Analysis of the Impact of Federal Reserve Interest Rate Policy Changes on US Stock Market Investment Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest market data, policy dynamics and historical experience analysis, I will provide you with a systematic and comprehensive analysis from the following dimensions.

In 2024, the Federal Reserve launched a new interest rate cut cycle, which was the first interest rate cut since 2020. On September 18, 2024, the Federal Reserve announced a 50-basis-point interest rate cut, lowering the target range for the federal funds rate to 4.75%-5.00%, followed by 25-basis-point cuts in November and December respectively [0][1]. The main triggering factors for this interest rate cut include:

- Gradual easing of inflation pressure: US inflation rate continued to decline and approached the Federal Reserve’s long-term target of 2%

- Weak job market: New job data fell short of expectations, and the unemployment rate showed an upward trend

- Slowing economic growth: Multiple economic indicators show that US economic momentum is weakening, and the Federal Reserve is worried that acting too late may exacerbate the risk of economic recession [2]

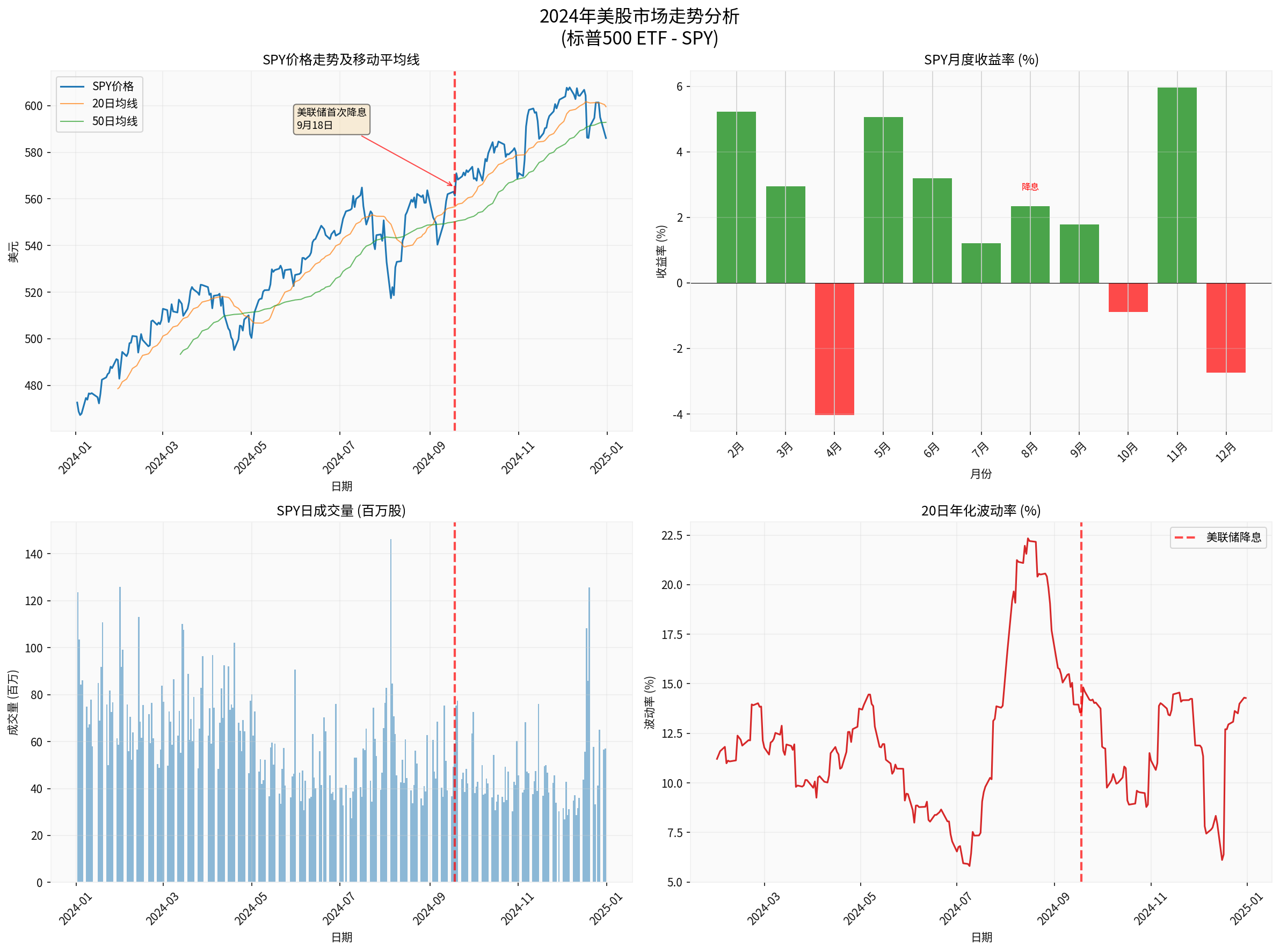

Looking at market data, the major US stock indexes performed strongly in 2024:

| Index | Year-start Value | Year-end Value | Annual Gain | Annual Volatility |

|---|---|---|---|---|

| S&P 500 (SPY) | $472.65 | $586.08 | +24.00% |

12.14% |

| Nasdaq | $14,873.70 | $19,310.79 | +29.82% |

1.07% |

| Dow Jones Industrial Average | $37,566.22 | $42,544.23 | +13.25% |

0.77% |

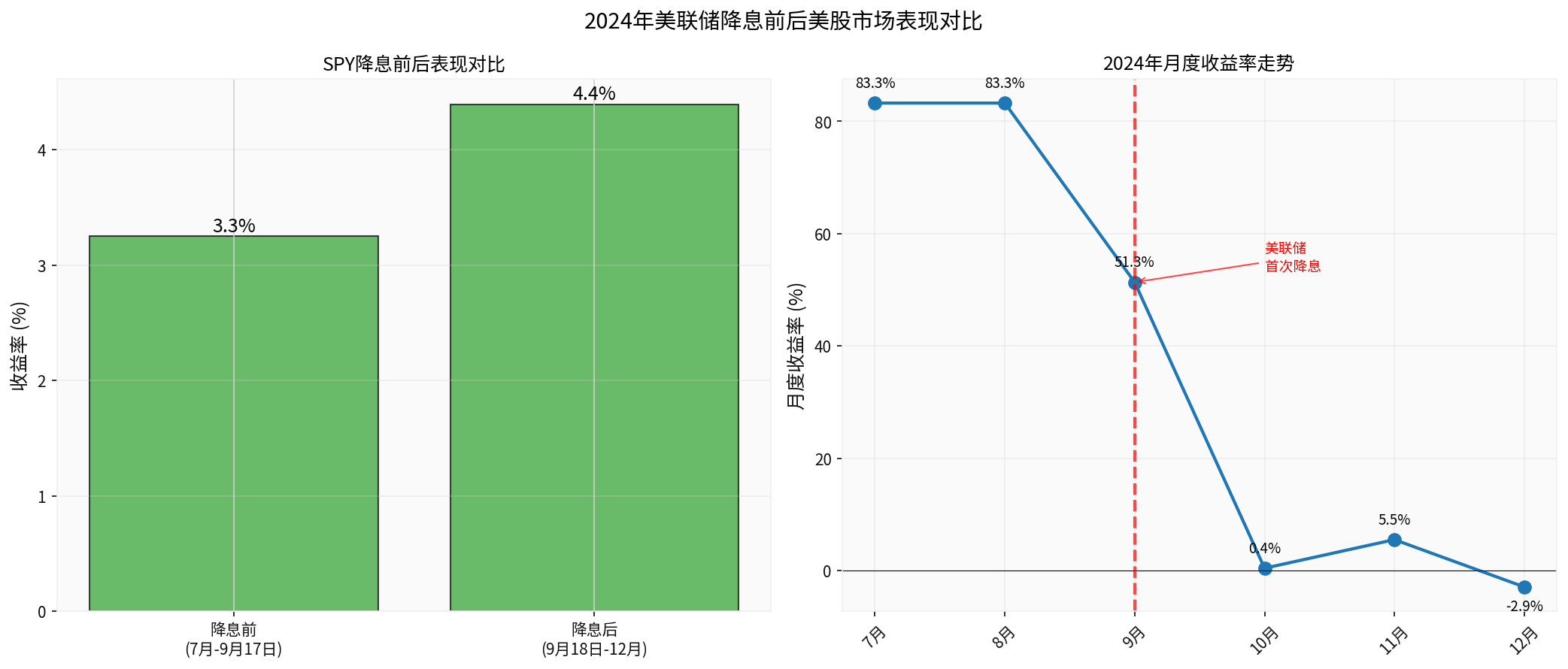

According to data analysis, the Federal Reserve’s interest rate cuts have had a significant boosting effect on the market:

This indicates that interest rate cuts have had a positive impact on market sentiment and risk appetite, especially as growth stocks and technology stocks performed more prominently.

| Aspect | Trump’s Position | Federal Reserve’s Position |

|---|---|---|

| Interest Rate Target | Advocates a sharp rate cut to 1% or even lower | Makes prudent decisions based on economic data |

| Interest Rate Cut Pace | Calls for rapid, sharp rate cuts | Gradual rate cuts, 25 basis points each time |

| Policy Basis | Focuses on political cycles and economic stimulus | Adheres to the dual mandates of inflation and employment |

Trump has publicly criticized Powell as a “stubborn idiot” on multiple occasions, urging an immediate interest rate cut, and even proposed that the Federal Reserve Board dismiss Powell [3]. He clearly stated that he wants interest rates to be “much lower” and hopes to select a “person who is honest on interest rate issues” to lead the Federal Reserve.

Since 2025, the conflicts between the White House and the Federal Reserve have continued to escalate, transcending simple policy differences and evolving into a fundamental challenge to the independence of the US central bank [4]. The main events include:

- DOJ Criminal Investigation: US prosecutors launched a criminal investigation into Powell, related to his testimony regarding the renovation of the Federal Reserve’s headquarters. Powell clearly stated: “The threat of criminal charges is because the Federal Reserve, when setting the benchmark interest rate, acts based on our professional judgment of what is in the best interest of serving the American public, rather than following the preferences of the US President.” [5]

- Personnel Appointment and Removal Game: The Trump administration attempted to dismiss Federal Reserve Governor Lisa Cook, despite the move being suspected of being illegal. According to the Federal Reserve Act, the President can only remove Federal Reserve officials for “cause”. The Supreme Court will hear arguments in the related case on January 21, 2026 [6]

- Personnel Infiltration Layout: By nominating confidants to serve as Federal Reserve Governors, Trump is building influence in the FOMC. He has successfully appointed Stephen Miller, Chairman of the White House Council of Economic Advisers, as a Federal Reserve Governor, who supported a 50-basis-point rate cut at the latest interest rate meeting [7]

Despite the policy game, the US stock market still achieved strong growth in 2024. This phenomenon can be understood from the following perspectives:

- In the short term, policy uncertainty has indeed exacerbated market volatility

- In the medium to long term, economic fundamentals and corporate earnings remain the core factors determining market trends

- Driven by the AI investment boom, technology stocks became the leading sector in the 2024 market

| Interest Rate Cut Cycle | S&P 500 Performance | Leading Sector | Style Feature |

|---|---|---|---|

| 2001-2003 | First fell, then rose | Technology Growth | Small-cap stocks led |

| 2007-2008 | Sharp decline | Defensive Sectors | Value stocks dominated |

| 2019 | Small increase | Technology & Consumer | Growth stocks led |

| 2024 | Strong growth |

Technology & Real Estate |

Growth stocks led |

Based on the current market environment and characteristics of the economic cycle, the following strategies are recommended:

- Prefer large-cap stocks: Between small-cap and large-cap stocks, it is recommended to lean towards large-cap stocks. Although small-cap stocks are more sensitive to interest rates, in an environment of slowing economic growth and shrinking profit margins, the defensive and liquidity advantages of large-cap stocks are more prominent [9]

- Technology sector remains attractive: AI-related investment continues to accelerate, with the year-on-year growth rate of information technology equipment investment rising from 5.1% in the fourth quarter of 2024 to 20.1% in the second quarter of 2025. Tech giants have raised their capital expenditure budgets, with the year-on-year growth rate expected to reach 44% in 2025 [10]

- Focus on cyclical sectors: As the effects of interest rate cuts gradually emerge, real estate chain and traditional investment-related sectors are expected to benefit. Investors can pay attention to real estate-related home appliances and home decoration, as well as investment-related non-ferrous metals and machinery sectors

- Shift from cash to bonds: In an interest rate cut cycle, it is recommended to gradually shift from high-yield cash products to short-to-medium-term bonds to obtain more attractive yields

- Moderately increase credit bond exposure: On the premise of maintaining quality, moderately increase the allocation of investment-grade and high-yield credit bonds [11]

- Pay attention to policy uncertainty risk: The game between Trump and the Federal Reserve may exacerbate market volatility, and investors need to closely monitor policy trends

- Inflation stickiness risk: Although the Federal Reserve has started interest rate cuts, the inflation rate is still significantly higher than the 2% target level, and the room for interest rate cuts may be limited

- Valuation risk: Current US stock valuations are at historically high levels, and investors need to be vigilant against the risk of valuation corrections

Federal Reserve independence is the cornerstone of the US dollar’s credit. If monetary policy is successfully intervened, the following risks may be triggered [12]:

- Investors’ confidence in US dollar assets declines, leading to capital outflows and US dollar depreciation

- Long-term borrowing costs rise, increasing the interest burden of US government debt

- The global de-dollarization process accelerates

According to the dot plot released by the Federal Reserve in December 2024, it is expected that there will be another 50-basis-point interest rate cut in 2025, followed by 25-basis-point cuts each year in the next two years [13]. However, this path faces the following uncertainties:

- Policy pressure from the Trump administration may interfere with FOMC decisions

- Inflation data performance may affect the pace of interest rate cuts

- Changes in the job market will be a key observation indicator

- Interest rate cut cycle is generally beneficial to US stocks: Historical data shows that in a non-recessionary interest rate cut environment, the stock market usually performs well, especially technology growth stocks

- Policy game increases uncertainty: The differences between Trump and the Federal Reserve have injected an additional political risk premium into the market, and investors need to remain vigilant

- Investment strategies should maintain flexibility: It is recommended to maintain equity exposure while focusing on quality factors, and moderately allocate bonds and alternative assets to diversify risks

- Long-term perspective is crucial: Although short-term volatility may intensify, the fundamentals of the US economy and technological innovation capabilities remain important factors supporting a long-term bull market

[0] Securities Times - Analysis of Performance of Various Assets After Federal Reserve Interest Rate Cuts

[1] CCTV News - Federal Reserve Announces 25-Basis-Point Interest Rate Cut

[2] Wall Street CN - What Happens After Interest Rate Cuts

[3] Sina Finance - The President’s Control Over the Federal Reserve and Interest Rates

[4] Zhejiang TV - US Government Launches Criminal Investigation into the Federal Reserve

[5] FastBull - Federal Reserve Official Talks About Trump’s Investigation

[6] Futu - Trump Variable Roils Financial Markets

[7] CNN Business - Powell fighting back against Trump

[8] CICC - Analysis of Asset Performance After Interest Rate Cuts

[9] BlackRock - Fed Rate Cuts & Portfolio Implications

[10] CICC - Analysis of AI Investment and Capital Expenditure

[11] BlackRock - Advisor Playbook for Fed Rate Cuts

[12] Zhejiang TV - Analysis of Federal Reserve Independence

[13] Securities Times Network - Analysis of the Resumption of Federal Reserve Interest Rate Cuts

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.