In-depth Analysis Report on FAWER Automotive Parts (000030.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the collected information, I have prepared a business analysis and strategic balance report for FAWER Automotive Parts.

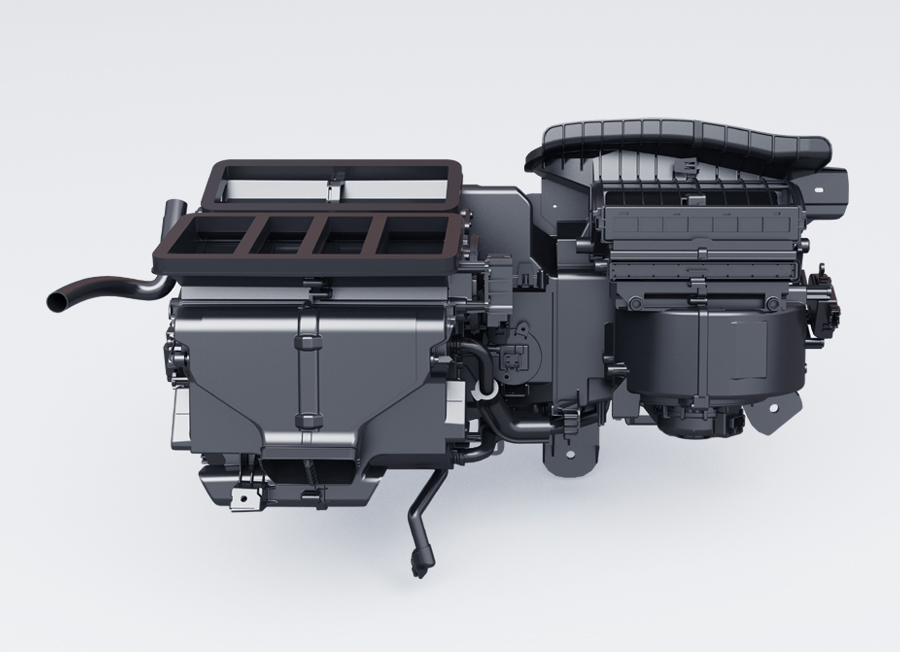

FAWER Automotive Parts is an A-share listed company focused on auto parts, with products covering multiple sectors including chassis systems, thermal management systems, and electronic control systems[0]. In recent years, the company has actively transformed towards new energy and intelligent technologies, and successfully entered the flying car supply chain in 2025.

| Indicator | Value |

|---|---|

| Market Capitalization | Approximately RMB 9.25 billion |

| Current Stock Price | RMB 5.53 |

| Price-to-Earnings Ratio (PE) | 14.15x |

| Net Profit Margin (TTM) | 3.93% |

| Return on Equity (ROE) | 8.35% |

According to public information, FAWER Automotive Parts has received a project designation and development notice from

| Product Type | Supply Model | Technical Features |

|---|---|---|

| Electronic Control Shock Absorbers | Co-development with Customer | Intelligent Active Suspension Technology |

| Thermal Management Products | Independent R&D Solution | Customized for the Special Needs of Flying Cars |

- Low-altitude economy has been included in the national strategic emerging industries, with broad market space

- Flying cars have higher demand for intelligent components such as electronic control shock absorbers

- Early layout can secure first-mover advantage in the track

- The low-altitude economy sector is still in the early development stage[1]

- The commercialization timeline is uncertain

- Market scale is limited, with limited revenue contribution in the short term

The business structure of FAWER Automotive Parts is undergoing significant changes:

| Time Period | Proportion of New Energy Orders | Proportion of Traditional Fuel Vehicle Orders |

|---|---|---|

| 2023 | Over 60% | Approximately 40% |

| H1 2024 | Nearly 80% |

Approximately 20% |

The rapid increase in the proportion of new energy business reflects the

Regarding the issue of declining net profit margin of traditional businesses, although precise data of an “8% decline” has not been found, the company does face the following challenges:

| Indicator | FAWER Automotive Parts | Industry Average (Estimated) | Gap |

|---|---|---|---|

| Net Profit Margin | 3.93% | 4-6% | Lower |

| Operating Profit Margin | 4.60% | 5-7% | Lower |

| Return on Equity (ROE) | 8.35% | 10-12% | Lower |

- Decline in capacity utilization due to the contraction of the traditional fuel vehicle market

- Sustained price reduction pressure on traditional auto parts products

- R&D investment tilted towards new energy and intelligent technology sectors

- Fluctuations in raw material costs affecting gross profit margin

In the first half of 2024, the company achieved a net profit growth of

- Accelerate capacity release of new energy product lines

- Increase the proportion of high-margin products such as thermal management systems and electronic control shock absorbers

- Optimize the capacity structure of traditional businesses and eliminate outdated production capacity

Although the flying car business is in the early stage, it represents the ultimate application scenario of

- Technology Synergy: Migrate electronic control shock absorber and thermal management technologies for new energy vehicles to the flying car sector

- Customer Binding: Deepen cooperation with leading flying car manufacturers to establish first-mover advantage

- Continuous R&D: Maintain R&D investment to ensure technological leadership

Build a product matrix with the trinity structure of

┌──────────────┐

│ FAWER Auto │

└──────┬───────┘

┌───────────────┼───────────────┐

▼ ▼ ▼

┌────────────┐ ┌────────────┐ ┌────────────┐

│ Traditional│ │ New Energy │ │ Flying Car │

│ Business │ │ Business │ │ Business │

│ Stable Cash│ │ Growth │ │ Future Growth│

│ Flow (20%) │ │ Engine (60%)│ │ Driver (20%)│

└────────────┘ └────────────┘ └────────────┘

| Indicator | Value | Evaluation |

|---|---|---|

| Price-to-Earnings Ratio (PE) | 14.15x | Mid-tier in the industry |

| Price-to-Book Ratio (PB) | 1.17x | Low, with a margin of safety |

| Current Price / 200-Day Moving Average | 5.53/5.79 | Approximately 4.5% below the moving average |

- 🚗 Continuous contraction of traditional businesses

- ⚡ Intensified competition in the new energy market

- ✈️ Flying car commercialization falling short of expectations

- 🔋 Rapid growth of new energy orders, improved profitability

- 🛸 Favorable policies for low-altitude economy

- 📈 Demand for intelligent upgrading of automobiles

The decline in net profit margin of traditional businesses and the expansion of new businesses faced by FAWER Automotive Parts are, in essence, a microcosm of the

- Rapid Growth of New Energy Business: Use high-growth business to hedge against the decline of traditional businesses; the 41.62% net profit growth in H1 2024 proves the effectiveness of this strategy

- Technology Synergy and Migration: Extend electronic control and thermal management technologies accumulated in the new energy sector to flying cars, realizing technology reuse

- Ladder-type Business Layout:

- Short-term: New energy business contributes main profits

- Mid-term: Flying car business begins to contribute incremental growth

- Long-term: Form a diversified business matrix

| Time Horizon | Rating | Rationale |

|---|---|---|

| Short-Term | Neutral |

Traditional businesses are under pressure, and it takes time for new energy business to release capacity |

| Mid-Term | Optimistic |

Leading layout in the flying car track, supported by policies |

| Long-Term | Watch |

Great potential of low-altitude economy, need to continuously track commercialization progress |

[0] Jinling API - FAWER Automotive Parts Company Profile and Market Data

[1] Shanghai Securities News/Securities Times - “FAWER Automotive Parts: Secured Project Designation from Flying Car Client to Supply Electronic Control Shock Absorbers and Other Products” (https://www.cnstock.com/tag/50884, https://www.stcn.com/article/detail/1635006.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.