Deep Research and Analysis of Anker Innovations: Cash Flow Crisis and Hong Kong IPO Strategy

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the comprehensive data collected, I now provide an in-depth analysis for you:

According to the latest financial data[0], the net cash flow from operating activities of Anker Innovations in the first three quarters of 2025 was

From a structural perspective, the surge in inventory is the primary reason for the negative cash flow. The inventory balance skyrocketed from RMB 3.234 billion at the end of 2024 to RMB 6.147 billion in the third quarter of 2025, an increase of over 90%[1]. The company clearly stated that this is partly due to normal stock preparation for the sales peak season, and partly due to strategic “pre-shipment stockpiling” to cope with potential changes in tariff policies[2]. Although this aggressive stock preparation strategy consumes a large amount of cash in the short term, it has certain rationality from the perspective of supply chain security and cost control.

It is worth noting for investors that Anker Innovations is not truly “short of money”. As of September 30, 2025, the company’s hand-held monetary funds reached RMB 2.591 billion, plus RMB 2.533 billion of tradable financial assets, and the total cash-like assets exceeded RMB 5.1 billion[3]. This means that the company has sufficient liquidity buffer, and the cash flow crisis is more of a phased phenomenon caused by adjustments in business strategies, rather than a signal of systemic financial risks.

Anker Innovations encountered an unprecedented product quality crisis in 2025, with at least 6 large-scale recalls conducted throughout the year, covering multiple core global markets:

| Time | Recall Region | Recalled Products | Quantity Involved |

|---|---|---|---|

| June 2025 | China | 7 models of power banks | 712,900 units |

| June 2025 | United States | PowerCore 10000, etc. | 1.158 million units |

| September 2025 | United States | Power banks | 480,000 units |

| October 2025 | Japan | Power banks + speakers | 522,200 units |

According to public data, the direct economic loss caused by the recall incidents is approximately RMB 500 million, including RMB 238 million in inventory impairment provisions and RMB 130 million in product quality margin accruals[4]. In addition, the company’s asset impairment loss reached RMB 290 million in the first three quarters of 2025, a significant increase compared to the same period last year.

A more far-reaching blow is the loss of brand equity. After the recall incidents, the negative review rate of Anker products on the Amazon platform soared by 280%, and organic traffic decreased by 40%[5]. Data from Japan’s Ministry of Economy, Trade and Industry shows that a total of 41 serious fire cases involving Anker products have been reported in Japan since last year, and the department has issued administrative guidance to Anker Japan, requiring a comprehensive inspection of all lithium-ion battery products sold in Japan.

Investigation results show that the root cause of the problem is the loss of control in supplier management. Some batches of battery cells from Amprius (Wuxi), the battery cell supplier used by Anker Innovations, had unauthorized raw material changes, leading to product safety risks[6]. It is worth noting that all 11 3C certification certificates of Amprius were suspended on June 10, 2025, due to reasons including failure of factory supervision and inspection, and product consistency issues. Anker Innovations has terminated cooperation with this supplier, signed a cooperation agreement with CATL’s subsidiary ATL (Amperex Technology Limited), and announced the establishment of a battery cell safety expert team and testing laboratory.

Anker Innovations officially submitted a prospectus to the Hong Kong Stock Exchange on December 3, 2025. Choosing to list in Hong Kong “at a self-reduced valuation” against the background of high A-share valuations, this seemingly abnormal decision contains in-depth strategic considerations:

Although the company currently has abundant cash on hand, listing in Hong Kong can provide it with an international financing platform and capital operation space. Especially against the background of complex and volatile Sino-US trade relations, having a Hong Kong listed status helps avoid the potential impact of geopolitical risks on the company’s capital operations.

The Ministry of Industry and Information Technology is promoting the formulation of a new national standard for “Power Bank Safety Technical Specifications”, which is expected to be officially released in February 2026 and implemented in June. Industry insiders predict that the overall production cost of power banks will increase by more than 20% after the new regulation is implemented[7]. Part of the funds raised from the Hong Kong listing will be used for “strengthening supply chain management”, which is clearly a preparation for the upcoming increase in compliance costs.

The prospectus shows that the fundraising purposes include “enhancing brand influence and strengthening product marketing in core cities”. Against the background of the brand reputation being severely damaged by the recall incidents, the company needs a large amount of funds for brand image restoration and market trust reconstruction.

However, large-scale recall incidents will most likely suppress Anker Innovations’ valuation in Hong Kong. Private equity fund analysts believe that on the one hand, potential refund losses of RMB 400-500 million and the accrued quality margin will directly erode profits; on the other hand, frequent recalls have severely damaged market confidence in brand reputation, and investors may require higher risk compensation[8]. Previously, market rumors stated that the company planned to raise US$500 million, but the actual fundraising amount may be lower than expected due to valuation discounts.

In the first three quarters of 2025, the company achieved operating revenue of RMB 21.019 billion, a year-on-year increase of 27.79%, maintaining a high-growth momentum[9]. From 2022 to 2024, the company’s total revenue jumped from RMB 14.3 billion to RMB 24.7 billion, with a compound annual growth rate of as high as 31.7%.

- Smart Charging and Energy Storage Business: As the core engine, it contributed revenue of RMB 10.89 billion in the first three quarters, accounting for half of the total revenue

- European Market Breakthrough: Benefiting from the outbreak of consumer-level energy storage demand after the energy crisis, the revenue of the Anker SOLIX brand in Europe grew by over 50%, and the energy storage business is expected to exceed RMB 6 billion in annual revenue and turn profitable

- Smart Home and Smart Audio-Visual Business: Maintains a compound growth rate of nearly 30%, forming the second and third growth curves

| Indicator | Value | Industry Comparison |

|---|---|---|

| ROE | 27.58% | Significantly higher than industry average |

| Gross Margin | 45.2% | Far higher than the average level of the consumer electronics industry |

| Net Profit Margin | 8.80% | Remains stable |

The company’s R&D expenses increased from RMB 970 million in 2022 to RMB 1.946 billion in the first three quarters of 2025, and the R&D expense ratio rose from 6.8% to 9.26%[10]. Innovative products launched in the third quarter of 2025, such as the 160W multi-port charger and home energy system, have received positive market feedback, reflecting the company’s strategic focus on driving growth through technological innovation.

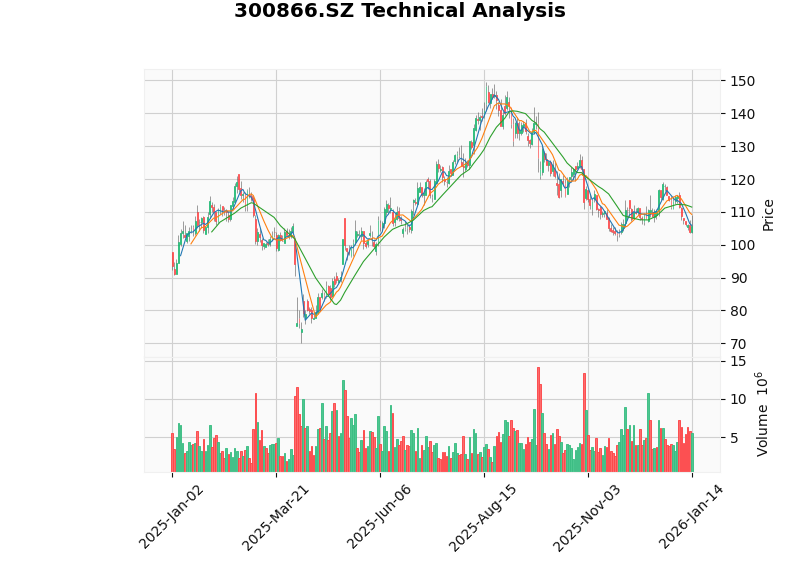

From a technical analysis perspective[0], Anker Innovations currently exhibits the following characteristics:

- Current Price: RMB 105.81 (January 14, 2026)

- Price Range: It reached a high of RMB 149.50 and a low of RMB 61.99 in 2025, with a large fluctuation range

- Moving Averages: 20-day moving average at RMB 111.47, 50-day moving average at RMB 109.80, 200-day moving average at RMB 113.15; the stock price is below all three moving averages

- Technical Indicators: MACD is in a death cross (bearish), KDJ is in the oversold zone (potential rebound opportunity), RSI is in the normal range

- Trend Judgment: Sideways consolidation pattern with no obvious trend; the reference oscillation range is RMB 104.02 - RMB 111.47

Since the high of RMB 148 in August 2025, the stock price has fallen by nearly 30% cumulatively, and a market value of over RMB 20 billion has evaporated in just a few months. The beta coefficient is 0.9, indicating that the stock price volatility is slightly lower than the market average.

- Quality Control Risk: Dependence on contract manufacturers under the light asset model is still a sword of Damocles; supply chain adjustment requires a certain period, and quality risks still need continuous attention in the short term

- Policy Compliance Risk: Production costs may increase by more than 20% after the new national standard is implemented, and there is uncertainty whether the cost pressure can be smoothly passed on

- Valuation Pressure Risk: Recall incidents may lead to lower-than-expected valuation of the Hong Kong IPO, weakening the financing effect

- Market Competition Risk: Competitors such as Ugreen and Xiaomi have launched price wars relying on their supply chain depth, and Anker is at a disadvantage in cost competition

- Brand Restoration Cycle: Reconstructing brand reputation takes time, which may continue to affect overseas market sales in the short term

- Energy Storage Business Outbreak: The energy storage business in the European market grew by over 50%, becoming a new profit growth pole, which is expected to offset the negative impact of the power bank business

- Adequate Cash Flow Reserves: Cash-like assets exceed RMB 5.1 billion, providing sufficient ammunition to cope with crises and strategic transformation

- R&D Innovation-Driven: Continuous R&D investment is expected to incubate new star product lines, and the printer business will be launched after five years of losses

- Supply Chain Reconstruction: Reached a cooperation with CATL’s subsidiary ATL, strengthening quality control from the source

- Deepened International Layout: Listing in Hong Kong will help the company further expand its international capital market presence and brand influence

Anker Innovations is currently in a critical period with multiple overlapping challenges. Cash flow “blood loss”, the impact of recall incidents, pressure from tariff-related stockpiling, and tighter regulatory policies constitute the “four-pronged” pressure faced by the company. However, looking beyond the surface, the company’s core competitive barriers have not been fundamentally shaken - the explosive growth of the energy storage business, sustained strong profitability, sufficient cash reserves, and proactive supply chain reconstruction measures all provide a solid foundation for the company to navigate the cycle.

Regarding the judgment on whether listing in Hong Kong can alleviate the dual pressures, I believe that:

[0] Jinling AI - Financial and technical analysis data of Anker Innovations (300866.SZ)

[1] Caifuhao - “Anker Innovations’ ‘Two-Sided Battle’: On the Brink of the Abyss, Breaking Through to Hong Kong IPO” (https://caifuhao.eastmoney.com/news/20260113191523028232140)

[2] CBNData - “Coexisting Pressure and Growth, Anker Innovations Heads for Hong Kong IPO” (https://www.cbndata.com/information/294673)

[3] Sina Finance - “Controlling shareholder’s net worth exceeds RMB 20 billion, Anker Innovations with over RMB 5 billion in cash-like assets still plans to raise funds in Hong Kong” (https://finance.sina.com.cn/roll/2025-12-13/doc-inharzei6204240.shtml)

[4] Times Finance - Reports related to Anker Innovations

[5] Caifuhao - Impact analysis of Anker Innovations’ recall incidents

[6] Daily Economic News - In-depth report on Anker Innovations’ power bank recall incident

[7] Sina Finance - Analysis of the impact of the new national standard for power banks on the industry

[8] CBNData - Valuation analysis of Anker Innovations by private equity fund insiders

[9] Nanfang Plus - “Another power bank recall! Revenue and profit both grew in the first three quarters, Anker Innovations’ quality control becomes market focus”

[10] Times Finance - Analysis of Anker Innovations’ R&D investment and business development

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.