Analysis of Rising Market Concentration in China's Film Market and the Possibility of Mergers and Acquisitions by Enlight Media

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and market trends, I will conduct an in-depth analysis of the

In 2025, China’s mainland film market achieved a total box office of

| Indicator | Figure | Year-on-Year Change |

|---|---|---|

| Total Box Office | RMB 51.832 billion | +21.95% |

| Admissions | 1.238 billion | +22.57% |

| New Films with Box Office Over RMB 100 Million | 48 films | Decreased by 24 films (-33%) |

| Box Office Share of Films Grossing Over RMB 1 Billion | 62.3% |

Record High |

| Days with Single-Day Box Office Below the “Freeze Threshold” of RMB 20 Million | 41 days |

Abnormally High |

The market presents an unprecedented pattern of

- “Ne Zha: The Demon Child’s Sea Adventure”topped the global box office history’s TOP 5 with a box office ofRMB 15.446 billion, and its single-film box office even exceeded the total box office of the entire 2025 summer season (RMB 11.966 billion) [1][2]

- “Ne Zha 2” + “Zootopia 2”jointly contributed nearly RMB 20 billion, accounting for38.6%of the annual box office [2]

- Mid-tier film supply collapsed entirely: only 32 films grossed between RMB 100 million and RMB 500 million, a year-on-year decrease of 24 films [2]

- The number of new films with box office over RMB 100 million plummeted from 72 in 2024 to 48, a decrease of one-third[2]

The differentiation of market structure has directly led to a

| Indicator | Figure | Trend |

|---|---|---|

| Current Market Value | Approximately RMB 5.9 billion |

Plunged 92% from RMB 80 billion |

| Consecutive Losses | 7 Years |

Cumulative Losses Exceed RMB 8.2 billion |

| Total Liabilities | Over RMB 2.2 billion |

Overdue Debt of RMB 52.5 million |

| Cash Reserve | Only RMB 19 million |

Extremely Tight |

| Founders’ Shareholding | Fully Frozen |

Subject to Consumption Restrictions |

The root cause of Huayi Brothers’ decline lies in the failure of its

Bona Film Group has accumulated losses of over

Despite its relatively balanced business layout, due to the failure of “The Legend of the Condor Heroes: The Great Hero”, its net profit in the first three quarters plummeted by

| Valuation Suppression Factors | Specific Performance |

|---|---|

Blockbuster Dependency Syndrome |

Performance is highly tied to the success rate of top-tier films; the failure of a single film leads to quarterly losses |

Fragile Cash Flow |

Huayi has only RMB 19 million in cash, Bona’s losses exceed RMB 2.6 billion, resulting in extremely low risk resistance |

Insufficient IP Reserves |

Lacks mature IPs for sustainable operation, making it difficult to generate stable revenue |

Schedule Dependency |

The Spring Festival and summer seasons contribute over 60% of box office; non-peak seasons are almost “frozen” |

High Cost Rigidity |

High production costs remain stubbornly high; a box office failure leads to huge losses |

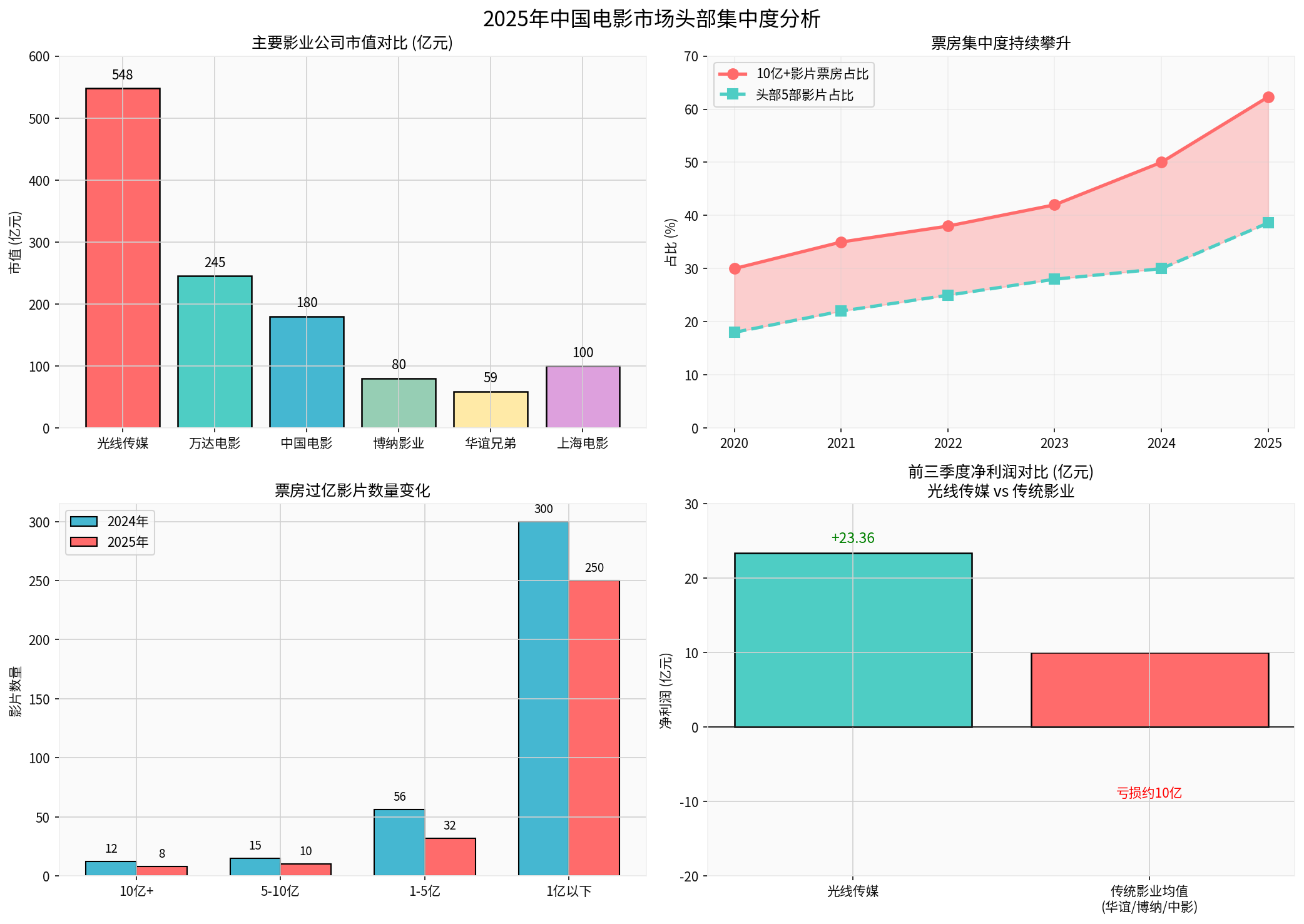

| Company | Market Value (in RMB 100 million) | Net Profit (First Three Quarters) | Cash Reserve | Valuation Characteristics |

|---|---|---|---|---|

Enlight Media |

548 |

+RMB 2.336 billion (+406.8%) |

RMB 4.2 billion |

High Growth, High Valuation |

| Wanda Film | 244.8 | Improved Profitability | Approximately RMB 2.5 billion | Initial Success in Theater Transformation |

| China Film Co., Ltd. | Approximately 18 | -69% | Approximately RMB 3 billion | Valuation Under Pressure |

| Shanghai Film Group | Approximately 10 | +29.81% | Approximately RMB 1.5 billion | Driven by Animated IPs |

Huayi Brothers |

59 |

Sustained Losses |

RMB 19 million |

Valuation Collapse |

| Bona Film Group | Approximately 8 | Losses Over RMB 2.6 billion | Tight | Sliding to the Edge |

Enlight Media is the only

| Indicator | Data | Industry Status |

|---|---|---|

| Market Value (in RMB 100 million) | 548 |

Ranked First in the Film Industry |

| Cash Reserve (Q3, in RMB 100 million) | 42 |

Ranked First in the Film Industry |

| Net Profit (First Three Quarters, in RMB 100 million) | 23.36 (+406.8%) |

Leading by a Wide Margin |

| P/E | 24.74x | Reasonable Valuation |

| ROE | 21.31% |

High-Quality Asset |

| Net Profit Margin | 57.63% |

Extremely High Profitability |

| Current Ratio | 4.23 |

Extremely Abundant |

The huge success of

Enlight Media is not a conservative

- 2016: AcquiredMaoyan Moviesthrough a “cash + stock” combination, gaining access to online ticketing channels

- 2016-2025: Made sweeping investments in dozens ofanimated film production companiesto build a content moat

- 2025: The full-industry-chain layout of animated IPs has entered the harvest period

These two historic M&A deals helped Enlight Media obtain the

| Driving Factor | Analysis |

|---|---|

Adequate Cash Reserves |

With a cash reserve of RMB 4.2 billion and meager interest income, there is a need to improve capital efficiency |

Strategic Demand |

The “Chinese Mythology Universe” requires more IPs and production capacity support |

Industry Downturn |

The valuation collapse of traditional film companies provides opportunities to acquire high-quality assets at low prices |

Competitive Pressure |

Need to consolidate the moat in the animation field to prevent competitors from catching up |

-

Animated IP Industry Chain Companies: Any move that helps with the full-industry-chain application of animated IPs is a possible direction, including:

- Animation technology companies (rendering, motion capture, etc.)

- Derivative product development companies

- ACG (Anime, Comic, Game) platforms or communities

-

Mature IP Operation Platforms: Acquire proven IP assets to reduce content development risks

-

Overseas Animation Companies: Leverage the international influence of “Ne Zha 2” to expand into the global market

-

Traditional Film Industry Assets: Acquire theater chains or production capabilities during the valuation trough [1]

- Structural contradiction of redundant entry-level positions and insufficient supply of high-end talent in the animation industry [4]

- Shortage of industrial blockbusters in 2026; industry confidence still needs to be restored

- Need to guard against goodwill risks brought by high-premium acquisitions

| Key Question | Analysis |

|---|---|

Will There Be Blockbusters Grossing Over RMB 10 Billion? |

The success of “Ne Zha 2” is difficult to replicate; it will require 3 films grossing over RMB 5 billion or 1 film grossing over RMB 10 billion |

Can Mid-Tier Films Recover? |

The failure of blockbusters such as “The Legend of the Condor Heroes: The Great Hero” and “Operation Jiaolong” has hit confidence in industrial blockbusters |

Contribution from Hollywood Blockbusters? |

2026 is a big year for Hollywood; whether films like “Avatar 3” can exceed RMB 3 billion is a key variable |

Schedule Balance? |

Can there be more effective schedules beyond the Spring Festival and summer seasons? |

- The Era of IP Operation Has Arrived: In 2025, IP-based films accounted for 7 of the top 10 box office films, contributing RMB 27.54 billion [2]

- “Guzi Economy” (Derivative Economy) Takes Shape: Derivative revenue has become an important growth driver; the first-day sales of merchandise for “Little Monsters of Langlang Mountain” exceeded RMB 7 million [1]

- Theater Transformation Accelerates: Wanda Film’s IP derivative sales increased by 94% year-on-year; Hengdian opened a “Toy Dream Factory” collection store [2]

- AI Animation Exploration: China Literature, iQiyi, Youku and others are deploying AI comic dramas, which may reshape content production efficiency [5]

- Top-tier companieswith mature IPs and cash flow will receive valuation premiums

- Traditional film companieslacking core competitiveness will continue to face pressure, and may even face the risk of being acquired or delisted

- M&A and integrationmay become the main theme of the industry in 2026

- Top-Tier Concentration Has Reached a Critical Point: Films grossing over RMB 1 billion account for 62.3% of total box office, and the “90/10 effect” in the industry is significant

- Traditional Film Companies Face Valuation Pressure: Companies such as Huayi and Bona face fundamental challenges to their business models, with significant market value shrinkage

- High Probability of M&A by Enlight Media: With RMB 4.2 billion in cash, strategic demand, and an industry downturn, it is expected to launch strategic M&A in 2026

- IP Operation Has Become the Core Competitiveness: The only way forward is to transform from a “content provider” to an “IP operator”

| Risk Type | Specific Content |

|---|---|

Single-Film Dependency Risk |

Over-reliance on the Ne Zha IP; the failure of sequels will impact performance |

Industry Cycle Risk |

High box office volatility, lack of a stable foundation for cash flow forecasting |

M&A Integration Risk |

Goodwill impairment from historical M&A; high difficulty in integrating cultural assets |

Policy and Regulatory Risk |

Uncertainties from policy changes such as content censorship and ticket price regulation |

[1] Huxiu - “Ten Questions About 2026 Chinese Films” (https://m.huxiu.com/article/4826481.html)

[2] Sina Finance - “Annual Box Office Reaches RMB 51.8 Billion: Is Chinese Film a Bubble or Real Gold?” (https://finance.sina.com.cn/tech/roll/2026-01-05/doc-inhfffrs9594892.shtml)

[3] Wenxuecity - “In Debt of RMB 2.2 Billion, the Domestic Entertainment Giant Has No Solutions: Huayi Brothers is Moving Toward Its End” (https://www.wenxuecity.com/news/2026/01/04/126474127.html)

[4] 36Kr - “Enlight Media: Still Living Under the Halo of Ne Zha?” (https://eu.36kr.com/zh/p/3545183355334535)

[5] Sina Finance - “China Literature + iQiyi + Youku + Suoyi Culture + Xuanji Technology Discuss the Future of Comic Dramas and AI Animation” (https://finance.sina.com.cn/roll/2026-01-13/doc-inhheqfr4718923.shtml)

[6] 36Kr - “Review of 2025: The Two Extremes Behind the RMB 50 Billion Film Market” (https://m.36kr.com/p/3624933405263108)

[7] Yiyu Observation - “Ten Questions About 2026 Chinese Films: Can the RMB 50 Billion Box Office Be Achieved? Will There Be Films Grossing Over RMB 10 Billion?” (https://m.huxiu.com/article/4826481.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.