Analysis of the Impact of SK hynix's HBM Chip Capacity Expansion on the Global Memory Chip Market

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest collected market data and research materials, I will provide you with an in-depth analysis of the impact of SK hynix’s HBM chip capacity expansion.

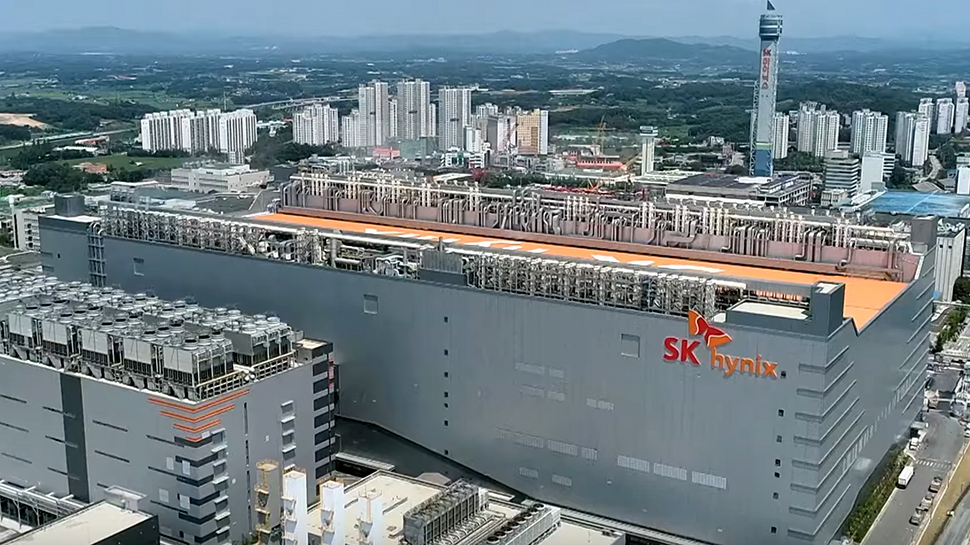

SK hynix has recently announced several major capacity expansion initiatives aimed at solidifying its leading position in the High Bandwidth Memory (HBM) sector:

| Project | Investment Scale | Location | Production Launch Time | Remarks |

|---|---|---|---|---|

Yongin New Plant |

- | Yongin, South Korea | Put into production 3 months ahead of schedule | Proactively address AI chip demand |

M15X Plant |

20 trillion KRW | Cheongju, South Korea | Under deployment | Convert next-gen DRAM production line to HBM production |

P&T7 Advanced Packaging Plant |

19 trillion KRW (approx. USD 13 billion) | Cheongju, South Korea | Construction starts in April 2026, full-scale production in 2028 | Advanced packaging and testing facilities |

Indiana, U.S. Plant |

- | West Lafayette | In operation | Overseas advanced packaging hub |

At the 2026 International Consumer Electronics Show (CES 2026), SK hynix showcased the core technical specifications of its latest-generation HBM4 chips:

- Stack Layers: 16-layer stack structure

- Single Chip Capacity: 48GB

- Bandwidth Performance: Over 2TB/s

- Manufacturing Process: 12nm process control logic developed in partnership with TSMC

- Mass Production Timing: Mass production expected to start in Q3 2026

The current global memory chip market is experiencing its worst supply-demand imbalance since 2024, with the following fundamental causes:

-

AI-driven Demand Surge: The rapid expansion of generative AI services has triggered unprecedented demand for specialized memory such as HBM; a single AI server requires 8-10 times more DRAM than a traditional server

-

Capacity Transfer Effect: The three major memory manufacturers (Samsung, SK hynix, Micron) have shifted advanced process capacity from traditional DRAM to high-margin HBM products, leading to a severe contraction in general-purpose memory supply

-

Manufacturing Efficiency Gap: Each GB of HBM capacity requires approximately 3 times the wafer capacity of standard DDR5, further exacerbating supply pressure

-

High Supply Chain Concentration: Over 90% of the global memory market is controlled by Samsung, SK hynix, and Micron, resulting in limited supply flexibility

| Time Period | DRAM Supply-Demand Gap (%) | NAND Supply-Demand Gap (%) | Notes |

|---|---|---|---|

| 2025 Q1 | -8% | -5% | Shortage begins to emerge |

| 2025 Q2 | -12% | -8% | Gap widens |

| 2025 Q3 | -15% | -12% | AI demand accelerates |

| 2025 Q4 | -18% | -15% | Capacity tightens |

2026 Q1 |

-22% |

-18% |

Expected peak |

| 2026 Q2 | -20% | -15% | Capacity gradually released |

| 2026 Q3 | -15% | -12% | Supply and demand tend to balance |

| 2026 Q4 | -10% | -8% | Gap narrows |

Negative values indicate supply shortage; Q1 2026 is expected to be the peak period of supply-demand imbalance

| Indicator | 2026 Forecast | YoY Change |

|---|---|---|

| DRAM Bit Supply Growth Rate | +15%~20% | Capacity expansion constrained |

| DRAM Bit Demand Growth Rate | +20%~25% | Strong growth driven by AI |

| NAND Bit Supply Growth Rate | +13%~18% | Enterprise SSD prioritized |

| NAND Bit Demand Growth Rate | +18%~23% | Data center demand |

| DRAM Consumption Growth Rate in Server Sector | +40%~50% | Driven by AI servers |

- 2026 Full-Year Average Price Growth: Morgan Stanley forecasts a 62% increase, Citigroup forecasts an 88% increase

- Q1 2026 Price Growth: Samsung and SK hynix plan a 60%-70% price hike

- DDR5 RDIMM Price: Expected to rise by over 40%

- Long-term Trend: Prices are expected to peak in 2026 and gradually decline in 2027-2028

- 2026 Full-Year Average Price Growth: Morgan Stanley forecasts a 75% increase, Citigroup forecasts a 74% increase

- Q1 2026 Price Growth: Expected to reach 33%-38%

- 512GB TLC Flash: Most significant price increase due to decommissioning of old capacity

- HBM3E: Surging demand in the Chinese market has brought nearly USD 3 billion in incremental demand, with prices remaining firm

- HBM4: Prices are expected to remain high in the initial mass production phase in Q3 2026

- Overall Trend: HBM supply will remain tight in 2026-2027

| Product Type | Price Growth Since September 2025 | Notes |

|---|---|---|

| DDR5 Memory Chips | Over 300% | Spot market |

| DDR4 Memory Chips | 158% | Spot market |

| Server DDR5 256GB | Exceeds RMB 50,000 | Some products approach RMB 60,000 |

| DDR5 Retail Price | Doubled | Some products |

| Year | DRAM Price Index | NAND Price Index | Notes |

|---|---|---|---|

| 2024 | 150 | 130 | Price hikes start |

| 2025 | 280 | 220 | Accelerated price growth |

2026 |

450 |

350 |

Expected peak |

| 2027 | 380 | 300 | Slight decline |

| 2028 | 320 | 260 | Continuous adjustment |

| 2029 | 290 | 240 | Tend to stabilize |

| 2030 | 270 | 220 | Return to rational levels |

| Manufacturer | 2024 | 2025 | 2026 Forecast | Competitive Advantage |

|---|---|---|---|---|

SK hynix |

52% | 50% | 48% | Leading HBM4 technology, key supplier to NVIDIA |

Samsung Electronics |

35% | 36% | 38% | Revival momentum, progress in NVIDIA certification for HBM4 |

Micron Technology |

13% | 14% | 14% | Aggressive capacity expansion, target 15,000 wafers of HBM4 capacity |

- Invest USD 13 billion to build the P&T7 advanced packaging plant

- Collaborate with TSMC to develop customized HBM4

- Plan to mass-produce 16-layer HBM4 in Q3 2026

- Target to maintain leadership in HBM3E while building an HBM4 ecosystem in 2026

- Close to reaching an HBM4 supply agreement with NVIDIA, targeting a supply share of over 30% in 2026

- Has passed certification in Google TPU’s SiP testing

- Accelerate efforts to narrow the technological gap in HBM3E

- HBM4 capacity is fully booked through the end of 2026

- Target to achieve 15,000 wafers of HBM4 capacity by the end of 2026

- Successfully obtained NVIDIA’s HBM4 specification certification

-

Surge in Semiconductor Equipment Demand:

- Orders for TC bonders (thermocompression bonding) have increased, with a unit price of approximately 3 billion KRW per unit

- SK hynix procured equipment worth 9.7 billion KRW from Hanmi Semiconductor

- Equipment manufacturers such as ASML and Applied Materials benefit from capacity expansion

-

Tight Supply of Key Materials:

- Increased demand for high-purity metal sputtering targets

- Material companies such as Jiangfeng Electronics are building plants in South Korea to meet demand

-

Tight Advanced Process Capacity:

- Advanced processes at 7nm and below are prioritized for AI chips and HBM

- Capacity for traditional consumer electronics chips is constrained

-

Demand for Packaging Technology Upgrade:

- Advanced packaging has become a strategic priority

- Advanced packaging capacity such as TSMC’s CoWoS is in short supply

| Industry | Impact Level | Specific Performance |

|---|---|---|

AI Servers |

Core Beneficiary | Strong demand, high procurement willingness, low price sensitivity |

Data Centers |

Highly Tight | North America’s four major cloud providers are expected to invest USD 60 billion in AI in 2026 |

PC/Laptops |

Significantly Pressured | Manufacturers’ costs increase by 15-20%; some products will see price hikes or component reductions |

Smartphones |

Obvious Impact | Flagship models will see price hikes of RMB 300-500; mid-range models will rise by RMB 200-300 |

Automotive Electronics |

Gradually Emerging | Supply of automotive-grade memory chips is tightening, increasing the risk of shortage |

New Energy Vehicles |

Potential Pressure | Chip costs account for a relatively high proportion, with potential for price hikes |

-

Alleviate HBM Supply Shortage:

- New capacity will gradually fill the HBM demand gap for AI chips

- The tight supply-demand situation is expected to start easing in H2 2026

-

Strengthen South Korea’s Semiconductor Industry Competitiveness:

- Cheongju will become a global HBM production hub

- Drive the development of South Korea’s semiconductor industry ecosystem

-

Drive Technological Innovation:

- Mass production of 16-layer HBM4 will raise industry technical standards

- Promote in-depth cooperation with foundries such as TSMC

-

Time Lag in Capacity Release:

- New plants will only reach full-scale production in 2028

- The tight supply-demand situation in 2026 cannot be fundamentally reversed

-

Technical Yield Challenges:

- 16-layer HBM4 stacking technology is highly difficult

- Yield issues cannot be fully resolved in the short term

-

Risk of Intensified Competition:

- Samsung and Micron are accelerating their catch-up efforts

- HBM market share may face erosion

- Memory Chip Manufacturers: SK hynix (000660.KS), Samsung Electronics (005930.KS), and Micron Technology (MU) benefit from volume and price growth

- Semiconductor Equipment: ASML (ASML), Applied Materials (AMAT), Tokyo Electron, etc. see continued order growth

- Packaging and Testing: Strong demand for advanced packaging benefits companies such as ASE Group and Jiangsu Changjiang Electronics Technology

- Domestic Substitution: Domestic memory manufacturers such as ChangXin Memory Technologies and Yangtze Memory Technologies face development opportunities

- Price Fluctuation Risk: Memory chip prices are highly volatile, and the industry has obvious cyclicality

- Overcapacity Risk: If demand growth slows after 2027, overcapacity may occur

- Technological Iteration Risk: New technology routes may change the competitive landscape

- Geopolitical Risk: Chip export control policies may affect market demand

| Dimension | Expected Trend |

|---|---|

| HBM Market Size | Grow to USD 14 billion (YoY +75%) |

| DRAM Price | Full-year growth of 50%-60% |

| NAND Price | Full-year growth of 60%-70% |

| Supply-Demand Balance Time | H2 2027 |

| Stock Performance | Memory manufacturers are expected to continue outperforming the broader market |

SK hynix’s HBM chip capacity expansion plan reflects the strategic adjustment of the memory chip industry to address the demand surge in the AI era. Against the backdrop of global memory chip supply-demand imbalance, capacity expansion will help alleviate supply shortages. However, considering the time lag in new capacity release and technical challenges, memory chip prices are expected to remain high in 2026. In the long term, as capacity is gradually released and technology iterates, the market will tend to balance in 2027-2028.

For investors, the memory chip industry is in a golden period of volume and price growth, but it is necessary to closely monitor changes in supply and demand and the evolution of the technological competitive landscape.

[1] SK hynix orders new equipment for HBM4 production

[2] SK Hynix to build $13 bn new advanced chip packaging plant

[3] SK Hynix undervalued as HBM pricing tightens into 2026

[4] Memory prices set to keep increasing over 2026

[5] The “Wait Tax”: IT Hardware Price Forecast Q1 2026

[6] 2024–2026 global memory supply shortage

[7] Samsung nears deal to supply over 30% of Nvidia’s HBM4

[8] Micron Technology and the Great Memory Debate of 2026

[9] The State of HBM4 Chronicled at CES 2026

[10] Up to 70% Price Hike! Major Breaking News from Two Chip Giants

[11] AI Computing Power Wave Drives Volume and Price Growth in the Memory Market

[12] AI Computing Power Triggers Price Hike Chain: Smartphones, PCs, and New Energy Vehicles All Affected

[13] A Box of Memory Chips Equals a House? AI Wave Drives Memory Chips

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.