In-Depth Analysis Report on Abnormal Stock Price Fluctuations of Zhidemai Technology (300785.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

In-Depth Analysis Report on Abnormal Stock Price Fluctuations of Zhidemai Technology (300785.SZ)

According to the latest trading data, Zhidemai Technology (300785.SZ) has experienced extremely severe stock price fluctuations recently [0]. As of the close on January 14, 2026, the company’s stock price stood at RMB 83.89 per share, hitting an all-time high. The specific fluctuation characteristics are as follows:

| Statistical Dimension | Specific Performance |

|---|---|

Short-term Abnormal Fluctuation |

From January 12 to 14, the cumulative deviation of closing price increases over three consecutive trading days exceeded 30%, constituting abnormal fluctuation |

Severe Abnormal Fluctuation |

From December 30, 2025 to January 14, 2026, the cumulative deviation of increases over 10 consecutive trading days exceeded 100%, constituting severe abnormal fluctuation |

Year-to-Date Increase |

Cumulative increase of 91.44% since 2026 |

Past Month |

Increase of 109.88% |

Past Three Months |

Increase of 148.20% |

Past Year |

Increase of 146.88% |

Past Three Years |

Increase of 298.15% |

From the technical chart, it is clear that the stock price showed an almost vertical upward trend from December 2025 to January 2026, surging from approximately RMB 45 to RMB 83.89, nearly doubling in value [0].

According to public market information, the abnormal rise of Zhidemai Technology’s stock price is closely related to the following concept speculations [1][2]:

Recently, the A-share market has a high enthusiasm for the GEO (Generated Engine Optimization) concept. Galaxy Securities’ research report points out that GEO is a new concept proposed to address the limitations of traditional SEO in AI dialogue scenarios with the rise of generative artificial intelligence, referring to optimizing content to make it easier to be retrieved and recommended in generative AI engine responses [2].

Multiple securities firms have released research reports optimistic about the GEO market space:

- 2025: The global GEO market size is expected to reach USD 11.2 billion, and the Chinese market RMB 2.9 billion

- 2030: The global market will reach USD 100.7 billion (5-year CAGR 55%), and the Chinese market will grow to RMB 24 billion (5-year CAGR 53%) [2]

The market has crowned companies like E-Data Technology, Chinese Online, and Tianlong Group as the new ‘Yi Zhongtian’ portfolio, and Zhidemai Technology has been included in related concept speculation by some investors.

Institutions are generally optimistic about the development of AI applications in 2026. Huaxin Securities stated that 2026 will be the “golden year” for AI applications; Soochow Securities believes that 2026 is expected to be a key year for the volume release of AI applications [2]. As an internet content information industry company, Zhidemai Technology has been included in AI application concept speculation by the market.

Zhidemai Technology released an abnormal fluctuation announcement on January 14, 2026, with the following important clarifications [1][2]:

| Clarification Item | Specific Content |

|---|---|

GEO Business |

The company’s business is not involved in the “GEO” related concept that has received high market attention recently |

AI Business Progress |

AI-related businesses and products are still in the initial stage of investment |

AI Revenue Contribution |

In the first three quarters of 2025, AI-related revenue accounted for a very small proportion of the company’s overall operating revenue |

Performance Impact |

Has not had a significant impact on the company’s overall operating conditions |

Major Matters |

The company and its controlling shareholder have no major matters that should be disclosed but have not been disclosed |

Operating Conditions |

There have been no major changes in the company’s recent operating conditions and internal and external environment |

- Ample Liquidity: The A-share market maintained ample liquidity at the beginning of 2026, with some funds flowing into small and medium-cap technology stocks

- Concept Rotation: Market hotspots are rotating from new energy vehicles, semiconductors, etc. to AI application concepts

- Retail Investor Follow-Up: Continuous daily limit-ups have attracted market attention, drawing a large number of retail investors to follow suit and buy

- Institutional Research: According to the investor relations activity record, more than 50 institutions participated in the company’s telephone conference research on August 26 [3]

According to the latest financial data, the fundamental situation of Zhidemai Technology is as follows [0]:

| Indicator Category | Indicator Name | Value | Industry Comparison |

|---|---|---|---|

Valuation Indicators |

Price-to-Earnings Ratio (TTM) | 196.53x | Significantly higher than the industry average |

| Price-to-Book Ratio | 8.83x | Relatively high | |

| Price-to-Sales Ratio | 12.72x | Relatively high | |

Profitability |

Return on Equity (ROE) | 4.48% | Relatively low |

| Net Profit Margin | 6.47% | Below medium level | |

| Operating Profit Margin | 5.19% | Medium level | |

Solvency |

Current Ratio | 5.10 | Excellent |

| Quick Ratio | 5.06 | Excellent | |

Valuation Risk |

EV/OCF | -473.16x | Extremely poor |

| Item | Amount/Range | YoY Change |

|---|---|---|

| Operating Revenue | RMB 582 million | Decrease (proactive contraction of low-margin revenue) |

| Net Profit Attributable to Parent Company | RMB 12.6926 million | +65.75% |

| Gross Profit Margin | 49.20% | +2.23 percentage points |

| Sales Expense | - | -19.46% |

| General and Administrative Expense | - | -17.03% |

| Operating Cash Flow | RMB 6.7 million | -RMB 48.44 million in the same period last year |

- The company proactively contracted low-margin revenue and businesses, putting pressure on the revenue side

- However, benefiting from efficiency improvements brought by AI investment, net profit increased significantly

- The increase in gross profit margin and decrease in costs and expenses indicate improved operating efficiency

- Cash flow situation has improved significantly, turning from negative to positive

According to public information, Zhidemai Technology’s main businesses include:

- What’s Worth Buying: Core consumer content platform

- Intelligent Marketing and Overseas Business: AI-driven overseas marketing tools

- Data Services: Commodity data, consumer data services

Company App User Situation (June 30, 2025):

- Registered Users: 31.049 million, YoY growth of 4.74%

- Mobile App Monthly Active Users: 80.4713 million, YoY growth of 7.32%

- Average User Dwell Time: 7.89 minutes

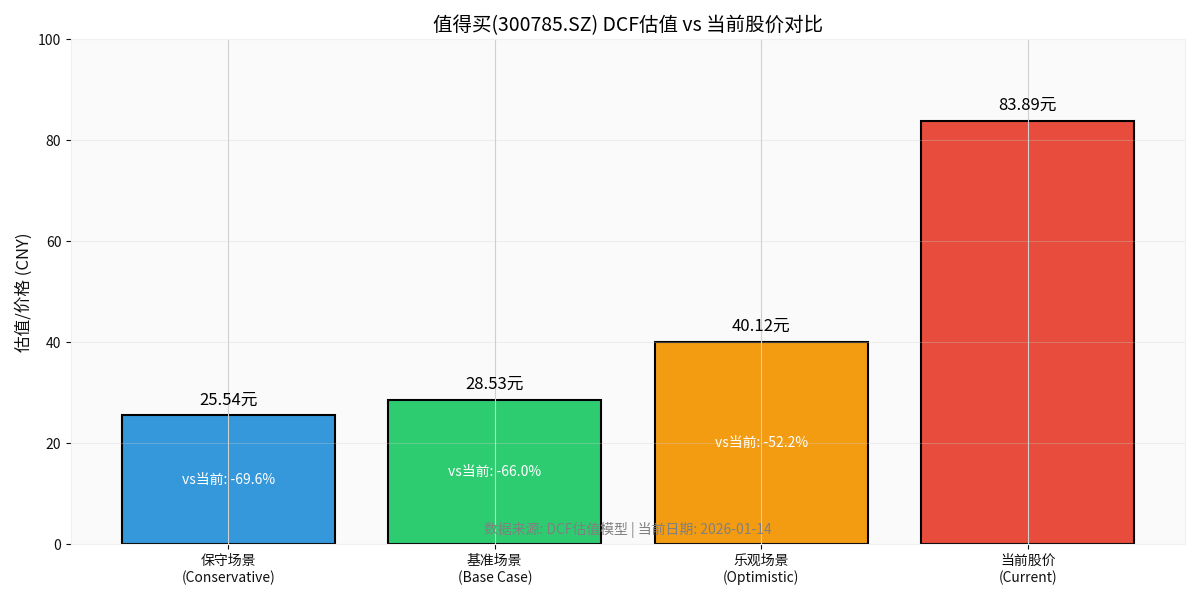

Through the Discounted Cash Flow (DCF) model to evaluate Zhidemai Technology’s intrinsic value, the results show [0]:

| Valuation Scenario | Intrinsic Value | Deviation from Current Stock Price |

|---|---|---|

Conservative Scenario |

RMB 25.54 | -69.6% |

Baseline Scenario |

RMB 28.53 | -66.0% |

Optimistic Scenario |

RMB 40.12 | -52.2% |

Probability-Weighted Valuation |

RMB 31.40 | -62.6% |

- Revenue Growth Rate: 0%

- EBITDA Margin: 11.4%

- Terminal Growth Rate: 2.0%

- Cost of Equity: 13.4%

- Revenue Growth Rate: 13.7%

- EBITDA Margin: 12.0%

- Terminal Growth Rate: 2.5%

- Cost of Equity: 11.9%

- Revenue Growth Rate: 18.5%

- EBITDA Margin: 12.6%

- Terminal Growth Rate: 3.0%

- Cost of Equity: 10.4%

According to the in-depth research report released by Huafu Securities in August 2023 [3], the target price of RMB 28.22 was given based on 34x PE for 2023, corresponding to a market value of RMB 5.616 billion. However, the current market value has reached approximately USD 16.8 billion (about RMB 120 billion), an increase of more than 20 times.

| Indicator | Value | Signal Interpretation |

|---|---|---|

KDJ |

K:89.7, D:81.2, J:106.6 | Severe overbought zone |

RSI(14) |

Entered overbought zone | Overbought risk signal |

MACD |

In bullish zone | Uptrend continues |

Beta |

1.06 | Slightly higher than market volatility |

Support Level |

RMB 53.52 | |

Resistance Level |

RMB 83.89 | |

Next Target |

RMB 88.69 |

- Severe Overbought: Both KDJ and RSI indicators show that the stock price is in a severe overbought state

- Excessively High Deviation Rate: The deviation rate between the stock price and the 20-day moving average (RMB 46.43) exceeds 80%

- Surge in Volatility: The daily volatility standard deviation reaches 6.10%, and the risk has increased significantly

- Price-Volume Divergence: During the sharp rise of the stock price, although trading volume has increased, its sustainability is questionable

| Assessment Dimension | Conclusion | Risk Level |

|---|---|---|

Concept Speculation Risk |

The stock price rise is mainly driven by GEO/AI concept speculation, and the company has clearly clarified that it is not involved in GEO business | ★★★★★ |

Fundamental Support |

The current 196x PE far exceeds the industry average, and DCF valuation shows the stock price is overvalued by approximately 62% | ★★★★★ |

Performance Matching Degree |

H1 2025 revenue declined, AI revenue contribution is minimal, which is difficult to support the valuation | ★★★★☆ |

Technical Side Risk |

KDJ/RSI are severely overbought, with extremely high short-term pullback risk | ★★★★★ |

Regulatory Risk |

Severe abnormal fluctuation has been triggered, and the exchange may take regulatory measures | ★★★★☆ |

- Do Not Recommend Chasing High to Buy: The current stock price has seriously deviated from intrinsic value, and technical indicators show extremely high overbought risk

- Be Wary of Concept Speculation Risks: The company has clearly clarified that it is not involved in the “GEO” business, and related concept speculation lacks fundamental support

- Pay Attention to Pullback Risk: The short-term increase is too large, and a sharp pullback may occur at any time

- Long-Term Observation of AI Business Progress: If AI business can generate substantial revenue growth in the future, the value can be re-evaluated

[0] Jinling AI Financial Database - Real-time market, financial analysis, technical analysis and DCF valuation data of Zhidemai Technology (300785.SZ)

[1] Sina Finance - “Zhidemai Technology’s stock price fluctuates abnormally, clarifies no involvement in GEO business and minimal AI revenue proportion” (https://finance.sina.com.cn/roll/2026-01-14/doc-inhhhtei4882299.shtml)

[2] The Paper - “Cumulative stock price increase exceeds 100%, E-Data Technology: Currently not involved in GEO business” (https://www.thepaper.cn/newsDetail_forward_32384795)

[3] Huafu Securities Research Institute - In-Depth Research Report on Zhidemai Technology (300785.SZ) (https://pdf.dfcfw.com/pdf/H3_AP202308221595497149_1.pdf)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.