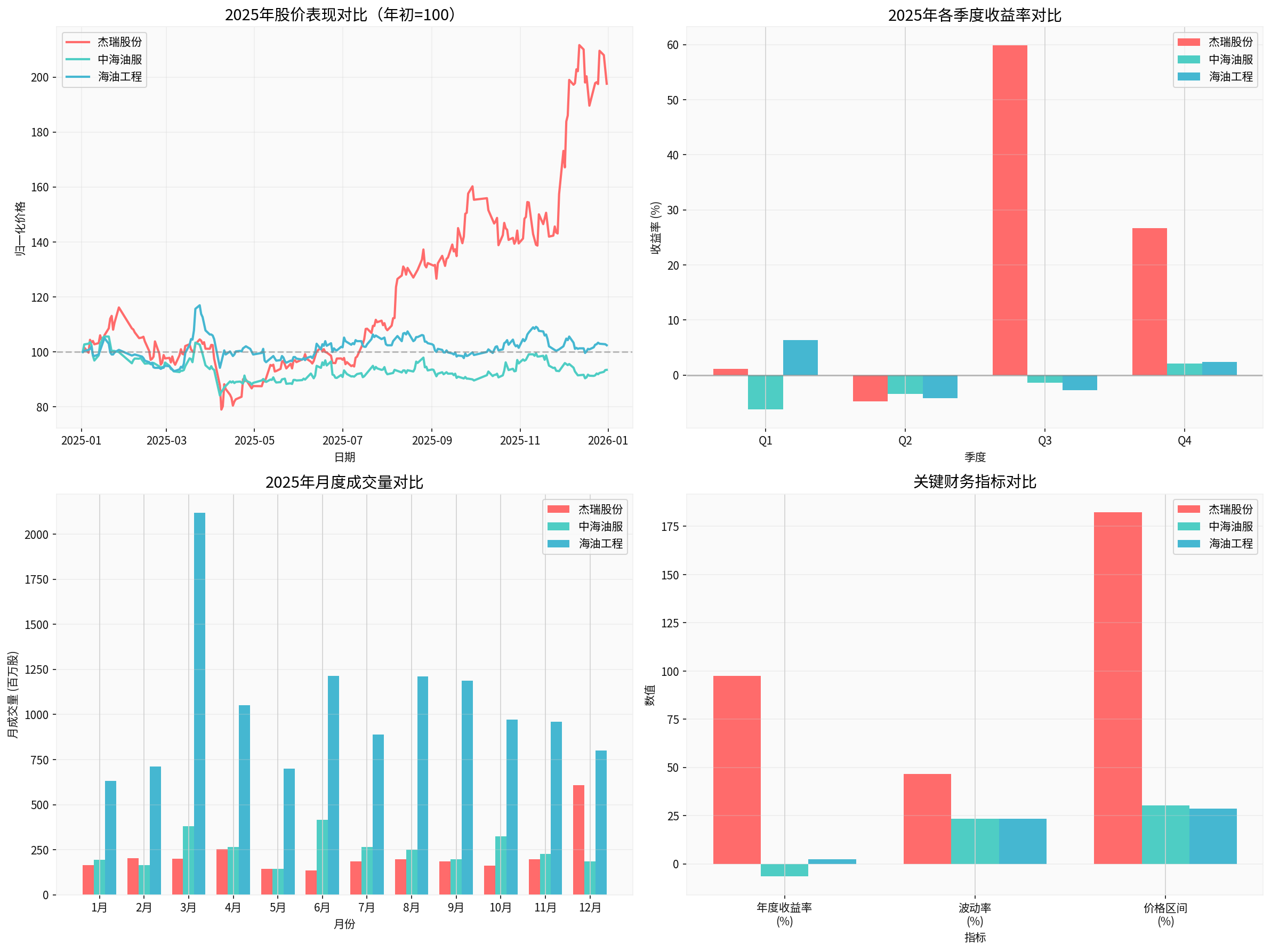

Based on the latest transaction data [0], the 2025 performance of major A-share oil service enterprises shows obvious differentiation:

| Enterprise | Beginning-of-Year Price (RMB) | End-of-Year Price (RMB) | Annual Return Rate | Volatility | Price Range |

|---|---|---|---|---|---|

Jereh Co., Ltd. |

35.85 | 70.83 | +97.57% |

46.71% | 182.39% |

Offshore Oil Engineering Co., Ltd. |

5.36 | 5.49 | +2.43% | 23.40% | 28.83% |

China Oilfield Services Limited |

15.02 | 14.04 | -6.52% |

23.39% | 30.38% |

- Jereh Co., Ltd.performed the most impressively, with an annual return rate nearly doubling, achieving increases of 59.92% and 26.71% in Q3 and Q4 respectively

- Offshore Oil Engineering Co., Ltd. and China Oilfield Services Limited performed relatively flat, with returns basically unchanged or slightly declining

- In terms of volatility, Jereh Co., Ltd. is significantly higher than the other two enterprises, reflecting its high growth and high elasticity characteristics

From the perspective of quarterly performance, the three enterprises show completely different trend rhythms:

| Quarter | Jereh Co., Ltd. | China Oilfield Services Limited | Offshore Oil Engineering Co., Ltd. |

|---|---|---|---|

| Q1 | +1.14% | -6.26% | +6.34% |

| Q2 | -4.81% | -3.37% | -4.21% |

| Q3 | +59.92% |

-1.39% | -2.75% |

| Q4 | +26.71% |

+2.11% | +2.43% |

Jereh Co., Ltd. saw explosive growth in the second half of the year, mainly benefiting from breakthroughs in AI data center gas turbine orders. Thematic investment opportunities significantly boosted the company’s valuation.

According to public information [3], Jereh Co., Ltd. has excellent order book performance in 2025:

- Natural Gas Business: In the first half of 2025, revenue from natural gas-related businesses surged 112.69% YoY, with new orders increasing by 43.28%

- Overseas Business: In the first half of the year, overseas revenue reached RMB 3.295 billion, up 38.38% YoY, accounting for 47.75% of total revenue

- Order Book: In the first half of 2025, the stock of unexecuted orders reached RMB 12.386 billion, up 34.76% YoY, sufficient to support revenue growth for the next 18-24 months

- Contract Liabilities: As of the end of Q3, contract liabilities were RMB 1.654 billion, up 10.67% YoY

- USD 920 million wellsite digital transformation EPC project for ADNOC Onshore in the UAE

- USD 316 million natural gas booster station project for Bahrain National Oil Company

- General contracting project for onshore natural gas receiving terminal in Brunei

According to research reports [4], oil service enterprises under CNOOC Group benefit from the parent company’s continuous high capital expenditure:

- China Oilfield Services Limited: As a giant in the entire oil service industry chain, its technical services continue to expand the market. High-value contracts have been gradually fulfilled since 2024, entering the performance realization period

- Offshore Oil Engineering Co., Ltd.: As an offshore oil engineering general contractor, the prospect of high-value overseas contracts is promising

- CNOOC Energy Technology & Services Limited: Focusing on services in the oil and gas production stage, it continues to benefit from the increase in reserves and production of China’s offshore oil and gas

CNOOC adheres to both oil and gas development, maintains high capital expenditure, and its net oil and gas production is expected to maintain high growth, providing a stable business source for its subordinate oil service enterprises.

According to industry research [1], the impact of upstream capital expenditure cycle expansion on different sub-sectors varies significantly:

| Sub-sector | Prosperity | Core Driver | Benefiting Enterprises |

|---|---|---|---|

Offshore Oil Service |

High Prosperity | Growth in global offshore capital expenditure, increase in daily rates of drilling platforms | China Oilfield Services Limited, Offshore Oil Engineering Co., Ltd. |

Onshore Oil Service |

Under Pressure | Slowdown in domestic shale oil and gas development, intensified competition | Jereh Co., Ltd. (in transition) |

Natural Gas Engineering |

Rapid Growth | Demand for natural gas clean transformation, full industry chain layout | Jereh Co., Ltd. |

Equipment Manufacturing |

Structural Opportunities | Replacement of electric-driven fracturing equipment in North America, power supply for AI data centers | Jereh Co., Ltd. |

The outstanding performance of Jereh Co., Ltd. in 2025 lies in its successful breakthrough in business boundaries:

-

AI Data Center Gas Turbine Business:

- Since November 2025, the company has successively won gas turbine generator set orders from leading US AI giants

- Each single contract is over USD 100 million, providing a total of more than 200MW high-power generator sets

- The subsequent potential demand reaches 1-2GW, and it is expected to continue to obtain order increments

-

Steady Growth of Traditional Oil and Gas Business:

- The domestic market share of high-end equipment (cementing equipment, fracturing equipment) exceeds 50%

- Breakthrough in the North American electric-driven fracturing equipment market

- Continuous implementation of EPC projects in the Middle East

Based on the current market environment, the impact of upstream capital expenditure cycles on A-share oil service enterprises in 2026 will present the following characteristics:

- CNOOC Group’s continuous high capital expenditure supports orders of Offshore Oil Engineering Co., Ltd. and China Oilfield Services Limited

- Accelerated global offshore oil and gas development, with an average annual growth of 6.2% in capital expenditure for deepwater projects

- The natural gas business remains prosperous, and clean energy transformation provides incremental demand

- Breakthroughs in overseas markets by some oil service enterprises bring new growth points

- The downward shift of the international oil price center may suppress the capital expenditure willingness of some oil and gas companies

- Domestic shale oil and gas development is affected by policy factors, with limited increments

- Intensified competition in the onshore oil service market puts pressure on profit margins

| Enterprise Type | 2026 Outlook | Recommendation Logic |

|---|---|---|

Offshore Oil Service Leader |

Relatively Optimistic | Benefiting from CNOOC’s capital expenditure and growth of global offshore projects |

Equipment + Service Integration |

Cautiously Optimistic | Sufficient order reserves, but need to pay attention to changes in gross profit margin |

Pure Onshore Oil Service |

Under Pressure | Limited domestic increments, need to rely on overseas market expansion |

Cross-border Transformation Enterprise |

Opportunity to Watch | If successfully entering emerging fields, valuation may be enhanced |

- Oil Price Fluctuation Risk: If oil prices fall below $50/barrel in 2026, it may impact the overall prosperity of the oil service industry

- Risk of Capital Expenditure Falling Short of Expectations: If oil and gas companies reduce capital expenditure due to low oil prices, it will directly affect the orders of oil service enterprises

- Geopolitical Risk: Geopolitical events in the Middle East, Russia-Ukraine and other regions may cause short-term disturbances to oil prices and capital expenditure

- Exchange Rate Risk: Enterprises with a high proportion of overseas businesses are exposed to exchange rate fluctuations

Based on the above analysis, the impact of upstream capital expenditure cycle expansion on orders and performance growth of A-share oil service enterprises presents the characteristic of

-

Overall impact is limited but differentiation is obvious: Although international oil prices remain at a relatively high level, the downward trend of the oil price center in 2025 limits the expansion of upstream capital expenditure, resulting in limited overall driving effect on the oil service industry.

-

Offshore oil service enterprises relatively benefit: Benefiting from accelerated global offshore oil and gas development and CNOOC’s continuous high capital expenditure, offshore oil service enterprises have relatively stable orders and performance.

-

Cross-border transformation enterprises perform impressively: Jereh Co., Ltd. successfully entered the AI data center gas turbine market, achieving explosive growth in orders and performance, with an annual stock price increase nearly doubling, verifying the importance of business boundary expansion.

-

Order visibility is a key variable: Enterprises with sufficient order books (such as Jereh Co., Ltd.'s RMB 12.386 billion unexecuted orders) have higher certainty of revenue growth in the next 18-24 months.

Looking ahead to 2026, it is recommended to focus on oil service enterprises with the following characteristics:

[0] Jiemian News - Global crude oil prices will be below $65 in 2026

[3] Sina Finance - Research Report: In-depth Analysis of Jereh Co., Ltd.

[4] Everbright Securities - Petrochemical Industry Weekly Report: CNOOC Group

[5] Investing.com - Piper Sandler expects the oilfield service industry to see strong growth in 2026

[6] Beijing Institute of Technology - 2026 Energy Economy Forecast and Outlook Research Report

[7] Gilin AI - 2025 Annual Transaction Data of A-share Oil Service Enterprises

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.