Analysis of U.S. Restrictions on Nvidia H200 Chip Exports to China and Their Impact on Semiconductor Investments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on the latest data and analysis I have collected, I now present a systematic and comprehensive investment analysis report.

U.S. semiconductor export controls on China have evolved from a “full ban” to “conditional opening”. In October 2022, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued the “October 7 Rule”, imposing the first restrictions on advanced process nodes and high-end AI chips for China [1]. Since then, policies have continued to tighten: in March 2023, Nvidia launched the A800 and H800 customized chips in response; in October 2023, it further updated the “October 17 New Rule”, incorporating chips with TPP ≥ 4,800 or TPP ≥ 1,600 and power density ≥ 5.92 into the control scope [1].

In January 2025, on the eve of the Biden administration’s departure, the “AI Proliferation Rule” expanded restrictions to a comprehensive level. Nvidia was forced to announce the discontinuation of H20 chip production. However, on December 8, 2025, the Trump administration announced that it would allow Nvidia to export H200 chips to China, marking a major shift in policy [2][3].

According to the latest regulations from the U.S. Department of Commerce’s BIS, the following restrictions are attached to H200 chip exports to China:

| Restriction Condition | Details |

|---|---|

Sales Revenue Share |

A 25% fee per chip will be paid to the U.S. government, which is expected to contribute approximately $4 billion in revenue in 2026 [2] |

Quota Limit |

Shipments to the Chinese market shall not exceed 50% of U.S. domestic sales [3] |

Supply Proof |

The applicant must prove that the U.S. market has sufficient supply, without affecting U.S. customer orders and global foundry capacity [2] |

Usage Restriction |

Commitment that the product will not be used for military purposes [2] |

Independent Testing |

Each batch of exported goods must undergo independent verification by a U.S. third-party testing laboratory [2] |

Technology Isolation |

More advanced Blackwell (B100/B200/GB200) and future Rubin chips are not included in the approved scope [1] |

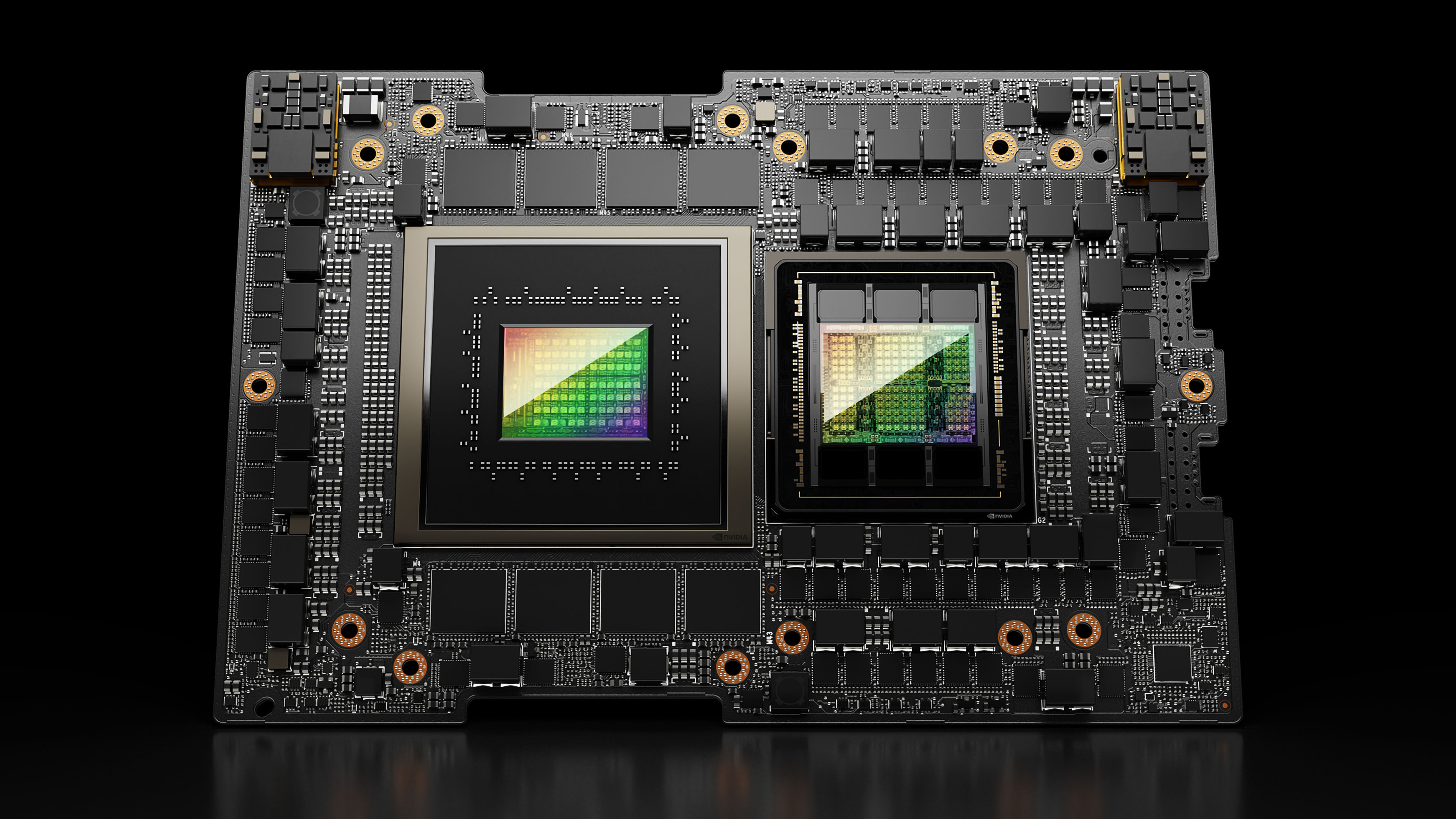

The H200 is based on the Hopper architecture and is the first GPU equipped with 141GB HBM3e memory with a bandwidth of 4.8TB/s. A comparison with previous-generation chips and competitors shows:

Chip Model FP16 Compute Power HBM Capacity NVLink Bandwidth

A100 312T 80GB 600GB/s

H100 1P 80GB 900GB/s

H200 1P 141GB 4.8TB/s

B100 1.75P 180GB 1.8TB/s

B200 2.25P 288GB 1.8TB/s

GB200 5P 800GB 3.6TB/s

The H200 has continued performance iterations compared to the A100, but there is still a significant gap with higher-end chips such as the B200 and GB200, and it still belongs to the “sub-advanced” category of products [1].

According to Nvidia’s latest financial report data, the company’s market capitalization reaches $4.44 trillion, with a current stock price of $182.31 and a price-to-earnings ratio of 45.24 [4]. In the second quarter of fiscal year 2026, its revenue from the Chinese market was $2.769 billion, a decrease of nearly $900 million compared to $3.667 billion in the same period of fiscal year 2025 [3].

After the approval of H200 exports, Nvidia is expected to supply approximately 633,000 chips to the Chinese market in 2026 (calculated based on capacity allocation). Based on the price of RMB 1.4 million for an 8-card module, it is expected to contribute nearly $16 billion in revenue [2]. Analysts predict that AMD’s stock may rise by 60% due to the policy favorable, and Nvidia’s return to the Chinese market will become an important catalyst for its performance growth in 2026 [5].

Previously, due to policy uncertainty, Nvidia urgently notified supply chain partners such as TSMC and Samsung to fully stop the production and packaging of H20 chips in August 2025 [1]. Now that the H200 has been approved, Nvidia has requested TSMC to increase capacity, planning to place pre-orders for 2 million H200 chips in 2026 [6].

The conditional opening of H200 exports may have complex impacts on China’s domestic substitution process:

- Chinese AI enterprises will obtain stronger computing power support than domestic chips

- May delay some customers’ domestic migration plans

- Huawei Ascend, Cambricon and other domestic players face more fierce competition

- Domestic chips have already been competitive in inference scenarios

- The localization rate in national intelligent computing centers and the information technology application innovation (ITAI) field has exceeded 90%

- Policy dividends such as chip deployment and power subsidies for data centers continue to be released [7]

According to TrendForce’s forecast, the chip pattern in China’s AI server market will change as follows:

| Year | Share of Purchased Chips | Share of Domestic Chips |

|---|---|---|

| 2024 | 63% | 20% |

| 2025E | 42% | 40% |

| 2026E | 35% | 50% |

It is expected that the market share of domestic chips will exceed 45% in 2027 [7][8].

- Huawei Ascend: At the 2025 Huawei Connect, it released its 2026-2028 roadmap, which will launch the Ascend 950/960/970 series with computing power doubling continuously. The Cloud Matrix 384 super node built by the Ascend 910C has already surpassed Nvidia’s products in some performance aspects [7]

- Cambricon: In the first three quarters of 2025, its revenue reached RMB 4.607 billion, a year-on-year surge of 2386%, with a net profit of RMB 1.605 billion, achieving profitability for the first time. The performance of its SiYuan 590 chip is comparable to that of the A100, and it has become an important choice for “domestic substitution” [9]

- Moore Threads: Listed on the STAR Market in December 2025, becoming the “first domestic GPU stock”, and launched the “Huagang” architecture comparable to CUDA [7]

According to SEMI data, the scale of China’s semiconductor equipment market reached $49.54 billion in 2024, accounting for 42.34% of the global share, ranking first in the world for five consecutive years. The CAGR from 2020 to 2024 reached 21.47% [10]. Driven by AI, China’s 300mm wafer fabrication equipment expenditure is expected to reach $94 billion from 2026 to 2028 [10].

Localization progress of key equipment:

- Lithography Machines: DUV lithography machines have achieved 28nm-level chip production, and it is expected to promote 7nm trial production through multi-patterning

- Etching Equipment/Ion Implanters: The localization rate is still in the initial stage, with great room for improvement

- Core Components: Dual-stage wafer stages have been mass-produced, and breakthroughs have been made in EUV light sources

The repeated adjustments of the U.S. chip policy toward China (from full ban to conditional opening) reflect the long-term nature and uncertainty of geopolitical games. Jensen Huang once warned that restricting chip exports to China has essentially handed over the world’s second-largest artificial intelligence market, and may create conditions for China to export technology to other countries [9].

Based on the above analysis, semiconductor investments should focus on the following main themes:

- Huawei Ascend industry chain (Ascend 910C/950, Cloud Matrix super nodes)

- Cambricon SiYuan series (590/690 comparable to international mainstream products)

- Domestic GPU manufacturers such as Moore Threads and Biren Technology

- Etching equipment: NAURA Technology, AMEC

- Thin film deposition: Tuojing Technology, Hahna Microelectronics

- Lithography machines and components: Accelerated domestic substitution

- Localization of SiC power devices

- Fields such as analog chips and MCUs

- Domestic computing power chip design enterprises

- AI software ecosystem (CANN, CUDA-compatible solutions)

As of January 14, 2026, major U.S. stock indices showed a slight pullback:

| Index | Latest Closing Price | Weekly Change |

|---|---|---|

| S&P 500 | 6,924.04 | -0.19% |

| NASDAQ | 23,487.23 | -0.33% |

| Dow Jones | 49,059.86 | -0.06% |

Nvidia’s current stock price is $182.31, with a price-to-earnings ratio of 44.81. The consensus target price of analysts is $268.50 (with +47.2% upside potential) [4]. The rating distribution shows:

| Rating | Percentage |

|---|---|

| Buy/Strong Buy | 75.9% |

| Hold | 20.3% |

| Sell | 3.8% |

As a leading domestic AI chip company, Cambricon’s market capitalization reached RMB 577.3 billion in 2025, a 9-fold increase since 2021 [9]. Moore Threads and Muxi Semiconductor were listed on the STAR Market in December 2025, and Biren Technology was listed on the Hong Kong Stock Exchange in January 2026, reflecting the capital market’s high attention to domestic semiconductors [7].

- Policy Risk: The U.S. chip policy toward China may be adjusted again, and export controls are uncertain

- Technology Gap: Domestic chips still have a gap with internationally leading products in high-end training scenarios

- Ecosystem Barriers: The CUDA ecosystem is mature, and the construction of domestic chip software ecosystems takes time

- Capacity Constraints: Advanced process foundry capacity is limited, which may affect the supply of high-end chips

- Market Competition: The return of Nvidia and AMD to the Chinese market may squeeze the market share of domestic manufacturers

- Long-term optimistic about the direction of domestic semiconductor independence, but need to pay attention to short-term valuation fluctuations

- It is recommended to diversify allocation to avoid over-concentration on a single company or sub-sector

- Focus on enterprises with core technological barriers and ecosystem construction capabilities

- Continuously track policy changes and technological progress

The U.S. conditional approval of Nvidia H200 chip exports to China is a phased result of the Sino-U.S. semiconductor game, reflecting the U.S. policy shift from “full ban” to “precision control + benefit sharing”. Conditions such as the 25% sales revenue share, 50% quota limit, and ban on exports of higher-end chips not only ensure the commercial interests of U.S. enterprises but also maintain their relative advantages in technological leadership.

For semiconductor investments, this policy change has

- On U.S. chip companies: Opens the door to the Chinese market, and it is expected that Nvidia and AMD will respectively obtain billions of dollars in incremental revenue in 2026

- On China’s domestic substitution: May delay the substitution process in the short term, but the structural substitution trend will not change, and domestic chips have already been competitive in inference scenarios

From an investment perspective,

[1] Eastmoney.com - Relaxation of Export Restrictions on Nvidia H200 Chips (https://pdf.dfcfw.com/pdf/H3_AP202512161801681438_1.pdf)

[2] Huxiu.com - U.S. Revises Chip Ban to Pave the Way for H200 Sales to China (https://www.huxiu.com/article/4826212.html)

[3] Securities Times - Nvidia’s “Conditional” Sale of H200 to China (https://www.stcn.com/article/detail/3531338.html)

[4] Jinling AI - Nvidia Company Profile and Real-time Quotes (API Data)

[5] Yahoo Finance - AMD Stock Will Jump 60% in 2026 (https://finance.yahoo.com/news/prediction-amd-stock-jump-60-233000904.html)

[6] The Motley Fool - Nvidia Just Made a Major Move for 2026 (https://www.fool.com/investing/2026/01/03/nvidia-just-made-a-major-move-for-2026-time-to-buy/)

[7] The Paper - AI Chips in 2025: Giants Fight Fiercely, Power Restructuring (https://m.thepaper.cn/newsDetail_forward_32307594)

[8] Donghai Securities - U.S. Introduces Measures to Strengthen Semiconductor Export Controls (https://pdf.dfcfw.com/pdf/H3_AP202505201675998312_1.pdf)

[9] EET China - Jensen Huang’s Warning, Cambricon’s Clarification (https://www.eet-china.com/mp/a457751.html)

[10] Futu News - Semiconductor Equipment Industry: 2026 Outlook Under Domestic Substitution (https://news.futunn.com/post/67155670)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.